THE PHILIPPINES is open to holding joint patrols with its Southeast Asian neighbors amid increasing tensions with China, the Department of Foreign Affairs (DFA) told congressmen on Tuesday.

“If there are proposals from other Association of Southeast Asian Nations (ASEAN) countries, we would be very open to consider them,” Foreign Affairs Secretary Enrique A. Manalo told a House of Representatives hearing on the agency’s 2024 budget.

“In principle, we believe joint coast guard patrols will be useful,” he said. There are no discussions yet with fellow ASEAN members on potential joint patrols, he added.

Mr. Manalo said the Philippines has discussed joint patrols with the United States, Australia, Japan and China.

“We’re not in a war footing [with China],” he said. “What we are doing is trying to protect our sovereignty in our exclusive economic zone through diplomatic and peaceful means.”

He said the ASEAN would resume negotiations for a Code of Conduct on the South China Sea in Manila on Aug. 22 to 24.

“We’re still committed with China to manage our disputes peacefully,” the country’s chief envoy said, citing President Ferdinand R. Marcos, Jr.’s “friend to all” foreign policy.

Mr. Manalo said filing a resolution before the United Nations (UN) General Assembly to call on China to stop its harassment of Philippine vessels in the South China could politicize the situation.

Philippine senators on Aug. 1 adopted a proposal asking DFA to file the resolution at the UN.

But Albay Rep. Edcel C. Lagman said the Philippines does not need to seek the UN General Assembly’s help to enforce a 2016 arbitral ruling by a Hague-based court voiding China’s claim to more than 80% of the sea.

“The decision is already final and executory,” he told the hearing. “The best [thing to do] is to have a meeting with these kindred countries supporting our claim.”

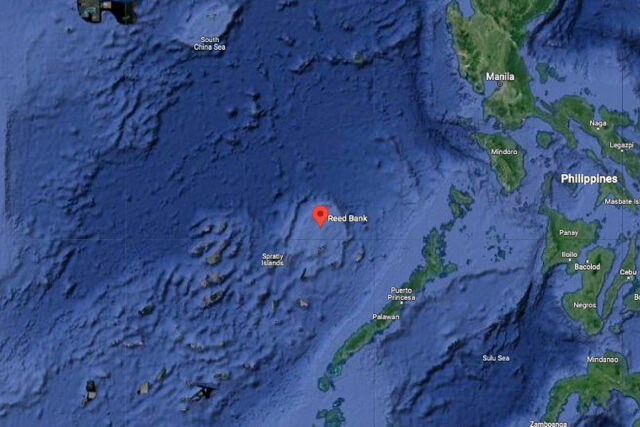

The South China Sea, a key global shipping route, is subject to overlapping territorial claims involving China, Brunei, Malaysia, the Philippines, Taiwan and Vietnam. Each year, trillions of dollars of trade flow through the sea, which is also rich in fish and gas.

Meanwhile, Mr. Manalo said the agency has no record of China’s claim that the Philippines had committed to pull out the BRP Sierra Madre, the country’s grounded warship at Second Thomas Shoal. “They have never given us a copy of any written agreement.”

DFA is seeking a P24.06-billion budget for next year, 15.37% higher than this year.

PHILIPPINE PIER

Meanwhile, Senator Francis “Chiz” G. Escudero proposed to build a pier and lodging structures for Filipino soldiers and fishermen at Second Thomas Shoal to increase Philippine presence there.

“If we allow ourselves to get bullied, nothing will happen,” he told CNN Philippines in Filipino. “But if we stand up to the bully, they will back off.”

Mr. Escudero said he would propose a P100-million budget for the Department of Public Works and Highways or Philippine Coast Guard to build the pier.

He said assigning the project to these “civilian agencies” would not add to the militarization of the shoal.

The structures would serve as a shelter for soldiers in the rusting World War II-ear BRP Sierra Madre and fishermen stationed in the area during bad weather, he added.

Philippine Coast Guard spokesman Jay Tristan Tarriela on Monday told ABS-CBN News Teleradyo China had every intent to block the supply mission, dismissing claims that the Chinese Coast Guard had allowed one of the two Philippine boats to reach its outpost.

A handful of Filipino troops are stationed on a rusty World War II-era US ship that the Philippines intentionally grounded at the shoal in 1999 to assert its claims.

Mr. Escudero also opposed calls to train civilians and deploy them as soldiers in the disputed water, saying the government should resolve the sea dispute peacefully.

President Ferdinand R. Marcos said last week said he was not aware of an agreement to remove BRP Sierra Madre from Second Thomas Shoal. “And let me go further, if there exists such an agreement, I rescind that agreement now,” he said.

On Monday, the Chinese Embassy’s Deputy Chief of Mission Zhou Zhiyong urged the Philippines to meet China halfway through diplomatic talks and manage their sea dispute.

Armed Forces of the Philippines (AFP) chief Romeo Brawner, Jr. has said China was using its coast guard instead of its Navy force to harass Philippine vessels because “they want to act short of declaring war.”

Mr. Brawner said the Philippines would deploy more ships and aircraft to secure areas of the sea within its exclusive economic zone. The government might tap naval reservists and Filipino fisherfolk to help establish Philippine presence there, he said.

“This proposal is not designed to anger China or bring us closer to the brink (of war),” Mr. Escudero said.

“This is just to give the President flexibility to act as the chief architect of our foreign policy as he deems fit.” — Beatriz Marie D. Cruz and John Victor D. Ordoñez