Robinsons’ Happy Pets Club holds online health consultation

ROBINSONS Malls Happy Pets Club, through its Pet Konsulta program, brings pet owners a free, informative, and accessible way to keep their pets healthy through an interactive Facebook Live stream. Pet owners can avail of free vet consultation from home during the “Pet Konsulta: Journey to Responsible Pet Ownership” session which will be streaming today Aug. 13, 3 p.m., on the Robinsons Malls Happy Pets Club and Pet Lovers Centre Philippines Facebook pages. This FB Live event is the first of Pet Konsulta’s four-part series Journey to Responsible Pet Ownership. The discussion will include a question-and-answer portion between the viewers and veterinarian Lester Lopez who has 15 years of clinical experience in small, exotic, and wild animal practice. He is also the owner of Manila East Veterinary Care and concurrently Elanco Philippines’ Technical Services Mentor for Pet Health. Prizes await viewers too, as pop quizzes will be conducted during the FB Live event. This is held in partnership with Pet Lovers Centre, Manila East Veterinary Care, Elanco, and brands Bayopet and Advantix.

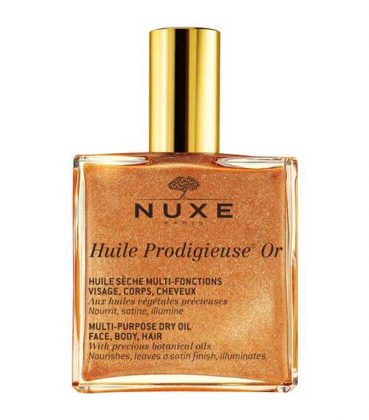

Rustans.com holds 2-day Anniversary Sale

RUSTANS.COM will hold a two-day Anniversary Sale offering up to 60% off on Aug. 14-15. Boasting of over 750 fashion, beauty, and lifestyle brands, Rustans.com’s Anniversary Sale will see brands like Dooney & Bourke, LeSportsac, Natori, HOFF, Michael Kors, Ricardo Preto, Love My Bags, Adolfo Dominguez, Kurt Geiger, Aquazurra, Danse Lente, Coccinelle, Seafolly, and Sergio Rossi offering up to 20% off on selected items. Men can check out New Balance, Samsonite, American Tourister, Jack Nicklaus, Champion, Victorinox, and Savile Row for selected styles that are up to 55% off. Rustan’s Private Brands Lady Rustan, Luna, Lotus Resortwear, and Criselda will be offering 20% off on all items, while selected pieces from SSI brands such as Kate Spade New York, Charriol, Cross, Calvin Klein, Kenneth Cole, Polo Ralph Lauren, Salvatore Ferragamo, and BALLY will be offering up to 60% off. Beauty brands Murad, Diptyque, Dolce&Gabbana, L’Occitane, Issey Miyake, and Narciso Rodriguez are offering special gifts when shoppers reach the minimum spend of their products during the anniversary sale weekend. Brands like Kanebo, Nuxe, Viktor&Rolf, Koh Gen Do, Jane Iredale, Stila, BaByliss, and Vidal Sassoon will be offering discounts of up to 30% on selected products. Selected items from Rustan’s Home, NOERDEN, Beka, Milvidas, C&F Home, Barprofessional, Leonardo, Reed & Barton, Cuisinart, and Tefal will be available for up to 50% off. Kids brands such as Baby Hood, Bebe Chic, Kindee, i-angel, Love to Dream, Mamas & Papas, Crane, Ecomom, Mustela, myFirst, Fisher-Price, and VTech are offering up to 50% discount on selected items. Besides the discounts and complimentary gifts from participating brands, Rustans.com shoppers will get gifts when they shop during the sale. Spend a minimum of P5,000 online and Rustans.com will throw in a complimentary Lexon Mino Bluetooth Speaker. For a P12,000 single-receipt purchase, the customer will receive a free Victorinox Rally Swiss Army Knife. A minimum P30,000 single-transaction purchase on the site will get the shopper a free Multiple Choice 12-Piece Tea Set. For single-receipt purchases of P50,000 and above, they will receive a complimentary American Tourister Preston Spinner. By using cards from Rustans.com’s bank and rewards partners — BDO, EastWest Bank, HSBC, MVP Rewards, PNB, RCBC, Security Bank, and UnionBank — the customer will get an additional 10% discount at checkout. For details on all of Rustans.com’s deals and promos, go to www.rustans.com.

Rak of Aegis online extended

THE PHILIPPINE Educational Theater Association (PETA) is extending the streaming presentation of its jukebox musical Rak of Aegis to include the weekend of Aug. 14 and 15 via www.ticket2me.net. The musical’s story follows Eileen and her efforts to help her community which has been submerged in floodwaters, as told using the songs of the rock band Aegis. Written by Liza Magtoto and directed by Maribel Legarda, the streaming cast includes Aicelle Santos, Pepe Herrera, Poppert Bernadas, Isay Alvarez-Seña, Robert Seña, Joann Co, Jimi Marquez, and Gie Onida. The livestream is available for P350 (8 to 12 p.m., Philippine Standard Time). For more information, follow PETA’s social media pages: Facebook (www.facebook.com/petatheater), Instagram (@petatheater), Twitter (@petatheater), YouTube (www.youtube.com/petatheateronline) or visit www.petatheater.com/rakofaegis.

Unboxing the Galleon Trade

EXPLORE the flavors of history in “Unboxing the Galleon Trade” with chef, artist, and writer Claude Tayag on Aug. 14, 4 p.m., via Zoom. In celebration of the 500th anniversary of the circumnavigation of the world, Ayala Museum and Served Manila will host an experiential historical conversation on the Manila-Acapulco Galleon trade — complete with a curated exploration kit that allows the viewer to make and taste the food during the event itself. The session will be surveying some of the most prominent food and dishes exchanged during the Manila-Acapulco Trade to explore the impact of the 250-year relationship between Mexico and Philippines, revealing what it says about the Filipino identity. Some of the iconic dishes that Mr. Tayag will try to unbox are like the proverbial chicken and egg question: chicharon vs chicharron, champorado vs champorrado, tuba vs tuba, and lambanog vs tequila. There will also be a cocktail making segment with guest mixologist, Lennon Aguilar. By marrying food and history together through a sensory experience, this event is just one way Ayala Museum and Served Manila want to continuously find new engaging ways to bring history to the community. For P3,000, participants will get access to the session plus an exploration kit that includes two craft cocktails, a DIY champorado kit, artisanal chicharon, craft chocolates, and more. Register for “Unboxing the Galleon Trade” at http://bit.ly/galleontrade.