By Jenina P. Ibañez, Senior Reporter

THE PHILIPPINE central bank may start raising its benchmark interest rates before mid-2022 to quell inflation risks caused by the Russia-Ukraine crisis, analysts said.

After easing to 3% in February, inflation in the Philippines could be affected by rising oil prices and natural disasters like typhoons, CLSA Senior Economist Anthony Nafte said at a briefing on Wednesday.

“Inflation is very volatile in the Philippines. I’m expecting a spike over the coming months to anywhere between 5.5% and 6%. That’s doubling the current inflation at 3%,” he said.

“Among emerging ASEAN (Association of Southeast Asian Nations) economies, the Philippines will be the highest risk of raising interest rates before the middle of the year.”

Mr. Nafte expects a 25-basis-point (bp) increase before mid-2022, and then another 50-bp hike in the second half of the year.

The Philippine economy would likely be “collateral damage” to the Russia-Ukraine crisis, raising prices in several sectors and pushing up inflation, Finance Secretary Carlos G. Dominguez III said on Monday evening.

Bangko Sentral ng Pilipinas (BSP) Governor Benjamin E. Diokno earlier said the war between Russia and Ukraine and its impact on international oil prices would continue to spill over to local costs. This could cause inflation to again exceed the central bank’s target of 2% to 4% this year, he said.

Mr. Diokno previously said the BSP would remain accommodative and wait for four to six straight quarters of economic growth before considering a rate hike. The central bank, however, said it was ready to act in case there is a need to respond to second-round effects of inflation.

Central banks in Southeast Asia have not yet raised rates, although Singapore has started tightening its monetary policy through its exchange rate settings.

Mr. Nafte said the Philippines is still expected to be an economic outperformer in ASEAN because it is a domestically driven economy, making it less vulnerable to export disruptions.

“We’re looking for a consumption spike in the second quarter. Traditionally, there’s this huge amount of pre-election spending,” he said, referring to the campaign season before the May 9 elections.

Declining coronavirus cases and improving vaccinations are also driving more mobility, Mr. Nafte added.

While there are investment uncertainties due to the upcoming elections, he said the economic recovery would be boosted if the next administration continues the government’s flagship infrastructure program.

Emerging markets like the Philippines could also relatively perform well amid the crisis because it is less vulnerable to liquidity shocks, Manulife Investment Management said in a note.

“It’s also likely that global export momentum slows somewhat, and so those economies less reliant on foreign demand may enjoy a mild relative advantage.”

ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa expects the central bank to consider hiking rates by the second quarter as inflation accelerates.

Inflation would likely come in at 5.2%, breaching the central bank’s target as early as the second quarter, due to the depreciating peso and higher energy prices, he said via Viber.

“Despite dovish undertones from (Mr.) Diokno, BSP may be backed into a corner by May with soaring commodity prices and a weaker currency,” he said.

House Ways and Means Chairperson and Albay Rep. Jose Maria Clemente S. Salceda said the continued rise of pump prices could push inflation higher.

“This could drive overall inflation to as high as 5.2 to 5.4% by June, considering added pressures on bread (Russia and Ukraine are among the world’s largest producers of wheat), typical power demand surges during the summer months, and second-round effects of oil prices on transport costs, electricity, food (especially fish), and other basic commodities,” he said in a statement.

Higher interest rates are needed before the middle of the year to manage inflation if petroleum prices continue to surge, University of Asia and the Pacific Senior Economist Cid L. Terosa said

“I’m less optimistic that the pace of the rise in prices of petroleum products this month will slow down drastically,” he said in an e-mail. “If prices fall, the pace would be slower than the speed it has risen for the past few weeks. I believe inflationary risks will intensify.”

Local gasoline, diesel and kerosene prices rose for the 10th straight week on Tuesday by P3.60, P5.85, and P4.10 per liter, respectively. World oil prices hit multi-year highs in the past few days due to supply concerns.

‘MOST VULNERABLE’

S&P Global Ratings on Wednesday warned central banks in the region should deal with inflation risks from the Russia-Ukraine crisis, alongside the impact of the looming rate hikes by the US Federal Reserve.

“Higher consumer price index inflation would strain monetary policy in India, Korea, the Philippines, Singapore, and New Zealand, where CPI (consumer price index) inflation is preoccupying central banks,” it said in a note.

S&P said the Philippines is one of the Asia-Pacific economies that is most vulnerable to the oil price spike triggered by Russia’s invasion of Ukraine.

The debt watcher warned that the war’s impact on prices and financial markets could hit growth prospects in the region, as consumer and business confidence is dampened.

“For the many economies in Asia-Pacific that are net energy importers, higher energy prices can trigger a terms-of-trade shock,” S&P said.

“This would hit current account balances and real domestic consumption and investment. This dynamics would be most keenly felt by the largest net energy importers (relative to gross domestic product): India, the Philippines, Korea, Taiwan, and Thailand,” it added.

S&P also said substantially higher energy prices and volatility could weaken currencies and asset markets in Asia-Pacific countries.

“This pressure will be strongest where higher energy prices pressure inflation targets — such as India, the Philippines, Korea, and Thailand. Or it could cause sizable current account deficits — in India, the Philippines, and Thailand,” according to the report.

The peso closed at P52.23 on Wednesday, the third straight day it finished at a P52-per-dollar level, amid safe-haven demand for the greenback.

In December, S&P said it expected the Philippine economy to grow by 7.4% in 2022, which is well within the 7-9% target set by economic managers. — with Luz Wendy T. Noble

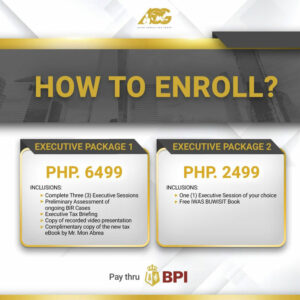

The price comes with a great deal of experience and takeaways but we don’t stop there. The package comes with an Executive Tax Briefing, one-on-one consultation with the ACG’s expert tax advisors, and Chairman and CEO, Mon Abrea.

The price comes with a great deal of experience and takeaways but we don’t stop there. The package comes with an Executive Tax Briefing, one-on-one consultation with the ACG’s expert tax advisors, and Chairman and CEO, Mon Abrea. To avail of the special discounted price, kindly use the promo code: BW2022

To avail of the special discounted price, kindly use the promo code: BW2022 Executive Tax Management Program is supported by our media partners: ABS-CBN Books, Start-Up Village, Project Match, The New Channel, and BusinessWorld. For questions and other concerns, feel free to email us at

Executive Tax Management Program is supported by our media partners: ABS-CBN Books, Start-Up Village, Project Match, The New Channel, and BusinessWorld. For questions and other concerns, feel free to email us at