While COVID-19 temporarily applied the brakes on the government program to spur the sector, the auto industry is starting to look electric

AFTER SEVERAL ups and downs in our two-and-a-half-year battle with COVID-19 and its various variants, we seem to be, finally, in a more stable period wherein we can truly look forward to a prolonged and hopefully sustained recovery stage for our battered economy and mindset.

Every single aspect of our economy took a beating in this pandemic, but we will be taking a closer look at the state of the local auto industry in particular — especially in the areas of manufacturing as well as in the technology we can expect in future products.

Of course, one can’t look at the Philippine car manufacturing industry without focusing on CARS, short for Comprehensive Automotive Resurgence Strategy — the program being implemented in order to attract new investments, stimulate demand, and effectively implement industry regulations that will revitalize the Philippine automotive industry with the view of developing the country as a regional automotive manufacturing hub.

The thrust of the CARS program is to provide time-bound as well as output or performance-based fiscal support to attract strategic investments in the manufacturing of motor vehicles and parts.

CARS is intended to augment and enhance the policy directions of existing motor vehicle development programs toward ensuring a resurgent automotive industry that supports innovation, technology transfer, environmental protection, and SME development, while creating more jobs in the country.

Total fiscal support for CARS has a cap of P27 billion, with each enrolled model qualified to get assistance in an amount not exceeding P9 billion. In exchange, a car company must locally produce 200,000 units of a specific model within a period of six years. In Toyota’s case, it’s the Vios; for Mitsubishi, it’s the Mirage G4 sedan.

We asked a few questions to both participants in the CARS program. Here are the replies from Toyota Motor Philippines Corp. (TMP) First Vice-President for Corporate Affairs Group Atty. Rommel Gutierrez, who also happens to be the president of the local automotive industry organization, the Chamber of Automotive Manufacturers of the Philippines, Inc. (CAMPI).

Will it be status quo or will be there be changes to the current CARS arrangement?

ATTY. ROMMEL GUTIERREZ: The commitment under CARS program remains unchanged. The required volume, while continuing to be a challenge, will be produced as the auto industry recovers.

Should the government extend CARS for another model, would TMP be amenable to it?

TMP is focused on the success of its enrolled model under the program. The extension of the CARS program is crucial in order to realize this. TMP supports government initiatives toward making the CARS program a success and to be a model for an auto industry development plan.

Overall, has CARS been beneficial to the industry and to the car-buying public?

Definitely. CARS participants have made huge investments in plant and production capacity, including localization of mandatory parts and components. The required volume of 200,000 units per enrolled model helps to achieve economies of scale in production. In turn, the car-buying public benefits. Overall, the CARS program contributes to the strengthening of the competitiveness of local vehicle manufacturing.

* * *

We also reached out to officials of Mitsubishi Motors Philippines Corp. (MMPC) for comments but were unable to obtain a reply. At present, the stakeholders are awaiting the decision of whether the program will be extended by another two or three years, in consideration of vehicle sales adversely affected by the Taal Volcano eruption in early 2020 (which affected a significant number of vehicles in stockyards in the south) followed by the economically devastating effects of the pandemic beginning in March of that year. The decision was originally slated to be announced last February, but the effects of the COVID-19 surge early this year plus all the distractions of the recent Presidential elections seem to have pushed the decision-making back.

AN ELECTRIFIED FUTURE

Meanwhile, another industry-related development is becoming the talk of the town, primarily because it heralds nothing less than the future of Philippine mobility.

We are talking, of course, about electric cars. And, needless to say, tech-savvy Filipinos are eagerly awaiting this new genre of automobiles — and praying that when these “cars of the future” finally hit mainstream showrooms, they can actually afford them. After all, cutting-edge technology is always very expensive.

This is why we need the government to offer incentives to car companies in the form of reduced or even waived duties and tariffs for every imported electric vehicle or EV.

Enter the Department of Trade and Industry (DTI), which welcomed the enactment last May of Republic Act 11697, otherwise known as the Electric Vehicle Industry Development Act (EVIDA). EVIDA provides for a national policy framework to develop the electric vehicle industry in the Philippines.

“With EVIDA, the Philippines is now in a stronger position to further attract high-tech investments and create high-value jobs in the country by taking advantage of the ongoing global shift to EVs through strong national policy support,” DTI Secretary Ramon Lopez said in a previously released statement.

Mr. Lopez also considers this measure a move toward lessening direct usage of oil products in transport thus, signifying the reduction of air and noise pollution in urban areas. This will also cut the transportation sector’s direct dependence on oil, especially amid rising fuel prices affecting both businesses and consumers, he said. EVIDA aims to promote innovation in the field of clean energy and sustainable transportation while developing a sunrise industry in the country — and generating more employment, to boot.

EVIDA aims to set clear policy directions for the government to raise EV awareness, streamline regulations, boost local demand that should attract EV production, and build a robust EV charging infrastructure.

The law also mandates the crafting of a Comprehensive Roadmap for the Electric Vehicle Industry (CREVI), which will be a national development plan for the EV industry to accelerate the development, commercialization, and utilization of EVs. EVIDA will also serve as a blueprint for a comprehensive and coordinated policy direction among national government agencies in terms of promoting EV to ensure investors’ confidence and attract EV-related investments.

As provided by the law, the Board of Investments is tasked to craft an Electric Vehicle Incentive Strategy (EVIS) similar to the CARS program, which will provide fiscal and non-fiscal incentives to narrow the production cost gap between EVs and traditional vehicles and achieve local EV production targets by 2030.

DTI Competitiveness and Innovation Group Undersecretary Rafaelita Aldaba highlighted the importance of EVIDA for the Philippines amid the rising competition in ASEAN to attract EV manufacturing investments.

“The EVIS will allow the government to provide competitive and industry-specific fiscal and non-fiscal support to attract private sector investments in strategic EV segments, especially manufacturing, which is a crucial step in deepening our participation in the regional automotive value chain,” she said. EVIDA is on the DTI’s priority legislative agenda for the 18th Congress.

To date, close to half-a-dozen car brands have begun selling pure electric vehicles — the most mainstream of which is Nissan, which began selling its globally popular Leaf electric hatchback in the Philippines last year. Other mass-market brands that sell pure electric vehicles are Chery, BYD, and Weltmeister — all from China.

The biggest surprise, however, is that the country’s best-selling EV importer is luxury car specialist PGA Cars, whose Porsche Taycan beat most other EV players to the market by almost a full year (and which quickly became its most sought-after model). PGA Cars followed this up by launching its second EV model in the Audi e-tron, which comes in SUV and four-door coupe versions. Demand for the e-tron is likewise impressively robust, making PGA Cars the leader in local EV sales.

PGA Cars emphasizes that its Porsche Taycan and Audi e-tron come with simple and convenient home charging systems that make operating these fully electric models as easy as using any digital mobile device. The models, as communicated by Audi Philippines’ “FutureNow” program, brings premium electric-powered mobility to the country.

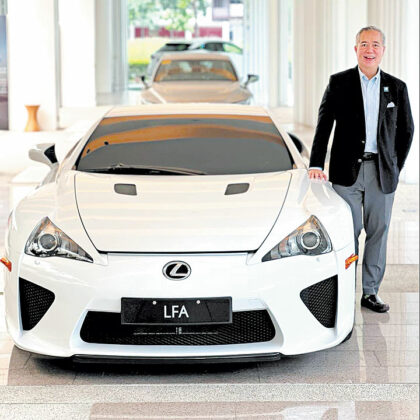

“As we take the lead in ushering sustainable electric mobility in the Philippines, we are building the infrastructure needed to promote the country’s reception of this new technology. By doing this, we are opening possibilities for consumers and stakeholders to embrace a more viable and environmentally responsible way by which to use resources,” said PGA Cars Principal and Founder Robert Coyiuto, Jr. in a statement.

International studies reveal that as much as 88% of EV owners charge their vehicles at home, making residential charging solutions a significant component in the transition to sustainable, electric-powered mobility.

The Audi e-tron models come with an Audi portable charging system that can be plugged into either a household outlet or a three-phase industrial outlet. But Audi Philippines also offers e-tron owners the option of having an alternating current (AC) charging unit installed in their homes. This allows them to fully charge an Audi e-tron model overnight, or “top-up” the battery charge level whenever it is convenient to do so — just like for mobile phones. For added convenience, Audi e-tron owners can monitor the charging status of their vehicles via a smartphone app.

In installing a home charging system, PGA Cars performs a Home Check, coordinating with Taycan and e-tron owners regarding their preference for the applicable location of the charger. Setting up a home charging system is no more complicated than installing an air-conditioning unit.

Crucial to the success of EVs in the market is infrastructure development, which the government must also be willing to support. Thankfully, the private sector is stepping up. Unioil was the first to put up an EV charging facility in its gas station along EDSA Makati, while Shell and SM Supermalls have recently inaugurated their pilot charging stations as well, with the promise of putting many more in the coming months.

A truly electrifying future, indeed. Let’s just continue praying that the pandemic comes to a screeching halt soon.

With the basic plan’s affordability, which is now at P1,500 for 100 Mbps, the cost isn’t as burdensome for a working scholar/athlete like Christian.

With the basic plan’s affordability, which is now at P1,500 for 100 Mbps, the cost isn’t as burdensome for a working scholar/athlete like Christian.