FINANCIAL MARKETS could experience another volatility in the near term as major central banks turned hawkish amid inflationary pressures due to the ongoing Russia-Ukraine war, analysts said.

In the first three months of the year, the Philippine Stock Exchange index (PSEi) averaged 7,230.08, up by 0.3% quarter on quarter from the 7,208.37 seen in the fourth quarter of last year, data from the local bourse showed. Annually, the benchmark PSEi went up 5% from the 6,882.77 average in the first quarter a year ago.

On an end-period basis, the PSEi was 1.1% higher in the first quarter at 7,203.47 versus the preceding quarter.

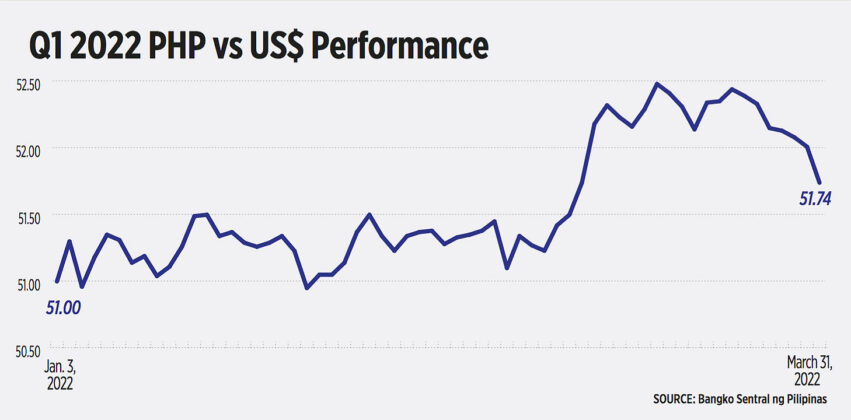

Meanwhile, Bangko ng Sentral ng Pilipinas (BSP) data showed the peso depreciated to P51.96 against the dollar as of end-March from P48.466:$1 last year.

Demand for government bonds remained strong during the period. Treasury bill (T-bill) auctions conducted in the first quarter saw total subscription for the quarter amounting to around P614.2 billion, which is around 4.1 times the P148-billion aggregate offered amount. This oversubscription amount of P466.2 billion, however, was lower than the P311.6 billion in the previous quarter.

Demand for Treasury bonds (T-bonds) were likewise robust with a total subscription amount of P519.4 billion, almost twice more than the offered amount of P225.9 billion.

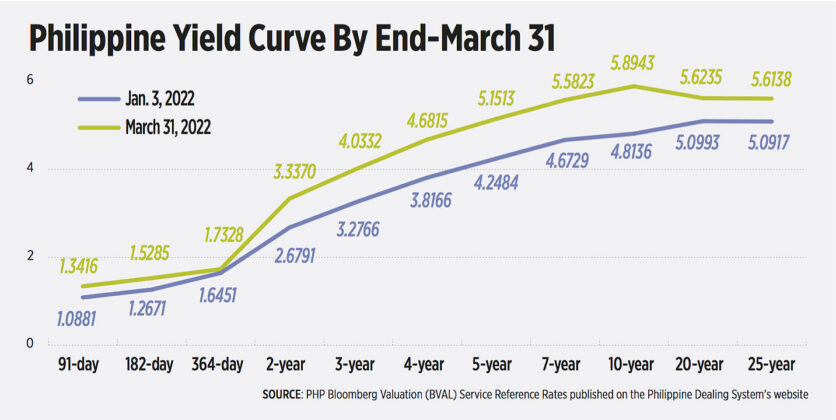

At the secondary bond market, domestic yields were higher by a range of 90.94 basis points (bps) for the seven-year T-bond to the 108.07 bps for the 10-year paper compared with end-December 2021 levels.

Yields rose across the board on a quarter-on-quarter basis. In the first quarter, rates were higher by an average of 62.01 bps during the reference period, according to the PHP Bloomberg Valuation Service Reference Rates published on the Philippine Dealing System’s website.

The Philippines welcomed the first quarter with the resumption of strict Alert Level 3 in various parts of the country to contain the Omicron-driven surge. It was subsequently relaxed to Alert Level 2 in February then to a more lenient Alert Level 1 starting March.

However, as the economy slowly gains ground from the lockdowns, Russia’s invasion of Ukraine started in on Feb. 24. With Russia being the world’s second largest producer of crude oil, news of the war sent global oil prices — and other commodities — to multi-year highs.

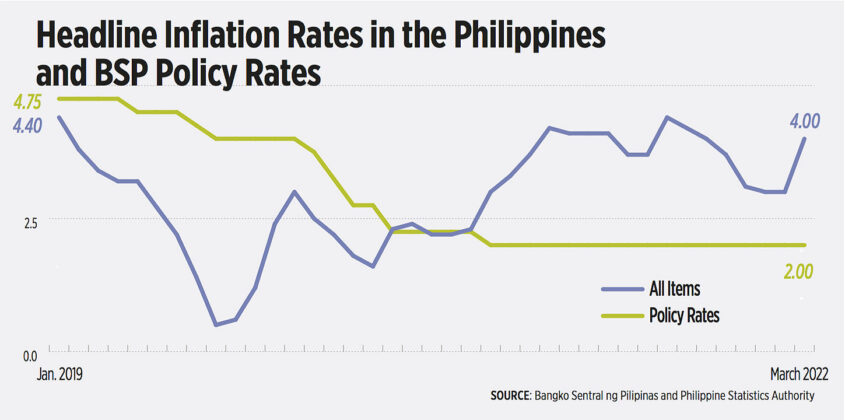

Inflationary pressures brought by the war triggered various economies, including the Philippines, to start hiking record-low borrowing costs in order to quell fast-rising inflation.

Despite these, the country’s economic output firmed up by market-beating 8.3% in the first quarter. For the first time since 2018, the BSP decided to hike benchmark interest rates by 25 bps in May to control above-target domestic inflation. It signaled another rate increase by June.

Consumer price index peaked to a 40-month high of 4.9% year on year in April from a 4% print in March, latest data from the Philippine Statistics Authority (PSA) showed.

WHAT INDICATORS TO WATCH OUT FOR

Despite the ongoing economic effects of the Russia-Ukraine conflict, analysts advise investors to remain cautious of the US Federal Reserve’s upcoming rate hikes amid global and local inflationary pressures in the months ahead.

“Russia-Ukraine conflict still highly uncertain: Risk that it could drag on. Possible turning point if it suddenly ends, but this is still highly speculative,” Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in an e-mail interview.

University of Asia and the Pacific Chief Senior Economist Cid L. Terosa said as the Russia-Ukraine war drags on, it will continue to exert upward pressure of prices and interest rates.

“Higher inflation will negatively affect the equities market since it could lower sales and profits of firms. Higher interest rates could negatively affect the equities market since it is more attractive to deposit money in banks or purchase fixed-income securities,” Mr. Terosa said in an e-mail.

“Conversely, higher interest rates can lead to higher demand for fixed-income securities because investors can purchase fixed-income securities with higher interest rates,” he added.

UnionBank of the Philippines, Inc. Chief Economist Ruben Carlo O. Asuncion said investors should also anticipate the US Fed’s rate tightening implications.

“The 10-year US treasury rate will provide a picture of the ripple effects of a more hawkish US Fed. As such, investors should expect US/offshore rates to exert influence on local bond yields,” he said in an e-mail.

“Oil prices may also bloat the trade deficit and further challenge the local currency, which is already assumed to be impacted by the sustained lockdowns in China. Aside from these, inflation expectations should need to be watched carefully moving forward,” Mr. Asuncion said.

At the domestic front, ING Bank NV Manila Senior Economist Nicholas Antonio T. Mapa said the market should keep an eye out for inflation, fiscal position, and economic growth.

“Looking at global markets, we may need to monitor developments surrounding the direction of monetary policy (US Fed, European Central Bank, Bank of England, etc.), and global growth, most notably the state of China’s economy,” Mr. Mapa said in an e-mail.

RATE HIKE IMPLICATIONS

The central bank’s decision to hike rates will help support the peso, Mr. Mapa said, “but this is not a hard and fast rule.”

“We remember well that in 2018, BSP resorted to an aggressive 175 bps rate hike cycle that did very little to shield the currency. Higher inflation and rising interest rates tend to slow down economic growth, especially ones that rely heavily on consumption for much of its activity,” Mr. Mapa said.

Meanwhile, the US Fed’s aggressive rate hike for the year could dampen the Philippines’ financial market growth.

“The Federal Reserve rate hike will most probably slow down the recovery and growth of Philippine financial markets in Q2 2022 and for the rest of the year. The BSP, however, has taken an important measure to stem the outflow of funds by raising policy rates,” Mr. Terosa said.

“This move by the BSP will stabilize the growth and recovery of Philippine financial markets, but the performance of Philippine financial markets in Q2 2022 and the rest of the year won’t be stronger than Q1 2022,” he added.

With the incoming new administration, political and economic stability as well as investor sentiment will most likely figure significantly after the second quarter, Mr. Terosa said.

“The new administration has to induce positive investor sentiment in the first three to six months of its term in order to boost Philippine financial markets for the rest of the year,” he said.

With these in mind, below are the analysts’ outlook for each of the key markets.

FIXED-INCOME

Mr. Asuncion: “Bonds are more sensitive to interest rate adjustment with a hike resulting to bond prices falling (because of higher interest rates). The continuing tightening of US financial markets may result to attraction of US bonds over emerging market ones. This can leave markets like PH with lower trading volume and interest from foreign players.”

Mr. Ricafort: “Rising trend in US/global interest rates and bond yields amid the continued Russia-Ukraine war and more aggressive Fed monetary tightening would still be important exogenous factors.

“The local fixed income market would also take cue from the incoming administration’s economic team, which needs to reduce the country’s debt-to-GDP ratio from the 17-year high of 63.5% as of Q1 2022 after the government’s wider budget deficits and more borrowings since the pandemic, through intensified tax collections, tax and other fiscal reform measures, disciplined spending through anti-wastage/anti-leakages/anti-corruption and other good governance measures to improve the country’s fiscal performance and overall debt management over the long term and for the coming generations.”

Mr. Mapa: “Bond markets will continue to see pressure on yields to increase as policy rates (and inflation) exert pressure on borrowing costs to rise.”

Mr. Terosa: “Higher interest rates can lead to higher demand for fixed-income securities because investors can purchase fixed-income securities with higher interest rates.”

EQUITIES

Mr. Asuncion: “On the equities side, market upside will be tempered by an environment of higher interest rates here and abroad which is likely to spill over into a restrained macro and earnings outlook… higher interest rates may result for higher demand for emerging market stocks and other equities.”

Mr. Ricafort: “Reflecting relatively elevated inflation could be a drag on stock markets amid higher borrowing/financing costs and the resulting slower economic recovery prospects and even potential risk of recession that could lead to some slowdown in sales, lower earnings, tighter margins, and lower valuation.”

Mr. Terosa: “Higher interest rates, however, will negatively affect the equities market this quarter because an increase in interest rate will make it more attractive to park funds in bank deposits or fixed-income securities.”

FOREIGN EXCHANGE

Mr. Asuncion: “Peso weakness as an outcome of May elections is expected — in sync with previous election cycle trends… A more hawkish US Fed actions may result to a weaker PHP and, thus, more exchange rate management moves from the BSP with the strong conviction to maintain the 52.50 level through suspected BSP agent banks. Any rally beyond the said price has been met by strong offers by the BSP through its market conduits.”

Mr. Ricafort: “Election-related catalysts could also partly determine the direction of the exchange rate in view of the honeymoon period for the incoming administration starting the first 100 days and then about six months to one year for any signals and clearer direction on policy priorities including foreign policy, reform measures, and anti-corruption/governance standards (especially adherence of Environmental, Social, and Governance standards that are increasingly encouraged if not even required by global investors and regulators) that would matter on the economy and fiscal performance/debt management.”

Mr. Mapa: “The Fed rate hike may prompt local investors to exit in favor of more attractive returns relative to risk in the developed markets. This in turn will, at least to some extent, exert pressure on BSP to continue its rate hike cycle to maintain attractiveness relative to our risk profile. The exchange rate will likely be impacted, as will bond markets as local interest rates rise. Likely, under depreciation pressure given both current account (trade deficit) and financial account (interest rate differentials) dynamics.”

Mr. Terosa: “If inflation persists, the peso will weaken in Q2 2022. As the peso weakens, upward pressure on inflation is expected. Consequently, the equities market will undergo persistent downward pressures.

“Hence, it appears that both the equities and foreign exchange markets will contend with negative pressures arising from higher interest rates and inflation in Q2 2022. The fixed-income market will most probably perform better than the equities market in Q2 2022.” — Ana Olivia A. Tirona

EDGE is a building certification system created by the IFC for emerging markets. It seeks to promote resource efficiency in buildings by adopting designs that help reduce materials, water, and electricity consumption. The IFC is a member of the World Bank Group.

EDGE is a building certification system created by the IFC for emerging markets. It seeks to promote resource efficiency in buildings by adopting designs that help reduce materials, water, and electricity consumption. The IFC is a member of the World Bank Group.