BPI considers $300-million bond issuance

BANK of the Philippine Islands (BPI) is looking to raise at least $300 million in dollar-denominated bonds around the second quarter of next year to refinance debt worth the same amount maturing in September.

The Ayala-led bank hopes to issue the bonds ahead of the maturing debt to avoid geopolitical risks, BPI Treasurer and Global Markets Head Dino R. Gasmen told reporters on Monday.

He added that the offer could be upsized if necessary.

Mr. Gasmen cited tensions stemming from elections in the US next year and in other jurisdictions, as well as monetary policy.

He noted the US Federal Reserve last year was expected to begin cutting rates by this time, “but the exact reverse is happening.”

“There’s still a possibility that the Fed might raise rates,” he added.

BPI is likely to issue dollar-denominated bonds before peso-denominated bonds next year due to the higher-than-expected amount recently raised in the second tranche of its P100-billion bond program, Mr. Gasmen said.

“It’s the biggest bond we have issued so far. So if you ask me, it’s more probable [if] we’re going to issue a dollar bond next year,” he said.

BPI on Monday listed peso fixed-rate bonds due 2025 on the Philippine Dealings and Exchange Corp. after raising P36.66 billion with a 6.425% interest rate per annum, payable quarterly.

The final issue size of the bonds was oversubscribed by over seven times the initial P5 billion target due to strong investor demand, which was fueled by the low amount of bond issuances this year, BPI Chief Finance Officer and Chief Sustainability Officer Eric Roberto M. Luchangco said.

“The net proceeds of the offer will be used for general corporate purposes, including funding source diversification,” BPI said in a statement.

Mr. Luchangco added BPI is not likely to issue any more bonds in 2023 since investors are no longer active as the year is about to end.

But he added that there is room for another issuance under the P100-billion bond program next year and that the target amount could be upsized as it nears the P100-billion mark.

BPI could also issue more bonds in 2024 if the Bangko Sentral ng Pilipinas (BSP) begins its easing cycle, Mr. Gasmen noted.

“If we feel the BSP will pivot, meaning they will reduce policy rates soon, then it’s more logical if we delay or hold off any issuances until rates fall a little lower so it will be cheaper for us as an issuer. If it’s tighter and we feel there is demand for bond issuers, then we’ll probably think seriously about issuing,” he said.

“If we feel that we have strong demand and we have a strong pipeline of loans, then we will likely issue more,” he added.

BPI saw its net income grow year on year by 33.3% in the third quarter to P13.5 billion due to higher revenues.

The bank’s financial statement was unavailable as of press time.

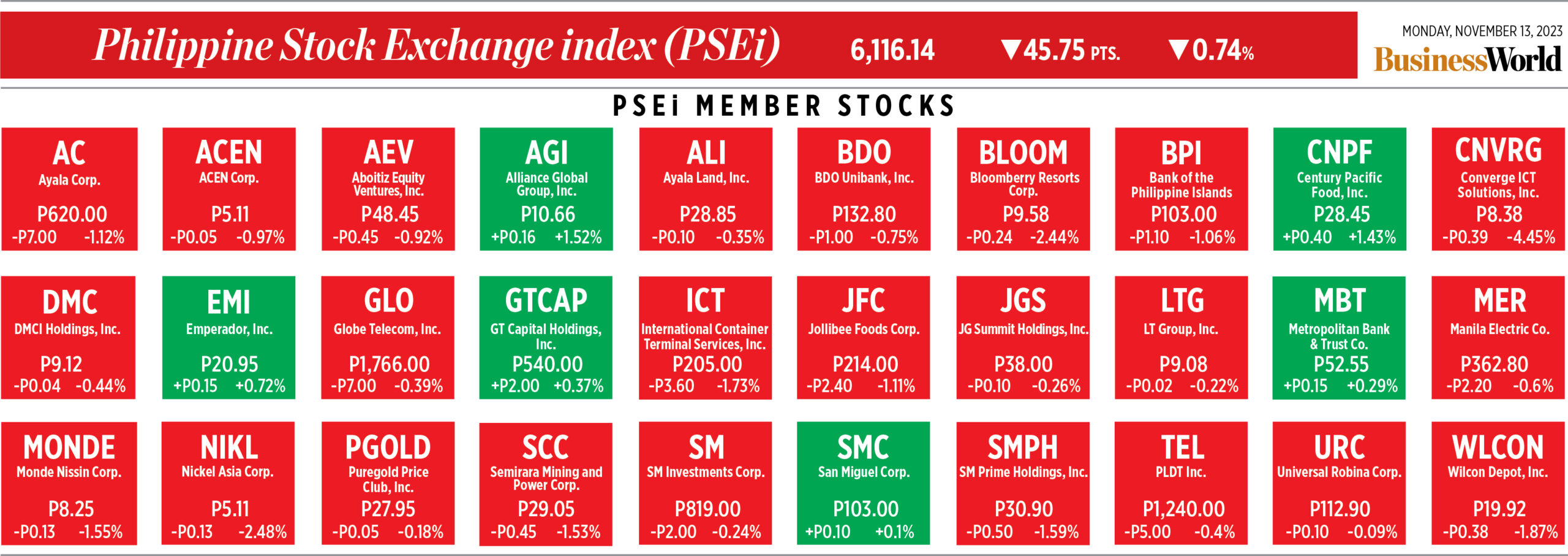

Its shares dipped by P1.10 or 1.06% to close at P103 apiece on Monday. — Aaron Michael C. Sy