Top 10 trends in global public debt in 2023

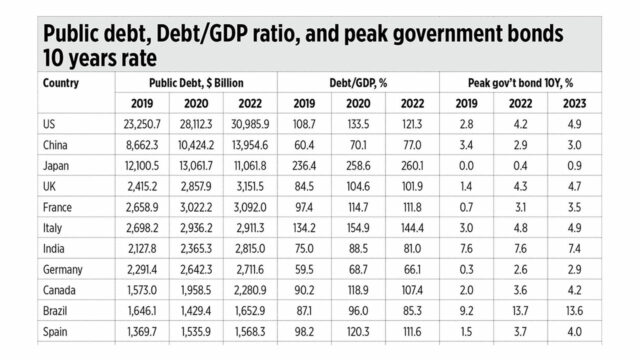

Continuing this column’s “Top 10” series for 2023, we look at government debt indicators. Below are the 20 countries with the largest public debt (Russia is the 20th) plus six other major indebted Asian countries. Here are the emerging trends.

1. The US remains the most indebted country in the world with $31 trillion in 2022. By end-2023, this has gone up to $34 trillion, according to the latest data from fiscaldata/treasury.gov. China, with $14 trillion in 2022, is second and Japan, with $11.1 trillion, is third but this is a decline from $13.1 trillion in 2022.

2. A big jump in public debt occurred in 2020 during the dictatorial global lockdown and the mandatory shutdown of many tax-paying businesses. This happened while expenditures kept rising as governments continued paying their personnel and bureaucracies plus creating new welfare programs. All countries in the table accompanying this story showed this trend except Brazil, Mexico, Argentina, and Pakistan. I think the decline was due to their currency appreciation that affected the conversion to US dollar value. Then these four countries’ public debt jumped in 2022.

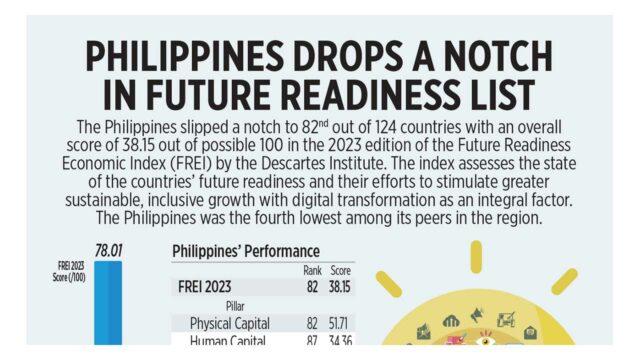

3. The Philippines breached the $200-billion mark with $224.6-billion public debt in 2021. It then rose to $232.5 billion in 2022. Vietnam was correct not to have breached the $200 billion in debt level.

4. The government debt/GDP ratio jumped in 2020 for all countries in the table. From 2019-2020, these countries had big increases in percentage points: the US went from 109% to 134%, the UK from 85% to 105%, Italy from 134% to 155%, Canada from 90% to 119%. In Asia, it seems that the Philippines has had the biggest increase, from 37% to 52%. The countries that saw the smallest increases were Bangladesh, Vietnam, and Pakistan.

5. The debt/GDP ratio in 2022 has declined from 2020 levels except seven Asian countries. These were China, Japan, South Korea, Singapore, Thailand, the Philippines, and Bangladesh. It seems many of these Asian countries contracted long-term debt that remained high even after dictatorial lockdowns were lifted in most countries.

6. The peak rates of 10-year government Treasury bonds doubled or tripled from 2019 to 2022 for Europeans. This was also the case for Japan, South Korea, and Australia. US rates touched 5% in some intra-day trading sometime last October (see table).

7. All G7 industrialized countries except Germany have debt/GDP ratios above 100%. This means fiscal discipline and responsibility is not in their vocabulary as they keep inventing new ways of spending (welfare, war, etc.) on top of existing ones. Asian countries, except Japan and Singapore, have ratios below 100% and somehow practice fiscal restraint.

8. Some rich countries suffered credit rating downgrades. The US went from Moody’s Aaa stable to Aaa negative last November. France went down from S&P’s AA stable to AA negative in December 2022. Italy went from S&P’s BBB positive to BBB stable in July 2022. In a way these are indicators of waning trust in their financial and fiscal capacity to service their long-term debt obligations.

9. The rise in price and value of alternatives to fiat money are additional indicators that many investors are slowly shying away from the US dollar and other currencies, anticipating small to big crashes in value. Gold is at an all-time high at $2,000+ per troy ounce, Bitcoin is recovering to $45,000+ and Ethereum is recovering to $2,300+, among others. Countries holding tens or hundreds of billions of dollars in US public debt will be scratching their heads if the dollar value would significantly depreciate and crash.

10. Most countries and governments are trending towards more profligate public spending and expanded borrowing instead of practicing more fiscal discipline and restraints. The Philippines and other Asian countries should actively and consciously aspire to reduce their debt/GDP ratio and retire much of their public debt — not via higher taxation but the privatization of certain government assets and corporations.

The Philippines’ economic team, headed by Finance Secretary Benjamin Diokno, has been very explicit about their stated goal of reducing the country’s debt/GDP ratio to below 60% by 2025, reducing the deficit/GDP ratio to 3% by 2028. I support their fiscal goal and I would add that we should aspire to have a debt/GDP ratio of 37% or lower by 2028. The numerator (public debt) should significantly decline via privatization of government assets. The denominator (GDP size) should keep expanding, with growth of 6-8% yearly. With more market-oriented reforms to encourage more private business dynamism and competition, the ratio will decline.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.