PSEi sinks further as net foreign selling surges

STOCKS continued to drop on Tuesday as net foreign selling surged amid Wall Street’s rise and expectations of global monetary tightening.

The benchmark Philippine Stock Exchange index (PSEi) fell by 110.40 points or 1.65% to close at 6,577.45 on Tuesday, while the broader all shares index retreated by 40.81 points or 1.13% to 3,550.40.

“Philippine shares continued to slide as investors returned to the US after being beaten down last week. Wall Street is also looking ahead to new home sales… US stocks bounced on Monday as investors snapped up beaten-down shares such as banks after the Dow Jones Industrial Average notched eight straight losing weeks,” Regina Capital Development Corp. Head of Sales Luis A. Limlingan said in a Viber message.

Net foreign selling surged to P9.58 billion on Tuesday from P305.97 million the previous trading day.

US stocks ended higher on Monday as gains from banks and a rebound in market-leading tech shares supported a broad-based rally following Wall Street’s longest streak of weekly declines since the dotcom bust more than 20 years ago.

The Dow Jones Industrial Average rose 618.34 points or 1.98% to 31,880.24; the S&P 500 gained 72.39 points or 1.86% to 3,973.75; and the Nasdaq Composite added 180.66 points or 1.59% to 11,535.27.

On Friday, the S&P 500 closed 18.7% below its record closing high reached on Jan. 3. If the benchmark index closes 20% or more below that record, it will confirm it has been in a bear market since then.

Markets have been roiled in recent weeks by worries about persistently high inflation and aggressive attempts by the US Federal Reserve to rein it in while the global economy copes with fallout from Russia’s invasion of Ukraine.

First Metro Investment Corp. Head of Research Cristina S. Ulang said the market was down again mainly due to increasingly more hawkish messaging from the world’s biggest central banks, including the European Central Bank (ECB).

The euro leapt on Tuesday after the ECB said it was likely to lift its deposit rate out of negative territory by September.

Majority of the sectoral indices ended in the red, except for mining and oil, which gained by 21.71 points or 0.18% to 11,780.86.

Meanwhile, holding firms sank by 145.31 points or 2.35% to 6,018.51; financials dropped by 27.79 points or 1.74% to 1,566.21; property lost 38.99 points or 1.27% to end at 3,017.08; industrials declined by 109.72 points or 1.17% to 9,248.14; and services went down by 9.12 points or 0.48% to 1,873.27.

Decliners bested advancers, 120 versus 63, while 54 names ended unchanged.

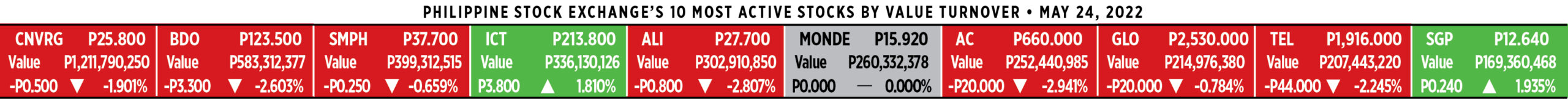

Value turnover surged to P20.20 billion on Tuesday with 1.54 billion shares changing hands from the P6.64 billion with 1.22 million issues seen on Monday. — Luisa Maria Jacinta C. Jocson with Reuters

Peso inches lower vs dollar on global inflation concerns

THE PESO moved sideways versus the greenback on Tuesday amid inflation concerns as the protracted war between Russia and Ukraine and coronavirus lockdowns in China roil global fuel prices.

The local unit ended trading at P52.32 per dollar on Tuesday, losing five centavos from its P52.27 close on Monday, Bankers Association of the Philippines data showed.

The peso opened Tuesday’s session at P52.32 versus the dollar. Its weakest showing was at P52.39, while its intraday best was at P52.23 against the greenback.

Dollars exchanged declined to $1.02 billion on Tuesday from $1.19 billion on Monday.

“USD/PHP continued to move sideways on Tuesday as dollar supply remained sufficient to meet demand,” Bank of the Philippine Islands Lead Economist Emilio S. Neri, Jr. said in a Viber message.

“Market players are currently monitoring developments that could affect inflation and interest rates in the coming months, like the movement of oil prices, the ongoing conflict in Ukraine, and the lockdowns in China,” Mr. Neri added.

Oil prices were caught between worries over a possible global downturn and the prospect of higher fuel demand from the US summer driving season and Shanghai’s plans to reopen after a two-month coronavirus lockdown, Reuters reported.

US crude eased 66 cents to $109.08 per barrel, while Brent fell 1.14% to $112.14.

Meanwhile, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in a Viber message that the peso weakened slightly after a slight upward correction in the benchmark 10-year US Treasury’s yield and local stock market’s decline.

The yield on 10-year Treasury notes rose 7.7 basis points (bps) to 2.864% after a more than 40-bp decline from a multi-year high of 3.203% set two weeks ago.

On the other hand, the benchmark Philippine Stock Exchange index fell by 110.40 points or 1.65% to close at 6,577.45 on Tuesday, while the broader all shares index retreated by 40.81 points or 0.13% to 3,550.40.

For Wednesday, Mr. Ricafort expects the peso to trade from P52.20 to P52.40 per dollar. — KBT with Reuters

GOCC losses exceed P703B as state insurers adopt PFRS

THE ADOPTION of Philippine Financial Reporting Standards (PFRS) has resulted in a net loss of P703.59 billion in 2021 for government-owned and -controlled corporations (GOCCs), up from P346.54 billion a year earlier, after the new accounting norms forced the recognition of major liabilities among government insurers, the Department of Finance (DoF) said.

In a statement on Tuesday, the DoF said the findings were contained in a Corporate Affairs Group (CAG) report on the 108 GOCCs’ performance from an examination of unaudited financial statements.

“The results of operations of the government corporate sector dropped to a P703.59 billion net loss in 2021 from a P346.54 billion net loss in 2020 primarily because of the recognition of the Insurance Contract Liabilities (ICL) by GOCCs classified as government insurance institutions when the Philippine Financial Reporting Standards (PFRS) was adopted in reporting their financial statements,” the DoF said.

“Before the PFRS adjustments, the results of operations of these corporations totaled a net income before tax of P324.63 billion in 2021 or a 19% increase from the P273.66-billion level in 2020. The results of operations in 2021, sans the PFRS adjustments in the social security institutions’ reports, shows that the GOCCs are starting to bounce back to their 2019 net income before tax level of P342.89 billion.”

In terms of assets, the DoF said the 31 most significant GOCCs are also signaling a recovery in the broader economy.

CAG found that the 31 major GOCCs had total assets of P10 trillion, against liabilities of P16.22 trillion, up 7% and 9% respectively.

The assets of the 31 GOCCs totaled P9.37 trillion. Taken as a group, the assets of all 108 GOCCs amounted to P10.3 trillion in 2020, the DoF said.

The 31 GOCCs are “considered fiscally significant either as major contributors to the revenue of the National Government (NG) or as recipients of direct and indirect support from the NG,” Finance Assistant Secretary Soledad Emilia F. Cruz was quoted as saying.

The big GOCCs “are the major drivers of the financial and fiscal health of the government corporate sector. These assets (are equivalent to) about half of the country’s gross domestic product (GDP),” CAG said.

Remittances from 15 of these 31 GOCCs totaled P30.8 billion, or over half of the P57.55 billion in total dividends generated in 2021.

The 31 GOCCs are the Philippine Deposit Insurance Corp., National Power Corporation, National Transmission Corp., Philippine National Oil Company, Philippine Economic Zone Authority, Bases Conversion and Development Authority, and Philippine Ports Authority;

The Power Sector Assets and Liabilities Management Corp., Philippine Amusement and Gaming Corp., Philippine Charity Sweepstakes Office, Manila International Airport Authority, Civil Aviation Authority of the Philippines, Land Bank of the Philippines, Development Bank of the Philippines, Social Security System (SSS), Government Service Insurance System (GSIS), and Philippine Health Insurance Corp. (PhilHealth);

The National Food Authority, National Development Co., Metropolitan Waterworks and Sewerage System, Local Water Utilities Administration, National Housing Authority, National Irrigation Administration, Philippine National Railways, Light Rail Transit Authority, National Electrification Administration, Philippine Guarantee Corp., Home Development Mutual Fund, Philippine Crop Insurance Corp., Social Housing Finance Corp., and National Home Mortgage Finance Corp.

Ms. Cruz said that various reforms, including the Rice Tariffication Law, the Social Security Act, and the Murang Kuryente Act, which took effect in 2021, helped increase the revenue of many GOCCs, which as a whole helped improve their operations.

“The movements in macroeconomic indicators, such as the currency exchange rate and interest rates, are significant variables and propellers of their operations.”

“The overall performance of the sector for 2021 reflects the firm resolve of the government to promote transparency in the financial health of the government corporations through adherence to international reporting standards and best practices and related laws, rules, and regulations,” the DoF said.

In December 2021, Finance Secretary Carlos G. Dominguez III directed PhilHealth, SSS, and GSIS to estimate their social benefit liabilities to reflect the PFRS 4 standard dating back to 2020 results.

“PFRS 4 is the current and interim accounting standard imposed on insurance entities in the Philippines,” the DoF said.

The combined ICL of GSIS, SSS, and PhilHealth was estimated at P10.81 trillion in 2021, up 10% from the previous year. — Tobias Jared Tomas

Indonesia, PHL recoveries to outperform ASEAN — Bloomberg Economics

THE disruptions imposed by the war in Ukraine and the lockdowns in China are expected to slow the economic recovery in Southeast Asia but not knock it off track, with Indonesia and the Philippines tagged as outperformers, a Singapore-based analyst with Bloomberg Economics said.

“We don’t expect recovery to be derailed because we have simultaneous pandemic reopenings helping to cushion the blow. Prior to China (lockdowns), ASEAN growth averaged 5.1%, only slightly less than the 5.3% projection in November,” Tamara Henderson of Bloomberg Economics said at a virtual webinar on Tuesday.

Ms. Henderson, who covers ASEAN for Bloomberg Economics, said Indonesia and the Philippines have more potential to post a strong recovery because they are “more domestic demand-driven.”

She said an element of their outperformance is the lag in the two countries’ economic reopening relative to the rest of the region.

Singapore and Thailand were identified as laggards because they “are seen as more vulnerable or are likely to register slower growth due to China’s prolonged lockdowns,” Ms. Henderson said.

She said Singapore has less reopening left to do and was more exposed to trade disruptions, while Thailand was reliant on Chinese tourism.

Ms. Henderson said that most countries were now adjusting to the pandemic.

“The good news is that the global weekly death toll is down, the lowest since March 2020 despite the emergence of new variants,” she said.

Bloomberg Economics said the economic reopening and unleashing of pent-up demand will underpin growth in the region.

However, not every economy in Asia is reopening, Ms. Henderson said, noting that China had yet to abandon its zero-COVID strategy.

“Its transition to living with COVID could take another year or even longer,” she said.

“As China reopens, we will see headwinds turn to tailwinds, but probably not a story for this year,” she added.

In Europe, the ongoing war between Russia and Ukraine will continue to hamper the global economic recovery, Ms. Henderson said.

“This is not the first time Russia has moved in on its neighbors; however, the impact is different because of the degree of sanctions on Russia, not without cost for the global economy,” she said.

The sanctions have been reflected in commodity price shocks, most notably in oil and grain.

“This is going to be more problematic for countries with a larger share of low-income households. It benefits commodity exporters; we have both of these in Oceania,” she added.

Ms. Henderson said that policy moves by the Federal Reserve remain closely watched by the market.

“In the US, all eyes are on inflation. The Fed is working to get its credibility back, and it may have to force a recession to get inflation under control,” she said.

Bloomberg Economics expects the Fed to press on with rate hikes until its funds rate goes to 3.5% by the end of 2022.

In Southeast Asia, she said that unless the central banks are moving more or less in step with the Fed, capital flows may become an issue.

“I don’t see all ASEAN central banks moving dramatically as the Fed this year,” she said. “However, the Philippines started its rate hike last week with inflation well above target.”

Bloomberg Economics said it is expecting the Bangko Sentral ng Pilipinas to hike by 200 basis points between 2022 and 2024. — Luisa Maria Jacinta C. Jocson

NEDA pressed to review infrastructure projects to manage debt load

THE incoming Socioeconomic Planning Secretary, Arsenio M. Balisacan, must review President Rodrigo R. Duterte’s active infrastructure projects in order to identify possible savings that may be applied to better managing the national debt, InfraWatchPH said in a statement.

Mr. Balisacan, who is set to return to the National Economic and Development Authority (NEDA), “should prioritize which infrastructure projects to continue, suspend, cancel or transform into public-private partnerships in order to effectively manage the country’s climbing debt load,” InfraWatch said.

The think tank said the massive spending on infrastructure projects must be balanced with the need to fund social programs and services.

“The overarching concern to limit infrastructure spending through foreign loans is the limited space to fund social programs as a result of our massive debt load,” it said. “We have reached this point no thanks to the outgoing administration’s infrastructure ambitions, not even half of which had in fact been completed or currently ongoing.”

InfraWatch said the foreign debt taken on by Mr. Duterte will result in serious belt-tightening by the new administration “on social programs aimed at directly benefiting the public, such as housing and cash aid.”

“If we continue with the current government’s infrastructure trajectory of massive spending on the back of foreign loans, there might not be enough cash left to build houses, schools, and health centers and to distribute cash aid during crises.”

InfraWatch said the new government, expected to be led by the top Presidential vote-getter Ferdinand R. Marcos, Jr., should “outrightly cancel” infrastructure deals flagged by the Commission on Audit and subject to negative reports.

It cited a dam project in Quezon province, which is being positioned as a second water source for the Philippine capital.

State auditors found that the bidding for the dam project, which environmentalists said will flood 300 hectares of forested area, appeared to have been rigged in favor of a Chinese firm.

“Infrastructure deals like the recently inaugurated China-funded bridges should not be allowed in the new government, as nearly half of the projects’ workforce were Chinese workers,” InfraWatch added. “How can we stimulate a post-COVID economy if foreign workers compete with our own workers?”

“These types of activities should have no place under a new government.”

Mr. Duterte led a foreign policy pivot to China when he took office in 2016, generating about P1.2 trillion in investment and loan pledges, though few have materialized. — Kyle Aristophere T. Atienza

Pre-pandemic economy seen restored by 2022 second half

THE ECONOMY will return to pre-pandemic levels by the second half, assuming no return to the stricter quarantine settings, a Palace adviser said.

Presidential Adviser for Entrepreneurship Jose Ma. A. Concepcion III said the 8.3% increase in gross domestic product in the first quarter can be taken as heralding a broader recovery.

“We are moving forward. Consumer spending is up despite inflation. This return to robust economic growth can be sustained if the incoming administration focuses its efforts on the country’s micro, small, and medium enterprises (MSMEs),” Mr. Concepcion said in a statement on Tuesday.

Metro Manila is currently under Alert Level 1, the most permissive setting in the coronavirus disease 2019 (COVID-19) quarantine system, until May 31.

Mr. Concepcion said the growth trajectory is not expected to be hampered by a surge in COVID-19 infections.

“I’m not so worried at this point because we still have lots of vaccines; we just need to implement and boost more. Filipinos’ high compliance with wearing face masks, probably contributed to maintaining low-risk levels,” Mr. Concepcion said.

Mr. Concepcion said the wearing of masks will remain even with a decline in coronavirus case counts.

“I believe masking will have to stay for some time until the virus simmers down and disappears. It will be important for our exit strategy. With the elections concluded, local governments can return their focus on vaccinations, especially now that the challenge is convincing Filipinos to take their booster shots,” Mr. Concepcion said.

“That’s why we’re intensifying our Booster to the Max campaign, and reminding people that the freedoms we enjoy today are because of vaccinations,” he added.

Mr. Concepcion also pressed the Health Technology Assessment Council to adopt guidelines by the US Centers for Disease Control which recommends second boosters for those 50 years and older.

“We have so many vaccines in stock and they will just go to waste if we don’t remove the barriers. Most of those in the 50 years and older category are our economic frontliners, and although infections may be muted for now, we have to protect them from infections and from the threat of long COVID,” Mr. Concepcion said.

“Long COVID presents prolonged symptoms like headaches, shortness of breath and joint pains among patients who contracted the virus. Experts say that long COVID is a threat to productivity and may decrease quality of life for those who suffer from it,” he added. — Revin Mikhael D. Ochave

US IPEF plan consistent with PHL priorities, DTI says

THE US initiative to re-engage economically in the region, known as the Indo-Pacific Economic Framework (IPEF), is consistent with the Philippines’ desire to promote inclusive growth and quality job creation, the Department of Trade and Industry (DTI) said.

IPEF, widely viewed as a counter to the gains made by China in the region, was announced in Tokyo on Monday by US President Joe Biden.

Trade Secretary Ramon M. Lopez attended the virtual IPEF launch and delivered a message on behalf of President Rodrigo R. Duterte, who called IPEF aligned with Philippine economic and development priorities.

IPEF participants, apart from the US, are Australia, Brunei, India, Indonesia, Japan, South Korea, Malaysia, New Zealand, the Philippines, Singapore, Thailand, and Vietnam.

“The broad themes of the IPEF are generally aligned with the Philippines’ economic and development priorities; advancing resilience, sustainability, inclusiveness, and competitiveness are consistent with the Philippines’ interests and development objectives,” Mr. Lopez said.

“We affirm the importance of promoting emerging areas in trade, technology, and digital economy. The IPEF’s pillars on supply chain resiliency, clean energy, decarbonization, and infrastructure are consistent with the joint vision statements for a 21st century US-Philippines partnership,” he added.

Mr. Lopez said the Philippines is looking forward to the greater participation of other countries, particularly those belonging to the Association of Southeast Asian Nations (ASEAN).

ASEAN countries that have not signed up to IPEF are Myanmar, Cambodia, and Laos.

“We welcome the US’ assurance of support for ASEAN member states in pursuing IPEF initiatives. Today›s launch is only the beginning of this conversation. Let us then continue to collaborate and work together towards our shared goals for the region,” Mr. Lopez said.

University of Asia and the Pacific Senior Economist Cid L. Terosa said in an e-mail interview that Philippine participation in IPEF is critical.

“The pillars of the IPEF framework are crucial to the future economic growth and economic development of the country. In particular, supply chain resilience and trade are keys to greater productivity while clean energy and decarbonization as well as tax and anti-corruption are essential for long-run sustainable inclusive economic growth,” Mr. Terosa said.

Mr. Terosa does not expect a rift to develop between the Philippines and major trading partner China as a result.

“The Philippines is still a (prospective) member of the Regional Comprehensive Economic Partnership (RCEP) which includes China. It is more important to clearly define the extent and limits of our participation in the IPEF and other trade frameworks to avoid squabbles with other countries,” Mr. Terosa said.

RCEP involves Australia, China, Japan, South Korea, New Zealand and the 10 members of the ASEAN.

India was supposed to join RCEP but opted out, citing the negative effect of the trade deal on its farmers and workers.

Mr. Terosa added that the IPEF framework implies that the Philippines will benefit from stronger supply chain networks, a more targeted focus on the environmental implications of economic and business activities, and greater attention to current trade-related issues involving the digital economy, emerging technology, labor rules, transparency, and regulatory practices.

“IPEF’s focus on custom-made economic integration is appealing since it recognizes the unique conditions and structural characteristics of participating economies. I believe that the Philippines would benefit more from this,” Mr. Terosa said.

However, Mr. Terosa said that the Philippines should evaluate its preparedness to participate in the agreements to be drafted under IPEF.

“The country needs to build sufficient technical, technological, and institutional capabilities in order to maximize benefits from participation in the IPEF,” Mr. Terosa said.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said that the participation in IPEF will expand economic cooperation between the Philippines and the US.

“IPEF would create more value-added since this would be moving in the direction of a possible FTA and other economic cooperation with the US, which is the world’s largest economy, one of the country’s biggest trading partners and sources of foreign investment,” he added. — Revin Mikhael D. Ochave

MORE Electric franchise area expansion bill hurdles Senate on second reading

THE SENATE on Monday approved on second reading a bill expanding the franchise area of MORE Electric and Power Corp. in Iloilo.

House Bill 10306, which seeks to amend Republic Act 11212, will allow MORE to establish, operate and maintain an electric power distribution system in the cities of Iloilo and Passi, as well as the municipalities of Alimodian, Leganes, Leon, New Lucena, Pavia, San Miguel, Santa Barbara, Zarraga, Anilao, Banate, Barotac Nuevo, Dingle, Duenas, Dumangas, and San Enrique.

Senate President Pro-Tempore Ralph G. Recto oversaw the interpellation and amendment of the bill in place of Senator Mary Grace Natividad S. Poe-Llamanzares, the primary sponsor, who had to leave the session for personal reasons.

A new section was added authorizing the Energy Regulatory Commission (ERC) to determine whether market abuse or anti-competitive behavior by parties to any power sales agreement operative in the franchise areas. Parties to any power sales agreement are allowed to renegotiate their tariffs if such a finding is arrived at.

The bill also requires that any amendment to the power sales agreement not diminish or impair the financial investment entered into by any party.

At an earlier hearing, the legislators heard testimony about how customers switching to MORE as a result of the expansion would affect competitors.

ERC Legal Service Director Maria Corazon C. Gines estimated that around 50% of Iloilo 1 Electric Cooperative, Inc.’s (Ileco 1) consumers will switch to MORE as its price per kilowatt-hour (kwh) is P6, or against the cooperative’s P11.

If consumers transfer to MORE, the base or the billing determinant — the basis for the computation of the rate — for the remaining Ileco consumers will be reduced, thus increasing the cost per kwh, she said.

“It’s the price that makes the customer want to choose another distribution utility,” she added.

The ERC has estimated that the franchise area expansion will affect 40% of Ileco I’s current sales, 55% of Ileco II’s, and 13% of Ileco III’s. The expansion will affect six municipalities served by Ileco I, seven municipalities and one city served by Ileco II, and two municipalities served by Ileco III. — Alyssa Nicole O. Tan

Meat import clearance validity restored to 60 days from 90

THE Department of Agriculture (DA) said it restored the validity period of sanitary and phytosanitary (SPS) clearances for imported meat to 60 days, after the period had been temporarily extended to 90 days.

In an administrative order, the DA said the temporary extension was resorted to in light of the supply chain disruptions caused by the pandemic, though it now sees logistics to be normalizing.

“The current global COVID situation has subsided in many parts of the world, resulting in an easing of the supply chain and logistical restrictions,” according to the order.

The Bureau of Animal Industry issues SPS import clearances for animals, animal feed and feed ingredients, and animal products and by-products including meat and meat products. — Luisa Maria Jacinta C. Jocson

Congress starts counting votes for President, VP

By Alyssa Nicole O. Tan, Reporter

CONGRESS on Tuesday met in a joint public session to count the votes for president and vice-president in the May 9 elections.

Senate President Vicente C. Sotto III and Speaker Lord Allan Jay Q. Velasco presided over the session held at the House of Representatives.

He noted that out of 173 certificates of canvass (COC), the Senate was still expecting the delivery of 8 certificates.

Mr. Sotto told his fellow lawmakers they should be “mindful of our moral duty” to resist attempts by some people to derail the proclamation of a new president and vice-president.

Ferdinand “Bongbong” R. Marcos, Jr. won the election by a landslide, according to the unofficial count from the Commission on Elections (Comelec) server.

Senators and congressmen created a 14-man joint committee that will count the votes. Senate Majority Leader Juan Miguel F. Zubiri and House Majority Leader Martin G. Romualdez will head the two panels.

Regular members for the Senate are Senators Franklin M. Drilon, Nancy S. Binay, María Imelda “Imee” R. Marcos, Grace Poe-Llamanzares, Ralph G. Recto and Pilar “Pia” S. Cayetano.

Making up the House panel are Reps. Jesus Crispin C. Remulla, Abraham Tolentino, Kristine Singson-Meehan, Sharon S. Garin, Manuel Jose M. Dalipe and Juliet Marie D. Ferrer.

The alternate members were Senators Lito M. Lapid, Ana Theresia Hontiveros-Baraquel, Aquilino “Koko” L. Pimentel III and Ronald M. dela Rosa, as well as Reps. Juan Pablo Bondoc, Johnny T. Pimentel, Alfredo A. Garbin Jr., and Stella Luz A. Quimbo.

During the session, the lawyers of presidential candidates recognized the authenticity of the election results that will be revealed after the official canvassing.

Romulo B. Macalintal, Vice-President Maria Leonor “Leni” G. Robredo’s lawyer, cited her call for her supporters to accept the election results.

“Although there are still questions about this election that need to be addressed, the voice of the people is becoming clearer,” he said. “We need to listen to this voice because in the end, we share only one nation.”

“We interpose no objection to the inclusion of the canvass of all certificates of canvass for president from the various provincial and municipal boards of canvassers,” he added.

“We would like to recognize and thank the patriotism exhibited by Vice-President Leni Robredo for expressly recognizing the integrity and the result of the recently concluded general elections,” Marcos lawyer Victor D. Rodriguez said.

Mr. Zubiri said this would significantly speed up the counting.

“They will no longer object to the results of the elections which would definitely hasten our proceedings,” he said. “We thank their graciousness as well as their patriotism in this time when we need the nation to heal from the very emotionally charged election of 2022.”

Mr. Sotto said they do not expect any serious objections to the results of the canvass “unless the COC will have incomplete records or does not match what was electronically transmitted.”

Lawmakers opened the certificates of canvass and supporting documents that were turned over to the canvassing committee.

The joint committee will decide all questions and issues raised involving the certificates of canvass by a majority vote of its members, with each panel voting separately.

In case of a disagreement, the decision of the chairmen will prevail. In case of a deadlock, the Senate president and Speaker will resolve the matter.

Congress seeks to proclaim the new president and vice-president by Wednesday evening.

Certificates and returns to be received by the Senate include those from Bangladesh, Myanmar, Syria, Morocco, Iran, Argentina and Brazil.

Ballot boxes being delivered to the House include certificates from Chile, South Africa, Timor Leste, Kenya, Mexico, Pakistan, Czech Republic and Nigeria. They were also awaiting local certificates from Lanao Del Sur.

A group of taxpayers on May 16 asked the Supreme Court to stop the count and void Mr. Marcos’ candidacy since he is allegedly unfit to become president after he was convicted of tax evasion in the 1990s.

Martial Law victims of Mr. Marcos’ father and namesake have also filed a similar lawsuit that seeks to overturn a Commission on Elections (Comelec) decision that favored the presidential frontrunner, who won the elections by a landslide.

The High Court has ordered Mr. Marcos Jr., Comelec, the Senate and House to comment on the first lawsuit.

“Unreasonable, unnecessary or deliberate delays in the canvass so that Congress would be prevented from proclaiming a new president and new vice president before noon of June 30 may just be the greatest disservice to the country,” Mr. Sotto said.

Mr. Velasco said it is Congress’ duty to ensure that the votes are counted correctly. — with Kyle Aristophere T. Atienza

Incoming Justice chief vows to speed up criminal cases

INCOMING Justice Secretary and Cavite Rep. Jesus Crispin “Boying” C. Remulla on Tuesday said he would fast-track pending criminal cases and keep track of the jail sentences of all prisoners.

He would do this by using a digital database for criminal cases and developing a data tracking system, as part of reforms that he seeks to enforce as Justice chief, he told CNN Philippines.

“We need to audit all detention prisoners to keep track of their sentences,” Mr. Remulla said in Filipino.

He said the Justice department and Supreme Court have to work closely to fast-track pending criminal lawsuits, which he said are often delayed by judges and lawyers.

He added that he is open to reviewing the case of detained Senator Leila M. de Lima, who has been in jail since Feb. 2017 on drug trafficking charges.

“I am willing to review her case, but recantations are frowned upon in court,” Mr. Remulla said. “It does not mean that if they recanted, they were not telling the truth in the beginning.”

Several witnesses have retracted their testimonies implicating Ms. De Lima, one of the most outspoken critics of President Rodrigo R. Duterte’s deadly war on drugs, in the illegal drug trade. They claimed to have been coerced by government officials into falsely accusing her.

Mr. Remulla also said he would be “more reserved” about accusing activists of being part of the communist movement.

During the campaign period, he linked supporters of Vice-President Maria Leonor “Leni” G. Robredo to the Maoist movement.

As justice chief, Mr. Remulla will be a member of the newest anti-terrorism law’s Anti-Terrorism Council. He will also head a committee that probes the killings of activists and dissenters.

Human rights group Karapatan on Tuesday said Mr. Remulla’s appointment is concerning due to his history of red-tagging.

“We express grave concern over his impending appointment as Justice Secretary, especially when his appointment also means he will get to sit as a member of the Anti-Terrorism Council,” it said in a statement.

“One thing is very much clear to us — we can only expect more injustice and even more impunity under the presumptive Marcos-Duterte administration with Remulla at the helm of the DoJ.”

The incoming labor chief on Monday acknowledged that there is no quick fix to workers’ issues such as short-term employment.

Meanwhile, incoming Labor Secretary Bienvenido E. Laguesma said he plans to create a “workable formula” with employers and workers to address labor issues, including contractualization.

“If the labor sector and employer sector will join my call for good governance, we can encourage existing investors and probably attract more investors to provide jobs,” he told the ABC-CBN News Channel (ANC).

Mr. Laguesma vowed to work closely with the newly established agency for migrant workers while encouraging more Filipinos to stay in the Philippines instead of seeking employment abroad.

“I will make my pitch on local employment because while I see foreign employment as providing us needed foreign remittances, I also look at the social costs that go with it,” he said.

Former Labor Undersecretary and Filipino worker advocate Susan V. Ople on Monday accepted presumptive President Ferdinand R. Marcos, Jr.’s offer for her to head the Department of Migrant Workers.

Mr. Ople is the daughter of the late Senator Blas F. Ople, who served for 17 years as Labor chief of Mr. Marcos’ father, the late dictator Ferdinand E. Marcos. — John Victor D. Ordoñez and KATA