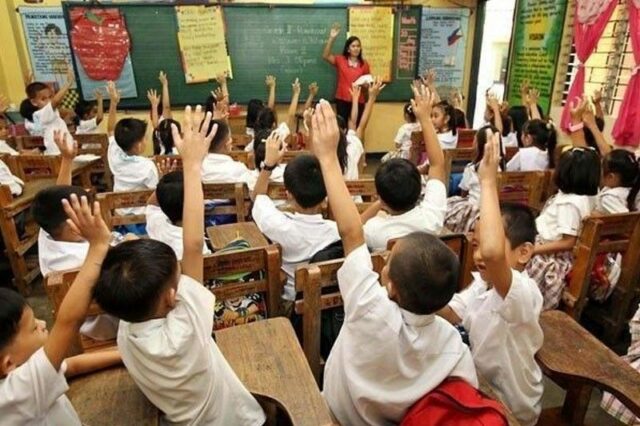

MANILA, (Thomson Reuters Foundation) – Just weeks after thousands of Filipino students were sent home from sweltering classrooms during a brutal heatwave, the country’s schools are bracing for a new climate change challenge ahead of the start of the typhoon season in Southeast Asia.

Schools were closed for several days as temperatures soared to over 40 degrees Celsius (104 Fahrenheit) in April and May. Now they are due to reopen after the holidays in July, rather than August, as authorities rework the education calendar to adapt to extreme weather.

The immediate threat comes from storms as typhoon season starts in July. In the past, many schools would be forced to suspend lessons and send pupils home as classrooms were flooded. Schools were also often used as temporary evacuation centers.

The state weather bureau has said the country is likely to experience more tropical cyclones in 2024 than last year due to the potential return of the La Nina weather phenomenon between June-August.

After the extremes caused worldwide by El Nino this year, forecasters are predicting a swing to generally cooler La Nina conditions in the coming months, with a greater risk of floods and drought.

Filipino meteorologists have also predicted “stronger and more destructive typhoons” due to climate change.

This is bad news for the country’s 47,000 state schools. As well as potential damage to physical structures, there is a fear that extreme weather will deepen educational inequalities because when children are sent home and forced to rely on online learning, the least well-off suffer the most.

“It’s hard every time classes are suspended due to disasters, and we could not understand the lessons properly at home,” said 15-year-old Prince Rivera, who goes to Bulihan National High School in Bulacan province, near the capital Manila.

His school has been flooded several times and he was also sent home during the recent heatwave.

Xerxes de Castro, basic education adviser at Save the Children Philippines, said awareness of climate risks is the first step to making schools resilient to future disasters.

“I think it’s just right now that schools, learners, and all the stakeholders are learning about the impacts of climate change. It’s a hard lesson,” Mr. de Castro told the Thomson Reuters Foundation.

The Philippines, which topped the World Risk Index in 2022 and 2023 as the most disaster-prone country in the world, is hit by typhoons about 20 times a year.

According to the World Bank, around 78% of public schools and 96% of students in the Philippines are exposed to multiple hazards. Between 2021 and 2023, around 4,000 schools were damaged due to various disasters, resulting in the disruption of learning for two million children.

ON THE RADAR

Education authorities have harnessed tech to help deal with climate change-related extreme weather and natural disasters.

One tool being used is the Rapid Assessment of Damages Report (RADaR) mobile and web application, used by teachers to quickly deliver updates when schools are caught up in disasters.

The tool was rolled out by the Department of Education in partnership with Save the Children and the charity Prudence Foundation and it reports on six different kinds of natural catastrophe, including storms and typhoons.

“Since its national launch in September 2021, RADaR has been used in 28 hazard events by more than 30,000 schools,” Marlon Matuguina, risk mitigation and climate resilience manager for Save the Children Philippines, said in an email.

Heatwaves are not yet included in the app because the effects of extreme hot weather are harder to quantify.

Data from the app showed that earthquakes were the most frequent hazard experienced by schools, while tropical storms received the highest number of reports because of damage caused.

According to Save the Children, RADaR has so far generated over 154,000 school-level reports that “offered new insights into the educational sector’s vulnerability to hazards”.

Teacher Shago Dela Cruz is the disaster coordinator of Mr. Rivera’s school. Before the RADaR app was introduced he said reporting disasters was slow but now the app allows him to monitor and record disasters online through closed circuit television at his school.

“Teachers do not have to personally go to the school after a disaster and face the risks,” said Mr. Dela Cruz.

Preparing for disasters is also key. The Department of Education has said it will invest in insulation, shading and ventilation systems. It hopes these measures will make it possible to keep students in school during hot weather.

It has also received 17 billion pesos ($291 million) from the national budget this year to build new classrooms that will be able to withstand higher temperatures.

The World Bank has also approved a 30 billion peso loan to help the Philippines better handle disasters and climate threats, with a particular focus on schools and hospitals.

The Filipino government says the money will be used to rebuild schools damaged by natural disasters outside the capital. The project will run from 2025-2029 and is expected to benefit more than 13,000 classrooms and around 740,000 pupils, whose buildings were damaged in disasters between 2019 and 2023.

For Save the Children, the message is clear: vulnerable countries need more support to shore up critical services, like schools, in a hotter, wetter world. And the necessary changes do not just affect bricks and mortar.

“Resilience is a complex issue,” said Mr. de Castro. “We’re not just talking about the infrastructure work but also … about making sure teachers and students can tackle any kind of disasters that could happen in the future.” – Reuters