A decade of offering affordable sanctuaries to Filipino families

Ovialand President and Chief Executive Officer Pammy Olivares-Vital’s journey in real estate began amidst a time of crises. While she initially did not want to get into the family business, her father persuaded her to help out as times were tough. The family had been providing homes via government relocation for the government well before Ovialand came to be, and this is how the family gained a well of experience in the home-building segment.

“That was the start of my career in real estate, or as part of our story. It was not the first and only crisis we experienced,” she recalled in an interview, referring to the 2008 financial crisis and other hardships that shaped her early years in the industry.

Ovialand was the result of her experiences, born out of a desire to be proactive and resilient in an industry that was rapidly changing. “We didn’t give up. What we wanted to do was to be better and prevent all these things by being proactive,” she said.

The proactive approach became a cornerstone of Ovialand’s philosophy. “We realized that even if we were in the affordable housing sector, we had to give our clients the best value for money,” Ms. Olivares-Vital said. This commitment to quality and value has guided the company through external and internal challenges, making it “weatherproof” by putting the homebuyer at the center of its operations.

Part of this is providing the homebuyers all the support they need to successfully complete their homebuying experience. The company’s commitment to customer service is paramount.

“We want to make the transition from renting to homeownership seamless. Our proactive customer service aims to address all concerns within 48 hours,” she explained.

And if this proactive approach to service was a cornerstone for Ovialand, the drive to provide “Premier Family Living” is the core. For Ms. Olivares-Vital, Ovialand’s mission goes far beyond financial success.

“It’s a family business. I can say that I grew up in a happy home. We were seven brothers and sisters. It was not always good times, but our home was a place of safety and security. And now that I am a mom, with my husband and four kids, every time I come home to my house, I always feel a sense of peace and security. And I tell myself, ‘I hope that all our homebuyers have this sense of security.’ Because that’s what all of this means,” she said.

“We like to imagine that the developments we make are like mini-suburbia, where you can let your children play in the street, where you can meet your neighbors. That’s how we embody the ‘Premier Family Living.’ So, it doesn’t stop at buying a house. It’s the lifestyle that you and your family will have after.”

As Ovialand celebrates its 10th anniversary, it stands as a testament to Ms. Olivares-Vital and her team’s resilience, innovation, and commitment to providing premium affordable housing. Under her leadership, Ovialand has navigated numerous crises and emerged stronger, continually redefining the standards in the affordable housing sector.

Through that journey, Ovialand has weathered even more intense storms. The pandemic, a period of global uncertainty, was another pivotal point when the company proved the strength of the company’s purpose.

Throughout the journey, the company met major milestones, such as their partnership with JJ Atencio, a mentor and partner who has been instrumental in Ovialand’s growth. “We have grown almost 10 times since we met JJ,” Ms. Olivares-Vital said.

This growth was further bolstered by the partnership with Japanese firm Takara Leben earlier this year, which came at a critical time when Ovialand had to defer its initial public offering. “It was very good; it was a better alternative. It was what was best for the company,” she said.

Embracing the future

To celebrate its anniversary, the company has reemphasized its focus on nation-building by giving back to its communities through education initiatives and the environment. Part of these initiatives includes supporting the education of children of construction workers who have been with Ovialand throughout the years, donating brand-new classrooms to San Pablo Elementary School in Barangay Soledad in Laguna, as well as planting 10,000 trees across South Luzon and Central Luzon.

“Education and health are crucial needs of society. We want to do our job in making tomorrow better for the future generation,” she said.

This is also a reflection of their overall strategy and approach with regard to the Philippine market. Ms. Olivares-Vital described Ovialand’s market as “educated, hardworking, and aspirational,” acknowledging the evolving expectations of homebuyers and their growing discernment of the real estate industry.

“There’s a misconception that just because it’s affordable, it can be below standard. But Filipinos are smart. They want to be wiser with their investment. They want to make well-thought-of decisions, and they want to plan better for the future,” she noted.

As she looks forward to the future of the country, she hopes that developers take this into consideration and “step up their game.”

“Clients are very discerning. And it will elevate the quality of businesses in the country, not just in terms of our industry but everybody else as well. It will force us to be better at the services that we give, and it will force us to become better employers and to have smarter organizations.”

As Ovialand prepares for the future, its regional growth strategy is set to expand beyond Southern and in Central Luzon with a plan to become a nationwide developer in the next ten years.

Hopefully in that time, Ms. Olivares-Vital noted, at least part of her vision for the company would come true. “I hope that — and I really mean this from the core of my heart — that all our communities would provide an environment for children to thrive,” she shared. “I hope that families will feel secure and happy in their homes — children will be able to play outdoors more, climb trees, make friends, and have lasting friendships in their community.”

“That would be, for me, a testament of a job well done.”

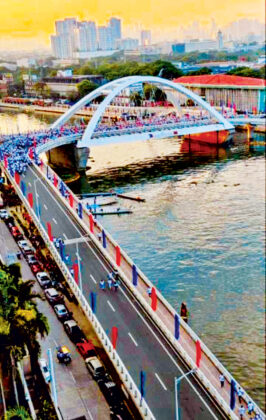

Simultaneously in the morning of June 9, the “FFCCCII Lakad Magkaibigan” civic walks were also conducted in Bacolod City, Cebu, Tacloban, and Palawan.

Simultaneously in the morning of June 9, the “FFCCCII Lakad Magkaibigan” civic walks were also conducted in Bacolod City, Cebu, Tacloban, and Palawan.

The magazine got its name and inspiration from the fabled and world-famous Manila Galleon trade of 250 years which saw Manila emerge as a vital entrepot between the thriving China intercontinental trade with Latin and Central America, Europe.

The magazine got its name and inspiration from the fabled and world-famous Manila Galleon trade of 250 years which saw Manila emerge as a vital entrepot between the thriving China intercontinental trade with Latin and Central America, Europe.