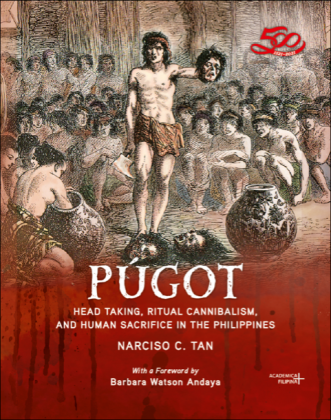

Vibal launches book on headhunting, cannibalism

THE VIBAL Foundation, Inc. (VFI) has launched Narciso C. Tan’s Púgot: Head Taking, Ritual Cannibalism, and Human Sacrifice in the Philippines. Encyclopedic and analytical in its approach, this scholarly book dissects the ritualized forms of violence such as human sacrifice, ritual cannibalism, and head taking in the prehistoric Philippines. Púgot weaves together historical data and archaeological studies with traditional myths, legends, and songs to create a seamless narrative of some of the most misunderstood aspects of Philippine culture and to shed light on deeply rooted cultures of violence. Preceding the emergence of Islam and Christianity, deeply held religious beliefs led various Philippine communities to sanction ritualized forms of violence: human sacrifice, cannibalism, and head taking. Púgot forces Filipino readers to contemplate and confront the not-so-ancient past, when their ancestors participated in violent community-wide celebrations and rituals. The book also reveals these practices not in isolation, but as part of the wider Southeast Asian and Austronesian milieu. The book is the latest addition to VFI’s Academica Filipina+, which is an interdisciplinary series that pushes the boundaries of scholarly publishing with smart, literate, and thought-provoking works exploring the Philippine past, present, and future. Púgot: Head Taking, Ritual Cannibalism, and Human Sacrifice in the Philippines is available for online purchase at the Vibal Online Shop at https://shop.vibalgroup.com/, Lazada https://www.lazada.com.ph/shop/vibal-books/, and Shopee https://shopee.ph/vibalgroup. For queries, e-mail customercare@vibalgroup.com and marketing@vibalgroup.com or call 8580-7400 or 1-800-1000-VIBAL (84225).

Robinsons’ Artablado show supports Chosen Children Village

Robinsons Land’s ArtAblado hosts an all-female group of artists who will showcase over 40 artworks this November. Their paintings will be displayed in ArtAblado, at the 3rd floor of Robinsons Galleria. The painting exhibit dubbed as “ARTtitude” is a showcase of the artistic talents of this group, with subjects ranging from landscapes and still life, to faces and figures. The artists are past or current students of the Creative Hands Workshop, along with members of the Sabado Group and the Art Wednesday Group. For this exhibit, the beneficiary is Chosen Children Village (CCV) in Silang, Cavite. “Due to the pandemic, the CCV now gets less support to fund basic needs such as food, staff salaries, diapers, medicines and for upkeep of the place. Hopefully, whatever we raise from the sale of artworks in the exhibit will augment the dwindling resources of the CCV,” says Maryrose Gisbert, one of the artists. The ARTablado “ARTtitude” exhibit runs until Nov. 16.

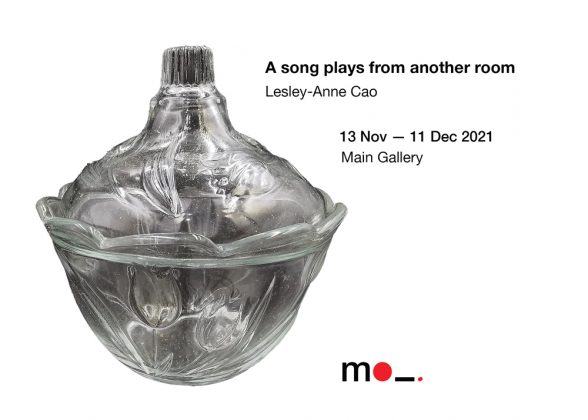

2 exhibits open at MO_Space

Two exhibits are opening on Nov. 13 at MO_Space: “A song plays from another room” featuring works by Lesley-Anne Cao at the Main Gallery, and “Tender Hours” featuring works by Pam Quinto at Gallery 2. They will be open for public viewing from Nov. 13 until Dec. 11. In her exhibit, Ms. Cao presents pensive reproductions of scenes and observations of the “ordinary.” In “Tender Hours,” Pam Quinto focuses her lens on blue sky, snapshots of dawn and dusk and moments in between, and also fashions her visions of blue in ceramics. The gallery is open daily from 10 a.m. to 7 p.m. For any inquiries, call 8403-6620, call or text 0917-572-7970, or by e-mail at exhibitions@mo-space.net. The gallery is at the 3rd level, MOs Design, B2 Bonifacio High Street, 9th Avenue, Bonifacio Global City.

8 fellows of the Virgin Labfest writing fellowship named

THE Artist Training Division of the Cultural Center of the Philippines (CCP) has announced the fellows accepted to the Virgin Labfest 16 Writing Fellowship Program which takes place online from Nov. 16 to Dec. 5. They are: Aleia Marie H. Anies, Shenn Airelle D. Apilado, Ian Carlo S. Bundoc, Neil Angelo S. Cirilo, Maria Isabel L. Jimenez, Faith Carisa F. Lacanlale, Mikaella Yoj B. Sanchez, and, Zarina T. Sarapuddin. The Virgin Labfest 16 Writing Fellowship Program is a three-week mentorship program on the study and practice of dramatic writing for the stage. The Fellowship Program will conclude in an online staged reading of the fellows’ works directed by Dennis Marasigan on Dec. 4 and 5.

4 exhibits at West Gallery

West Gallery currently has four exhibits on show which are running until Nov. 21. On view are the group exhibit “C20H25N30” featuring works by Edric Go, Bjorn Calleja, Geremy Samala, and Jigger Cruz, and the solo exhibits “Nucleus,” featuring works by Winner Jumalon, “Super Artists,” featuring works by Francis Bejar, and “As Days Go By,” featuring works by Lawrence Canto. “As Days Go By” features a series of eight paintings and eight videos which explore the precariousness of the human condition. The gallery is at 48 West Ave., Quezon City. Visitors must make an appointment via 3411-0336 (landline) or 0915-175-3729 (mobile). The gallery is open on Mondays to Saturdays from 9 a.m. to 4 p.m.

MADE 2021 online catalog out

TO CLOSE this year’s program cycle, the Metrobank Foundation, Inc. (MBFI) presents the 2021 MADE Art Catalogue featuring young and budding artists whose artistry has been shaped by these changing times. The MBFI recognized this year’s MADE awardees through an online awarding ceremony and exhibit which was held on Sept. 16. To access the catalogue, visit https://issuu.com/metrobankartanddesignexcellence/docs/2021_made_art_catalog_-_fa?fr=sYjdkMjQzODIwMTI.

The National Library welcomes vaccinated guests

THE NATIONAL Library of the Philippines (NLP) is now accommodating fully vaccinated visitors. Guests with an approved appointment schedule are advised to bring their certified vaccination cards for presentation to the lobby guard together with their valid ID and QR code. The National Library is open from 9 a.m. to 3 p.m. from Monday to Friday. To book an appointment, visit https://bit.ly/nlp-online-appointment. For more information, visit https://www.facebook.com/NLP1887.

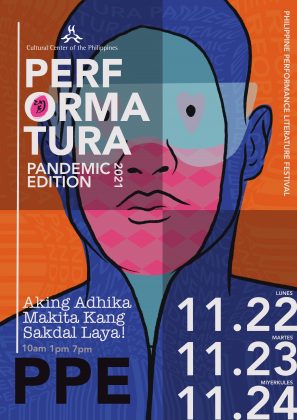

CCP presents Performance Literature Festival

The Cultural Center of the Philippines (CCP) brings back the Performatura: Performance Literature Festival on Nov. 22 to 24, 2021, with the theme Performatura Pandemic Edition (PPE). This event, now virtual, will showcase poetry readings, storytelling, theatrical shows, dance dramas, musical presentations, and even spoken word competitions, through Facebook live stream and Zoom, under the festival’s director Dr. Vim Nadera, a poet and a performance artist. On Nov. 22, or Araw ni Huseng Batute, Performatura celebrates the poet Jose Corazon de Jesus’s 125th birthday, starting at 10 a.m. with a welcome speech from Arsenio “Nick” Lizaso, CCP president and National Commission for Culture and the Arts chair, followed by a keynote speech by National Artist for Music Ramon Santos about De Jesus’ life as a lyricist. Musicians from Performatibo Manila, will perform. Jesus Jaime Aguila, the direct descendant of De Jesus, gives his response on behalf of his family. From 1-5 p.m. are the finals of the Pambansang Balagtasan; then at 7-10 p.m., Mike Coroza, Jeanette Job Coroza, Felipe de Leon, Jr., and Sonia Roco host a special edition of Pamana ng Lahi, Arte, Kultura, Atbp. Entitled Titik ni Huseng Batute sa P.L.A.K.A. On Nov. 23, CCP Vice-President and Artistic Director Chris Millado opens the day at 10 a.m. by honoring the Bagong Bonifacio through Front Act (Liners) which focuses on the unsung healing heroes who sing. At 1-5 p.m. is Claiming Indie Spaces in Challenging Times, with the Indie Publishers Collab-PH conducting a book launch and a series of storytelling performances. From 7-10 p.m. it is the S.I.P.A. International Performance Art Festival, an inter-cultural project that promotes exchange, solidarity, and peace organized by independent Filipino artists inviting artists from all over the world. On Nov. 24, Araw ng mga Aklat at Akdang Bayan, CCP Board of Trustees Chair Margie Moran Floirendo opens the last day of Performatura. At 10 a.m., via livestream from Los Baños in Laguna, the National Book Development Board (NBDB) inaugurates Book Nook, a concept that realizes reading centers for families living in areas where accessibility to books and the internet are limited. At 1-5 p.m., its Epic Center, with Luzon’s Lam-ang, Visayas’ Hinilawod, and Mindanao’s Darangen taking centerstage via modernized or post-modernized forms of the pre-colonial literature. From 7-10 p.m., the Philippine Librarian Association, Inc. Marks the 87th National Book Week with Tanghal Makata, a nationwide spoken word contest tackling the theme “Outcomes, Outreach, Outstanding: Library Beyond Boundaries.” For details, visit https://ccpperformatura2021.wordpress.com/ or the CCP Intertextual Division Facebook page.

Course on preventive maintenance for heritage structures and sites offered

The Escuela Taller de Filipinas Foundation, Inc. will be hold “Preventive Maintenance towards Disaster Risk Reduction: A course for Managers and Administrators of Heritage Sites” on Nov. 11 until Dec. 6. Over a blended-learning period of 14 days, combining seven days of synchronous sessions and seven days of asynchronous sessions, attendees shall build their capacities in the proper maintenance of heritage structures and sites and reduce their vulnerabilities to natural and human-induced hazards through preventive conservation. The course is mainly targeted for local government officials from various offices, parish council members, parish priests, and cultural heritage groups. Some topics that attendees can expect are an overview of Philippine Architectural Heritage, developing a Preventive Maintenance Program and Cyclical Maintenance Plan, and basic documentation, condition survey, cleaning, and repair procedures. Among the roster of speakers are David Mason (Senior Heritage Specialist from the Public Works Advisory of New South Wales, Australia), Carmen Bettina “Tina” Bulaong (Executive Director, Escuela Taller de Filipinas), Jeffrey Cobilla, Archt. Michael Querido (Project Officer, Escuela Taller de Filipinas), Sarah Jane S. Pahimnayan-Pagador (architect, Escuela Taller de Filipinas), and Ma. Nicole “Nikky” Angeline Losa (Site Officer, Old La Loma Cemetery Chapel).

NAMCYA 2021 finalists announced

Organizers of The National Music Competitions for Young Artists Foundation, better known as NAMCYA, have announced the finalists in the various categories of the music competition. Those who made the cut after the rigorous selection round include Jabez Ronaldo Lejano, Kyle Adam Lorenzana, and Agung Dayaw Sicam (Junior Guitar Category); Lucio Raphael Binalla and Rayselle Anne Manipol (Children’s Solo Rondalla); Aniweng Na Cuerdas Rondalla, the Enverga Candelaria Rondalla, and the South Cotabato Family Rondalla (Junior Rondalla); and Josemaria Vincent Thomas Collado, Marvic Espino, Evan John Jamisola, Jean Galway Silangcruz, and Josh Rampall Silangcruz (Open Woodwinds). In the Senior Division, the finalists are the Bukidnon Singing Ambassadors and Coro Bicolano (Senior Choir); Denzel Abarquez, Brian Berino, and Reynaldo Gendrano (Senior Piano); Maria Monica Bacus, Alain De Asis, Vincent Del Rosario, Jose Marie Eserjose, and Mishael Romano (Senior Strings-Violin); Kirk Allen Mallorca, Jann Minn Mendoza, and Lance Morrison Tulagan (Senior Strings-Lower Strings); and Carmina Lourdes Atienza, Nerissa De Juan, Maria Corazon Flores, Jomel Garcia, Camille Juanitez, and Jane Florence Wee (Senior Voice). The National Winners in the Traditional Music category are the Kagan Traditional Ensemble, the Madayaw Cultural Ensemble, the Massalingga Dacalan Ensemble, and the Sangasang Ji Anak Ud Malibcong Ethnic Ensemble. The lone Honorable Mention awardee in the Music Video Production category is the PUP Bagong Himig Serenata. The NAMCYA National Finals will be streamed via the NAMCYA Facebook page and webpage on Nov. 23 to 28, from 3 p.m. onwards.

RWM opens Christmas art exhibit

Resorts World Manila (RWM) has opened an art exhibit, the “Christmas Mall-seum,” as part of RWM’s signature holiday celebrations, Grand Fiesta Manila 2021. The “Christmas Mall-seum” at Newport Mall will feature a line-up of 12 of the country’s most prominent artists and art houses over a span of 12 weeks. Selected art pieces will be available for purchase through www.rwmexclusives.com using cash, credit, or RWM membership points, with part of the proceeds from the sales to be donated for the benefit of the Concordia Children Services and San Lorenzo Ruiz Home for the Elderly. For more information on the “Christmas Mall-seum” and other upcoming events, visit www.rwmanila.com.