By John Authers

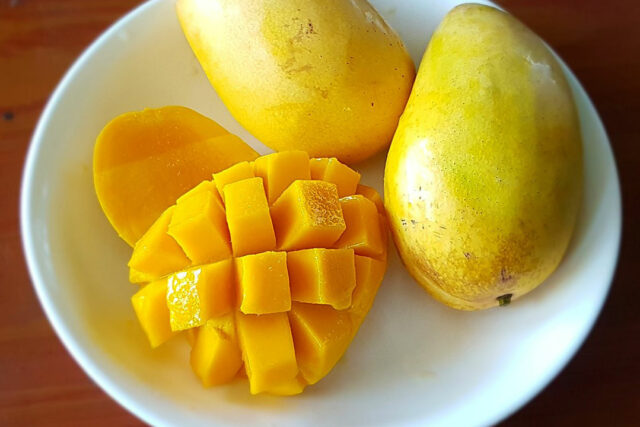

WHATEVER happens, the global shipping lanes will still be active. Trade must continue. To use US Commerce Secretary Howard Lutnick’s favorite analogy, the US can never produce its own mangoes; it will keep importing them, and shouldn’t slap on tariffs that would only make them more expensive for Americans.

Lutnick isn’t the only one with a financial mango analogy. The British novelist John Lanchester, who became an avid student of economics during the Global Financial Crisis, has used them to denounce contemporary financialized capitalism. He offers this example of a farmer who will soon harvest his fruit:

“Because it’s helpful to get the money now and not later, you sell the future ownership of the mango crop to a broker, for a dollar a crate. The broker immediately sells the rights to the crop to a dealer who’s heard a rumor that thanks to bad weather mangoes are going to be scarce and therefore extra valuable, so he pays $1.10 a crate. A speculator on international commodity markets hears about the rumor and buys the future crop from him for $1.20…”

Lanchester then details deals involving a momentum trader, a contrarian trader, and short sellers, who take the price up to $1.30 and then down to 90 cents before the mangoes are harvested and shipped for a dollar a crate. His point is that the fruit can spark huge financial activity that creates no value. But while this is true, there are also transactions that are vital if trade in mangoes is to continue. And therein lies the problem.

Put the analogies together, and you can conclude that the mango trade is bound to continue, and even Lutnick says this will be without tariffs, but that it would be easy to halt the financial flows around them. For all of this year’s worries that global trade will dry up, the risk that capital flows will be thwarted is much greater.

This isn’t just about the edifice of derivative bets. Capital is the fuel for the capitalist economy, and it can be diverted at the stroke of a pen.

AUTARKY

Even before the trade war erupted, the anti-globalization backlash was well underway as countries moved toward national self-sufficiency, or what economists call autarky. Total self-sufficiency in goods cannot happen (assuming Americans can’t do without mangoes) but an autarky in capital — “national capitalism” or “capitalism in one country” — is already taking shape.

“I don’t think autarky in goods is possible,” says Julian Brigden of MI2 Partners. “The rush to negotiate deals shows that people want to preserve the global trading system. The greater risk is that you end up with financial Balkanization.”

The concept has deep roots, and both left and right have profound problems with it. “The reactionary tendencies of autarky,” Trotsky wrote a century ago, “are a defense reflex of senile capitalism to the task with which history confronts it.” Followers of Hayek denounce autarky for undermining economic freedom and democracy. Hayekians and Trotskyites alike have a point: If kept rigidly within national borders, neither capitalism nor socialism can flourish.

And yet some of the world’s most enthusiastic globalists are embracing self-sufficiency. French President Emmanuel Macron made a speech last year provocatively titled, “Europe: It Can Die.” To prevent that, he argued for the continent to be more self-reliant. Beyond defense, the European Union needed “dedicated financing strategies” for crucial sectors, including AI, quantum computing, space, and biotechnology.

“To do this, we need the right instruments,” he said. “This means we need to define, we need to invest in these sectors, and we need to act together.” In other words, governments need to force European finance to pour capital into those strategic efforts.

FINANCIAL REPRESSION

Countries have steered private capital this way in the past, and the institutionalization of finance makes it ever easier. Brigden draws an analogy with the period from the Second World War until the 1980s. “Governments were fighting tooth and nail to maintain solvency and so had to put in place all these rules to enforce Balkanization — exchange controls, capital controls, price and income policies. A return to that world is entirely possible, and it could happen out of necessity.”

Now, as then, governments have massive debt loads. Critical to paying down the debts from the war was financial repression — manipulation of laws and regulations to oblige low bond yields. Or, less kindly, to force people to lend to the state at preferential rates. This was arguably less painful than the alternatives of default or runaway inflation.

Unlike trade, capital flows can be shut off easily, because capital is corralled. After the war, about 90% of the New York Stock Exchange’s value was held by individuals on their own account. Now it’s dominated by institutions. Financial historian Russell Napier says: “The regulatory state is more powerful than fiscal or monetary policy. When capital is in the hands of capital institutions, not individuals, you can control it with regulation.”

The total assets held by mutual funds in the US have risen to $22 trillion now from $570 billion in 1990, mostly concentrated in the hands of a few huge players. Regulators can push these firms around easily, without provoking anything like the fuss that comes with other nationalistic moves, such as barring Harvard University from recruiting foreign students. Repeated skirmishes between politicians and BlackRock, the biggest US fund manager, have created much less of a stir.

Across the world, governments are moving to ensure that they have control over their biggest pools of capital. Last year, Canberra changed the mandate of The Future Fund of Australia, which backs public sector pensions, so that it’s now expected to address “national priorities” led by infrastructure and housing, and the energy transition. The Canadian province of Alberta fired the entire board of directors of its own pension fund in what was labeled by one academic as a “government takeover” of assets belonging to retirees.

WINNERS AND LOSERS

As capital returns home, there will be winners and losers. Britain has much to gain, as it has been the greatest loser from regulatory inertia. In 1990, British pension funds and insurance companies owned 54% of the country’s publicly quoted equities. Three decades later, that number had dropped to only 7%. Bankers complain that there are not enough local investors who understand the British market for small companies to go public.

Michael Tory, the Canadian financier who heads Ondra LLP in London, denounces “decades of policy negligence regarding the deployment of the nation’s savings.” Two decades ago, regulators were alarmed by the risk that pension funds might not be able to make good on their guarantees to pensioners, and took steps to ensure that they had enough assets to cover commitments. Inadvertently, that forced them to sell their UK holdings and channel money into the much deeper US market. This helped savers, but it starved the UK of capital.

Tory argues that the Pension Protection Fund, a state-owned backstop, should be mandated to allocate 75% of its assets to domestic equities. Chancellor Rachel Reeves refuses to rule out mandating pension funds to invest at home.

That is an autarkic move, but it looks like one the UK should take. “Self-sufficient economies will demand increasingly self-sufficient capital,” argues Ian Harnett of Absolute Strategy Research in London. “Weaponized trade may lead to weaponized capital flows, with big implications for global finance.”

If the UK (and others who feel the need to be in control of their own house) does bring capital home, that will mean drastic things for the US, where foreigners hold some 26% of Treasuries and 18% of equities. All those inflows have pushed up the dollar, limiting inflation but making exporters less competitive, so the Trump administration would welcome a cheaper currency. The problem is that the country could lose access to a huge pool of capital, like Britain did before it.

If this seems abstruse, we can return to fruit. All the money splashing through the American system at present makes it that much easier to afford mangoes. It also provides handy financing for those who import and retail the fruit. Mangoes may not carry a tariff, but financial balkanization could yet make them more expensive.

BLOOMBERG OPINION