Nina to perform at Bar 360 in Newport

ORIGINAL PILIPINO MUSIC singer Nina is returning to Newport World Resorts as she takes the stage of Bar 360 on Feb. 26 at 10:15 p.m. Attendees must pay a minimum cover charge of P2,000, consumable on food and drinks. Nina will serenade the crowd with her hits like “Jealous,” “Love Moves in Mysterious Ways,” and “Someday.”

National Artist Nora Aunor stars in Mananambal

NATIONAL ARTIST for Film and Broadcast Arts Nora Aunor is back on the big screen with the horror film Mananambal. The film is classified R-13 by the Movie and Television Review and Classification Board. Set in the province of Siquijor, the story explores the repercussions of exploiting sacred traditions, with Ms. Aunor portraying Lucia, a healer whose powers lead to unintended consequences. The film is now showing in cinemas nationwide.

Experimental films screened for free at MCAD

A SCREENING of experimental films titled “Visible Disruptions” will take place from Feb. 26 to 28. Curated by Ricky Orellana, Mowelfund Film Institute’s audiovisual archive head, the films will be screened at the Museum of Contemporary Art and Design (MCAD) at De La Salle College of Saint Benilde. The three-part program is free and open to the public. To be shown on day one is Tadhana (1978), the first-ever Philippine full-length animated film. The next day will feature 11 critically acclaimed cinematic shorts which all tackle Filipino psyche, culture, and politics. The holy Mt. Banahaw-set documentary Bahala na si Bathala sa mga Banal na Bata (2022) by Reuben T. Domingo and Tita Pambid will be shown on the third day. Interested participants may e-mail mcad@benilde.edu.ph.

97th Oscars to stream on Disney+

DISNEY+ will be streaming the 97th Oscars live and exclusive to Filipinos on March 3. The event will see some of Hollywood’s biggest names gathering to celebrate the best in film. Hosting the program for the first time is Emmy Award-winning television host, writer, producer and comedian Conan O’Brien.

All seasons of Sherlock now on Lionsgate Play

THE award-winning British drama series from the mid-2010s, Sherlock, can now be viewed online in the Philippines on the streaming platform Lionsgate Play. Spanning four seasons and a special episode, Sherlock is a fast-paced adventure series set in present-day London starring Benedict Cumberbatch as Sherlock Holmes and Martin Freeman as his loyal friend, Doctor John Watson.

Jericho Rosales is the lead of biopic Quezon

TBA STUDIOS has announced that Jericho Rosales has been cast in the titular role in Quezon, the third film of Jerrold Tarog’s “Bayaniverse” following Heneral Luna and Goyo: Ang Batang Heneral. The new biographical historical movie is expected to follow the life of Manuel L. Quezon, a Filipino lawyer and soldier who became the President of the Commonwealth of the Philippines from 1935 to 1944. Quezon will also mark Mr. Rosales’ return to Philippine cinema after a long hiatus; he was last seen on the big screen in the 2018 romantic drama The Girl in the Orange Dress.

The Juans brings more fan experiences, concerts

FILIPINO band The Juans will be presenting exclusive fan experiences and concerts through its Juaniversity Campus Tour. Open to students, these will take place on March 10 at Balacat Festival Open Concert, Pampanga; March 14 at JAB’s Nueva Ecija; March 15 at the Guiguinto Town Fiesta, Bulacan; and March 21 at ITCI 28th Founding Anniversary, Bataan.

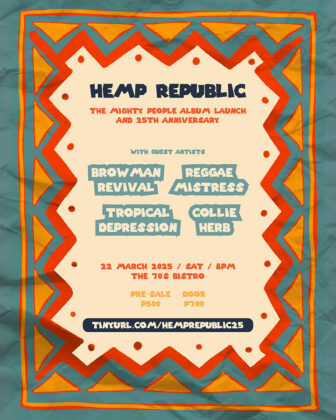

Hemp Republic marks 25th year with show, album

ICONIC Filipino band Hemp Republic is marking its 25th anniversary in the music industry with the official launch of its six-track release, The Mighty People, which promises to be a celebration of resilience, unity, and the evolving sound of Pinoy reggae. Its album launch will be on March 22 at the ’70s Bistro in Quezon City, from 7 p.m. onwards. There will also be guests from the local reggae, ska, and dub scenes such as Brownman Revival, Reggae Mistress, Tropical Depression, and Collie Herb. For more information, visit Hemp Republic’s social media pages.

BINI headlines Aurora Music Festival Clark 2025

THE Aurora Music Festival is back for its fourth year on May 3 and 4 at Clark Global City. The lineup will be headlined by P-pop group BINI. The girl group will headline both days of the festival. Festival goers will also be treated to a display of more than 20 hot air balloons. The Aurora Music Festival Day 1 on May 3 will feature a lineup of Moira, TJ Monterde, Arthur Nery, BGYO, and Rico Blanco. Day 2 on May 4 will see Cup of Joe, Maki, Dionela, Flow G, and Over October. Ticket prices start at P500.

Immersive experiences on Disney Adventure

NEW experiences will be unveiled at the Disney Adventure, the Disney Cruise Line announced. These include the Marvel Style Studio, the Bibbidi Bobbidi Boutique, and Royal Society for Friendship and Tea, which welcomes children to various spots on the cruise. In another first for the fleet, Duffy and Friends will appear onboard through a series of retail and entertainment experiences, including the brand-new show, Duffy and The Friend Ship. The Disney Adventure will set sail on its maiden voyage on Dec. 15 from Singapore. Guests can book sail dates between April and September 2026 directly from the Disney Cruise Line website via https://disneycruise.disney.go.com/ships/adventure.

Benj Pangilinan confronts self-doubt in new single

AFTER releasing sentimental tunes “Love That’s Rare” and “Nandito Na Ako,” a duet with Angela Ken, Original Pilipino Music singer-songwriter Benj Pangilinan once again bares his soul in his latest single, “Alinlangan.” Released under Sony Music Entertainment, the heartfelt, piano-driven ballad expresses self-doubt and questions the validity of one’s feelings of love. Co-written with veteran composer Kiko Salazar, the song transitions from a minimalist piano arrangement with subtle instrumentation into a soaring pop anthem as it progresses. “Alinlangan” is out now on all digital music platforms worldwide via Sony Music Entertainment.

Mavy Legaspi is PBB Celebrity Collab Edition’s host

SPARKLE artist Mavy Legaspi is now one of the hosts of Pinoy Big Brother Celebrity Collab Edition. He becomes the second GMA artist to join the roster of PBB hosts for this year’s special edition, following his fellow Sparkle and GMA artist, Gabbi Garcia. Mr. Legaspi has previously hosted Tahanang Pinakamasaya and GMA Network’s popular cooking talk show Sarap, ‘Di Ba? alongside his mother Carmina Villarroel, and twin sister Cassy Legaspi.

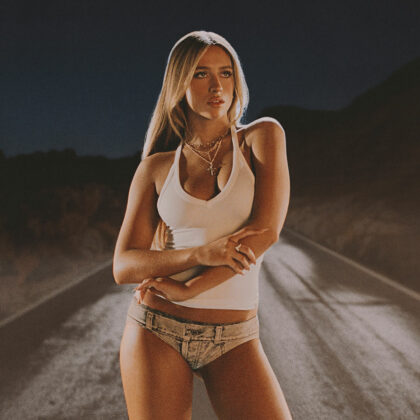

Tate McRae releases third album

MULTI-PLATINUM pop sensation Tate McRae has released her third album, So Close To What, via RCA Records. It represents “the insurmountable moments in life, where the road ahead at times can feel endless and the destination non-existent,” Ms. McRae said in a statement. “It’s an introspective exploration of self-discovery, love, and nostalgia.” Its songs are written and produced by hitmakers like Ryan Tedder, Grant Boutin, Amy Allen, and Julia Michaels.