GMA Playlist to launch new talents

GMA Music has created a sub-label, GMA Playlist, targeting millennials and GEN Z fans. The lineup of young GMA artists in the label are Mikee Quintos, Arra San Agustin, Anthony Rosaldo, Crystal Paras, Denise Barbacena, Faith Da Silva, Jeniffer Maravilla, Kaloy Tingcungco, Kim De Leon, Lexi Gonzales, Shayne Sava, Mark Herras, and Seb Pajarillo. “The GMA Playlist sub-label was born out of our passion to contribute to the OPM industry. It is also a venue for us to release original songs and have them performed by our untapped singers of the network. We also give our listeners an alternative to their usual playlists,” GMA Senior Manager for Music Production Section Racquel S. Gacho said in a statement.

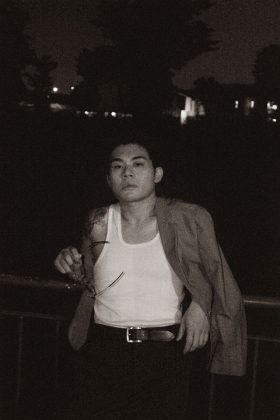

Paolo Sandejas releases cover of disco song

FILIPINO singer-songwriter Paolo Sandejas has released a cover of the 1980s disco song “Never Knew Love Like This Before.” The originally version by Stephanie Mills made it to the US Billboard Pop Singles Chart and won Best R&B Song at the 1981 Grammy Awards. Mr. Sandejas incorporates his brand of funky and modern indie-pop music to the song in his single. He worked closely with his producer, Tim Marquez of Timothy Run and One Click Straight, on this record. “Being an artist I wondered how the song would’ve possibly sounded like if it came out today. This project is the result of that curiosity and I hope everyone enjoys it as much as I enjoyed working on it,” Mr. Sandejas said in a statement. “Never Knew Love Like This Before” is available on Spotify and Apple Music.

Clara Benin drops Bahasa version of ‘Tila’

AWARD-winning singer-songwriter Clara Benin has dropped her first international single, “Suara Hati” under Southeast Asian label, OFFMUTE. The folk-pop tune sung in Bahasa Indonesia, which showcases Benin’s stripped-down sound and delicately intimate songwriting style, was originally written and released in 2015 as “Tila,” a Filipino track off her debut EP Riverchild. To date, “Tila” has amassed more than 6 million streams on Spotify and YouTube combined, becoming one of her most commercially successful releases. As part of OFFMUTE’s initiative to champion its roster of new and emerging music acts across and beyond the region, “Tila” was re-recorded by Ms. Benin in Bahasa Indonesia, becoming “Suara Hati,” with the help of prolific music producer, composer, and multi-instrumentalist The Ringmaster, who has worked with Filipino bands such as UDD and Ang Bandang Shirley. “It was really important for me to make this song sound authentic and true to its language,” Ms. Benin said in a statement. “My producer, The Ringmaster, made that easy for me because he actually grew up in Indonesia and speaks Bahasa fluently. He helped me a lot with the pronunciation and delivery of the vocals. Berto Pah, who is an Indonesian sasando player, also helped in making the song sound authentic.” The release of “Suara Hati” comes with a lyric video in Bahasa Indonesia which features Benin performing the song with her acoustic guitar, and a backdrop of flowers and nature elements projected against the wall. “Suara Hati” is available on all digital music platforms.

Dominic Chin releases new single

DOMINIC Chin puts a refreshing spin on the Mando-pop of yesteryears with his new single, “My Love,” featuring Jerry Galeries. The song was inspired by Chin’s fascination with the music of his childhood, listening to the likes of A-mei, JJ Lin, and Stefanie Sun in the backseat of his family’s car. Backed by rich, dramatic instrumentation and a retro-leaning production, the singer-songwriter/producer revisits classic Chinese pop balladry. “This is a classic love song that stems from the old-fashioned style of professing one’s love for another person, with lines speaking poetically and hopping between two romantic languages: English and Mandarin,” Mr. Chin said in a statement. Listen to “My Love” at https://www.umamirecords.sg/my-love/.

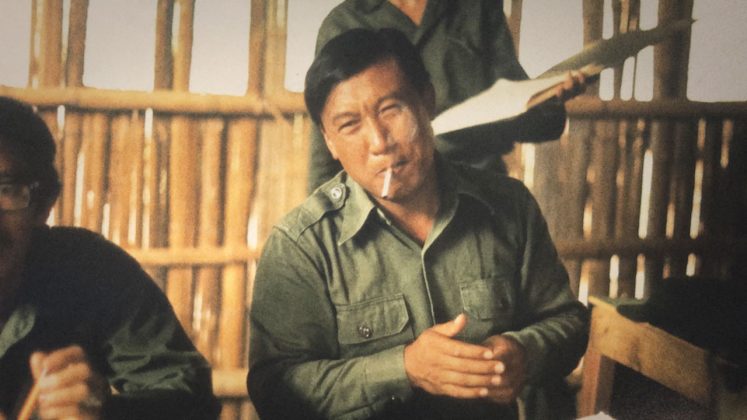

HBO Go’s Traffickers: Inside the Golden Triangle

WARNERMEDIA presents Traffickers: Inside the Golden Triangle, an HBO Asia Original documentary series that exposes the secretive epicenter of illicit drug production inside the Golden Triangle. The documentary series follows the rise and demise of three drug kingpins in Thailand, Myanmar, and Laos. The three-part documentary series unravels how “the Opium King,” “The Mekong River Pirate,” and “The Playboy Drug Lord” exploited drugs, war and violence to claw their way to the top. It features exclusive interviews with members of the drug lords’ inner circles, drug enforcement agents, and victims’ families, as well as never-before-seen archive footage and immersive recreations. Directed by Robbie Bridgeman, Steve Chao and John Lam and executive produced by Dean Johnson, the documentary series is filmed on location in the Golden Triangle, Thailand, Burma, China, the USA, Malaysia, the Philippines and Australia. Stream Traffickers: Inside the Golden Triangle on HBO GO.

Christopher Lee in iQIYI drama

IN IQIYI’S prison-themed Chinese language series Danger Zone, Singaporean actor Christopher Lee plays a police officer once again in almost 20 years. In the series, Mr. Lee chases after criminals and investigates cases. The drama is formatted into chapters, with 24 episodes split into two chapters, “In the Dark Night” and “The Silver Lining.” Directed by Zhuang Xuan Wei, joining Mr. Lee in the cast are Vic Chou, Sandrine Pinna, Wu Hsing-kuo, Berant Zhu, Tseng Chin-hua, and Teresa Daley. Danger Zone begins streaming on Sept. 3, with new episodes released on Fridays. Download the iQiyi app or log in to www.iQ.com for more Asian shows.

World’s first Batman augmented reality app

DC has released a Batman mobile experience for children ages six to 12. The “DC: Batman Bat-Tech Edition” app is a one-of-a-kind free mobile app available in app stores in 13 different languages around the world. The app lets kids join Batman’s crime-fighting team, the Knightwatch, and experience the world of Batman, learning how to use his Bat-Tech to fight crime and help defend Gotham City from his evil adversaries. “DC: Batman Bat-Tech Edition” is COPPA compliant and free to download and play. The app features first-of-its-kind augmented reality (AR) technology to engage children and immerse them in the world of the iconic hero who uses crimefighting tech to help him foil the evil deeds of the Joker, Mr. Freeze, The Riddler, and other super-villains. The launch comes just in time to celebrate “Batman Month” in September and DC Fandome, the global fan experience on Oct. 16. In Southeast Asia, Hong Kong, and Taiwan, streaming service HBO GO and Cartoon Network are gearing up for a month of Batman-themed stunts, contests, and social media takeovers dedicated to the Caped Crusader. In addition to learning about Batman’s technology through the app’s AR storytelling features, children can play mini games, transform photos with AR face filters and stickers, read exclusive digital comics, watch Batman Bat-Tech themed video content, and gain access to the Batcomputer, the super-computer where Batman’s tech secrets are stored. Additionally, launching exclusively on the “DC: Batman Bat-Tech Edition” app is a digital comic series, Batman — Knightwatch, where children can explore how the Knightwatch program was created and follow along with Batman and his Super Hero team as they take on Gotham’s City’s villains following a massive breakout at Arkham Asylum. Additional digital comics will be added to the app on a regular basis. The app is available for free on the Apple Store and the Google Play store, and is playable on both tablets and smart phones. The app is available globally and is localized in 13 different languages, including Korean, Japanese and Simplified Chinese.