THE Bangko Sentral ng Pilipinas (BSP) is likely to continue its easing cycle, but second-round effects from a looming global trade war could hamper its policy path, analysts said.

“The BSP remains in an easing mode from a fundamentally tight monetary stance; it is yet to unwind its significant tightening of previous years,” GlobalSource Partners Country Analyst and former BSP Deputy Governor Diwa C. Guinigundo said.

“However, the BSP could find itself in the middle of its easing mode faced with upside risks,” he added.

The central bank unexpectedly held interest rates steady last Thursday, leaving the target reverse repurchase rate (RRP) unchanged at 5.75%.

This after the Monetary Board delivered three straight rate cuts since it began easing in August. It cut rates by a total of 75 basis points (bps) by end-2024.

BSP Governor Eli M. Remolona, Jr. said the decision to hold rates was due to global uncertainties arising from the US’ tariff policies. He has said he is more concerned about the indirect effects of these tariff moves, as direct effects on the Philippines will likely be modest.

Markets have been rattled by fears of a global trade war amid US President Donald J. Trump’s plan to slap reciprocal tariffs on every country that taxes US imports.

Mr. Guinigundo said these tariff adjustments could directly impact price levels and domestic inflation in the short term.

“Trade uncertainties also tend to increase the risk premium and therefore they could also pose inflationary pressures. Direct effects of tariff and trade uncertainties as well as the impact of fuel prices could be limited as yet, but the indirect effects on wages, transport fare, and domestic pricing could be substantial,” he said.

Mr. Guinigundo said these second-round effects could “build up into inflation” in the coming months.

In a report, Capital Economics said the indirect impact from reciprocal tariffs “would potentially prove bigger” than a universal tariff.

“A reciprocal tariff would potentially undermine the case for friendshoring in those emerging markets that have high tariff barriers given that there would be other, less vulnerable options for multinationals to consider when it comes to supply chain configuration — notably Vietnam and other parts of Southeast Asia as well as developed markets,” it said.

ANZ Research said emerging Asian economies would be under a “direct line of fire” if reciprocal tariffs were implemented.

“The current trade tensions could become significantly more disruptive if the US administration imposes reciprocal tariffs on Asian economies,” ANZ said.

“Unlike in 2018, when these economies experienced only secondary effects from the US-China trade war, they would now be directly impacted.”

The United States is the Philippines’ top destination for exports, while China is usually the Philippines’ biggest source of imports.

Citi Economist for the Philippines Nalin Chutchotitham said these trade policies could also put pressure on the peso.

“Looking ahead, the delayed Fed funds rate cut and the US trade policy uncertainties pose risks of peso depreciation, which could impact inflation via imports of food and energy, as well as from converted income remittances from overseas workers,” she said.

MEASURED EASING

Despite the pause last week, analysts said that the BSP will likely continue easing rates but at a cautious and measured pace.

“We think the decision signals BSP is looking to slow the pace of the easing cycle (after three consecutive cuts), based on the governor’s definition of ‘measured’ and absent a strong rationale for the on-hold decision,” Nomura Global Markets Research analysts Euben Paracuelles and Nabila Amani said.

Bank of the Philippine Islands Lead Economist Emilio S. Neri, Jr. said he sees limited room for monetary easing this year.

“A narrowing interest rate differential could lead to capital outflows, while the country’s current account deficit heightens the vulnerability to external shocks… Keeping interest rates steady might be needed to mitigate these risks. We still expect the policy rate to end the year at 5.25%,” he said.

For the rest of the year, Mr. Guinigundo said he expects two more rate cuts.

“Depending on future data on inflation and inflation expectations, two more rate cuts could be in the works,” he said.

“Easing monetary policy could have marginal effects on growth. But tightening it promises better results in taming inflation without significant collateral harm on growth.”

At the same time, Nomura expects the Monetary Board to lower borrowing costs by 75 bps through three rate cuts.

“We still forecast an additional 75 bps of policy rate cuts in this cycle, taking the RRP rate to 5%, which we still believe is BSP’s estimate of the neutral level, given its forward guidance suggesting its stance remains restrictive and that it will look to reduce this restrictiveness.”

Both Nomura and Citi expect the Monetary Board to cut rates in April, August and December by 25 bps each.

“While we think the BSP could afford to cut a total of 75 bps this year, considering a high real policy rate and positive interest rate differential with the Fed, Governor Remolona’s more cautious forward guidance of a total of 50-bp cut this year means a third cut still hinges on several factors besides domestic demand and inflation,” Ms. Chutchotitham said.

For his part, Mr. Neri said the BSP could resume cutting rates in June.

“Additional policy easing is still possible later this year, as the outlook for domestic inflation continues to be positive. There’s a chance that the BSP could cut in June if the gross domestic product (GDP) growth in May continues to disappoint,” he said.

However, he said uncertainties from the Federal Reserve’s guidance and changing global conditions could make cutting rates in the second half of the year more challenging.

Mr. Remolona has said the BSP is still in an easing cycle, adding there is a possibility of up to 50 bps worth of rate cuts this year.

RRR CUT IN APRIL

Meanwhile, Nomura expects the BSP to further reduce the reserve requirement ratio (RRR) in April.

“We think April is a plausible window, as demand for liquidity could pick up ahead of the midterm elections in May,” it said.

“We have also argued that this sequencing (i.e., RRR cuts first before further rate RRP cuts) makes sense. From BSP’s perspective, these cuts are consistent with its longer-term goal of reducing the RRR to single-digit levels but also helping to further improve the transmission of its policy rate cuts later in the year.”

Mr. Remolona has said an RRR cut is still on the table this year, possibly before the Monetary Board’s next policy review on April 3.

He has signaled a 200-bp reduction, which would bring the RRR for big banks to 5% from the current 7%.

“Potentially, such a move would help support economic activity while having limited impact on the exchange rate versus the policy rate,” Ms. Chutchotitham added. — Luisa Maria Jacinta C. Jocson

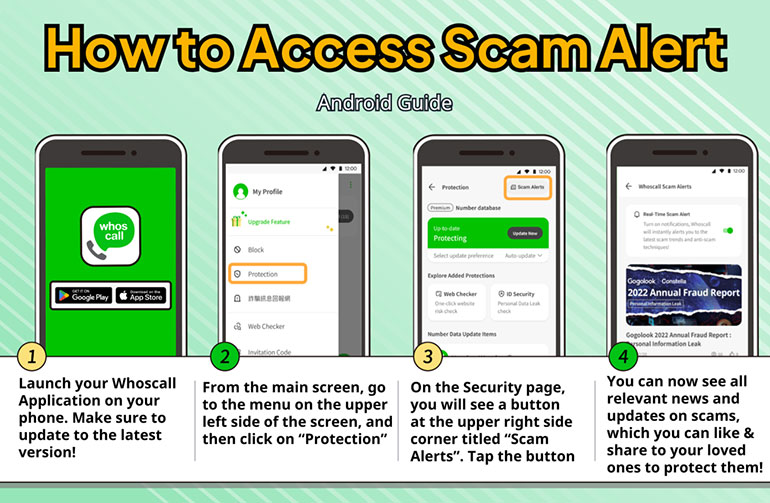

Android users can access this feature by opening the Whoscall app and tapping the three-bar menu icon in the upper left corner of their screen.

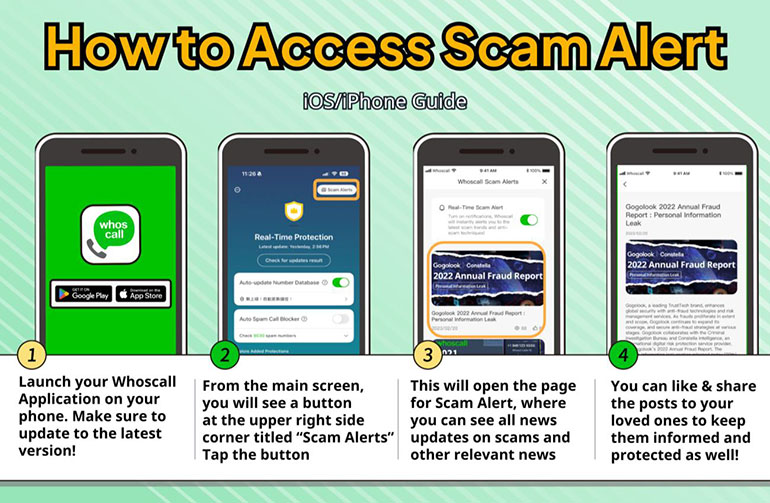

Android users can access this feature by opening the Whoscall app and tapping the three-bar menu icon in the upper left corner of their screen. For iOS users, accessing the feature is even simpler. By opening the Whoscall app, they can immediately access the “Scam Alert” section in the upper right corner of their screen.

For iOS users, accessing the feature is even simpler. By opening the Whoscall app, they can immediately access the “Scam Alert” section in the upper right corner of their screen.