Inflation, cement importation, and electricity concerns

Three different topics here, we go straight to them.

RISING PHILIPPINES INFLATION, BIDENFLATION

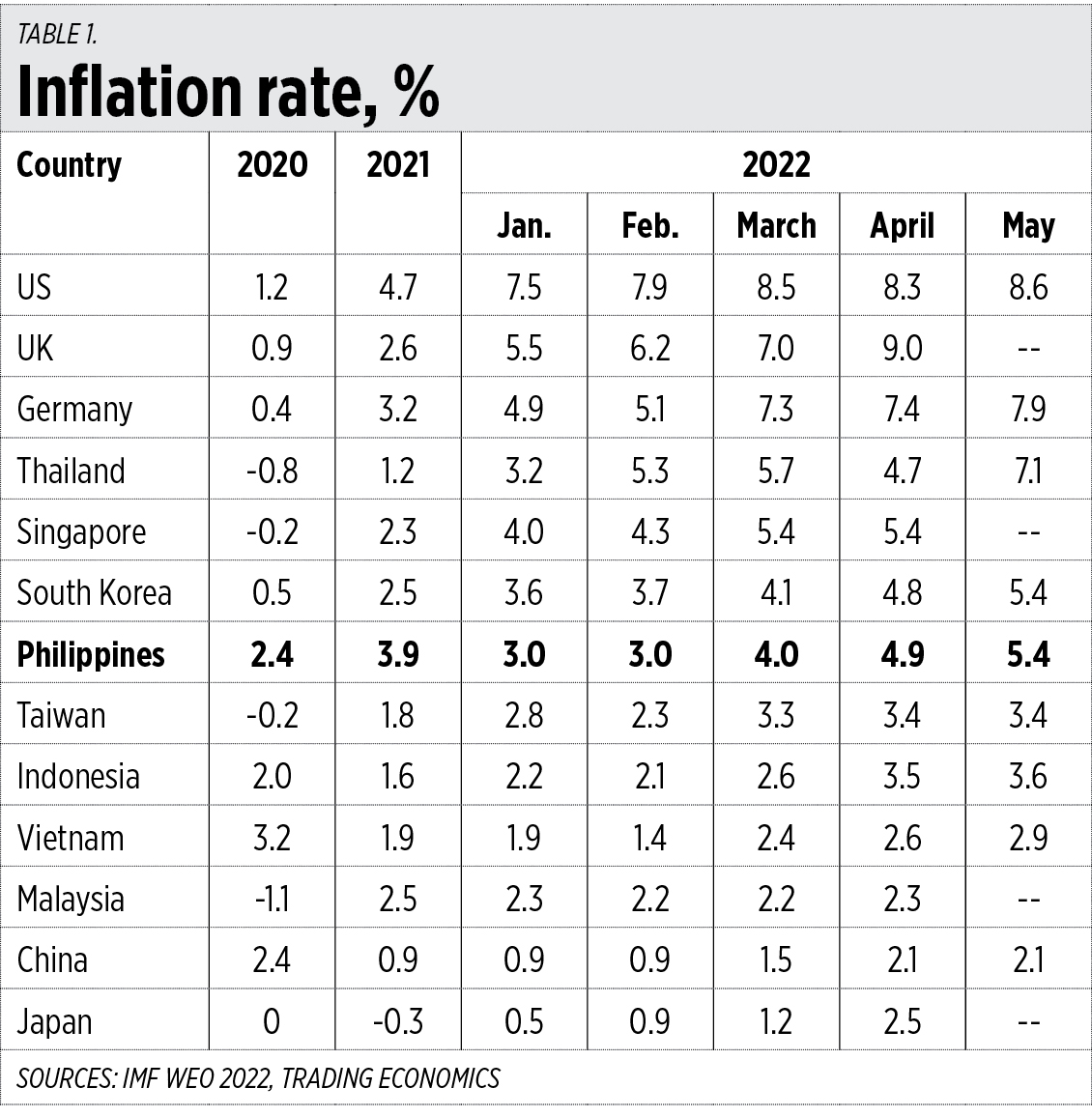

The Philippines saw a big jump in its inflation rate last month, from 3% in January-February to 5.4% in May. Big increases in May happened in transport (14.6%), housing, water and electricity (6.5%), and alcoholic beverages and tobacco (6.8%).

In the US, “Bidenflation” continued to wreak havoc in ordinary American households. The US inflation rate was only 1.4% in January 2021 when Trump left the White House; it jumped to 7.5% in January 2022 or 12 months into the Biden presidency and before the Russian invasion of Ukraine, and went up to 8.6% in May, the highest rate in 40 years.

Germany’s inflation of 7.9% in May was highest perhaps in about six decades, while the United Kingdom’s 9% in April was the highest in 40 years. The industrial economies of America and Europe are limping from high inflation (Table 1).

The west’s “war on fossil fuels” is a big reason why this happened. High oil-gas-coal prices mean a higher cost of manufacturing, and higher commercial and household electricity bills. Underinvestment in oil refining also contributed to low fertilizer output and high fertilizer and food prices.

CEMENT IMPORTATION AND THE CONSUMERS

I recently received many materials on “Cement Anti Dumping” presented by the Cement Manufacturers Association of the Philippines (CEMAP). They believe that cheaper imported cement, mainly from Vietnam, is bad for the economy because it adversely affects the revenues of their member-companies, their capacity expansion and job generation. Their argument is summarized in one report in BusinessWorld, “Cement group seeks safeguard for local manufacturers” (June 9).

Free trade means the consumers are the main beneficiaries of trade. Cheaper cement, steel, and other construction materials means poor people who otherwise would have weak wooden or bamboo houses can have concrete houses that can better protect them from strong typhoons and flash flooding, helping save lives and properties. And CEMAP think this is bad, that cheaper imported cement should be penalized with high tariffs to make it more expensive for consumers. Bad lobby.

I checked the Philippine Statistics Authority (PSA) data — the construction materials price index and price changes from 2020 to April 2022 — and it shows that concrete materials and cement has low or small price changes compared to overall construction materials and national inflation. In 2021, Philippines inflation was 3.9%, inflation for all construction materials was 3.2%, and inflation for cement was 1.5%. In the first four months of 2022, Philippines inflation was 3.7%, all construction materials 6%, cement 4.1% (see Table 2). This means cement liberalization is working for the consumers and if CEMAP will have its way, cement inflation should rise higher — at a time when higher inflation is causing more social and economic stress on Philippine households and businesses.

The Tariff Commission (TC) should consider the interests of consumers and not just the cement manufacturers, importers, and traders. Free trade is pro-consumers.

ELECTRICITY CONCERNS

These recent reports in BusinessWorld are interesting.

1. “NGCP starts new transmission line for Bataan capacity expansion” (May 26),

2. “Meralco seeks ‘sound’ policies to cut power costs” (June 1),

3. “Razon firm ‘poised’ to control Malampaya project” (June 3),

4. “Prime Infra unit plans world’s largest solar farm” (June 9),

5. “Gov’t imposes sanctions on two electric cooperatives” (June 9),

6. “Meralco power rates to rise in June” (June 10).

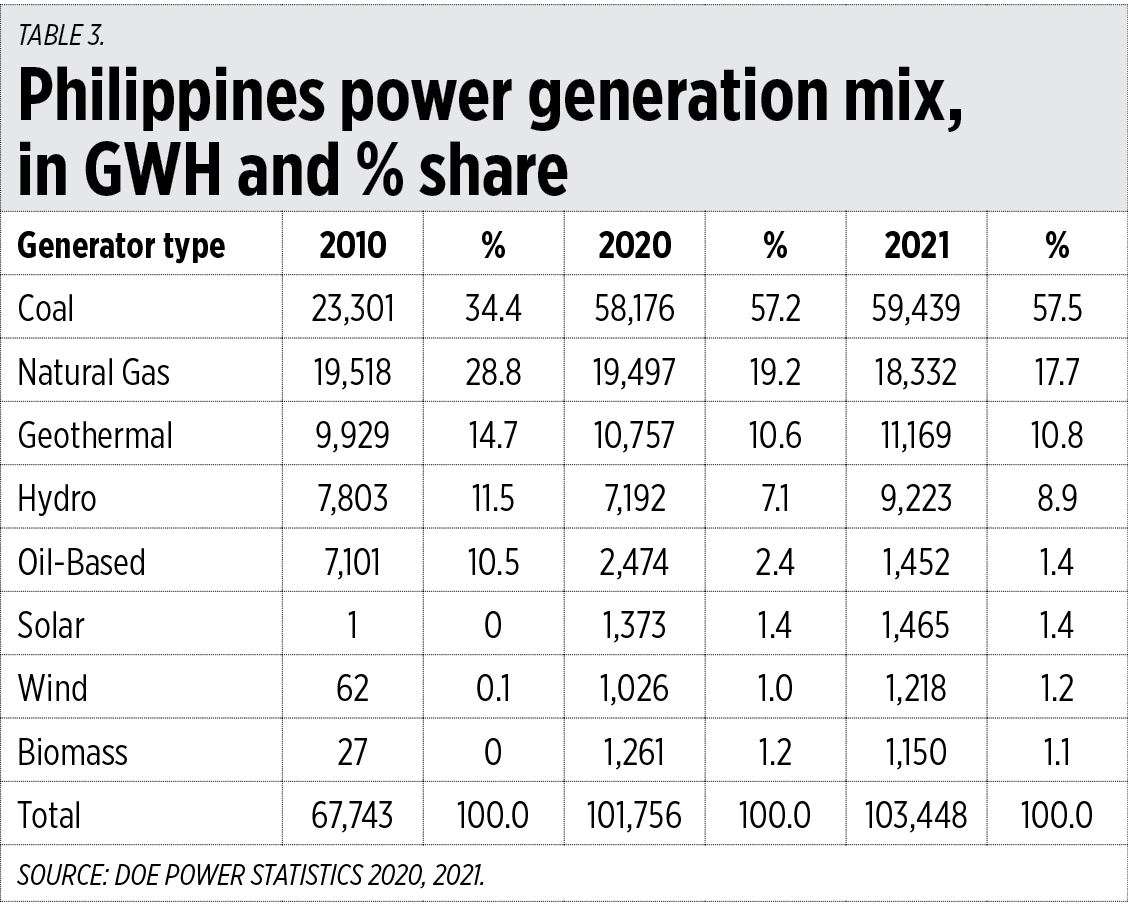

Report No. 1 is somehow good because the National Grid Corp. of the Philippines (NGCP) has a record of frequent delayed delivery of the needed transmission lines between new power plants and distribution utilities. The report refers to the Mariveles to Hermosa, Bataan line, which should have been finished much earlier. And NGCP should have finished the Hermosa, Bataan to San Jose, Zambales line by June 30 as the delayed transmission line there chokes 818 MW of power (GN Power Dinginin Unit 2 with 668 MW and SMC Mariveles Unit 1 with 150 MW) that can expand supply in the Luzon grid. This is far from happening yet. See Table 3 of this column on May 16, https://bit.ly/Oplas051622.

Reports Nos. 2 and 6 are related: Meralco has no choice but to raise electricity rates because the generation cost has increased. The price of coal (Newcastle) this June was $390+ per ton which is three times higher than a year ago when it was $175+ per ton. Even the price of domestic Malampaya gas is pegged to Dubai crude’s price and thus is also rising. Good thing that Meralco is able to keep its distribution charge flat, with no increase since about 2015.

Reports No. 3 and 4 show further expansion of Mr. Razon’s Prime Infra in energy. Its planned 2,500-3,500 MW solar plants will have a big impact on competition for land use because that will require about 4,000 to 5,500 hectares of land. In addition, more intermittent renewables with priority dispatch to the grid mean they can discourage other investments in coal, oil, gas, and nuclear as they are a lower priority in the grid. For instance, if coal and gas plants offer power at P5/kwh and solar offers P6/kwh, the latter will still be prioritized. Discouraging investments in conventional thermal plants can lead to the threat of blackouts in the future, and this is happening now in Europe, the US, and even Japan.

Report No. 5 is about Maguindanao Electric Cooperative, Inc. (Magelco) and Lanao del Sur Electric Cooperative, Inc. (Lasureco). They respectively owe P3.8 billion and P12.9 billion — a total of P16.7 billion — to the state-owned Power Sector Assets and Liabilities Management Corp. (PSALM). These two electric cooperatives (ECs) could be the reason why PSALM asked for P16 billion in budgetary support for 2021 and 2022. So, taxpayers from Zamboanga to Visayas to Luzon are subsidizing these ECs as they extract more “free electricity” from PSALM. Wow. This is one more reason why the National Electrification Agency (NEA) that supervises all ECs should go, and all ECs should become private distribution utilities, supervised and monitored by the Securities and Exchange Commission (SEC) and not by a political agency like the NEA.

Meanwhile, Department of Energy (DoE) data show that in 2021, the Philippines produced 103,448 gigawatt-hours (GWH) of electricity, more than 2020’s 101,800 GWH but still lower than 2019’s 106,000 GWH. Coal’s share in installed capacity is still at around 35% of the total but contributed 57.5% in actual power generation in 2021.

Malampaya gas generation is declining, from 19,500 GWH in 2010 and 2020 to 18,300 GWH in 2021. The shares of geothermal and hydro are increasing slightly, and wind-solar’s contribution is only 2.6% of total generation in 2021, still insignificant even if the Renewable Energy law was enacted in 2008 and feed-in tariff (FIT) or assured high prices for 20 years was granted in 2012 or a decade ago (Table 3).

I am hoping that the Ferdinand Marcos, Jr. administration will realize that energy rationing, giving unnecessary priorities to intermittent renewables and discouraging investments in thermal power generation, will be counter-productive economically. The right energy mix should be done by the consumers themselves, not by government’s Executive or Legislative branches, nor by environmental and climate lobby groups.

Bienvenido S. Oplas, Jr. is the president of Minimal Government Thinkers.