Understanding NFTs

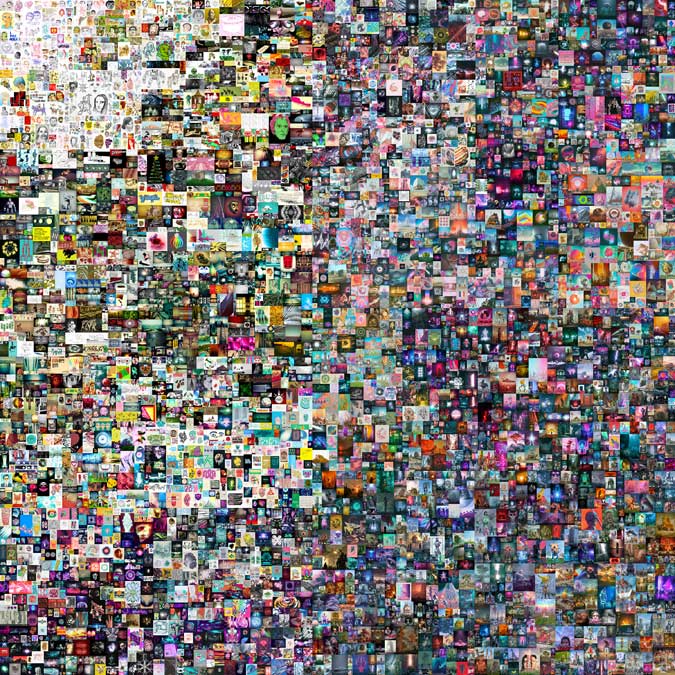

— MAKERSPLACE.COM/BEEPLE

The world of non-fungible tokens is a major part of this year’s Art Fair Philippines

IN MARCH 2021, a collage of images called Everydays — The First 5000 Days by Beeple (graphic designer Mike Winkelmann) was sold to Singapore-based technopreneur Vignesh Sundaresan at a Christie’s auction for $69.3 million worth of the crypto-currency Ether. The sale positioned Beeple as among the top three most valuable living artists, after English painter David Hockney and American sculptor Jeff Koons.

Just last month, the meme Disaster Girl, showing the then four-year-old Zoe Roth (now 21 years old) grinning at the camera with a burning house in the background, sold at an auction for $473,000.

Meanwhile, Filipino artist Luis Buenaventura III recently sold 222 editions of Satoshi The Creator – Genesis, a collaboration with Argentinian artist Jose Delbo, for $1,999 each on the Nifty Gateway platform.

Everydays —The First 5000 Days, the Disaster Girl meme, and Satoshi The Creator – Genesis were all sold as non-fungible tokens (NFTs).

WHAT IS AN NFT?

NFTs are one-of-a-kind digital properties (a drawing, meme, animated GIF, video, etc.) which are bought through crypto-currency. NFTs use a blockchain, a digital ledger where its record of ownership is stored.

Artists can create an NFT through minting — making limited copies or offering it via bid — their artworks on NFT platforms. Notable NFT platforms include SuperRare, Nifty Gateway, Rarible, and Foundation.

NFTs are purely digital and can be sold anywhere globally without the worry of shipping costs and insurance.

THE COST OF NFTS

The mining of an NFT requires high usage of computer power since artists have to pay a fee to tokenize their NFT in a blockchain.

According to an article by Time magazine, “Ethereum mining consumes about 26.5 terawatt–hours of electricity a year, nearly as much as the entire country of Ireland and its almost 5 million residents.”

NFT art platform SuperRare, however, argues that NFT trading does not increase carbon emissions as it has a fixed energy consumption.

An article by the SuperRare Team titled, No, CryptoArtists Aren’t Harming the Planet stated that “the total energy spent on mining depends on a relationship between Ethereum price, which is the source revenue for miners, and the cost of energy.” It states further that carbon emissions remain the same whether or not users take a break from their Ethereum apps and if no transactions are sent for an entire day.

In an effort to reduce carbon emissions by NFT trading, the Ethereum community is looking at more efficient alternatives such as the development of ETH2, aimed at increasing Ethereum sustainability.

NFTS IN THE PHILIPPINES

With the goal to educate and introduce the local art market to digital arts, this year’s Art Fair Philippines — which goes fully online for the first time from May 6 to 15 — will have a section called the Metaverse, which takes visitors “to the world of digital media via our NFT 101 Showcase.”

There one can view artworks from 43 local and international galleries and explore the world of crypto arts, including a showcase of Narra Art Gallery and Tropical Futures Institute, a series of talks with topics ranging from getting started in crypto arts to mining an NFT and its environmental impact.

“[W]ith all the publicity surrounding [NFTs], it is becoming very attractive and very much an option,” Art Fair Philippines co-founder Lisa O. Periquet said on BusinessWorld’s B-side podcast.

“So, it tells me that this whole subject is really soaking in to a much wider audience than you would imagine. From the beginning, it’s not just people in the crypto world. It’s now people who are just interested and they could be interested in both the art, and in investing in it as a currency,” she added.

Salcedo Auctions director Ramon “Richie” Lerma noted that NFTs have an impact on both artists and collectors.

“If your definition of an artist is someone who creatively expresses themselves through a chosen medium and can sell that creation to a collector, then by that definition, anyone can become an artist by creating and selling NFTs,” Mr. Lerma wrote in an e-mail to BusinessWorld.

“In fact, this is precisely what we’re seeing with the sale of internet memes and even tweets as NFTs, and is definitely a point of interest for new and established collectors. We’re now once again faced with questions like, ‘So what is art?’ and ‘Can anyone really be an artist?’,” he said.

“As a collector, it’s interesting to note that NFTs, as a cryptocurrency, have a digital record of their transactions on the blockchain which can technically serve as provenance. [And] because the creation and sale of NFTs is an unfolding story, it also opens up avenues for first-time collectors to acquire something they perceive to be of value,” he added.

“Curiosity and outright interest are two different things. It’s hard to say at this point whether the primary market for NFTs will find its way to the local secondary art market,” Mr. Lerma said of the potential of NFTs at local auctions.

“Right now, we see the two audiences existing in separate spheres. But again, the beauty of working in the auction industry is being able to see firsthand that curiosity growing into interest, and maybe into a dedicated following. Who knows? But it will certainly be interesting — and fun — to see this all unfold,” he said. — Michelle Anne P. Soliman