Gov’t collected P1.4 trillion of revenue as of April — Recto

THE GOVERNMENT collected P1.4 trillion in revenue in the first four months of 2024, accounting for almost a third of its full-year target, preliminary data from the Finance department showed.

“My calculation is we are at P1.4 trillion. That’s for the first four months,” Finance Secretary Ralph G. Recto told reporters in mixed English and Filipino on the sidelines of an event on Monday.

Preliminary figures from the department showed that Bureau of Internal Revenue (BIR) collections reached P912.9 billion.

The agency is expected to generate P3.055 trillion this year. It collects about 70% of the government’s overall revenues.

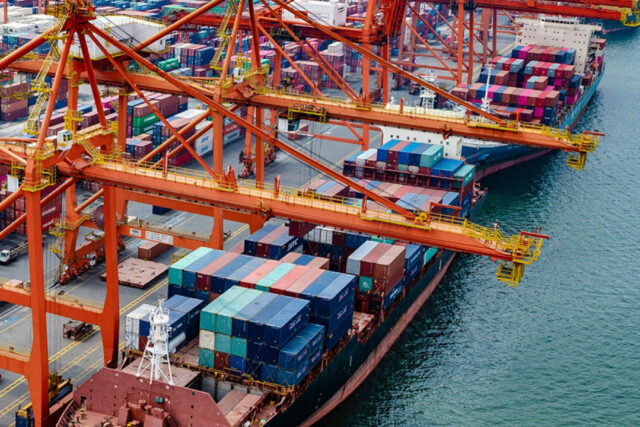

Meanwhile, data from the Bureau of Customs (BoC) showed that it had collected P299.674 billion as of end-April. It aims to collect P959 billion this year.

The Finance department also recorded nontax revenues worth P206.4 billion in January-April, data showed.

“We expect both our tax and nontax revenues to dramatically increase over the coming months as we intensify our revenue mobilization efforts,” Mr. Recto said.

If the pace of its revenue performance continues, the government can meet its fiscal targets, Mr. Recto said. “It’s the first four months of the year. Let’s see if it’s sustainable for eight more months.”

This year, the government is expected to generate P4.3 trillion in revenue, equivalent to 16.1% of the gross domestic product (GDP).

Mr. Recto said there are no plans to increase revenue targets.

“I doubt it very much. As far as (we’re) able to collect what is targeted already, I’m happy with that,” he said.

The budget balance is also expected to remain in a deficit, he added.

“You will always have a deficit. Your debt will increase this year. There’s no doubt about that.”

Latest data from the Bureau of the Treasury (BTr) showed the National Government’s budget deficit widened by 0.65% to P272.6 billion in the first quarter.

The government set a budget deficit ceiling of P1.48 trillion this year, equivalent to 5.6% of GDP. It aims to reduce the deficit-to-GDP ratio to 3.7% by 2028.

GLOBAL BONDS

Meanwhile, Mr. Recto said the BTr is finalizing its first global bond offering for the year.

“The Treasury is timing the market. I think it’ll be within the first half,” he said, noting that most of the global bond offerings this year would be dollar-denominated.

The government’s last global bond issuance was its Sukuk bond offering in December, when it raised $1 billion from its first-ever sale of Islamic bonds.

“We’re open to (other) bonds, whatever is cheap and has less risk,” Mr. Recto added.

The government’s borrowing mix favors domestic sources (75%) to mitigate foreign currency risks. Its borrowing program is set at P2.57 trillion this year. — Luisa Maria Jacinta C. Jocson