NEARLY 20 countries where monkeypox is not endemic have reported recent outbreaks of the viral disease, with more than 230 confirmed or suspected infections mostly in Europe.

While no associated deaths have been reported to date, the World Health Organization (WHO) said that the situation is evolving and more cases are expected to be identified as surveillance expands in non-endemic countries. No cases have been reported in the country to date, according to the Department of Health (DoH).

Monkeypox is a rare disease that is caused by infection with the monkeypox virus. The name “monkeypox” originated from the initial discovery of the virus in a Danish laboratory in 1958 and the first human case was reported in 1970.

It is transmitted from one person to another by close contact with lesions, body fluids, respiratory droplets, and contaminated materials such as bedding.

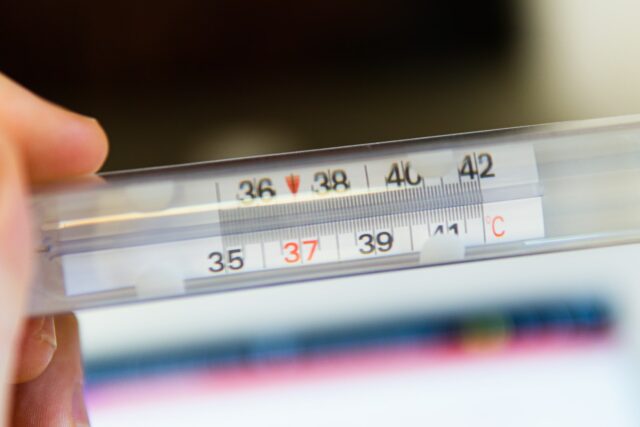

Symptoms are milder but very similar to those seen in the past in smallpox patients, according to the US Centers for Disease Control and Prevention (CDC).

Monkeypox begins with fever, headache, muscle aches, backache, swollen lymph nodes, chills, and exhaustion. Within one to three days (sometimes longer) after the patient develops a fever, a rash appears, often beginning on the face then spreading to other parts of the body.

Before ultimately falling off, lesions progress through the following stages: macules, papules, vesicles, pustules, and scabs. The illness typically lasts for two to four weeks.

In Africa, monkeypox has been shown to cause death in 1 in 10 persons who contract the disease.

While the virus is self-limiting, it may still be severe in some children, pregnant women, or persons with immune suppression.

According to the WHO, reported monkeypox cases thus far have no established travel links to an endemic area. Current available evidence suggests that those who are most at risk are those who have had close physical contact with someone with monkeypox, while they are symptomatic.

Avoiding contact with symptomatic individuals, practicing good hand hygiene by washing hands with soap and water or using an alcohol-based hand sanitizer, and using personal protective equipment (PPE) when caring for patients can help prevent monkeypox infection. It is also important to avoid contact with sick or dead animals that could harbor the virus.

An attenuated live virus vaccine has been approved by the US Food and Drug Administration (FDA) for the prevention of monkeypox. The CDC is currently evaluating the vaccine for the protection of people at risk of occupational exposure to smallpox and monkeypox in a pre-event setting.

To control a monkeypox outbreak in the United States, the CDC recommends the use of smallpox vaccine, antivirals, and vaccinia immune globulin (VIG).

Because monkeypox virus is closely related to the virus that causes smallpox, smallpox vaccine can also protect people from getting monkeypox. The CDC said that past data from Africa suggests that smallpox vaccine is at least 85% effective in preventing monkeypox. Experts also believe that vaccination after a monkeypox exposure may help prevent the disease or make it less severe.

However, the WHO does not believe the monkeypox outbreak outside of Africa requires mass vaccinations as measures like good hygiene and safe sexual behavior will help control its spread. At the moment, some countries are offering vaccination only to certain people who are at high risk of potential exposure to smallpox and/or monkeypox.

In the Philippines, independent experts will evaluate the safety and efficacy of existing vaccines, or those undergoing research and development, to make sure that when the need for them arises, the vaccines will be safe for use.

The Pharmaceutical and Healthcare Association of the Philippines (PHAP) and its members are monitoring global and local developments, and are closely coordinating with partners on measures to be taken. PHAP Members are also coordinating with the DoH to prepare for this health threat to ensure that vaccines and diagnostics will be available in the country if and when they become necessary.

Teodoro B. Padilla is the executive director of Pharmaceutical and Healthcare Association of the Philippines (PHAP), which represents the biopharmaceutical medicines and vaccines industry in the country. Its members are at the forefront of research and development efforts for COVID-19 and other diseases that affect Filipinos.