By Lourdes O. Pilar, Researcher

GEOPOLITICAL TENSIONS, climate transition, inflation and various economic developments have led to volatility of the country’s financial market performance in the second quarter.

The barometer Philippine Stock Exchange index (PSEi) closed the second quarter at 6,411.91, down 7.1% quarter on quarter. Likewise, the index declined by 1% year on year from the 6,468.07 finish in the second quarter of 2023.

Data from Bankers Association of the Philippines showed that the peso closed at P58.61 against the dollar in the second quarter, depreciating by 4.2% from the previous quarter’s end of P56.24 to a dollar. On an annual basis, the local unit also retreated by 6.2% from P55.20 finish in the second quarter last year.

Demand for Treasury bills auctions saw a total subscription amounting to P600.43 billion with P199 billion total offered amount in the second quarter.

The oversubscription amount of P401.43 billion was higher than the P349.19 billion in the first quarter.

Meanwhile, demand for Treasury bonds reached P611.84 billion, lower than the P1.07 trillion in the first quarter. However, this demand was higher than the aggregate offered amount of P299.21 billion in the second quarter.

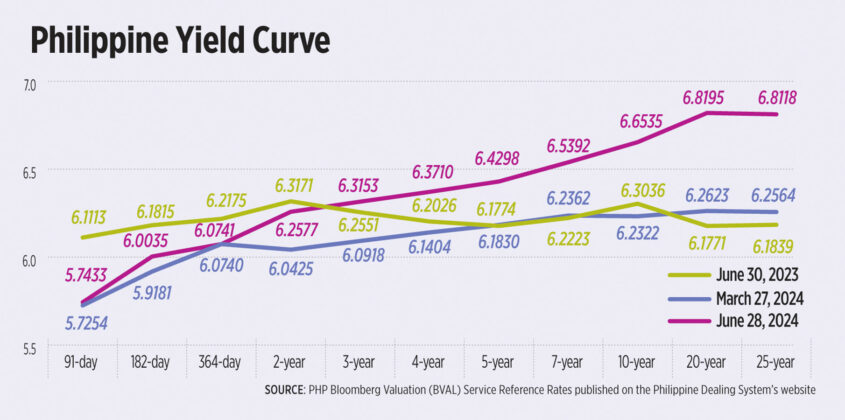

At the secondary bond market, domestic yields rose by 25.97 basis points (bps) on a quarter-on-quarter average, based on the PHP Bloomberg Valuation (BVAL) Service Reference Rates published on the Philippine Dealing System’s website.

On a year-on-year basis, yields also grew by 15.18 bps.

“Globally, elevated oil and energy prices in the second quarter from output cuts in the Organization of the Petroleum Exporting Countries (OPEC)+ countries and ongoing conflicts in the Middle East region as well as the reduced, but noticeable pressures from the Russia-Ukraine conflict have led to volatility in global markets,” Union Bank of the Philippines Chief Economist Ruben Carlo O. Asuncion said in an e-mail.

Mr. Asuncion added that at the local scenery, markets were affected by the continuing effects of El Niño that persisted until late May which was followed by climate transitioning to the early onset of La Niña.

“With disrupted rainfalls and fluctuating climate conditions, pressures on agriculture prices became the leading contributors to inflation in the second quarter with food prices rising at an average 6.3% year on year. Higher inflation led to Bangko Sentral ng Pilipinas (BSP) maintaining rates at 6.5% throughout the quarter leading to lower bond prices and higher yields,” added Mr. Asuncion.

“The ongoing geopolitical tensions and the United States Federal Reserve’s monetary policy decisions have created a volatile environment for global markets, including the Philippines. The fluctuations in commodity prices have also impacted inflation rates and investor sentiment,” Security Bank Corp. Chief Economist Robert Dan J. Roces said in an e-mail.

Mr. Roces added that domestic economic conditions, particularly inflation and gross domestic product (GDP) growth, have been key drivers of market sentiment. The BSP’s monetary policy decisions, aimed at balancing economic growth and price stability, have also influenced interest rates and the peso’s value.

Preliminary data from by the Philippine Statistics Authority (PSA) showed GDP expanded by an annual 6.3% in the April-to-June period. The second-quarter print was stronger than the revised 5.8% growth in the first quarter and 4.3% in the second quarter of 2023.

For the first half, the Philippine economy growth averaged 6%, meeting the low end of the government’s target of 6-7% this year.

In the seven months to July, inflation averaged 3.7%, still within the 2-4% central bank target.

WHAT INDICATORS TO WATCH OUT FOR

Economists noted that the same indicators will continue to persist and will affect the financial market performance in the next quarter.

Mr. Asuncion said that climate conditions in the Philippines is a key development to watch for, which is expected to impact agricultural production due to increased flooding, damaged crops leading to low crop output and higher prices of agricultural produce.

“Rainy season will also impact other sectors such as tourism and potentially increase government spending in construction of public infrastructure and works,” Mr. Asuncion said.

Mr. Asuncion also added that geopolitical conflicts in the Middle East combined with OPEC+ members cutting oil production will continue to pressure oil and energy prices upward.

Maybank Investment Banking Group senior economist, Zamros Bin Dzulkafli, said that, on the foreign exchange front, focus would continue to be on pace of the US Fed easing and the US election uncertainty.

“Our base case scenario remains for a US soft landing and so we expect the US Fed to ease rates gradually with 50 bps of cuts this year. This in turn should continue to support a downward trend for dollar/peso. However, we note that there could be bumps along the way as US data may not necessarily decline in a straight line,” said Mr. Dzulkafli said in an e-mail.

“Remittances are likely also to be higher in the final quarter of this year due to the festive season and that should give some support to the peso. The trade balance would likely remain in deficit amid the country’s weaker export base and import dependency and therefore, the external position should stay as a negative factor for the currency. Our year end forecast for dollar/peso stands at P56.00,” added Mr. Dzulkafli.

Cash remittances in the first semester period jumped by 2.9% year on year to $16.25 billion from $15.8 billion. The BSP expects cash remittances to grow by 3% this year.

In June, the value of exports slumped by 17.3% to $5.57 billion from $6.73 billion a year ago, the first double-digit decline since November 2023. Year to date, exports rose by 3% to $36.41 billion.

On the other hand, the value of imports declined by 7.5% year on year to $9.87 billion in June from $10.67 billion in the same month a year ago. For the first six months, imports slipped by 2.5% to $61.41 billion.

For the first six months of the year, the trade deficit narrowed by 9.5% to $25 billion.

INTEREST RATE CUT

For the first time in almost four years, the Monetary Board last August reduced the target reverse repurchase (RRP) rate by 25 bps to 6.25% from the over 17-year high of 6.5%. Rates on the overnight deposit and lending facilities were also lowered to 5.75% and 6.75%, respectively.

“We forecast that the BSP will continue to cut rates to a cumulative 50 bps to end at a 6% overnight RRP by yearend, and a potential additional 25 bps (total of 75 bps for 2024) is something we think the BSP would definitely consider. Nonetheless, a further 100 bps in 2025 to 5% is what we are also expecting,” Mr. Asuncion said.

Philippine National Bank economist Alvin Joseph A. Arogo said that if headline inflation returns to the target range starting August and the US Fed starts its own easing cycle in September, he anticipated that the BSP’s next move will be another 25 bps cut on Oct. 17.

“As a baseline view, we also believe that the monetary authorities will pause in December to allow the initial rate reductions to work their way through the economy and avoid spiking up inflation pressures. However, another 25 bps of easing is possible if inflation undershoots expectations, the peso strengthens further, and/or the third quarter GDP shows continued weakness in components not linked to government spending,” Mr. Arogo said in an e-mail.

Mr. Arogo forecasts end-of-year RRP rate remain at 6% for 2024 and 5% for 2025.

Mr. Roces said that a rate cut by the US Fed could lead to a weaker US dollar, which would generally benefit the Philippine peso and trade.

“However, it could also increase inflationary pressures if imported goods become more expensive. The BSP will want to carefully assess the potential impact of a weaker dollar on domestic inflation and the economy before making any adjustments to its monetary policy.

In a recent annual economic conference speech, US Fed Chair Jerome H. Powell signaled a start to interest rate cuts, saying further cooling in the job market would be unwelcome and expressing confidence that inflation is within reach of the US central bank’s 2% target.

After more than a year of holding interest rates at 5.25%, the highest level in more than two decades, officials finally have enough confidence to change their stance by cutting rates at their Sept. 17-18 meeting.

“US Fed and local policy rate cuts from 2024-2026 (by a total of about -2.25) would further spur greater business and overall economic activities, faster GDP growth and development in terms of further reduction in borrowing costs and further increase in the demand for loans for consumers, businesses, governments, and other institutions,” Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort, said in an e-mail.

FIXED-INCOME MARKET

Mr. Asuncion: Based on historical data and Autoregressive Integrated Moving Average (ARIMA) models, we have projected that August’s headline inflation will fall above 4% year on year with September slowing to 3.8% year on year. We forecast that 2024’s year-end inflation will be 3.7%. With inflation expected to slow in the coming months and BSP cutting rates, there will be a decrease in the yield on fixed-income securities.

Mr. Ricafort: For the coming months, barring external risk factors, local inflation could stabilize at 3%-3.5% levels, local policy rates could go down to 4%-5% levels from 2025-2026, local interest rate benchmarks would go down further by another 0.50-1.00 or even more from current levels from 2025-2026, as the US Fed would cut rates by a total of about -2.25 from 2024-2026 (that could matched locally by the BSP).

Mr. Dzulkafli: Expectations of US Fed easing but no major downturn are conducive to higher yielders including the Philippines government bonds. The 10-year RPGB yields may consolidate after a strong rally, then trade on high beta vs the US Treasury.

EQUITIES MARKET

Mr. Asuncion: During second quarter, PSEi index closed at 6,700.49, 6,433.10, and 6,411.91, with July closing at 6,619.09. The PSEi have been upward trending since August, with this week opening at 6,889.87 reflecting the market’s expectations for further rate cuts. Based on historical prices and expectations for a cumulative 50-bp cut this year, the PSEi would increase to close at yearend of 7,200-7,400.

Mr. Ricafort: The local stock market posted huge gains recently after the peso exchange rate remained among the strongest versus the US dollar in more than 4.5 months or since April 2024; also after mostly stronger local GDP, employment, bank loans, and other economic data recently, as well as mostly better corporate sales and earnings reports by some listed companies/conglomerates that fundamentally support higher valuations; after local monetary officials still reiterated possible -0.50 local policy rate cut for the rest of 2024.

Mr. Dzulkafli: We expect that equities market would rally in light of rate cuts that could support economic growth. Lower lending cost could boost both corporate expansion and consumer spending.

FOREIGN EXCHANGE MARKET

Mr. Asuncion: For the remainder of the third quarter, we expect exchange rates to favor the peso owing to increased expectations of a more aggressive US Fed rate cut of 75-100 bps compared to BSP’s rate cut of 25 bps recently. Based on historical prices and ARIMA models, we forecast dollar/peso to close at P56.63 by yearend 2024. The strength of the peso will persist. However, import season (usually strong in 2H historically) may counter this strength.

Mr. Ricafort: Going forward, the performance of the US dollar/peso exchange rate would be partly a function of intervention as consistently seen over the past two years; amid the need to better manage inflation and inflation expectations to fulfill the price stability mandate that would also require stability in the peso exchange rate, which affects import prices and overall inflation.

Mr. Dzulkafli: USDPHP may rebound from current levels as markets expectation of 100 bps of Fed cuts are pared back. The Fed is likely to only gradually ease amid a US soft landing. More concerns about US election uncertainties also look to possibly weigh in, too.