QCinema 2024 Pocket Reviews: What an international film festival offers to a Filipino market

By Brontë H. Lacsamana, Reporter

BOTH LOCAL and foreign films make up the weighty lineup of this year’s QCinema International Film Festival. In celebrating a coming-of-age in its 12th edition, the festival has expanded — initially catering to avid Pinoy cinephiles whose calendars (and wallets) are prepped for this time of year — to serving as an industry platform to connect Southeast Asian filmmakers and producers through the QCinema Project Market (QPM).

Modeling itself after the likes of Busan, Venice, and Toronto is no easy feat. Led by the city’s Film Commission, the QPM, running from Nov. 14 to 16, is awarding grants to 20 films across the region and holding forums to tackle topics on cultural intersections and financing strategies.

Welcoming Southeast Asian filmmakers to collaborate and screen their works is a healthy sign of a growing film market, and this manifests in the festival’s lineup as well. At QCinema, a solid 77 films offer a wide range of cinematic narratives and experiences that Filipinos and international guests can enjoy.

QCinema runs until Nov. 17 at the cinemas of Gateway Mall 2, Trinoma, Shangri-la Plaza, and the Power Plant Mall. Regular tickets cost P300.

Here are reviews of a few films that BusinessWorld was able to watch:

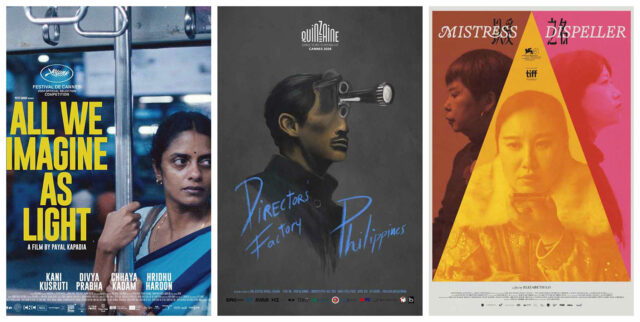

DIRECTORS’ FACTORY: PHILIPPINES

A local edition of Cannes Directors’ Fortnight, an initiative that pairs four filmmakers from the home country (in this case, the Philippines) and four from its regional neighbors, has resulted in an omnibus film of four striking short works. All filmed in Dapitan, they capture themes of exile and alienation while steeped in the natural mise-en-scène of the location.

Cold Cut by Don Eblahan of the Philippines and Tan Siyou of Singapore kicks it off with a moving dance performance, starring a 19-year-old girl at a talent show. A push and pull is seen between her and a butcher, whom she chases after amid auditions where girls like her line up in hopes of a better future.

Silig by Arvin Belarmino of the Philippines and Lomorpich Rithy of Cambodia is more accessible, tackling queer displacement with heart. It follows a dying woman (played by Sylvia Sanchez) returning to a hometown that shunned her for her identity and reconnecting with an old flame (played by Angel Aquino).

Nightbirds by Maria Estela Paiso of the Philippines and Ashok Vish of India, while not baked to its full potential, puts a fun, surreal spin on the local mythology of the Tigmamanukan, or bird god, through the story of a disillusioned woman (played by Pokwang) becoming a chosen one of sorts.

Finally, Walay Balay by Eve Baswel of the Philippines and Gogularaajan Rajendran of Malaysia depicts a mother and daughter (played by Ruby Ruiz and Shaina Magdayao) longing for their war-torn home of Marawi. It concludes the set powerfully by using sound to evoke memory and trauma.

MISTRESS DISPELLER

Directed by Elizabeth Lo

The logline of the documentary Mistress Dispeller reads like it would delve into family and relationship drama, with the central figure of Teacher Wang being a “mistress dispeller,” an emerging career in China where one is hired to break up extramarital affairs. It does, of course, have drama in it given the nature of the subject, but the way it was filmed allows for nuance.

Here, we see the progression of one of her cases, where a wife heartbreakingly relays how she discovered her loving husband’s secret affair and seeks to end it to save the marriage. The ensuing operation is fascinating, with Teacher Wang endearing herself to the couple through a tennis club, later to the husband as he opens up about his insecurities over dinner, and finally to the mistress whose perspective reflects her choices in life.

While it is easy to condemn both the husband and the mistress for their sins, the film is not interested in that. It views everything through the lens of romance becoming an industry in contemporary China, where people no longer organically let relationships start and run their course. In the same way a matchmaker orchestrates love, the titular subject initiates a strange form of therapy and manipulation, working to fix a marriage through conversations that coax out the truth from the involved parties.

For audiences, more details on the cultural ubiquity and relevance of the mistress-dispelling industry in China may be welcome, but the picture Ms. Lo paints is equally enthralling, told in a way that gets one to question just how necessary such services should be in contemporary society.

ALL WE IMAGINE AS LIGHT

Directed by Payal Kapadia

This film is a soulful look into the lives of women musing on the pitfalls of city life. It is clear why it won the Cannes Grand Prix this year — moving performances by the three leads anchor Mumbai as a place where people grapple with an endless pursuit of desires.

All We Imagine As Light has beautiful cinematography, with natural light, sounds, and colors informing the personal histories of the responsible nurse Prabha (played by Kani Kusruti), the naive and romantic nurse Anu (played by Divya Prabha), and the increasingly displaced yet headstrong elder nurse Parvaty (played by Chhaya Kadam). Their rich inner lives endear the characters to the audience, with tender direction peeling back the layers of dreams and insecurities born in the harsh setting they find themselves in.

Its sense of melodrama is not exactly new, especially in the world cinema landscape. It can even be described as the quintessential “international film festival darling,” but its heartfelt touch cannot be denied. All We Imagine As Light conveys a magic that makes naturalistic, humanist drama an arresting category, especially towards the end where it blends subtly into the mystical.

There are many gems to catch in this year’s Screen International section, and this film is undoubtedly one of them.

ROOM IN A CROWD

Directed by John Torres

The structure of Room in a Crowd is anything but straightforward. It is made of a barrage of images and sounds culled from behind-the-scenes of an upcoming science fiction film and the day-to-day conversations of the filmmaker (John Torres) over the course of shooting.

Inevitably, no straight description can do this experimental behemoth justice. Mr. Torres makes something out of everything, be it recordings of his daughter speaking in gibberish, a Zoom call with film students reading a script, or a phone conversation with a close friend expressing their anxieties under militaristic threat. The cinematic medium is pushed beyond its limits, the audience challenged to follow the wide net cast across life on the margins of the making of a film, and even beyond it.

Mr. Torres’ live spoken word performance, backed by the entrancing electronic score by Itos Ledesma, concludes the film in an extended epilogue that feels less like a regular final act and more like a spiritual rave in the church of cinema. It’s a rare experience that Filipino art, music, and film lovers should catch, especially in the optimally communal movie theater.

Of all the special screenings in QCinema, Room in a Crowd is the one to watch for those who want to see just how much more the boundaries of film can be pushed.

Brontë H. Lacsamana is one of the six emerging critics participating in the QCinema Critics Lab this year.