Peso weakens anew vs dollar ahead of US inflation report

THE PESO depreciated against the dollar anew on Wednesday on expectations of a pickup in US consumer inflation last month.

The local currency closed at P56.72 versus the dollar on Wednesday, weakening by seven centavos from Tuesday’s P56.65 finish, data from the Bankers Association of the Philippines’ website showed.

The local unit opened Wednesday’s session at P56.68 per dollar. Its intraday best was at P56.60, while its weakest showing was at P57.73 against the greenback.

Dollars traded went down to $1.02 billion on Wednesday from the $1.11 billion on Tuesday.

The peso was dragged down by expectations of faster US inflation in August, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in a Viber message.

“The peso depreciated anew amid potentially higher US consumer inflation reports due to be released tonight,” a trader likewise said in an e-mail.

US consumer prices likely increased by the most in 14 months in August amid a surge in the cost of gasoline, but an expected moderate rise in underlying inflation could encourage the Federal Reserve to keep interest rates on hold next Wednesday, Reuters reported.

The consumer price index (CPI) likely increased by 0.6% last month, according to a Reuters survey of economists. That would be the largest gain since June 2022 and would follow two straight monthly advances of 0.2%.

Mr. Ricafort added that a stronger dollar and higher global crude oil prices on Wednesday caused the peso to decline.

The dollar index, which tracks the currency against six peers, held firm, though moves were subdued, up 0.1% to 104.70, as traders awaited the US CPI reading for August.

The dollar index has surged 5% since late July and stands at its highest level in around half a year.

Meanwhile, oil prices jumped about 2% to a near 10-month high on Tuesday on a tighter supply outlook and optimism over the resilience of energy demand in major economies.

Brent futures rose by $1.42 or 1.6% to settle at $92.06 a barrel, while US West Texas Intermediate crude rose by $1.55 or 1.8% to settle at $88.84. Both benchmarks closed at their highest levels since November 2022.

For Thursday, the trader said the peso could weaken further following the US CPI report and ahead of the release of US producer price index data.

The trader sees the peso moving between P56.60 and P56.85 a dollar on Thursday, while Mr. Ricafort expects it to range from P56.60 to P56.80. — AMCS with Reuters

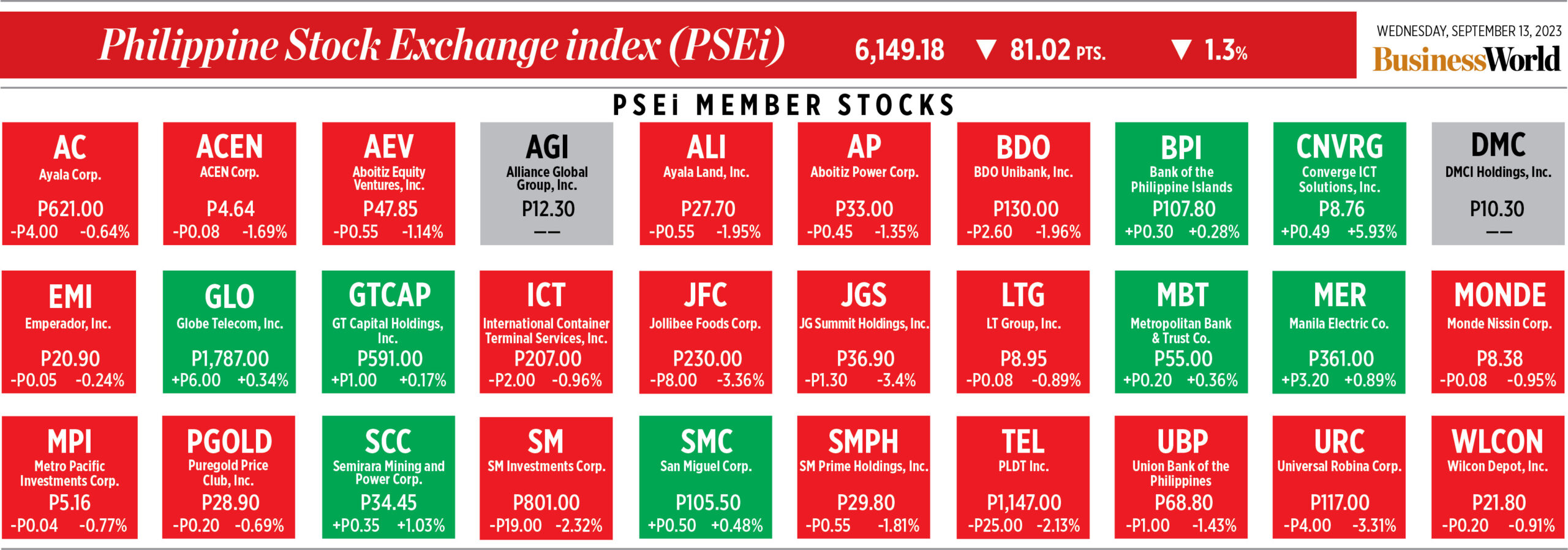

PSEi sinks to 6,100 level amid inflation concerns

THE MAIN INDEX dropped to the 6,100 level on Wednesday as investors remained cautious ahead of the release of August US consumer price index (CPI) data and amid rising oil prices.

The Philippine Stock Exchange index (PSEi) went down by 81.02 points or 1.3% to end at 6,149.18 on Wednesday, while the broader all shares index dropped by 28.62 points or 0.85% to close at 3,330.81.

“The market fell to its lowest close since October 2022, triggered by heightened investor caution ahead of the US August inflation print as well as worries about rising oil prices,” Juan Paolo E. Colet, managing director at China Bank Capital Corp., said in a Viber message.

“Everyone’s attention will be on the US consumer price index report, and the data will determine whether our market rebounds or continues its descent in the coming days,” Mr. Colet added.

The PSEi declined as investors pocketed gains ahead of the release of US CPI data overnight, Luis A. Limlingan, head of sales at Regina Capital Development Corp., said in a Viber message.

US consumer prices likely increased by the most in 14 months in August amid a surge in the cost of gasoline, but an expected moderate rise in underlying inflation could encourage the US Federal Reserve to keep interest rates on hold next Wednesday, Reuters reported.

The consumer price report from the Labor department on Wednesday will be published a week before the Fed’s rate decision. It would follow on the heels of data this month showing an easing in labor market conditions in August.

The consumer price index likely increased by 0.6% last month, according to a Reuters survey of economists. That would be the largest gain since June 2022 and would follow two straight monthly advances of 0.2%.

Meanwhile, oil prices rose by 2% on Tuesday amid tighter supply outlook and as the Organization of the Petroleum Exporting Countries projected the global oil demand to rise by 2.25 million barrels per day in 2024, Reuters reported.

Brent crude was up by 1.6% or $1.42 to $92.06 a barrel, while US West Texas Intermediate crude increased by 1.8% or $1.55 to $88.84 a barrel. Both benchmarks closed at their highest levels since November 2022.

Back home, almost all sectoral indices dropped on Wednesday, except for mining and oil, which rose by 4.52 points or 0.04% to 10,393.65.

Meanwhile, holding firms declined by 90.71 points or 1.52% to 5,857.30; property fell by 37.06 points or 1.43% to 2,546.63; industrials dropped by 123.28 points or 1.37% to 8,817.59; services decreased by 13.71 points or 0.9% to 1,509.01; and financials lost 13.49 points or 0.74% to end at 1,790.04.

Value turnover went up to P4.73 billion on Wednesday with 740.94 million shares changing hands from the P3.97 billion with 535.63 million issues seen on Tuesday.

Decliners outnumbered advancers, 100 to 70, while 47 names closed unchanged.

Net foreign selling dropped to P436.53 million on Wednesday from P961.49 million on Tuesday. — SJT with Reuters

Potential market for exports to Japan estimated at $107 billion

THE Department of Trade and Industry (DTI) said Philippine exports have the potential to expand significantly, with the country in a position to supply up to $107 billion worth of products that Japan currently buys from other sources.

DTI Export Marketing Bureau Director Bianca Pearl R. Sykimte, speaking at the 2023 Philippine Investment Business Seminar on Tuesday, said the range of potential exports to Japan represents about 250 trade lines.

“For these product lines, Japan only imports around $7 billion from the Philippines, but Japan’s total imports of the same products reach as high as $107 billion,” she said.

“The Philippines is among the top global suppliers of products being imported by Japan. Hence there is a wide scope for the Philippines and Japan to expand bilateral trade based on existing and projected demand and the existing supply capacities,” she said.

Citing data from the International Trade Center, Ms. Sykimte said that the sourcing opportunities will be largest in integrated circuits, ignition wiring sets and data processing machines.

Evariste M. Cagatan, DTI executive director of Investments Promotion Services, said the Philippines and Japanese companies could look into partnerships in renewable energy, electric vehicle (EV), green metals, agribusiness, IT services and healthcare industries.

“The Philippines offers not only its growing local market for EVs as we are seriously moving toward adoption, but we are keen to establish the Philippines as a hub for EV manufacturing and assembly,” she said.

She said that the Philippines could be a great prospect for the EV manufacturing as it possesses abundant supply of green metals and talents used in the production of EVs.

“We have opportunities in the Philippine agribusiness industry as well. The country has established a strong global presence on key commodities for exports,” Ms. Cagatan said.

“We remain committed to modernizing these sectors and we are on the lookout for partners and investors that can aid us in the production and value-adding activities through advanced agricultural technology and logistics, for which Japan has expertise and strong capabilities,” she added.

Ms. Cagatan cited the need for exploring partnerships in cold chain technology.

“At present only 60% of the agriculture or food products produced in the country pass through cold chains and the gap in capacity, especially during peak months, is estimated to reach about 100,000 pallets,” she said.

“Hence, we likewise encourage investment from Japan in the establishment and operations of cold storage warehouses and operation of temperature-controlled logistics services, not only for food, but also for pharmaceuticals and plant food items,” she added.

The Philippine Statistics Authority estimates that Japan was the Philippines’ second-largest trading partner in July.

The value of Philippine exports to Japan during the period amounted to $861.5 million, while imports from Japan totaled $865.03 million. — Justine Irish D. Tabile

Marcos solicits infra investment in speech at Singapore conference

PRESIDENT Ferdinand R. Marcos, Jr. invited international investors on Wednesday to take part in the Philippines’ infrastructure program.

“We welcome foreign investors to take advantage of the opportunities presented in our infrastructure program,” he said in a speech at the 10th Milken Institute Asia Conference in Singapore.

“We open our doors to international developers and construction companies who wish to take part in the infrastructure development of our country,” he added.

Mr. Marcos said the government actively encourages public-private partnerships, which “demonstrate our commitment to provide services to our public while delivering goods and returns to our investors.”

The government plans to spend 5.3% of gross domestic product (GDP) or about P1. 29 trillion on infrastructure this year. Infrastructure spending is expected to come in at 5-6% of GDP until 2028.

Mr. Marcos said the government’s “commitment to connectivity is unwavering,” citing projects lined up under the Build, Better, More infrastructure program.

Investors should consider the Philippines considering its “strong (economic) fundamentals,” he said.

He said the Philippines hopes to grow its economy by 6% this year.

“Our growth story is underpinned by strong domestic demand and increasing fixed capital investment as a result of upbeat domestic activity and improved business confidence,” Mr. Marcos said.

“Moreover, the Philippines’ strategic location within Asia, coupled with our membership in regional trade agreements, positions us as a gateway to countless possibilities,” he added, citing the country’s participation in the Regional Comprehensive Economic Partnership.

“From digital and renewable energy to manufacturing and tourism, we are a nation on the rise, ready to collaborate with partners who see the potential that we hold in the Philippines.”

Mr. Marcos also urged investors to “tap into our increasingly digital economy.”

Citing the country’s “English-speaking workforce that has propelled us onto the global stage,” Mr. Marcos said several data centers already operating in the Philippines including those of Google, Microsoft, Amazon, and Meta, among others.

“We are the number one country of choice for the delivery of customer support (to) the healthcare services and one of the top destinations for outsourcing overall, second only to India,” he said.

Meanwhile, Mr. Marcos touted the Maharlika Investment Fund, which he said could drive “economic development through strategic investments both domestically and overseas.”

In the question and answer portion of the event, Mr. Marcos said his government considers the wealth fund as a means of reducing dependence on foreign loans.

“We… started to worry about borrowing,” he said. “Although our borrowing in terms of GDP is not as high as maybe our neighboring countries, we are at about 62.3% up to 63% of GDP… for us that is high.”

“So we need to invest more without increasing our borrowing,” he said. — Kyle Aristophere T. Atienza

ADB approves $303-M PHL flood risk management loan

THE Asian Development Bank (ADB) said on Wednesday that it approved a $303-million loan to the Philippines to help build resilience against floods and other climate hazards.

In a statement, the bank said that the loan will help “reduce flood and climate risks and protect people and livelihoods in three major river basins in the Philippines, one of the most vulnerable countries to the effects of climate change and disasters caused by natural hazards.”

The loan will finance the first phase of the Integrated Flood Resilience and Adaptation Project. It aims to “upgrade and construct flood protection infrastructure in the Abra river basin in northern Luzon and the Ranao/Agus and Tagum–Libuganon river basins in southern Mindanao.”

“The infrastructure takes into account future climate change impacts and incorporates nature-based solutions such as restoring and reconnecting old river channels for natural drainage and reinforcing riverbanks with mangroves and vegetation,” it added.

The project seeks to help 22 local government units and around 150 barangays improve their climate and disaster risk management systems. It will also finance training programs for building local capacity.

“The project will help strengthen the Philippines’ capacity to perform flood risk management planning by providing training for government officials, installing equipment for weather and river flow monitoring and early flood warning, and introducing an asset management information system,” the ADB said.

“Climate change is expected to raise risks from extreme weather events. These river basin communities are highly vulnerable to climate-related hazards, as we have seen in recent years when typhoons destroyed infrastructure, displaced families, and damaged crops,” ADB Senior Water Resources Specialist Junko Sagara said.

Last year, the ADB extended a total of $2.995 billion to the Philippines in the form of loans, grants, and co-financing programs. This was 7.3% higher than the $2.791 billion committed in 2021.

The bank is earmarking $4 billion worth of loan financing this year, mainly in eight projects and programs. — Luisa Maria Jacinta C. Jocson

PHL to start avocado exports to South Korea this month

THE Philippines will start exporting Hass avocados to South Korea by the end of September, the Department of Agriculture (DA) said.

The DA said that the initial shipments will come from orchards accredited by the DA’s Bureau of Plant Industry and the packaging operations of Dole Philippines, Inc. in Davao, Bukidnon, and South Cotabato.

“We thank the Korean government for finally approving market access for our Hass avocado exports,” (DA) Senior Undersecretary Domingo F. Panganiban said in a statement.

The DA said that the initial agreement was signed on June 19 and took effect on Sept. 8 for produce harvested during the 2023-2024 season.

“Hass avocados have become popular in Korea as the main nutritional ingredients for salad and sandwiches. They are available at leading retail stores and online markets, in fresh and frozen form, but are mostly from Latin America,” the DA said.

The government initially requested export access for Hass avocados in 2009 but was blocked due to pest concerns.

“The PRA (Pest Risk Analysis) for Hass avocado resumed after the Philippines’ success in securing market access for okra exports to Korea in 2021,” it added.

Additionally, the DA will promote Philippine avocados through its agriculture office in Seoul, in collaboration with Dole Korea Ltd.

Aleli Maghirang, the agriculture attaché in Seoul, said that there is an increasing demand for agricultural products in South Korea, especially those items associated with healthy lifestyles.

Korean consumers are expressing a preference for “food with health and wellness benefits bodes well for Philippine agricultural exporters,” Ms. Maghirang said.

“This presents an opportunity for the DA to encourage the increased cultivation of export winners such as tropical fruit and high-value agricultural products to meet the growing demand of the discerning Korean market for healthy food,” she added.

In 2022, the Philippines produced a total of 20.08 million metric tons of avocado, up 1%, according to the Philippine Statistics Authority.

Other fruit exports are fresh bananas, pineapple, papaya, and mango. The Philippines is the sole exporter of fresh okra to South Korea. — Adrian H. Halili

Filipino-Chinese chamber supports rice tariff reduction

THE Federation of Filipino-Chinese Chambers of Commerce and Industry, Inc. (FFCCCII) has declared its support for a reduction in rice tariffs as a temporary measure to address shortages in the commodity.

In a statement, the chamber said it backs the proposed temporary reduction in tariffs on imported rice to between 0% and 10% to stabilize prices and supply.

Last week, Finance Secretary Benjamin E. Diokno proposed to temporarily reduce the 35% rice import tariff to as low as 0%.

“The FFCCCII believes that Secretary Diokno’s proposal to temporarily reduce the said rates … would not only translate to a decrease in rice prices and temper the increasing inflation in food prices, but also address the demand-supply gap,” it said.

It added that the move will “undeniably” mitigate the sharp increase in the price of the staple.

However, FFCCCII said the lowering of the tariff should be coupled with other measures to ensure long-term stabilization of prices.

It also noted the need to address the needs of the broader public before worrying about the effect of imports on the income of domestic farmers.

“At this time of soaring prices and lack of supply of this staple, we need to consider foremost the needs of our consuming public, the over 110 million Filipinos, and support this short-term measure,” FFCCCII said. — Justine Irish D. Tabile

BIR updates list of registered tobacco companies, brands

THE Bureau of Internal Revenue (BIR) said it has updated the list of registered manufacturers, importers, and exporters of tobacco and vapor products.

In a memorandum circular dated Sept. 4, the agency updated the list to also include their corresponding product brands or variants of cigarettes, heated tobacco products, vapor products, and novel tobacco products.

The BIR said this will help “intensify its campaign against illicit tobacco products.”

Registered manufacturers, importers and exporters must register their brands and variants within six months from the date of the release of the circular to avoid penalties for non-compliance.

“Furthermore, the products must comply with the requirement on graphic health warning and affixing of BIR tax stamps except for vapor products and novel tobacco products for which Internal Revenue Stamps Integrated System stamps are not yet available in the system,” the BIR added.

Under the updated list, domestic manufacturers of locally produced cigarettes include Associated Anglo-American Tobacco Corp., JT International Philippines, MPE Tobacco Trading, PMFTC, Inc., Rolyo Cigarette, Inc., Telengtan Brothers and Sons, Inc. (La Suerte Cigar and Cigarette Factory), Vidda Resources, Inc., Yosimite Oriental Supersystem, Inc.

Meanwhile, export manufacturers include PMFTC and Telengtan Brothers and Sons.

Cigarette manufacturers registered with the Philippine Economic Zone Authority are Baisisen Global Corp., Fourthstripe Manufacturing Corp., Gold Tree Tobacco Manufacturing Corp., Golden Leaf Manufacturing International, Inc., Hongcim Int’l Corp., JT International Asia Manufacturing Corp., Magnum Tobacco Manufacturing Corp., Noble Leaf Manufacturing, Inc., OneSubic Premier Manufacturing Corp., Pan Subic Brothers Manufacturing Corp., Prudence Development and Management Corp., Thaitian Cigarette and Tobacco Corp., and TM8 Enterprises, Inc.

The BIR also listed cigarette importers 20 S, Inc., Duty Free Philippines, Gold Tree Import and Export, Inc., Indigo Distribution Corp., JT International Philippines, Kenstand Philippines, Inc., Phil-One Extreme Corp., PMFTC, Inc., Realway International Phil. Corp., Stable East Tobacco Trading Corp., Sunshine Bay Philippines, Inc., Vidda Resources, Inc., and Winning Touch International Marketing, Inc., among others.

The updated list also includes manufacturers and importers of vapor products, importers of novel tobacco products, and importers of heated tobacco products.

The BIR earlier released a revenue memorandum circular which requires importers or manufacturers of raw materials and equipment used to make heated tobacco products and vapor products to apply for an authority to release imported goods.

In May, the BIR filed 69 complaints against tobacco traders for tax evasion amounting to a combined P1.8 billion.

The agency expects to collect P2.64 trillion this year. Of the total, excise tax collections from tobacco products are expected to hit P169.8 billion. — Luisa Maria Jacinta C. Jocson

DoE preparing microgrid auction notice

THE Department of Energy (DoE) said on Wednesday that it is currently designing an auction process for qualified bidders interested in putting up microgrids.

“We have islands that are not connected to the grid, (which need) microgrids,” Energy Undersecretary Rowena Cristina L. Guevara told reporters on the sidelines of the Giga Summit 2023.

She cited the need for rapid implementation, adding: “We will conduct an auction this year of the candidate microgrids.”

Republic Act No. 11646 or the Microgrid Systems Act lapsed into law last year. It was passed to accelerate the electrification of unserved and underserved areas.

The law authorizes the DoE to streamline the competitive selection process for microgrid system provider service contracts.

Under the law, microgrid system providers are not required to obtain a franchise from Congress, but need to apply for an authority to operate from the Energy Regulatory Commission.

“We have 130 islands that are not connected to the grid, but not all (will be included initially) … We are (compiling) the list of those who want to have microgrids,” Ms. Guevara said.

Ms. Guevara said the auction rules are still being designed while the number of contracts to be offered remains undetermined.

“Within the year definitely because we are still designing the auction because there are many (interested parties),” she said.

Microgrid systems are intended to help the government achieve its target of total electrification by 2028.

Microgrids will also help “diversify our energy mix while ensuring a path towards a sustainable, carbon-neutral, and clean energy future and by requiring more energy sources to support the country’s increasing power demand for economic recovery and development,” Ms. Guevara said in her speech at the conference. — Sheldeen Joy Talavera

PPP governing board to set fees for disqualified proponents filing appeals

THE Public-Private Partnership (PPP) Governing Board said it is working on guidelines governing appeals filed by prospective proponents who were eliminated at a project’s pre-qualification stages.

According to a notice posted to the website of the PPP Center, the guidelines will “set a fair and appropriate amount of appeal fees for disqualified proponents which shall not discourage potential appellants from challenging the disqualification decision.”

The guidelines are also designed to “dissuade non-serious bidders (from) filing appeals which can impede the procurement process for PPP projects.”

“Proponents who fail to pre-qualify may appeal their disqualification, subject to the rules and prerequisites outlined in implementing rules and regulations (IRR) of the Build-Operate-Transfer Law. One of these conditions is the payment of a non-refundable appeal fee,” it said.

Appeal fees are set at no less than 0.5% of the project cost, according to Section 5.5 of the revised IRR.

“However, during the amendment process of the 2022 IRR, particularly in the inter-agency discussions, some agencies raised concerns about the lack of flexibility of the provision on appeal fees,” it said.

“The revised 2022 IRR removes this lack by not setting the appeal fee at a specific percentage and instead providing that it shall be in an amount approved by the Approving Body pursuant to guidelines to be issued by the PPP Governing Board,” it added.

According to a draft resolution, the appeal fee will vary from 0.75% of the project cost for projects costing P2 billion or less, to 0.10% of the project cost for projects costing more than P200 billion.

The PPP Governing Board is chaired by the National Economic and Development Authority Secretary, with the Finance Secretary acting as vice-chair. Its members include the secretaries of the Departments of Budget and Management, Justice, Trade and Industry, the Executive Secretary, and Private Sector Co-Chairman of the National Competitiveness Council.

The PPP Center acts as the secretariat for the board.

Comment on the guidelines is being solicited as part of the consultation process. The deadline to comment is Sept. 27. — Luisa Maria Jacinta C. Jocson

Estate tax amnesty: A refresher

Estate settlement entails huge tax payments. Prior to the TRAIN Law, the estate tax due was the aggregate of a specific base tax plus an additional 5% to 20% of the amount in excess of a base net estate threshold.

For many Filipinos, this graduated estate tax rate proved a bit steep. Coupled with the lack of information on how to go about settling an estate, and at times, lack of agreement on how to distribute the estate, this resulted in heirs, transferees, and/or beneficiaries opting to leave the estate unsettled. Others, with the expectation of the inconvenience that they could face when they settle their kin’s estate, resort to simulating a sale transaction just to avail of the 6% capital gains tax applicable to sale of real property.

With the passage of the TRAIN Law, the graduated estate tax rates were scrapped and the tax rate was set at a uniform 6%. With the rate reduction, it made more sense to settle the estate than to simulate a sale given that the estate may benefit from the deductions allowed under the law. However, while prospectively, estates would benefit from the reduced rate, unsettled estates are left in no better condition as they face penalties and interest should they decide to undergo the settlement process.

To encourage the processing of unsettled estates, Republic Act (RA) No. 11213, or the Tax Amnesty Act of 2018, was signed on Feb. 14, 2019. This gave estates of decedents who died on or before Dec. 31, 2017, with or without assessments, whose estate taxes remained unpaid or have accrued as of Dec. 31, 2017, the opportunity to settle their tax obligations without having to pay the penalties that had accumulated due to the failure to pay the estate tax on time. Aside from dispensing with the penalties and interest, the amnesty also imposed the 6% estate tax under the TRAIN Law at every stage of transfer of the property.

Notwithstanding the reduction in the estate tax rate and the waiver of the corresponding penalties and interest for failure to settle the estate on time, the Tax Amnesty Act of 2018 imposed certain conditions. For instance, the deductions remain those applicable at the time of the death of the decedent. Meanwhile, if the deductions exceed the value of the gross estate, there is a minimum estate amnesty tax for the transfer of the estate of each decedent in the amount of P5,000. In addition, in case there are properties included in the Estate Tax Amnesty availment which are the subject of a taxable donation/sale, they shall be assessed donor’s tax/capital gains tax/other applicable taxes at the time of the donation/sale, plus penalties, if applicable.

The period to avail of the benefits of the Estate Tax Amnesty Program under RA 11213 was only until June 14, 2021, which is two years from June 15, 2019, the effectivity of the Revenue Regulations No. 6-2019, the Implementing Rules and Regulations (IRR) of RA No. 11213.

Before the expiration, however, the amnesty program was further extended until June 14, 2023 under RA No. 11569. This year, pursuant to RA No. 11956 which lapsed into law on Aug. 5, 2023, the period to avail of the program was further extended for another two years, i.e., until June 14, 2025.

Aside from the extension, RA No. 11956 expanded the coverage of the amnesty program to include estates of decedents who died on or before May 31, 2022, with or without assessment, but whose estate taxes have remained unpaid or have accrued as of May 31, 2022. It also listed in detail the documents that must be submitted to the Bureau of Internal Revenue (BIR) to avail of the estate tax amnesty and allowed payment by installment within two years from the statutory date of its payment without civil penalty and interest.

HOW TO AVAIL

Under the law and the IRR of RA No. 11956 (RR No. 10-2023), within the two-year extended window (i.e., June 15, 2023 to June 14, 2025), the executors, administrators, legal heirs, transferees or beneficiaries must file and pay either electronically or manually, with any authorized agent bank (AAB), Revenue District Office (RDO) through the Revenue Collection Officer (RCO), or authorized tax software provider, a sworn Estate Tax Amnesty Return. The return together with the Acceptance Payment Form (APF) and the complete documents shall be presented to the concerned RDO.

RR No. 10-2013 lists the documents that must be submitted. Nevertheless, in the absence of the required documents, the Commissioner may request alternative documents as may be deemed appropriate.

Within five working days from receipt of complete documents, the concerned RDO will endorse the APF for payment of the estate amnesty tax with AABs, RCOs, or authorized tax software provider, or shall notify the taxpayer in case there is any deficiency in the application. Only duly endorsed APFs shall be presented to and received by the AAB, RCO or authorized tax software provider.

After payment, the duly accomplished and sworn Return and APF with proof of payment and complete documents, must be submitted to the concerned RDO in triplicate.

Proof of settlement of the estate, whether judicial or extrajudicial, need not accompany the return if it is not yet available at the time of filing and payment of taxes, but no electronic Certificate Authorizing Registration (eCAR) may be issued unless such proof is presented and submitted to the concerned RDO. The eCAR, which serves as confirmation that the requisite tax has been paid, is indispensable to transfer ownership of real and personal property.

As emphasized by Congress, the pandemic posed challenges that likely affected the opportunity to avail of the amnesty program. This necessitated the passage of another extension. Still, the pandemic aside, the extension is a welcome measure to help alleviate the financial burden that has been a showstopper for most estate settlements.

The views or opinions expressed in this article are solely those of the author and do not necessarily represent those of Isla Lipana & Co. The content is for general information purposes only and should not be used as a substitute for specific advice.

Kathleen C. Galano is an assistant manager at the Tax Services department of Isla Lipana & Co., the Philippine member firm of the PwC network.

63 (2)8845-2728