YIELDS on government securities (GS) traded in the secondary market went down last week amid heightened expectations of rate cuts by both the Bangko Sentral ng Pilipinas (BSP) and the US Federal Reserve.

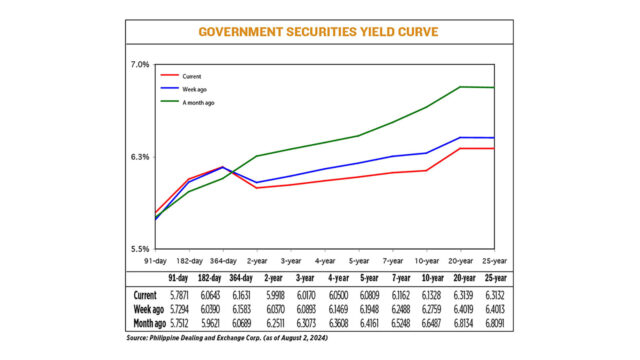

Bond yields, which move opposite to prices, fell by an average of 6.29 basis points (bps) week on week, based on PHP Bloomberg Valuation Service Reference Rates data as of Aug. 2 published on the Philippine Dealing System’s website.

At the short end of the curve, rates went up. Yields on the 91-, 182- and 364-day Treasury bills rose by 5.77 bps (to 5.7871%), 2.53 bps (6.0643%) and 0.48 bp (6.1631%), respectively.

Meanwhile, yields on Treasury bonds (T-bonds) went down across all tenors last week.

At the belly of the curve, the two-, three-, four-, five- and seven-year T-bonds declined by 4.52 bps (to 5.9918%), 7.23 bps (6.0170%), 9.69 bps (6.0500%), 11.39 bps (6.0809%), and 13.26 bps (6.1162%), respectively.

Lastly, at the long end of the yield curve, the 10-, 20-, and 25-year debt papers likewise saw their rates fall by 14.31 bps (to 6.1328%), 8.8 bps (6.3139%), and 8.81 bps (6.3132%) respectively.

GS volume traded stood at P31.8 billion on Friday, lower than the P34.19 billion recorded on July 26.

“Optimism on an August rate cut by BSP pushed domestic yields lower, supported by Fed Chair Jerome H. Powell’s statements suggesting a cut in borrowing costs could be on the table,” Jonathan L. Ravelas, senior adviser at Reyes Tacandong & Co., said in a Viber message.

“Local fixed-income markets had a strong rally to end July, mirroring the sharp decrease in US Treasury yields overseas. The long-end tenors were once again the winner for last week’s session as the investors stocked up on duration in anticipation of the expected rate cuts by the BSP in the following months,” Alessandra P. Araullo, chief investment officer at ATRAM Trust Corp., likewise said in a Viber message.

Mr. Powell’s dovish remarks at the close of the Federal Open Market Committee’s July 30-31 meeting also caused GS yields to go down, she added.

“Market players were keen on risk-taking as the longer-term bonds were heavily lifted. Bonds with maturities of more than 10 years saw yields decrease by an average of 12 bps,” Ms. Araullo said.

BSP Governor Eli M. Remolona, Jr. earlier said the Monetary Board may deliver its first rate cut in over three years at its Aug. 15 review — the only policy meeting scheduled in the third quarter — as they expect inflation to continue easing this semester.

The Monetary Board could reduce borrowing costs by 25 bps in the third quarter and by another 25 bps in the fourth quarter, he said.

The BSP in July kept its policy rate at a 17-year high of 6.5% for a sixth straight meeting after raising interest rates by a cumulative 450 bps from May 2022 to October 2023.

Meanwhile, Mr. Powell said on Wednesday interest rates could be cut as soon as September if the US economy follows its expected path, putting the central bank near the end of a more than two-year battle against inflation but square in the middle of the nation’s presidential election campaign, Reuters reported.

The Fed ended its latest two-day policy meeting with a decision to hold its benchmark interest rate steady in the 5.25%-5.5% range that was set a year ago, but its statement softened the description of inflation and said the risks to employment were now on a par with those of rising prices — neutral language that opens the door for rates to fall after more than two years of tightening credit.

Mr. Powell pushed the message even further forward in his post-meeting press conference, noting that price pressures were now easing broadly in the economy — what he called “quality” disinflation — and that if coming data evolve as anticipated, support for cutting rates will grow.

Investors saw Mr. Powell’s comments as clearly setting the stage for a reduction in borrowing costs at the Fed’s Sept. 17-18 meeting.

Meanwhile, weak US data reaffirmed investor worries last week, fueling a sell-off in global equities and pressuring US Treasury yields to multi-month lows, Reuters reported.

The US Labor department reported last week that the US unemployment rate jumped to near a three-year high of 4.3% in July amid a significant slowdown in hiring.

July US nonfarm payrolls report, which showed job growth slumped to 114,000 new hires in July from 179,000 in June.

The market mood soured after data showed a measure of manufacturing activity from the Institute for Supply Management dropped to an eight-month low in July at 46.8.

The yield on benchmark US 10-year notes fell 18 bps to 3.798%. The 2-year note yield, which typically moves in step with interest rate expectations, fell 28.5 bps to 3.8798%.

For this week, Ms. Araullo said the release of July Philippine inflation data will be a major driver for yields.

“The BSP has estimated the year-on-year figure to fall between 4.0% and 4.8%, which is higher than June’s 3.7%. A further upside surprise may cause investors to take profit and we may finally see some short-term market correction,” she said.

The Philippine Statistics Authority is set to release inflation data on Tuesday (Aug. 6).

A BusinessWorld poll of 15 analysts last week yielded a median estimate of 4% for the consumer price index in July. This matches the lower end of the BSP’s forecast.

If realized, July inflation would be faster than 3.7% in June but slower than 4.7% a year earlier. It would also mark the eighth straight month that inflation settled within the BSP’s 2-4% annual target.

“Another event that may affect yield movement is the five-year bond auction. Investors may look to trim some positions in anticipation of the fresh supply,” she added.

On Tuesday, the Treasury will offer P30 billion in reissued seven-year T-bonds with a remaining life of four years and nine months.

For his part, Mr. Ravelas said GS yields could move sideways to lower in the near term ahead of the BSP’s expected monetary easing. — Lourdes O. Pilar with Reuters