Government support, from safety to classes

(Part 3)

As a response to the peculiar circumstances that prevailed during the COVID-19 pandemic, the Film Development Council of the Philippines (FDCP) launched in July 2020 the Safe Filming program with the aim of ensuring that safety measures are in place for the resumption of film and audiovisual production activities once the pandemic is put under control.

With an active website, Safe Filming makes an accessible platform for productions to register their activities so that the FDCP may provide them with the appropriate resources and the guidelines they need to comply with during their activities. As regards the all-important objective of preserving safety and health during these perilous times, the FDCP offers a training program called the Safety and Health Officers Training Seminar (SHOTS), a free, online, 40-hour basic occupational safety and health training course for audiovisual companies, done in partnership with the Department of Labor and Employment-Occupational Safety and Health Center (DOLE-OSHC).

Since the film industry is one of those most susceptible to rapid technological change, the FDCP has been quick in offering training programs geared towards upskilling, reskilling, and retooling aspiring film workers and professionals so that they can excel in their work.

Pursuant to FDCP-DOLE Joint Memorandum No. 001, Series of 2020, producers were required to register their audiovisual activities at the FDCP Safety Filming Program so that the agency may provide endorsements and assistance to the activities.

Highlighting the importance of Public Private Partnership (PPP), the Full Circle Lab Philippines (FCL PH) is a joint venture of the FDCP with Tatino Films offering a capacity-building program aimed at supporting Filipino and Southeast Asian film makers by organizing various labs that can range from the stages of pre-production to post-production. The program enhances selected projects from around the globe, elevating a particular film to its highest potential and allowing it to reach international standards. The labs offered are First Cut Lab, the Creative Producers Lab, the Story Editing Lab, the Fiction Lab, the Series Lab, and the Animation Lab.

The Philippine film industry is made up of animation companies, film studios, equipment providers and post-production/VFX enterprises. Parenthetically, VFX or Visual Effects is a term used to describe imagery created, manipulated, or enhanced for any film, or other moving media that does not take place during live-action shooting. VFX often involves the integration between actual footage and this manipulated imagery to create realistic looking environments for the context. These environments created are either too dangerous to actually shoot, or do not exist in the real world. They use computer-generated imagery (CGI) and particular VFX software to make it happen. VFX producers communicate with directors and cinematographers to determine which scenes require them to shoot with green screens. Visual effects are different from special effects because visual effects require a computer and are added in after shooting. Special effects, or SFX are realized on set — they are things like purposeful and controlled explosions, fake gunshot wounds, etc. An example of VFX would be the dragons flying through the sky in Game of Thrones, or a spaceship flying through space in Star Wars.

The leading Philippine animation companies are Animation Vertigo, Rocketsheep Studios, Santelmo Studio Inc., Synergy 88, Toei Animation Philippines Inc., Toon City Animation, Top Draw Animation, and Top Peg Animation Studio. The film studios are ABS-CBN, Big Foot Studios, Siren Studios, and Shooting Gallery Studios. There are two equipment providers: CMB Film Services and RSVP Film Studios. Post-Production/VFX outfits are Black Ops Asia, Central Digital Lab, Hit Productions, Mothership, Inc., Quantum Films, Riot, Inc. and Widsound Studios.

In order to expand the supply of filmmakers, the FDCP is currently working on a partnership with the Korean Government for establishing a film training center, which will offer various film courses geared toward both students and professional filmmakers in order to develop or further enhance their skills in various aspects of film making.

Aspiring filmmakers who have the financial resources to study abroad may consider the following leading film schools in the United States: the University of Southern California, the AFI Conservatory, New York University, Chapman University, CalArts School of Film/Video, Emerson College, Columbia University, UCLA, Loyola Marymount University, and the University of North Carolina School of Arts. In the Philippines, the leading film schools are the University of the Philippines Film Institute, De La Salle College of St. Benilde, International Academy of Film and Television, the Asia Pacific Film Institute, and School of Intermedia, Film and Technology (SHIFT).

I have personal knowledge of a university in Spain that offers a bachelor degree in film, photography, and media. A grandnephew of mine is about to graduate from a course in filmmaking at the University of Navarre, Pamplona, Spain, where there is a sizable number of Filipino students who are enrolled in this third ranking university in teaching quality (by THE Teaching Ranking—2019) in the whole of Europe after Oxford and Cambridge. High school graduates who are attracted to filmmaking as a profession may want to consider enrolling in this university which offers a bachelor’s degree in film, photography, and media.

The course will help the student specialize in one of the popular visual arts of the present. One may choose to study for a degree that will teach the inner workings that make a feature movie, documentary, or short film come to life. Or, study for a degree in photography, teaching one the subtleties of capturing shape, light, color, and framing as artistically as possible. A media degree may explore ways of combining film and photography with other emerging visual tools such as digital integration.

Having been a Visiting Professor in the business school attached to this world class university in Spain, the IESE Business School, I can attest to the very high quality of the education imparted by the University of Navarre both in professional or technical terms, as well as in the human formation aspects of education.

More evidence of stronger support from the Government for the film industry is the launching of Pugad Sining, the Film and Audiovisual Industry’s Creative Hub. Each Pugad Sining is unique to its artistic nature, the arts community served, and the people who support its work.

This trend towards a more proactive stance taken by the Philippine Government, hopefully following the South Korean example, will be matched by a greater willingness of the private sector to invest in film production. Among the private investments that are forthcoming are film financing services for film productions, e.g. raising private equity financing from individual investors, preselling film tax incentives to fund firms, options for loans, etc. Also forthcoming are venture capital investments which involve investing in startup film productions, not only money-wise but also by bringing connections and a vast knowledge of financial and industry-specific business knowledge to the table. Also in the investment horizon are financial bonds which involve the establishment of a completion guarantee that ensures a film will be finished and delivered on schedule and within budget.

It is hoped that in the administration that will be in place after the elections, there will be enough public officials (especially among the legislators) who will capitalize on these emerging trends that augur well for a bright future for the Philippine film industry.

Bernardo M. Villegas has a Ph.D. in Economics from Harvard, is professor emeritus at the University of Asia and the Pacific, and a visiting professor at the IESE Business School in Barcelona, Spain. He was a member of the 1986 Constitutional Commission.

bernardo.villegas@uap.asia

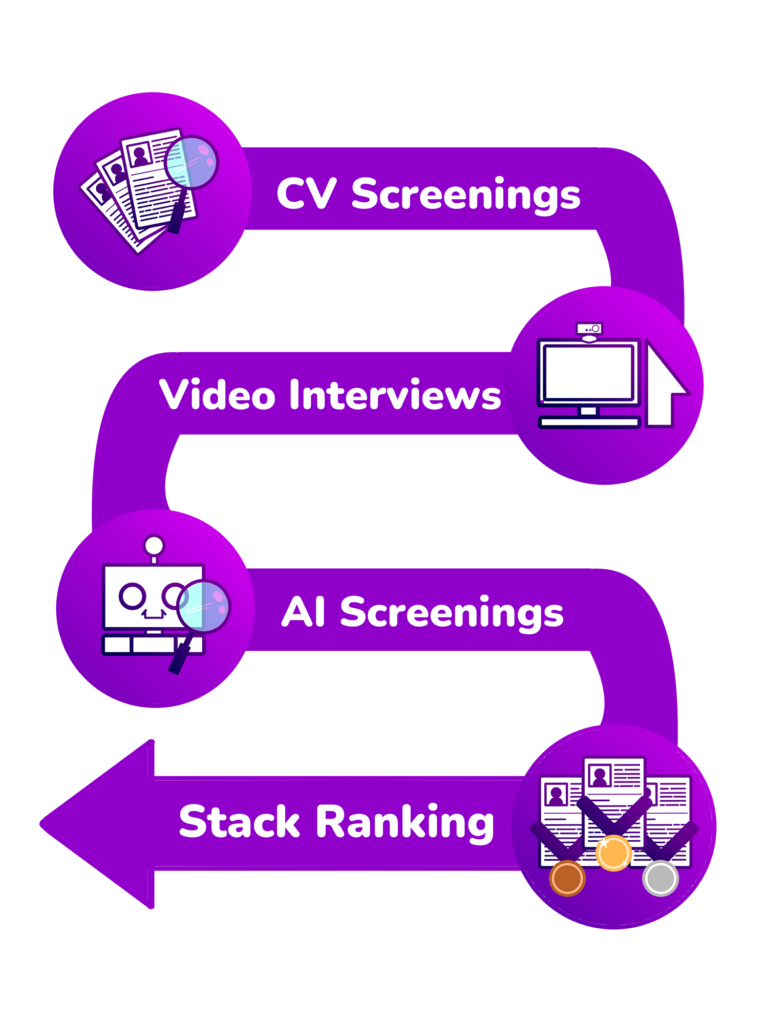

This insight inspired MetroCity AI to develop a recruitment platform that solves the pain of long hours spent on CV screening and initial virtual interviews. Companies can make use of the asynchronous video interview (AVI) functionality in the platform to invite applicants to record themselves on camera as they answer questions related to culture-fit, behavior, and skills provided by the company.

This insight inspired MetroCity AI to develop a recruitment platform that solves the pain of long hours spent on CV screening and initial virtual interviews. Companies can make use of the asynchronous video interview (AVI) functionality in the platform to invite applicants to record themselves on camera as they answer questions related to culture-fit, behavior, and skills provided by the company.