Peso inches lower vs dollar on Fed officials’ comments

THE PESO inched lower against the dollar on Thursday amid hawkish signals from US Federal Reserve officials.

The local unit closed at P57.19 per dollar on Thursday, weakening by a centavo from its P57.18 finish on Wednesday, Bankers Association of the Philippines data showed.

This was the peso’s worst finish in almost 17 months or since its P57.375-a-dollar close on Nov. 22, 2022.

The peso opened Thursday’s session slightly stronger at P57.15 against the dollar. Its intraday best was at P57.01, while its weakest showing was at P57.24 versus the greenback.

Dollars exchanged went down to $1.799 billion on Thursday from $1.92 billion on Wednesday.

“What we saw was the start of choppy consolidation in the short term as the pair has begun to show signs of being overbought from a technical perspective,” Security Bank Corp. Chief Economist Robert Dan J. Roces said in a Viber message.

Mr. Roces said this was due to Fed Chair Jerome H. Powell’s comments the previous day.

The peso was also dragged down by cautious comments from Cleveland Fed Bank President Loretta Mester and Fed Governor Michelle Bowman, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort added in a Viber message.

Top US central bank officials including Mr. Powell backed away on Tuesday from providing any guidance on when interest rates may be cut, saying instead that monetary policy needs to be restrictive for longer and further dashing investors’ hopes for meaningful reductions in borrowing costs this year, Reuters reported.

Fed policy makers have said since the start of the year that rate cuts are contingent on gaining “greater confidence” that inflation is moving towards the central bank’s 2% goal, but readings over the past few months show price pressures may even be moving in the opposite direction.

“The recent data have clearly not given us greater confidence and instead indicate that it’s likely to take longer than expected to achieve that confidence,” Mr. Powell told a forum in Washington, in what is likely to be his last public appearance before the April 30-May 1 policy meeting.

Meanwhile, Ms. Mester said on Wednesday she expects price pressures to ease further this year, allowing the Fed to reduce borrowing costs, but only when it is “pretty confident” inflation is heading sustainably to its 2% goal.

Progress on lowering US inflation may have stalled, and it remains an open question whether interest rates are high enough to ensure that it returns to the Fed’s 2% target, Ms. Bowman also said on Wednesday.

For Friday, Mr. Roces said the peso could continue to trade sideways versus the dollar. Mr. Ricafort expects the local unit to range from P57.05 to P57.25 against the greenback. — A.M.C. Sy with Reuters

Shares rise further as BSP chief hints at Q4 cut

PHILIPPINE STOCKS rose for the second straight session on Thursday on continued bargain hunting and expectations of rate cuts in the fourth quarter (Q4).

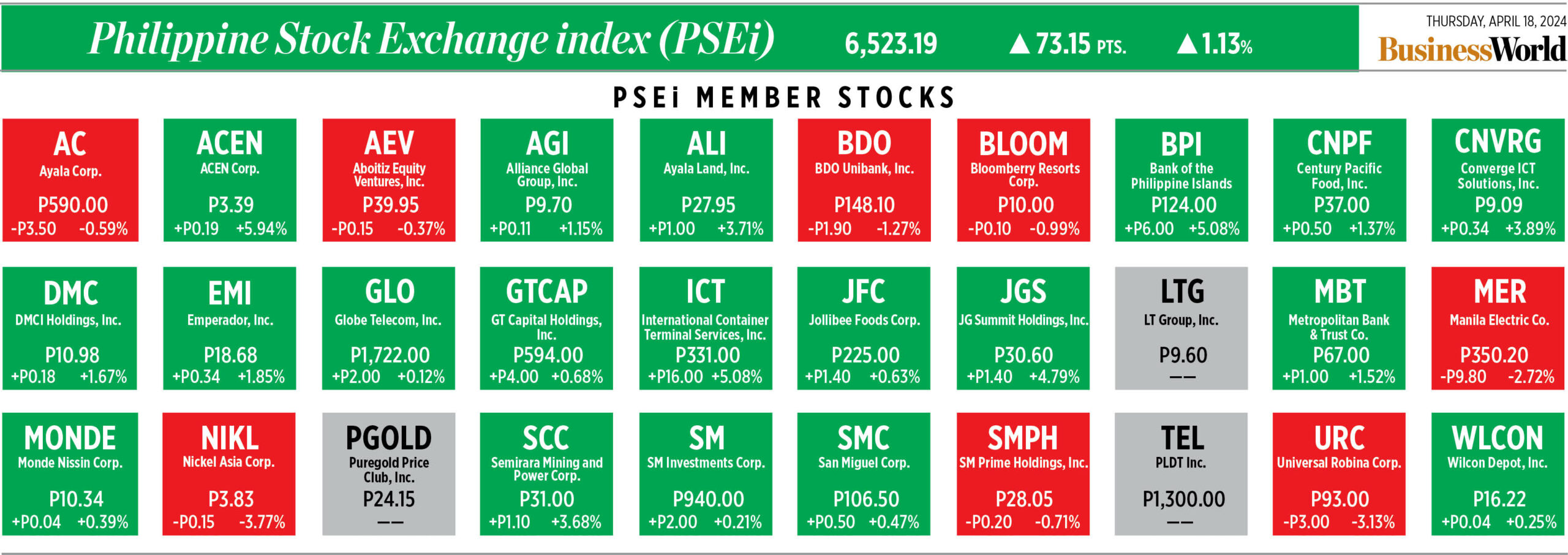

The Philippine Stock Exchange index (PSEi) rose by 1.13% or 73.15 points to close at 6,523.19 on Thursday, while the broader all shares index climbed by 0.76% or 26.30 points to finish at 3,456.32.

“Fueling the positive sentiment was the resurfacing of rate cut hopes as Bangko Sentral ng Pilipinas (BSP) Governor Eli M. Remolona, Jr. stated the possibility of monetary easing starting in the fourth quarter of this year,” Philstocks Financial, Inc. Research and Engagement Officer Mikhail Philippe Q. Plopenio said in a Viber message.

“The local market rose by 73.15 points (1.13%) to 6,523.19 due to sustained bargain hunting. Investors continued to take opportunities from the market’s recent steep decline,” Mr. Plopenio said.

The BSP could cut its key rate as early as the fourth quarter despite the peso’s recent weakness, Mr. Remolona said on Wednesday.

The Monetary Board may still cut policy rates in the fourth quarter, he told a news briefing on Wednesday.

“If things are worse than we think, that might be postponed to the first quarter of 2025.”

The peso and other regional currencies have weakened in recent days as markets bet against the odds of early rate cuts around the world.

The local unit closed at the P57-per-dollar level on Tuesday for the first time since November 2022, ending at P57 flat, due to expectations that the US Federal Reserve would delay cutting interest rates.

It dropped further on Thursday, closing at P57.19 against the greenback.

The BSP this month kept its policy rate steady at a near 17-year high of 6.5% for a fourth straight meeting.

“Local investors continued to bargain hunt… as the index closed above 6,500, with a 1.13% improvement. Meanwhile, US technology shares continued to soften as the artificial intelligence play continued to lose steam,” Regina Capital Development Corp. Head of Sales Luis A. Limlingan added in a Viber message.

Almost all sectoral indices closed higher except for mining and oil, which dropped by 1.62% or 134.32 points to end at 8,129.43.

Meanwhile, services climbed by 2.6% or 46.59 points to 1,833.87; financials rose by 1.74% or 35.08 points to 2,049.42; property went up by 0.92% or 22.81 points to 2,481.56; holding firms increased by 0.47% or 28.19 points to 6,005.47; and industrials inched up by 0.21% or 18.13 points to 8,507.76.

Value turnover went up to P6.56 billion on Thursday with 634.82 million issues switching hands from the P5.89 billion with 595.37 million issues traded on Wednesday.

Advancers beat decliners, 107 against 76, while 43 names closed unchanged.

Net foreign selling increased to P619.45 million on Thursday from P521.52 million on Wednesday. — R.M.D. Ochave

DA to propose P513.81-billion infra-heavy budget for 2025

THE Department of Agriculture (DA) said Thursday that its significantly expanded budget proposal for 2025 will help address shortcomings in farm infrastructure.

In a statement, the DA said that it will propose a P513.81 billion budget for 2025. If approved, this would be more than double the DA budget of P208.58 billion in 2023.

Agriculture Secretary Francisco P. Tiu Laurel, Jr. said that the funds will support the construction of irrigation and postharvest facilities.

“(The budget) is still a work in progress but clearly shows the direction we are headed,” he added.

Under its proposed budget plan, the bulk of expenditures will go to the National Irrigation Administration, National Food Authority, Philippine Coconut Authority, Philippine Fisheries Development Authority, and the National Dairy Authority.

“The proposed combined budget for the eight DA attached corporations is P287.98 billion, more than triple their total budget of P94.3 billion for this year,” the DA said.

Mr. Laurel has said that P93 billion is needed for postharvest facilities to reduce rice and corn waste.

He added that about P1.2 trillion will be required to irrigate an additional 1.2 million hectares to boost rice production and reduce imports.

“For the DA itself, the envisioned budget for 2025 is nearly double at P225.83 billion… to allow various bureaus to cope with the need to modernize the fisheries and farm sectors as well as address food safety and anti-smuggling efforts,” the agency said.

The DA said that 57% or P294.21 billion of the proposed budget will be dedicated to rice.

Fisheries will get P50.6 billion, while locally funded projects will be allotted P45.48 billion.

It added that cross-cutting programs will be allocate P34.5 billion, high value crops P32 billion, livestock P28.56 billion, foreign-assisted projects P13.77 billion, corn P11.3 billion, and credit programs P3.38 billion. — Adrian H. Halili

John Hay’s potential to be unlocked by SC ruling — investment secretary

FREDERICK D. GO, Special Assistant to the President for Investment and Economic Affairs said a Supreme Court (SC) decision resolving a dispute between the Bases Conversion and Development Authority (BCDA) and lessee, CJH Development Corp. holds the potential to open up the John Hay Special Economic Zone (SEZ) to investors.

“This development will enable the government to unleash the full potential of the John Hay SEZ and spur inclusive economic opportunities for northern Luzon,” Mr. Go said in a statement Thursday.

“We invite private sector partners to look into John Hay as an ideal investment hub in the northern region for commerce, eco-tourism, and leisure,” he added.

He said that this development will help in realizing the Marcos administration’s goal of promoting investment “by utilizing and fully supporting ecozones, consequently bringing in strategic industries and promoting growth outside Metro Manila.”

The SC said on April 10 that it had upheld an arbitral ruling ordering CJH Development to vacate John Hay.

The SC, through Justice Japar B. Dimaampao, upheld the decision of the Philippine Dispute Resolution Center, Inc. (PDRCI), which found that CJH Development and BCDA breached their obligations under their agreement.

The decision ordered both parties to revert to their original positions prior to the execution of the agreement, as far as practicable.

In particular, CJH Development was ordered to return the leased property with the improvements to BCDA, with the BCDA to refund the rent paid by CJH Development worth P1.42 billion.

On Monday, Executive Secretary Lucas P. Bersamin also welcomed the decision and said: “The BCDA will meet with stakeholders to map out the next plan of action following the ruling of the High Court.”

In a previous statement, the BCDA said that the decision will allow it to recover the 247-hectare property in the former Camp John Hay, a former rest and recreation center for US forces based in the Philippines. — Justine Irish D. Tabile

DTI, Plug and Play accelerator program expected to help 40 startups each year

AT LEAST 40 startups annually are expected to obtain funding and training from an accelerator program launched by the Department of Trade and Industry (DTI) and US venture capital firm Plug and Play Tech Center.

On the sidelines of the program launch late Wednesday, Plug and Play Co-Founder Jose Avelino Flores said in partnership with the DTI, Plug and Play will act as the facilitator in identifying the problems faced by startups and market them to sources of capital worldwide.

“Normally, with startups, and we see about 20,000 a year globally; these startups will not have 100% of the solutions,” he said.

“So they will have to go through that acceleration program where, on that platform, they will work with the industry to build the products that will work,” he added.

Plug & Play can help the startups tap the $10 billion pool of the firm’s network globally, said Mr. Flores.

“You know, I invest about $25 million a year in startups. But… it’s just one fund. I am relatively small, and I have access to at least $10 billion worth of funding from our network globally,” he said.

The project will not only be open to Filipino startups but also international ones as well, and will cycle every six months with at least 20 participants in each batch.

“The idea is that these startups will now also attract foreign direct investment from venture capitalists in the Philippines, attract other companies that also want to look at their solutions and build those solutions,” he said.

“Because these solutions will be built anyway in other parts of the world, so why are we waiting and buying these solutions made outside of the country when we can build them here? So that is the idea, so we will have the intellectual property,” he added.

He said that the long-term goal of the program is for the startups to sell their solutions to the global market after being deployed in the Philippines.

Called the National Startup Accelerator Platform, the program will initially run for two years and is expected to be extended to five years.

Under the partnership, the DTI will be providing the office and coworking space to house the startups at the National Innovation Gateway.

“And of course, we’ll introduce them to existing startups that we’re working with already out of our other programs,” Trade Secretary Alfredo E. Pascual said.

In terms of priorities, Mr. Pascual said these include artificial intelligence, cybersecurity, software development, animation, agritech, and foodtech.

During the launch, Plug and Play also signed a memorandum of understanding with its first corporate partner under the accelerator program, DFNN, Inc.

Under the partnership, DFNN Executive Chairman Ramon C. Garcia, Jr., said that the company will provide the incubating companies with access to markets for their products.

“Second, we ourselves are also contributing cash for the next five years to seed these startups, and what the DFNN Group hopes to get in return is an external way to look at innovative processes that we ourselves may tap and use within our own operations,” he said.

“Remember, when you talk about seed funding, you’re talking about $10,000–$20,000 per investee. So it really doesn’t take a lot, but we’re hoping to get a big return over the next number of years,” he added.

In particular, the DFNN is interested in innovations involving cybersecurity, defense technology, and space technology. — Justine Irish D. Tabile

NEDA Board to approve revised PGH cancer center plan next week

THE National Economic and Development Authority (NEDA) board is set to approve a revised plan for the Philippine General Hospital (PGH) cancer center next week, addressing changes in project cost and parameters, the Public-Private Partnership (PPP) Center said Thursday.

“The thing with cancer center is since it was the first approved (PPP project) under the Marcos administration, some of the assumptions were set in the pre-pandemic (period)” PPP Executive Director Ma. Cynthia C. Hernandez told reporters on the sidelines of a luncheon organized by the European Chamber of Commerce of the Philippines.

The NEDA Board, which is chaired by President Ferdinand R. Marcos, Jr., initially greenlit the project on Feb. 2, 2023.

However, the cost for the 300-bed cancer center was raised to P9.4 billion from P6 billion. This includes the financing, design, engineering, construction, operation, and maintenance of the hospital.

“When they were drafting the detailed terms and conditions, I think PGH realized that they need to substantially upgrade the standards, especially they want it to be world class. So there were adjustments to the project cost which necessitated another round of NEDA (Board) approvals,” Ms. Hernandez said. — Beatriz Marie D. Cruz

Well-milled rice prices average P57.03 per kilo in early April

THE national average retail price of well-milled rice in early April was P57.03 per kilogram (kg), the Philippine Statistics Authority (PSA) said in a report.

The average price was up from the P56.95 recorded between March 15 and 17, which the PSA refers to as the second phase of the month.

The highest retail price in the first phase was reported in Central Luzon, averaging P59.18 per kg during the period.

At the low end during the period was Ilocos Region with rice prices averaging P50.37 per kg.

The PSA reported that regular-milled rice averaged P51.39 per kg, up from P51.21 per kg during the first phase.

The highest price for regular-milled rice was recorded in the Bangsamoro Autonomous Region in Muslim Mindanao, with an average of P54.70 per kg.

Cagayan Valley posted the lowest price for well-milled rice at P46.69 per kg.

The Department of Agriculture has said that the retail price of rice is expected to remain elevated until midyear due to the impact of El Niño.

Meanwhile, the PSA said that brown sugar averaged P76.37 per kg, a 0.4% increase from the previous period.

The PSA reported that brown sugar prices were highest in Calabarzon at P88.3 per kg during the first phase of April.

The lowest average price was reported in the Caraga Region at P69.47 per kg.

The PSA reported that the national average retail price for refined sugar was P87.29 per kg.

For the first phase of April, prices in Calabarzon were the highest with sugar averaging P96.56 per kg.

Prices for refined sugar were also lowest in Zamboanga Peninsula, where they averaged P81.43 per kg. — Adrian H. Halili

Recto invites investment in infrastructure, energy projects

FINANCE Secretary Ralph G. Recto invited US investors to look into Philippine infrastructure and energy projects, as well as collaborate with the Maharlika sovereign wealth fund.

“We eagerly look forward to the US becoming a key player in realizing our development goals by strengthening our long-standing alliance with more forward-looking business partnerships,” he said in his speech at the Philippine Dialogue in Washington.

The dialogue was held on the sidelines of the World Bank Group-International Monetary Fund (WB-IMF) Spring Meetings.

Mr. Recto cited bright spots such as the Philippines’ resilient economic growth driven by domestic demand, the young labor force, the tourism recovery, pro-business policies and continued fiscal consolidation.

“The Philippines is now open to full foreign ownership of renewable energy projects. This will help unlock the vast potential of the country’s mineral sector, valued at $6 trillion,” Mr. Recto said.

“We also now allow full foreign ownership in public services like telecommunications, airports, and shipping. And we have lowered the minimum paid-up capital requirement for foreign corporations,” he added.

National Economic and Development Authority (NEDA) Secretary Arsenio M. Balisacan, in a statement, said that the government has worked to improve ease of doing business in the Philippines.

“These reforms and initiatives clarify ambiguities in the rules, expand markets for our industries, streamline government processes, and promote more competition. Through the President’s policy issuances, we have underscored the government’s strong commitment to promote the ease of doing business,” he said.

Mr. Recto also invited investors to look into infrastructure projects. The government currently has 185 flagship infrastructure projects worth P9.14 trillion.

“The Maharlika Investment Fund, our first sovereign wealth fund, also presents an ideal platform for private-sector engagement in financing our flagship infrastructure projects,” he added.

Meanwhile, Mr. Recto urged multilateral lenders to ramp up assistance to developing economies.

“I urge the World Bank, the International Monetary Fund, and other partners to intensify their efforts in assisting developing countries to mitigate and reverse the factors threatening our growth prospects,” he said in his Intergovernmental Group of Twenty-Four (G24) speech.

“The primary concern for emerging markets and developing economies is securing immediate access to short-term liquidity and affordable long-term financing to navigate the turbulent waters ahead,” he added.

Mr. Rectocalled for more “ambitious” lending targets to ensure that development goals are met.

“Without improvements to financing conditions in the short term, decades of individual and global efforts to eradicate poverty and inequality, combat climate change, and invest in growth-enhancing infrastructure projects will be put to a halt, if not reversed,” he said.

In its communique, the G24 called on policymakers to “be mindful of the heightened trade‑offs in policy choices.”

“External risks are likely to remain as disinflation policies prevail. Risks from persistent core inflation could trigger additional monetary policy tightening, further compounding already high levels of debt, fiscal and current account imbalances, with negative effects on economic prospects,” it said.

“This means that the goal of achieving sustainable and inclusive development by 2030 is more challenging than before. We ask all parties of the international community, especially multilateral organizations, to work together and make their best efforts to accelerate progress,” it added.

The Intergovernmental Group of Twenty-Four on International Monetary Affairs and Development, or G24, was established in 1971.

The governing body of the G24 meets twice a year to discuss key global issues, preceding the Spring and Fall meetings of the WB-IMF. The communique emerging from the meetings reflects the consensus views of member countries. — Luisa Maria Jacinta C. Jocson

Axelum signs multi-year coconut water supply deal with US brand Vita Coco

AXELUM Resources Corp. signed a 10-year coconut water supply deal Thursday with US customer The Vita Coco Company., Inc.

Axelum Chairman and Chief Executive Officer Romeo I. Chan said that the deal runs until 2033, with an additional option for extension by another five years.

Asked about the value of the deal, Mr. Chan declined to answer.

He added that the supply deal will bolster the company’s “fastest-growing segments,” adding that the company is focused on meeting growing demand from Vita Coco.

Axelum recently constructed a new facility to bolster production and meet the long-term volume requirements of Vita Coco.

“We are buying coconuts up to a 200-kilometer radius all over Mindanao, and we’ve augmented the income of farmers by buying 187 million coconuts every year, that’s valued at P1.12 billion,” Mr. Chan said.

Axelum has business interests in manufacturing coconut water and other such products for the domestic and international markets.

It ships its products to the US, Canada, Australia, New Zealand, Europe, the Middle East, Japan, and elsewhere in Asia.

Mr. Chan said that the company has supplied about 260 million liters of coconut water since 2009, when Axelum became the first non-Brazilian supplier to Vita Coco.

Citing a report by SkyQuest Technology, Mr. Chan said that the global coconut water market is set to expand to $25.18 billion by 2031, with a compounded annual growth rate of 16.1%.

“As far as supply, we strive for the highest number. But our goal is to double and then redouble the business. We want to grow,“ Jonathan Burth, Vita Coco chief operating officer said.

Mr. Burth added that Axelum supplies around 40% of the company’s coconut water requirements.

Vita Coco’s products include Original Coconut Water, Farmers Organic and Pressed Coconut Water. — Adrian H. Halili

NEA loans to power co-ops hit P263.78M in first quarter

THE National Electrification Administration (NEA) said it lent P263.78 million in loans to 12 electric cooperatives in the first quarter of 2024.

Citing a report from its Accounts Management and Guarantee department, the NEA said that P178.45 million helped fund capital expenditure projects of nine electric cooperatives.

Meanwhile, three electric cooperatives availed of P72 million for working capital. These borrowers are Camarines Sur III Electric Cooperative, Inc., Camotes Electric Cooperative, Inc., and Negros Oriental I Electric Cooperative, Inc.

Bohol I Electric Cooperative, Inc. took on a P13.33 million calamity loan to rehabilitate the Janopol Mini-Hydro Power Plant which NEA said was damaged by Super Typhoon Odette in 2021.

“The NEA has been offering financial assistance to ECs (electric cooperatives) through its Enhanced Lending Program,” the agency said.

The program consists of regular, calamity and concessional loans, standby and short-term credit loans, single-digit system loss loans, renewable energy loans, and modular generator set loans.

Republic Act No. 9136 or the Electric Power Industry Reform Act of 2001, tasks the NEA with overseeing missionary electrification and providing financial, institutional, and technical assistance to electric cooperatives. — Sheldeen Joy Talavera

US-China ‘decoupling’ seen disrupting Philippine trade

THE “decoupling” of the US and Chinese economies could affect Philippine trade as manufacturers rely on demand from both countries, with China also being a key source of imports, according to Moody’s Analytics.

“(The) Asia-Pacific economies are sensitive to changes in the world’s top two economies. US-China decoupling and changing growth dynamics within China are key risks for the region, although some countries and industries are more exposed than others,” Moody’s Associate Economist Dave Chia and Senior Economist Stefan Angrick said in a report.

The US-China trade war began in 2018 after hundreds of billions of dollars worth of tariffs were imposed by the two economies.

The US and China were the Philippines’ top export markets in 2023, according to the Philippine Statistics Authority (PSA). Its total exports to the US were valued at $11.55 billion while exports to China were worth $10.93 billion.

China imports are crucial to key Philippine industries like minerals and metals, electronics, textiles, machinery, agriculture, chemicals, and vehicles, according to a Moody’s chart.

“China is a key supplier of inputs and an increasingly important market for many of the region’s manufacturers,” Moody’s said.

Philippine imports from China were valued at $29.39 billion last year, with electronic products at $5.71 billion, the PSA reported.

“Most of the region’s high- and mid-income economies, from Singapore to the Philippines, are particularly dependent on machinery and electronics imports from China,” Moody’s said.

Export markets of the Philippines, South Korea, Malaysia, Vietnam, and Taiwan heavily rely on Chinese demand for electronics.

“Electronics and machinery are highly vulnerable to geopolitical disruptions — particularly those that relate to semiconductors,” Moody’s said.

The US recently asked South Korea to restrict exports of chipmaking equipment to China. It has also called on Japan and the Netherlands to impose export restrictions on the Chinese market.

Meanwhile, Asia-Pacific exports of finished goods to the US would also be affected by the decoupling.

“Low-income economies such as Cambodia and Vietnam export textiles to the US, while Taiwan, South Korea, Japan, Malaysia, Thailand, Vietnam, and the Philippines send their electronics and machinery there,” according to the report.

The Philippines’ key exports to the US include electronics, machinery, agriculture, and textiles.

“Imports from the US are insignificant for most Asia-Pacific economies, especially when compared with imports from China,” it said.

Hansley A. Juliano, who teaches political science at the Ateneo de Manila, said the Philippine government must consider alternative partners to avoid disruptions to its market.

“It would be the responsibility of our economic managers to begin actively identifying which these alternative countries are, to what extent are we at risk of competition with fellow Asia-Pacific (especially the Association of Southeast Asian Nations or ASEAN) countries, and to what extent collaborative efforts are possible yet will still make the Philippine economy profit,” he said in a Messenger chat.

On the other hand, Mr. Juliano said the effects of the US-China decoupling on local industries are an opportunity to revisit its sustainability and environmental impacts.

“A number of these rely on mining, and a number of them produce pollutants that ruin Philippine natural resources,” he said.

“Should this be seen as an overall threat or also an opportunity to revisit which of our competitive advantages (say agriculture and dying manufacturing sectors) should be resurrected instead?” he added. — Beatriz Marie D. Cruz