BSP raises policy rates by 50 bps

By Keisha B. Ta-asan

THE BANGKO SENTRAL ng Pilipinas (BSP) raised its benchmark interest rate by 50 basis points (bps) on Thursday, and signaled it has room to further hike rates as it battles inflation.

The Monetary Board (MB) increased the overnight reverse repurchase rate by 50 bps to 3.75%, as expected by 13 out of 18 analysts in a BusinessWorld poll.

The rates on the overnight deposit and lending facilities were also increased to 3.25% and 4.25%, respectively.

The central bank has raised rates by a total of 175 bps so far this year.

“The Monetary Board deemed further monetary action to be necessary to anchor inflation expectations and avoid a further breach in the inflation target over the policy horizon,” BSP Governor Felipe M. Medalla said during a briefing after the MB meeting.

The BSP on Thursday also raised its inflation outlook for 2022 to 5.4% from 5% previously. This is beyond the central bank’s 2%-4% target band.

It lowered the 2023 inflation projection to 4% from 4.2%, as well as the 2024 outlook to 3.2% from 3.3% previously.

“The inflation target remains at risk over the policy horizon owing to broadening price pressures. Elevated inflation expectations likewise highlight the risk of further second-round effects,” Mr. Medalla said, adding that inflation will likely peak in October or November this year.

Upside risks may continue to weigh on inflation outlook due to rising global commodity prices, a shortage in local fish supply, a spike in sugar prices, and pending petitions for transport fare hikes, he added.

A weaker global economic recovery and the resurgence of local coronavirus disease 2019 (COVID-19) cases are still the downside risks to the outlook, Mr. Medalla said.

“The favorable growth outcome in the first half of the year also gives the BSP the flexibility to act against inflation pressures while allowing domestic demand to sustain its recovery momentum amid prevailing headwinds,” he added.

The Philippine economy expanded by 7.4% in the second quarter, bringing first-half growth to 7.8%.

The Development Budget Coordination Committee (DBCC) is targeting 6.5-7.5% gross domestic product (GDP) growth this year.

While the economy is robust enough to absorb policy rate hikes, Mr. Medalla said the government may not be able to achieve the 6.5-7.5% growth targets this year.

“It’s impossible for tightening not to reduce economic growth. However, it’s still possible that even with possibly additional measures, respectable growth is still possible,” he said.

“Achieving a target-consistent path of inflation is of great importance to us. In our view, respectable growth is still possible, whether that is lower or within the DBCC target of 6.5 to 7.5% is important to us. But at the same time, to us, price stability is the primary concern,” he added.

Meanwhile, BSP Director Dennis D. Lapid of the Department of Economic Research said higher-than-expected inflation, jeepney fare hikes, and peso depreciation were taken into consideration in monetary policy action and revisions in inflation projections.

“These factors were partly offset by lower assumptions for both global crude oil and non-oil prices as well as slower domestic and global economic growth and also the impact of BSP’s recent policy interest rate adjustments which were carried out in May, June, and July,” Mr. Lapid added.

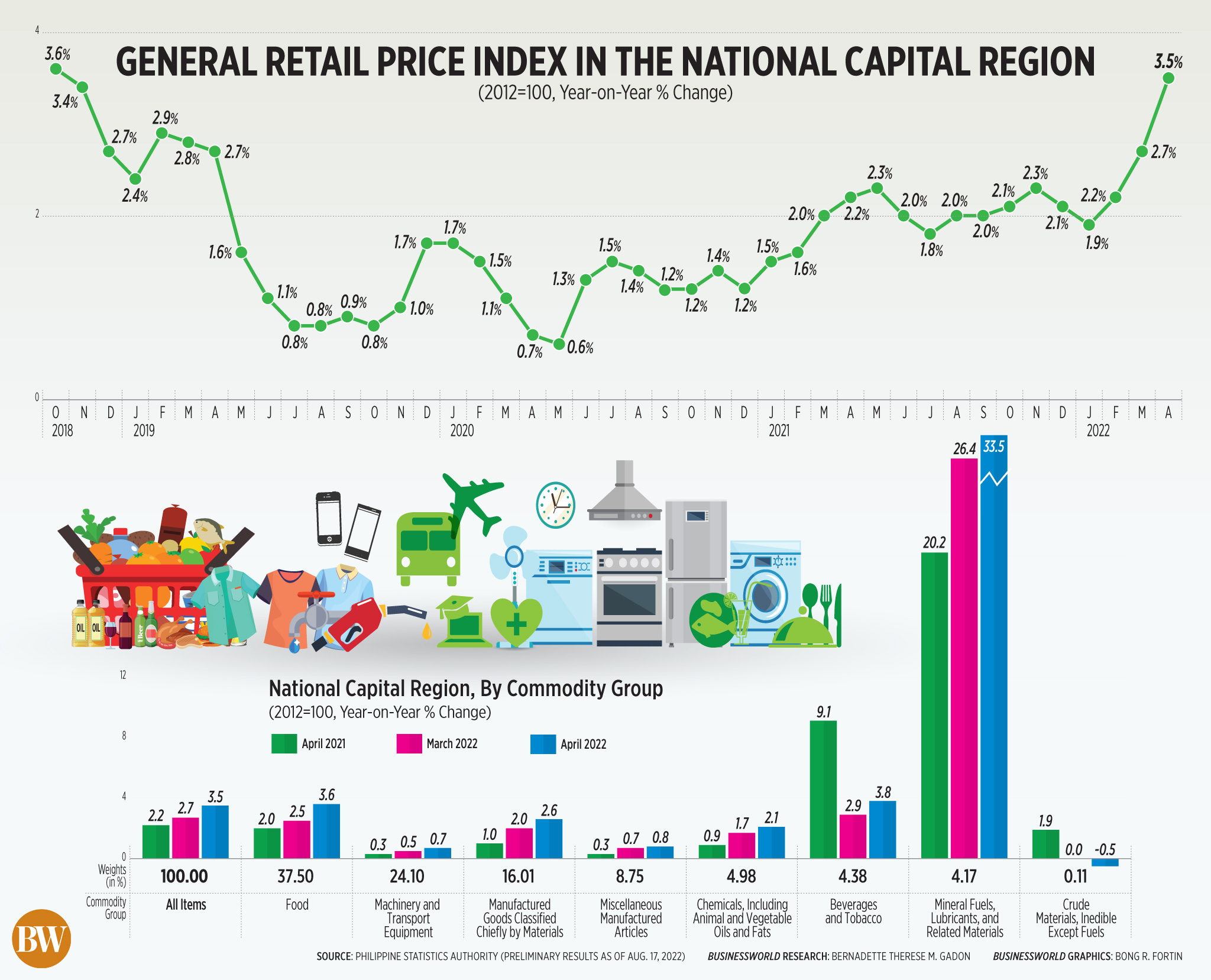

Inflation rose by 6.4% year on year in July, the fastest in nearly four years and exceeded the central bank’s 2-4% target band for a fourth straight month. The average inflation rate in the first seven months is 4.7%, still below the BSP’s full-year forecast of 5.4%.

The implementation of a daily minimum wage hike in 14 regions and an increase in fares for public utility jeepneys in Metro Manila, Central Luzon, Calabarzon and Mimaropa in June also added to inflationary pressures.

The peso also continued to weaken against the dollar on Thursday amid the US Federal Reserve’s hawkish signals. The local unit closed at P55.888 per dollar on Thursday, shedding 2.80 centavos from its P55.86 finish on Wednesday, based on Bankers Association of the Philippines data.

MORE HIKES SOON

Mr. Medalla said further policy adjustments will depend on the data and the US Federal Reserve’s next moves.

“The BSP reassures the public of its commitment and readiness to take all necessary actions to steer inflation towards a target-consistent path over the medium term in keeping with its price and financial stability mandates,” Mr. Medalla said.

Economists expect the BSP to maintain a hawkish stance.

ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa in an e-mail said the central bank would likely carry out 25-bp increases at each of the remaining policy meetings this year.

“ING expects inflation to accelerate further with inflation likely peaking at 6.8% by October,” Mr. Mapa said.

For MUFG Bank analyst Sophia Ng, inflation may peak at 5.5% this year.

“The BSP’s commitment to ‘take all actions’ to curb inflation suggests more rate hikes are likely down the line with another 75 bps of rate hikes likely by yearend,” Ms. Ng said.

ANZ Research Chief Economist Sanjay Mathur and economist Debalika Sarkar said they expect the BSP to continue raising rates at least until the early part of the first quarter of 2023, “with the magnitude of hikes contingent on the evolving external landscape and inflation trajectory.”

“On balance, we forecast 25-bp hike in each policy meeting until February 2023. The evolution of inflation, balance of payments and extent of further tightening by the US Federal Reserve will potentially reshape our assessment,” the ANZ Research economists said.

Makoto Tsuchiya, Oxford Economics assistant economist, said he expects another 25-bp hike in the fourth quarter.

“Inflation is yet to reach its peak of around 7.7% in Q4, and we see the peso remaining weak in 2022 entering into 2023, keeping import prices elevated. As such, the BSP still has more work to do. But thereafter we expect the Bank to take an extended pause,” he said.

“Given the negative output gap and unstable recovery, we only see one more hike in this cycle.”