Implementation of the Mandanas ruling seen to dampen economic growth

THE IMPLEMENTATION of the Supreme Court ruling expanding the local governments’ share in national taxes next year would lead to a “three percent lower economic growth,” according to Department of Finance (DoF) estimates.

The DoF in a statement on Tuesday said the higher tax allocation for local government units (LGUs) would dampen spending efficiency because the National Government usually spends at double the pace.

Lower spending efficiency refers to the reduced share of productive spending — or funds that go back to the economy by creating jobs or stimulating demand — to total spending.

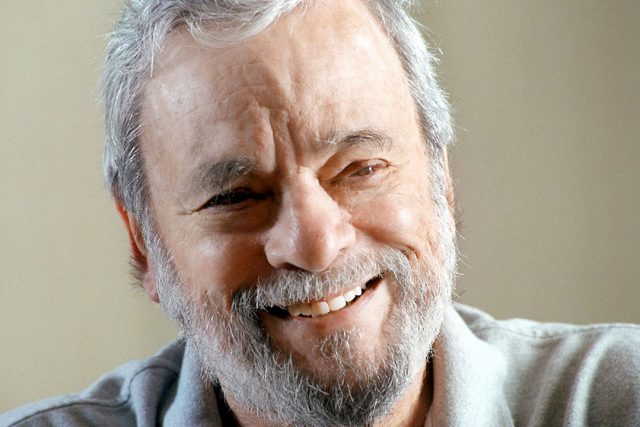

“Based on our estimates, the implementation of the Supreme Court’s 2018 ruling will yield lower economic growth because local governments spend less efficiently,” Finance Secretary Carlos G. Dominguez III said.

The Supreme Court’s Mandanas ruling is named after Batangas Governor Hermilando I. Mandanas who successfully challenged the government’s previous position that LGUs were entitled to a smaller share of National Government funds.

Starting in 2022, LGUs will get a bigger share of the National Government’s tax collections, alongside the transfer of basic services.

President Rodrigo R. Duterte in June signed Executive Order (EO) 138 which transfers a number of basic services to LGUs by 2024. With this, the government is shifting programs and projects, worth an estimated P234.4 billion, to LGUs.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said there are more policy uncertainties among LGUs when it comes to spending, compared with continuity at the national level.

“LGUs may vary in their management style in terms of handling various government projects — while more standardized at the National Government level — amid some continuity issues as local officials are re-elected every three years,” he said in a Viber message.

Greater funding flexibility for LGUs positively affect those that spend efficiently, he said, but misappropriation and wastage are a drawback for others.

The World Bank has said that funds that the LGUs fail to spend could increase by P155 billion next year, or the equivalent of 0.7% of gross domestic product (GDP), if their capability to enforce projects are not upgraded.

Unspent budgets waste opportunities to bring crucial services to communities that need them most, World Bank economist Kevin Cruz said in June.

World Bank estimates found that tax allotments to LGUs could grow by 55% to 1.08 trillion next year.

To minimize economic scarring from the pandemic and the larger share of LGUs on national taxes, Mr. Dominguez said the Finance department is reviewing a possible fiscal consolidation plan, or policies aimed at reducing the country’s deficit.

“Tax revenue losses from the pandemic-induced economic slump, the rise in debt to fund our COVID-19 response, the looming revenue impact of our economic recovery measures, and lower spending efficiency as a result of the Supreme Court decision to expand the share of LGUs from the national tax allotment (NTA) must be adequately addressed by the next administration’s economic team,” he said.

The DoF flagged revenue losses and financing costs caused by the pandemic-induced economic decline. The department estimates revenue losses stood at P785.64 billion for 2020 and anticipates higher foregone revenues as the country enforces its tax reform programs.

Loans to finance the coronavirus disease 2019 (COVID-19) response has reached P1.47 trillion, or $28.91 billion, DoF said.

“The outstanding balance or the principal value of the loans is US$22.58 billion or P1.15 trillion, while the projected amount of interest payments until maturity is US$6.32 billion or P320.85 billion,” DoF said. “These loans will mature between 2024 and 2060.”

The DoF plans to focus on debt management, inflation, economic inequality, and climate change as it transitions to the next administration after the national elections in May 2022. — Jenina P. Ibañez