By Justine Irish D. Tabile, Reporter

THE Philippine Economic Zone Authority (PEZA), whose locators account for more than half of the country’s exports, said that it is projecting export growth of 5% this year from companies it oversees, on the expected recovery of the electronics industry.

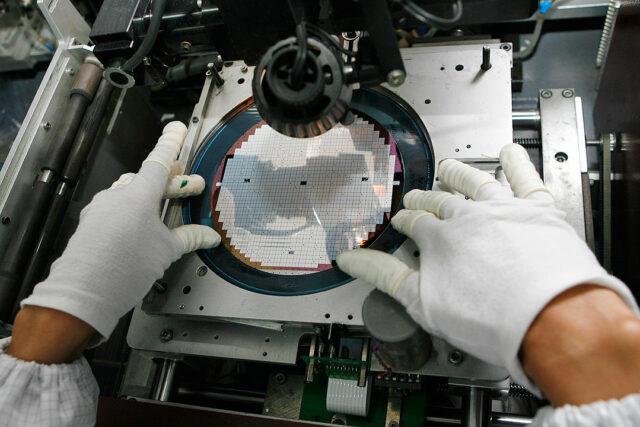

Tereso O. Panga, director general of PEZA, told BusinessWorld that electronics and semiconductors will still be driving export receipts this year.

“Our best exports this year are IT-BPM (information technology and business process management) services, electronics and semiconductors, metals, and automotive products. While semiconductors saw a decline last year, I expect this to rebound,” Mr. Panga said in a Viber message.

“Investments in green power, manufacturing, and agro-industrial sectors will contribute to PEZA growth in particular and the economy in general, while expansion projects from current locators continue to contribute to overall growth,” he added.

PEZA estimates that its locators’ exports last year hit $63.71 billion, or 61.5% of total exports. It said that it is hoping for such exports to grow 5% this year to around $67 billion.

Exports of IT services were among the top contributors to PEZA exports, accounting for $17.83 billion. IT services performed in ecozones accounted for 50.2% of the total Philippine IT services exports last year, which were valued at $35.5 billion.

Revised data from the Philippine Statistics Authority indicate that the top commodity export last year remained electronic products ($41.91 billion), which accounted for more than half of total exports, even though shipments from the industry declined 9.2%.

Asked to identify potential risks to the projection, he cited “the global shortage in chips, contraction in the electronics sector due to global slowdown in product demand, and disruption in the global supply chain due to the worsening trade war between the US and China.”

He also cited the war between Russia and Ukraine, economic tensions in the region due to the West Philippine Sea (WPS) territorial dispute, and the reshoring policy of the US government.

“The WPS has been a long-standing issue even before the current administration. Currently, we have seen more interest from US companies based on recent geopolitical developments,” Mr. Panga said.

“Chinese companies also continue to look into the Philippines as an optional extended manufacturing base for products meant for the western hemisphere,” he added.

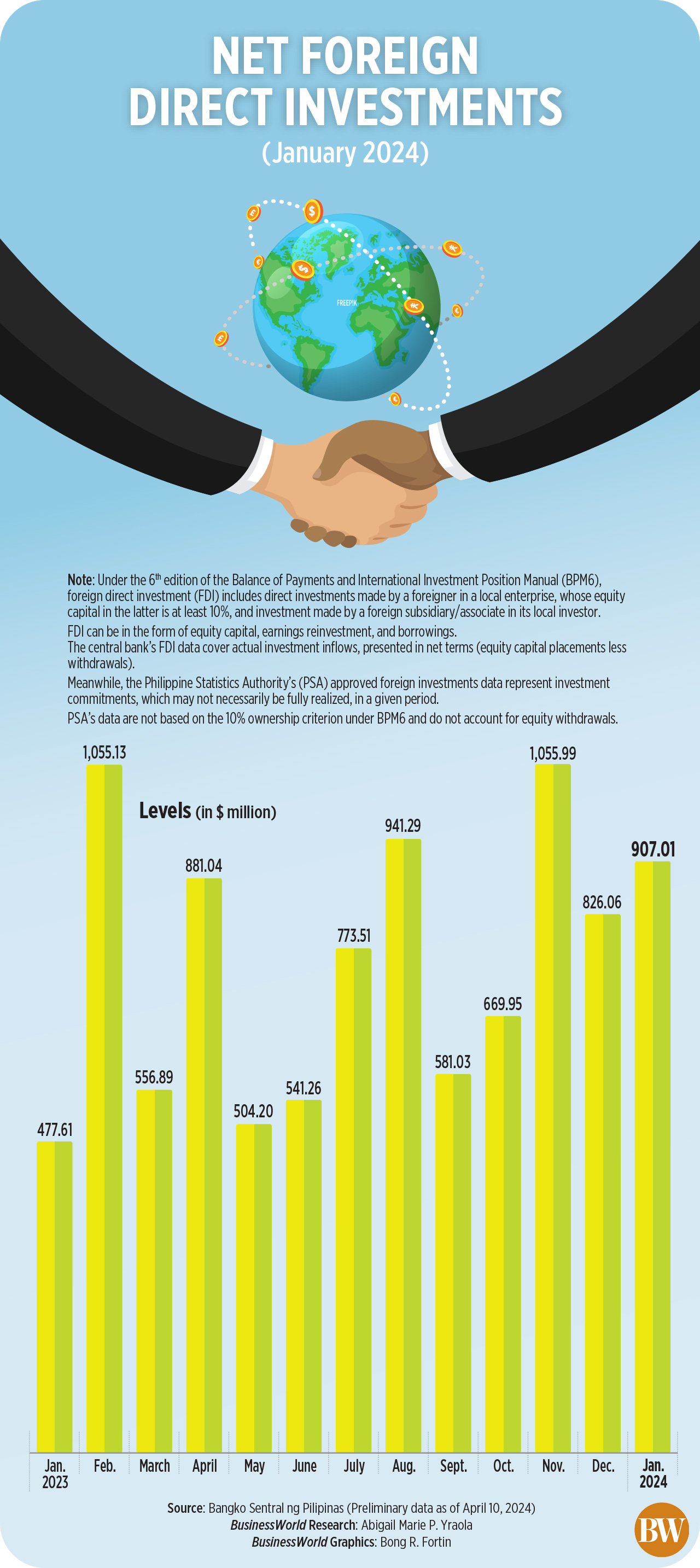

However, he said that the tensions rising in the WPS issue did not have any substantial effect on foreign direct investment (FDI) from China.

“In the US, Australia, South Korea, the EU, and Japan, we expect more FDI as part of the closer economic ties established by the President,” he said.

“We are batting to adjust certain provisions in the laws to create a level playing field with other investment destination countries to further attract these investments and see them locate in the Philippines,” he added.

For this year, he said South Korea and India will be among the top export markets following the signing of a free trade agreement (FTA) with South Korea and calls to develop pharmaceutical economic zones.

“The Philippine-Korean FTA will bode well for the Philippines. We expect a higher level of tech-based companies to invest in the country. As you know, South Korea, like Japan, has been evolving towards high technology exports,” he said.

“This will enhance our workforce knowledge base and improve the skills of our workforce. It will also boost our agricultural product exports,” he added.

PEZA has reported that investments from South Korea hit P51.39 billion as of last year, across for 212 locator companies that exported $1.65 billion in 2023.

“We have also seen an increased interest in India, specifically in the field of medicine production. This is a direct match to the pharma zones we are currently developing,” Mr. Panga said.

“We see these pharma zones as a base not only for manufacturing but also for research and development, where new medicines may be created,” he added.

Earlier this year, PEZA said that it plans to build pharmaceutical parks in Bulacan and Laguna.