(This was lifted from the speech of the author as the Guest Speaker at the MAP Inaugural Meeting 2025.)

At my age, I’ve probably seen more of modern history than many of you. If you’re wondering where my confidence to speak on this matter comes from, it is the fact that AI is not the first revolution I’ve encountered.

To all of us, AI is touted as this monumental technology that will forever alter the landscape of business. That is in fact true. AI will be impactful. For us frontliners in the technology battlefield, it is simply another big challenge.

But let’s talk about fear for a moment — because fear and progress are strange bedfellows. Every time a new technology arrives, it carries with it the ghost of Macbeth’s Banquo. That ghost whispers into our collective ear: This will replace you. This will obsolete you. This will end you.

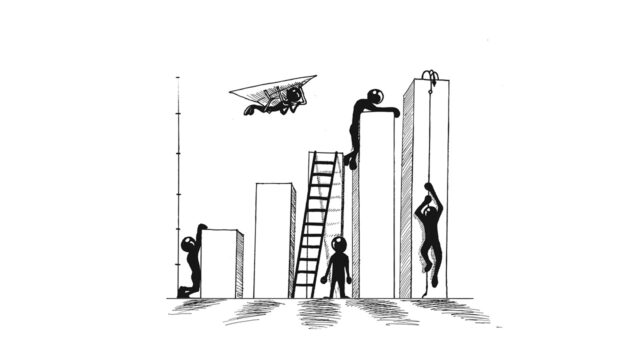

History is replete with echoes of fear. When the automobile replaced the horse-drawn carriage, people worried about the livelihood of coachmen and stable hands. When automated systems for the telephone were invented, switchboard operators saw their roles eventually vanish. And, yes, BPO workers — a cornerstone of economies like ours — may one day find most of their tasks — repetitive, routine, or simple — fully automated.

Time and again, we have confronted these fears, only to emerge transformed — not diminished. The end of one job often signals the beginning of another. When coachmen disappeared, mechanics and drivers rose in their place. When telephone operators faded into history, a new world of telecommunications — faster, versatile, and more useful — was born. There are examples in PLDT. One of our labor relations personnel is a former switchboard operator. My personal secretary Kathy was once the voice that said: “The number you dialed is out of coverage area.” AI reflects not just the rhythm of progress; it is the heartbeat of mankind.

So, the lesson here is that humanity has never been shaped by the jobs we lose. Instead, we are defined by the future we create.

AI is already changing the way we live. When a colleague was asked by his wife to shop for washing machines, he decided to simply take pictures of every machine available, before uploading them to Chat GPT to analyze the options in a spreadsheet. Dating apps are also determining our romantic futures through algorithms.

These relatively mundane innovations will foreshadow even bigger ones to address hunger and malnutrition. Think about AI’s help in getting leftover food from restaurants and hotels and distributing it to the poor. Or something even bigger: imagine if we could develop an end-to-end digital map of our nation’s food supply chain: we could know exactly which food items are consumed monthly per individual, how much are in inventory, how much are in transit, and what and where we produce or import.

So what factors are slowing down AI adoption in the Philippines? There are three:

First: data. For AI to work, companies need to feed their algorithm a vast cache of data, which must be complete, high quality, and available.

Second: talent and expertise, probably the scarcest resources. Because AI needs to be customized for particular business needs. Open-source solutions may not always work.

Third: infrastructure, robust data networks, and hyperscaler data centers with humongous and ultra-fast computing capacities. PLDT is currently building, and planning to build, more hyperscaler data centers to handle AI.

Looking ahead, those born this year — Gen Beta — will not know a world without AI and robots, because these will be integrated by then into their daily lives.

There are always inter-generational gaps in our management hierarchies if only because of age. However, today, these differences are wider, and more significant.

Millennials and Gen Zs make up 74% of the employee base of PLDT and SMART. Gen X comprises 24% — and of course, boomers like me comprise the remaining 1%.

Fresh from Wharton, I thought that management was as simple as being thrown straight into a den of wolves.

Now, Millennials and Gen Zs represent a new breed of wolves. They are disruptive. They have bad hair. They wear different clothes. They’re addicted to a bewildering raft of apps and messaging platforms. They have been defined as digital nomads — mobile and digital. And some accuse them of being entitled and self-centered.

I don’t know if that is fair. It’s quite possible that they’re misunderstood. To them, work isn’t about the paycheck. It’s about their story. Those more senior see this as being self-centered. But that narrative is also framed by the world they know they’re inheriting, which is either magical or collapsing.

The misunderstanding cuts both ways. They’ll roll their eyes at our jokes. They’ll challenge you with jargon you don’t understand — like momol and fubu and sheesh and rizz, irl, yolo, yono, and G na G. They say sanaol when you give a bonus.

The point though is — we need to understand them first, so we can manage them better. Our predecessors were similarly dismayed by us Baby Boomers — to them, we were hippies and activists — privileged kids who never had to go through the perils of war. Despite the divide, I know that this new generation still craves challenges that stretch them, leaders who inspire them, teachers who mentor them, and workplaces where their jobs connect to something larger than their work.

There are moments when the wisdom of years serves as a useful compass for uncharted waters, especially in a place like the Philippines. But even the finest old compasses must one day allow younger hands to steer the ship. Succession is not merely about finding replacements and nurturing them for the future; it is about creating space for growth, about recognizing when our wisdom must give way to their energy, when our experience must make room for their ingenuity. Leadership is not a chair to sit on forever — it is a torch to pass on.

To close, in 1857, Harper’s Magazine — the oldest monthly in America — published an essay that commented on the politics and society then. I’d like to quote a portion because it seems to connect to our time: “The political cauldron seethes and bubbles — with toil and trouble. Politics hang like a cloud, dark and silent upon the horizon. It is a solemn moment. Of our troubles, no man can see the end.”

In today’s vocabulary, a Gen Z on TikTok might say it more elegantly: “Nothing is okay, and everything sucks.”

But the job of those of us in business is to remain upbeat. In the MVP Group, the optimists have it — not because they are right but because they are positive. This brings to mind what Linus —the younger, and more optimistic friend of Charlie Brown of “Peanuts” once said — “I guess it’s wrong to worry about tomorrow. Maybe we should think only about today.” To which the ever good-natured Charlie Brown responded — “No, that’s giving up. I’m still hoping yesterday will get better.”

In this, every generation, but especially those who come next — Millennials, Gen Zs, Alphas, and Betas — are allies, not adversaries. AI, with its immense power, is not an existential threat; it is a tool. Together, they form the scaffoldings of the next great cathedrals of progress. But scaffolding alone does not build edifices. It is human creativity and ingenuity — the minds and hearts and hands of men and women — ultimately are responsible for turning visions into grandiose creations — no matter the era.

Margaret Mead once said: “Never doubt that a small group of thoughtful, committed citizens can change the world; indeed, it’s the only thing that ever has.” In this hall, it is this small group which has the collective will, intelligence, and courage needed to turn the page to the next great chapter of our nation. And now, you can even get help from AI.

Manuel V. Pangilinan is the chair of the MVP Group.

map@map.org.ph