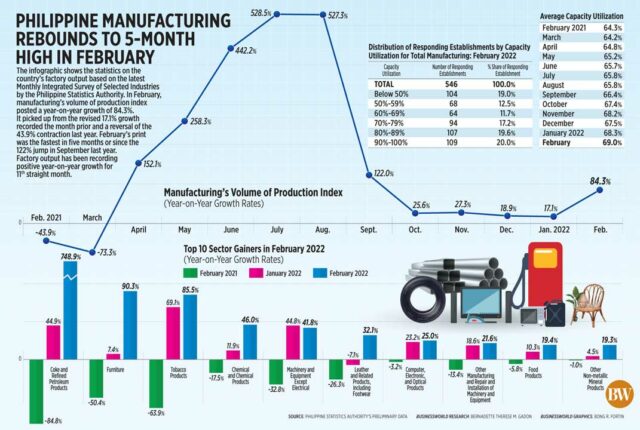

Philippine manufacturing rebounds to 5-month high in February

MANUFACTURING rose to its highest level in five months in February, thanks to favorable base effect and increased economic activity amid looser mobility curbs. Read the full story.

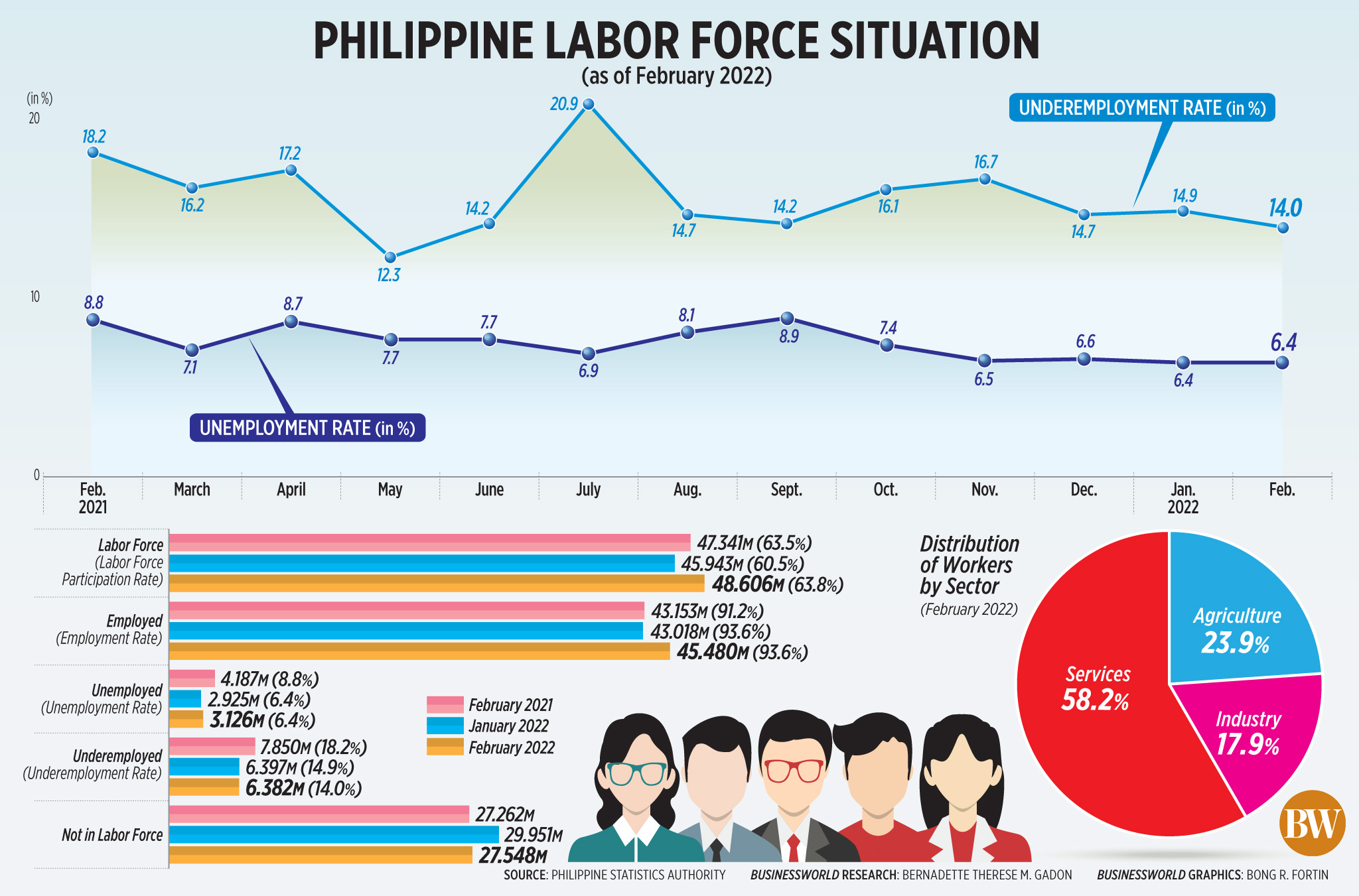

Philippine labor force situation (Feb. 2022)

THE PHILIPPINES’ unemployment rate steadied on a monthly basis in February, but the number of jobless Filipinos increased to 3.126 million despite the gradual reopening of the economy, the Philippine Statistics Authority (PSA) reported on Thursday. Read the full story.

Peso sideways after Fed minutes

THE PESO closed sideways versus the greenback due to the hawkish tone of minutes of the US Federal Reserve’s latest meeting.

The local unit closed at P51.42 per dollar on Thursday, inching up by a centavo from its P51.43 finish on Wednesday, based on Bankers Association of the Philippines data.

The peso opened Thursday’s session at P51.37 versus the dollar. Its weakest showing was at P51.43, while its intraday best was at P51.33 against the greenback.

Dollars exchanged dropped to $885.5 million on Thursday from $1.263 billion on Wednesday.

The peso slightly appreciated following the release of minutes of the Fed’s March meeting, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in a Viber message.

The minutes released on Wednesday showed the Fed was initially looking to increase rates by 50 basis points (bps), but reduced this to 25 bps as it took into account the war in Ukraine, Reuters reported.

It also showed officials generally agreed to cut up to $95 billion monthly from the central bank’s asset holdings to fight surging inflation.

Meanwhile, a trader in a Viber message said the peso gained after the decline in fuel prices.

The Brent and West Texas Intermediate benchmarks dropped to their lowest closing levels since mid-March at $101.07 and $96.23 a barrel, respectively.

For Friday, Mr. Ricafort gave a forecast range of P51.30 to P51.45 per dollar, while the trader expects the local unit to move within P51.25 to P51.45. — LWTN with Reuters

PSE index falls to 6,900 level on Fed minutes

SHARES continued to decline on Thursday as the majority of Wall Street indices fell due to the US Federal Reserve’s hawkish tone in the minutes of its latest meeting where it raised rates from near zero.

The benchmark Philippine Stock Exchange index (PSEi) plunged by 183.23 points or 2.57% to close at 6,926.03 on Thursday, while the broader all shares shed 79.26 points or 2.09% to 3,701.23.

“Philippine shares fell with investors continuing to digest the Federal Reserve’s plans to tighten monetary policy… On top of this, the minutes indicated that participants judged it appropriate to move towards a neutral policy position ‘expeditiously,’” Regina Capital Development Corp. Head of Sales Luis A. Limlingan said in a Viber message.

COL Financial Group First Vice-President April Lynn C. Lee-Tan said the PSEi’s decline was due to weak performance of US market overnight.

“Also, the higher-than-expected inflation and rising 10-year bond rate. Investors [are] locking in gains for the meantime,” Ms. Tan added.

Wall Street’s main indexes fell on Wednesday, with steep declines in tech and other growth stocks, after minutes from the Federal Reserve’s March meeting sharpened investors’ focus on the US central bank’s plans to fight inflation, Reuters reported.

The Dow Jones Industrial Average fell 144.67 points or 0.42% to 34,496.51; the S&P 500 lost 43.97 points or 0.97% to 4,481.15; and the Nasdaq Composite dropped 315.35 points or 2.22% to 13,888.82.

Minutes of the Fed’s March 15 to 16 meeting showed policy makers rallying around plans to cut the central bank’s massive balance sheet as soon as next month.

Fed officials “generally” agreed to cut up to $95 billion a month from the central bank’s asset holdings as another tool in the fight against surging inflation, even as the war in Ukraine tempered the first US interest rate increase.

Policy makers were convinced to not only raise the target policy rate by a quarter of a percentage point from its near-zero level but also to “expeditiously” push it to a “neutral posture” of around 2.4%.

All sectoral indices ended in the red on Thursday. Property went down by 98.26 points or 2.97% to 3,207.11; financials dropped by 48.59 points or 2.86% to 1,644.87; industrials lost 239.09 points or 2.44% to end at 9,556.07; mining and oil gave up 284.06 points or 2.26% to 12,257.61; services retreated by 43.61 points or 2.26% to 1,886.08; and holding firms decreased by 148.66 points or 2.21% to 6,566.87.

The MidCap index fell by 23.3 points or 1.93% to 1,181.73, while the Dividend Yield lost 36.99 points or 2.17% to close at 1,669.40.

Value turnover increased to P6.41 billion with 920.28 million shares changing hands from the P4.98 billion with 11.53 billion issues seen on Wednesday.

Decliners overwhelmed advancers, 139 versus 33, while 52 names were unchanged.

Net foreign selling grew to P953.3 million on Thursday from the P464.96 million seen the previous trading day. — Luisa Maria Jacinta C. Jocson with Reuters

VP candidate Sotto says Palace about to break ‘endo’ promise

By Alyssa Nicole O. Tan

SENATE President Vicente C. Sotto III, who is running for vice-president (VP) , said the Palace is on the verge of breaking its promise to end the practice of labor contractualization, and expressed his disappointment about the President’s decision to veto a 2019 bill, which he said had arrived at a balance of interests between workers and employers.

“For whatever reason, the fact is, (the 2019 bill) was vetoed,” told BusinessWorld in a Viber message on Thursday. “Employees waited for it. Employers were against it… We worked on the bill that was equitable for all stakeholders. It’s sad that the executive felt that way.”

The administration’s term is about to end without addressing contractualization, which is known as “endo.” Endo denies workers a path to permanent employment by engaging them in contracts that do not bring them past the six-month probation period. Employers are obliged to grant their workers regular status after they complete six months’ probation.

Re-electionist Senator Emmanuel Joel J. Villanueva has promised to refile the Security of Tenure (SoT) bill if he is returned to office after the May polls.

On Thursday, the President’s acting spokesman, Jose Ruperto Martin M. Andanar said in a statement that the SoT bill that had been vetoed “unduly broadens the scope and definition of prohibited labor-only contracting, effectively proscribing forms of contractualization that are not particularly unfavorable to employees involved.”

“The President hopes that Congress would rectify the vetoed provisions as he remains committed to eradicating all forms of abusive employment practices and protecting the workers’ right to security of tenure,” Mr. Andanar added.

Under the bill, workers will be classified as either regular or probationary employees. Project and seasonal workers will be considered regular employees. The services of any worker cannot be terminated without cause.

In July 2019, the President said in his veto message that the SoT bill contains a “sweeping expansion of the definition of labor-only contracting, (which) destroys the delicate balance and will place capital and management at an impossibly difficult predicament with adverse consequences to the Filipino workers in the long term.”

Fitch Solutions bullish on PHL power industry decarbonization

FITCH SOLUTIONS Country Risk and Industry Research said policies adopted by the Department of Energy (DoE) are poised to accelerate the decarbonization of the power industry by raising investor interest in renewable energy (RE).

The positive outlook for the renewables sector was driven by changes to the regulatory environment such as the DoE’s Renewable Portfolio Standard (RPS) and the Green Energy Option Program (GEOP).

Fitch Solutions also noted a significant expansion of more than 10 times in the renewables project pipeline compared to the level recorded in March 2021. Pending projects include those participating in the DoE tender for 2 gigawatts of renewable energy for the Luzon, the Visayas, and Mindanao.

Under RPS, power distribution utilities, as well as electric cooperatives and retail electricity suppliers, are required to source portion of their energy supply from RE.

Meanwhile, the GEOP gives electricity consumers the option to tap RE for their energy needs.

In a virtual interview, DoE Director of the Renewable Energy Management Bureau Mylene C. Capongcol said that the department has also started examining how to mitigate risk for geothermal energy investors.

“Geothermal actually is 24/7 and can compete with other conventional (sources) like coal. Right now, the cost of developing geothermal is very expensive and the success rate is very low, so recognizing the value of that, we will be coming out soon with a risk mitigation policy for geothermal energy development,” she said.

Strong opposition to the use of coal as a fuel for power generation has led Fitch Solutions to revise downwards its forecast for coal-fired power generation in the Philippines.

Even with the moratorium on coal-fired power projects issued by the DoE in December 2020, coal remains the leading fuel for the industry, with coal-fired plants accounting for 61% of the power mix by 2031. — Ram Christian S. Agustin

Household subsidy for poor families rising to P500 by May

THE monthly household subsidy for poor families will increase from P200 to P500 and is set for distribution by May, a senior legislator said on Thursday.

“The low-income household subsidy is definitely pushing through. I think the Executive has already found some funding sources in the form of unused cash balances,” House Ways and Means Chairperson and Albay Rep. Jose Ma. Clemente S. Salceda said in a statement.

“President (Rodrigo R.) Duterte also followed up with an instruction to increase the monthly subsidy from P200 to P500. I am quite positive that we will start distributing those subsidies before the elections.”

The Department of Social Welfare and Development (DSWD) will oversee the household subsidy, he said, noting that he “explicitly requested for an exemption of all DSWD aid transactions from the COMELEC (Commission on Elections) election spending ban.”

The fuel subsidy to be distributed to drivers under the Pantawid Pasada Program will also continue, to head off any fare increases and second-round effects from oil prices, he added.

“That said, we will continue to follow up with implementing agencies when there are delays in the implementation,” Mr. Salceda said.

“My reservation with targeted programs such as these has always been that they take a while to fully implement, compared with outright exemptions or universal cash transfers. But, as this is the direction the executive has decided to take, we will provide policy support or appropriations support as needed.”

Separately, Samar Rep. Edgar Mary S. Sarmiento, who chairs the House Committee on Transportation, welcomed the poll body’s decision to lift the ban on distributing the fuel subsidy.

“We are very happy that the Comelec has finally given the go signal for the LTFRB (Land Transportation Franchising and Regulatory Board) to resume the distribution of the fuel subsidy,” Mr. Sarmiento said in a statement.

“This is definitely not enough to ease the burden of our drivers and operators because the cost of fuel remains very prohibitive but at least, this fuel subsidy is a reminder that the government is doing everything to help them.” — Jaspearl Emerald G. Tan

SRP for imported galunggong set at P180 in NCR

THE Department of Agriculture (DA) has set the suggested retail price (SRP) for imported medium-sized galunggong (round scad) in wet markets in the National Capital Region (NCR) at P180 per kilogram.

“Considering the effects of rising fuel prices due to the Russia-Ukraine conflict (and) aggravated by the pandemic, (which raised the) prices of agricultural commodities… there is a need to manage the prices of basic necessities,” the DA said in an administrative circular issued on Thursday.

The circular estimated that one kilogram of medium-sized, female galunggong will consist of 11 to 20 pieces.

“The state shall ensure the availability of basic necessities and prime commodities at reasonable prices at all time, without denying legitimate business a fair return on investment,” the circular read.

The DA has the authority to regulate prices, particularly for agricultural goods.

The administrative circular will take effect immediately after its publication on the DA website and will remain in effect for 60 days from its approval. — Luisa Maria Jacinta C. Jocson

Back taxes collected from shuttered firms hit P2.95 billion in 2021

THE Bureau of Internal Revenue (BIR) collected P2.95 billion in 2021 worth of back taxes from 523 companies which were shut down for tax violations, the Department of Finance (DoF) said in a statement on Thursday.

The shuttered companies fell foul of the BIR’s Oplan Kandado crackdown, which targets establishments that do not comply with tax laws.

The 2021 total is nearly five times the 2020 collections. Two years ago, 209 establishments were shut down by Oplan Kandado.

BIR Commissioner Caesar R. Dulay added that last year, the bureau collected an additional P122.40 million in registration penalties after inspecting over 120,000 establishments.

Mr. Dulay said that under the bureau’s Run After Tax Evaders program, 137 cases were filed before the Department of Justice involving P4.4 billion worth of tax liabilities, in 2021 while 17 cases were filed before the Court of Tax Appeals involving an estimated P1.4 billion worth of unpaid taxes.

The BIR had collected P3.91 billion in taxes from Philippine Offshore Gaming Operators (POGOs) as of December 2021.

An Act Taxing Philippine Offshore Gaming Operations, or Republic Act No. 11590, took effect on Oct. 9, 2021, which imposed new taxes, including a 5% tax on gross gaming revenue.

The DoF expects collections from POGOs to hit P76.2 billion by 2023.

Mr. Dulay added that the BIR has expanded its social media presence to boost awareness of tax laws and bureau circulars. The bureau logged 9.6 million views of its Facebook content, while its YouTube channel has 10,000 subscribers.

The BIR hopes to collect P2.4 trillion this year. In April, the BIR’s collection target is P256.89 billion. — Tobias Jared Tomas

LGUs urged to meet norms for transaction processing time

LOCAL GOVERNMENT UNITS (LGUs) have been reminded to meet standards for transaction processing times and minimize backlogs, the Anti-Red Tape Authority (ARTA) said.

“Each LGU should always remind all of their offices… to observe the 3-7-20 processing time and maintain a zero-backlog program,” ARTA Director General Jeremiah B. Belgica said at a webinar on Thursday.

“All applications and all transactions in government should have a period by which people can reasonably expect government action. It is better for an application to be denied instead of being delayed or unacted upon because the denied applicant can reapply or submit an appeal,” he added.

The 3-7-20 rule refers to the three days allowed to process simple transactions, seven for complex transactions, and 20 for highly technical applications.

“We should not just monitor compliance once a year, but for all government agencies and LGUs, we are encouraging that (they) make this as a regular staple,” Mr. Belgica said.

According to Mr. Belgica, the agency chiefs and LGUs are responsible for ensuring that applications and permits are processed within the recommended period.

“The heads of agency (are responsible) in the implementation of the provisions of Republic Act 11032 (Ease of Doing Business and Efficient Government Service Delivery Act) as well as ensuring that applications and permits are acted upon within the prescribed processing time,” Mr. Belgica said.

“The zero-backlog program should be shepherded by the head of the agency. The partner of the local chief executive is the committee on anti-red tape,” he added. — Revin Mikhael D. Ochave

Golden rice registered with seed industry council

GOLDEN RICE was recently approved for registration with the National Seed Industry Council, according to the Philippine Rice Research Institute (PhilRice).

“This (means) it is now fully recognized by the Bureau of Plant Industry. If ever farmers plant this, they can now apply for crop insurance, they are now at the same level as other varieties. It’s much easier now that it’s registered,” PhilRice Research Specialist Reynante L. Ordonio said in a virtual briefing.

“Golden Rice is a complementary solution to existing vitamin A deficiency preventions. Rice is life for Filipinos and an integral part of our diet,” he added.

Golden rice is a genetically modified, biofortified crop engineered to produce beta-carotene, which is not normally present in rice. Beta-carotene is converted into vitamin A when metabolized by the body.

The taste of golden rice is the same as white rice, Mr. Ordonio said.

The variety was designed to lower malnutrition and growth stunting in poor countries.

“There are successful complementary solutions, like biofortification. However, vulnerable groups are being missed and this is where golden rice can help as a tool in the basket of interventions,” he said.

“Especially during the pandemic, we find it all the more difficult to consume a diversified diet,” he added.

Biofortification is the process of breeding crops to increase their nutritional value. This can be done through conventional selective breeding or genetic manipulation.

“Because rice is widely grown and eaten, even a small increase in the micronutrient content in the grain could have a significant impact on human health,” Mr. Ordonio said.

“In other countries, they already have orange sweet potato, yellow cassava, and sweet rice as a product of biofortification,” he added.

Golden rice is targeted for distribution to provinces with high malnutrition levels, like Quirino, Catanduanes, Samar, Antique, Lanao del Norte, Agusan del Sur, and Maguindanao.

Mr. Ordonio said the next step in seed certification lies with the National Seed Quality Control Services (NSQCS).

“We want to make everything formal to facilitate deployment to farmers, most importantly to seed producers, because they need the seed class,” he said.

“It would depend on the NSQCS on when they will allow us to have the certification so the planting can be done by wet season. Hopefully, by the wet season we can proceed with planting. The seeds will be produced by PhilRice,” he added.

High iron and zinc rice (HIZR) is another genetically modified rice that was developed to improve the uptake of the two nutrients.

“Previously, as proof-of-concept, iron concentrations in a well-polished rice grain were achieved with no yield penalty, and the dietary target of the iron and zinc in the polished grain has been achieved under field conditions,” Mr. Ordonio said.

This year, HIZR is being prepared for a field trial in Batac, Ilocos Norte and Muñoz, Nueva Ecija.

There are also plans to stack HIZR with Golden Rice in a project led by the International Rice Research Institute. — Luisa Maria Jacinta C. Jocson