How to prep for your capital markets debut

“Dragons” dancing, confetti falling, champagne bottles popping, bells ringing. These are some of the familiar scenes on the stock exchange trading floor during a listing ceremony of an initial public offering (IPO).

More than pomp and pageantry, the day a company begins trading on the stock exchange is always a reason to celebrate. After all, private companies seeking to raise capital and access deep pools of liquidity through an IPO have to undertake a challenging but worthwhile and rewarding journey.

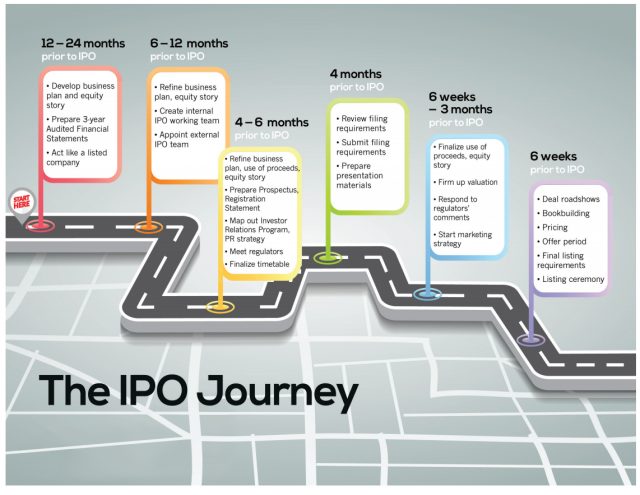

First Metro Investment has been conducting investment briefings to urge firms to go public or guide them in their IPO journey. Here is its step-by-step guide on preparing for a stock market debut:

1. To list or not to list? This is the question that you may want to answer before you decide on going public. By definition, an IPO is the first sale of stock by a company to the public. So if you are looking to grow your company and need to raise capital to expand, then having an IPO can help you. Aside from accessing public capital, IPO issuers also benefit from enhanced liquidity, wealth creation, tax efficiency, well as enhanced public reputation and image.

2. Ready for changes? Successful issuers know that having an IPO is like a transformation — a metamorphosis from being privately owned to publicly listed. With the benefits you get to reap from an IPO come the responsibilities. These include sharing company ownership and financial gain with other investors (including small ones), being more transparent by disclosing to the public any material information that might affect the performance of your stock, and being subjected to tighter regulatory scrutiny, among others.

3. Prepping for the journey: The process leading up to an IPO is extensive, but preparing early and thoroughly can make all the difference. In preparing your company for this milestone, First Metro Investment has prepared the following roadmap:

12-24 months prior to IPO:

- Develop a good business plan and equity story.

- Prepare a 3-year Audited Financial Statement by a reputable auditor (SEC Class A) and interim Financial Statement.

- Start acting like a listed company — i.e., adhere to the highest standards of corporate governance principles and practices, ensure compliance with laws and regulations and reportorial requirements, ensure a good corporate structure.

6-12 months prior to IPO:

- Refine your business plan and equity story.

- Build an internal IPO working team.

- This should include a senior executive from your company to make critical decisions, and the following departments: Investor Relations, Compliance, Legal, Finance, Business Development/Marketing, and Corporate Planning.

- It is highly recommended to appoint an overall point person from the company who will be responsible for the timely execution of IPO-related activities.

- Appoint an external IPO team.

- For a domestic listing, the following parties are required:

- Issue Manager/Bookrunner/Underwriter

- Legal Counsel for Issuer

- Legal Counsel for Underwriter

- Receiving/Stock Transfer Agent

- Custodian/Depositary Bank

- Escrow Agent

- If you plan to offer some shares abroad, on top of the external domestic team, the following are required:

- International Issue Manager/s and Bookrunner/s

- International Legal Counsel for Issuer

- International Legal CounselUnderwriter

- For a domestic listing, the following parties are required:

4-6 months prior to IPO:

- Refine your business plan, establish your use of proceeds, and equity story.

- Produce a draft prospectus and a Registration Statement.

- Prepare your Investor Relations Program and PR strategies.

- Meet with the regulators: Securities and Exchange Commission and PSE.

- Finalize your timetable.

4 months prior to IPO:

- Review filing requirements before filing with regulators.

- Submit filing requirements.

- Prepare presentation materials emphasizing your company’s equity story.

6 weeks – 3 months prior to IPO:

- Finalize your use of proceeds and equity story.

- Firm up your valuation.

- Respond to regulators’ comments in a timely manner.

- Start your marketing strategy, including formation of a selling syndicate.

6 weeks prior to IPO:

- Start deal roadshows.

- Bookbuilding

- Pricing

- Offer period

- Comply with final listing requirements.

- Hold a listing ceremony at the Philippine Stock Exchange (PSE).

If you think your job is done after you have rung the bell at the PSE, think again!

When the excitement has died down after your company has gone public, the real hard work begins. As a public company, you will now lead a life post-IPO focused on complying with all relevant regulation, and ensuring complete and timely disclosure of material information to the public.

Most of all, it is all about delivering on the promises you made to investors when you were asking them to buy your equity story. At the end of the day, the success of an IPO is not just about the money raised; it is about how investors have put their trust in the company and placed their bet on its long-term growth.