Last week there were several important developments in the macroeconomic and fiscal situation of the Philippines. See these reports in BusinessWorld: “NG debt hits record P15.18 trillion” (April 4), “Philippines lowers growth target for 2024, raises deficit ceilings” (April 4), “PSA lowers economy’s growth to 5.5% in 2023” (April 5), “Inflation accelerates for a second month in a row in March” (April 5).

Public debt keeps rising, not falling. The GDP growth targets made by the Development Budget Coordination Committee (DBCC) were adjusted downwards. And the inflation rate rose to 3.7% in March — although this is just half of the 7.6% inflation in March 2023, the steady decline from October 2023 to January 2024 has halted.

NEW MACROECONOMIC AND FISCAL TARGETS

In Table 1 are the new targets set by the DBCC last week, I arranged them into three sets of parameters: A for macroeconomic assumptions, B for fiscal outlook, and C for GDP growth targets. Then I compared the old targets made in April 2023 with the new ones.

For 2023, the actual growth of 5.5% was lower than the targeted 6-7% but the deficit target was generally achieved.

For 2024, the new deficit target is much higher — P1.48 trillion (5.6% of GDP) vs the P1.36 trillion of the old target. It is the same for 2025, with the new deficit target set much higher at P1.49 trillion compared with the P1.20 trillion in old target (see Table 1).

It is the same trend for 2026 to 2028, the deficit’s new targets are set much higher than the old targets. And this points to a dangerous trend — disbursements and public spending have become more uncontrollable while projected revenues cannot keep up.

Two important medium- to long-term policies should be set.

First, the planned privatization of some government assets — like property of the Ninoy Aquino International Airport or NAIA, the New Bilibid Prison property, the Armed Forces of the Philippines’ golf course, Philippine Amusement and Gaming Corp. (better known as PAGCOR), etc. — should be started earlier.

Second, the planned huge procurement (P2 trillion) of materiel for the Armed Forces of the Philippines (AFP) (submarines, battleships, jetfighters, missiles, ammo) and several hundred billion pesos worth of materiel for the Philippine Coast Guard (PCG) should be junked. Instead, we should focus on high-profile diplomatic negotiations as the cheaper alternative to have a peaceful resolution of the territory disputes in the West Philippine Sea.

If these two measures are not considered, if government will only rely on more taxation while public spending keeps rising fast, the public debt stock will keep rising and interest payments alone would approach P1 trillion/year — it was already P670 billion in 2023.

ELECTRICITY SUPPLY TO SUSTAIN HIGH GROWTH

Last Friday, April 5, I attended the Philippines Electric Power Industry Forum (PEPIF) 2024, which had the theme, “Powering a Sustainable and Secure Energy Future for the Country,” held at the Iloilo Convention Center in Iloilo City. I will write more about it in the next column, but for now I will make my own projection on the amount of electricity in terawatt-hours (TWh) we will need in the medium-term to avoid blackouts because the projected power demand will be high due to high GDP growth targets as discussed above.

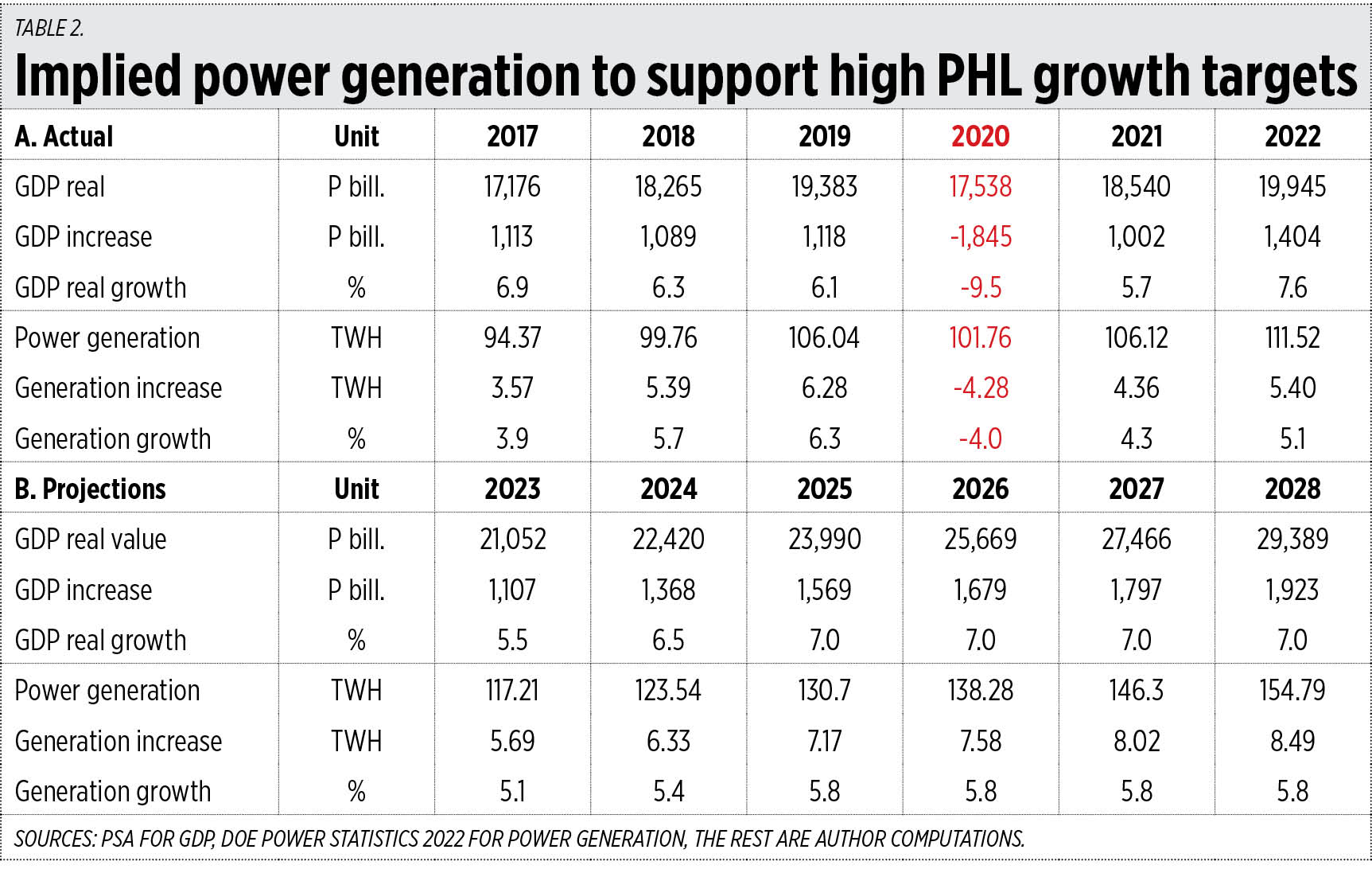

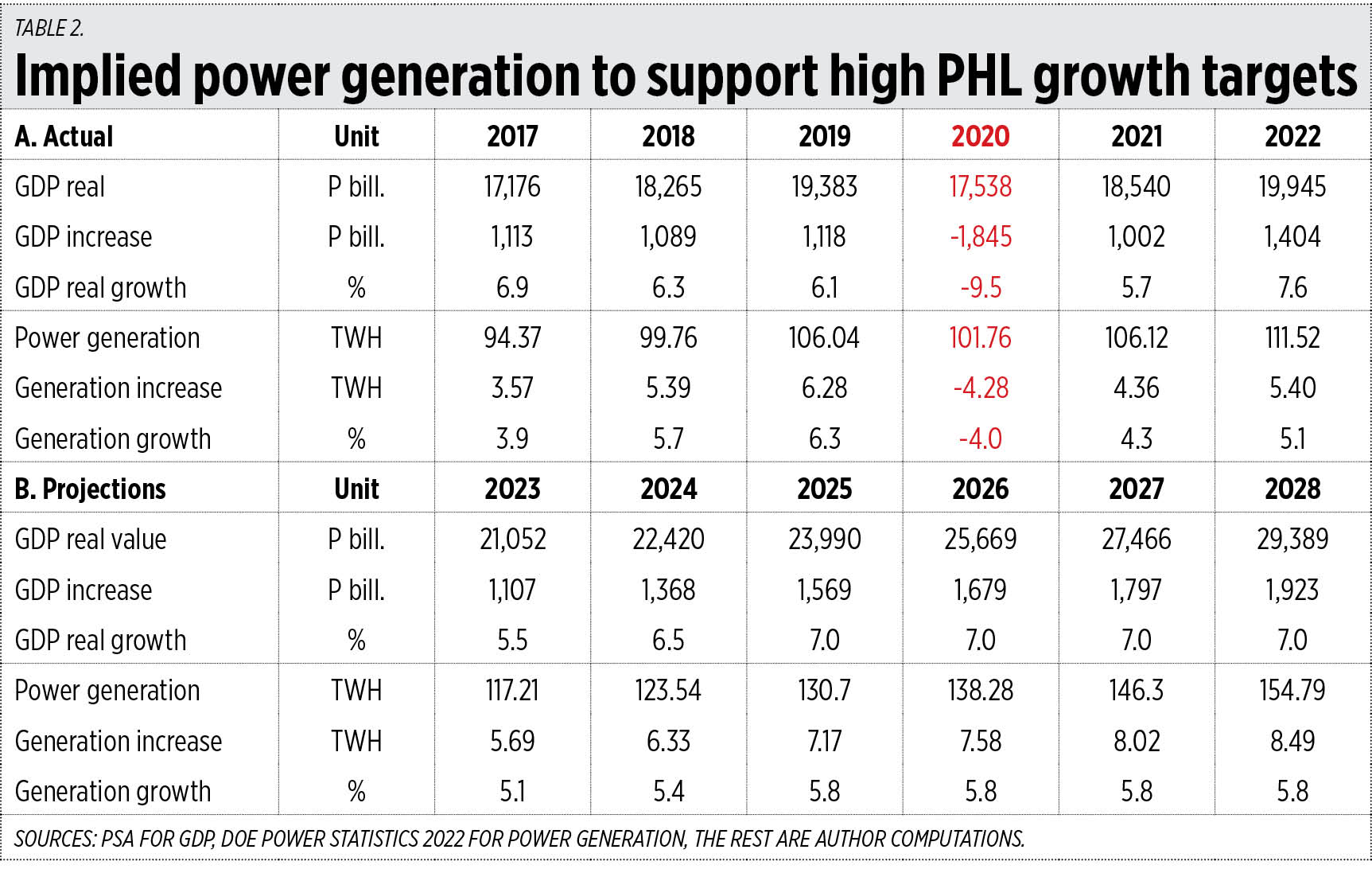

First, I computed the average growth in power generation from 2017 to 2022 (it’s 5.1%) to approximate generation in 2023 as data is not yet available from the Department of Energy. Second, I introduced and computed two concepts: 1.) the electricity multiplier in percent expansion (= % growth GDP / % growth power generation), and, 2.) the electricity multiplier in monetary values (= GDP P billion increase / generation TWh increase). All this is done with the assumption of ceteris paribus or all other things/factors being equal or constant.

For the first concept (the electricity multiplier in percent expansion), it shows that a 1% expansion in power generation contributes to a 1.3% expansion in GDP. For the second concept (the electricity multiplier in monetary values), a one TWh increase in power generation contributes to a P236 billion expansion in real GDP size.

But since the country’s per capita kilowatt-hour (kWh) generation remains low and “yellow-red alerts” were still being declared even through 2023, I adjusted the electricity multiplier from 1.3% to 1.2% to help ensure more electricity stability and security in the medium-term.

My results show that the Philippines’ power generation must expand from 5 TWh/year in 2017-2022 (excluding the horrible lockdown year of 2020) to 6.4 TWh/year in 2023-2025, and 8 TWh/year in 2026-2028 (see Table 2).

The electricity multiplier in monetary values from 2023-2028 is at a more realistic level: for every 1 TWh increase in power generation, real GDP size increases by P222 billion.

Since the theme of PEPIF 2024 was focused on renewable energy (RE), lots of the discussions were focused on megawatt (MW) installed capacity expansion by RE, not megawatt-hours (MWh) actual generation expansion. The former can be a deceptive metric because not all MW are the same. A 100-MW solar plant can deliver only about 18 MW of electricity in a day while a 100-MW coal plant and 100-MW gas plant can deliver about 65 MW and 60 MW of electricity in a day, respectively.

For our economic security, we should have energy security, and such can only come from reliable sources like thermal plants (coal, gas, oil peaking plants) and nuclear power. I liked the assessment and speech by Jimmy Villaroman, President of Aboitiz Renewables, Inc. (ARI). He said at the forum:

“We advocate a balanced approach, growing renewable energy and investing in traditional sources… our transition in the Philippines, as in the rest of Asia and the Pacific, must be gradual and intelligent. It has to be well-planned; uniquely suited to each country… We believe LNG is a great complement to RE due to the latter’s inherent intermittency…. We’re also studying the feasibility of small modular reactors… as other long-term solutions.”

Yes, we cannot and should not abandon conventional sources. Sustained high economic growth, more job creation, are goals that are more noble and more practical than high RE share to total energy mix.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.

minimalgovernment@gmail.com