By Kyle Aristophere T. Atienza, Reporter

THE STRONG PRESENCE of offshore gambling operators complicates the Philippines’ efforts against dirty money and does not bode well for its ambition to become an investment hub, economists warned.

Money laundering in gaming activities has been a major concern of the Financial Action Task Force (FATF), which has placed Manila under its “gray list” of countries under increased monitoring for dirty money since 2021, said Enrico P. Villanueva, who teaches money and banking at University of the Philippines Los Baños.

“The presence of Philippine Offshore Gaming Operators (POGOs) and their links to crimes undermine the country’s effort to exit from FATF’s gray list,” he said in a Facebook Messenger chat.

POGOs, which cater to customers in China and other countries, have been a major headache for authorities in recent months, with policy makers flagging national security risks and linking them to transnational crimes.

Congress under former President Rodrigo R. Duterte passed a law taxing POGOs in a bid to legalize them, despite mounting concerns on their social costs. Chinese President Xi Jinping himself had asked the former Philippine leader to not just regulate but ban the online gambling business.

“There are 402 canceled POGOs and we are looking at 58 that are subjects of interest given that they are still operating,” Presidential Anti-Organized Crime Commission (PAOCC) spokesperson Winston John Casio said in a Viber message.

The Philippine economy is still immature in terms of legal and social frameworks, making it unprepared for a gaming sector that is, to begin with, illegal in other countries, said John Paolo R. Rivera, president and chief economist at Oikonomia Advisory & Research, Inc.

“The economy has yet to mature to be able to operate POGOs according to legal, economic, social frameworks,” he said via Messenger chat. “The current form of POGOs in the country are a red flag on the integrity of money circulating in the economy.”

The Philippines was re-included in the gray list in June 2021 and could be added to the FATF’s blacklist due to increasing risk of money laundering from casinos and lack of prosecution for terrorism financing cases, among other reasons.

WEAK REGULATIONS

Diwa C. Guinigundo, a former central bank deputy governor, said domestic regulations over POGOs are weak, and it does not help that institutions are prone to corruption.

“The financial operations of POGOs are opaque and therefore open to money laundering,” he said in a Viber message.

“I don’t think FATF would look kindly to the Philippines in the presence of these operations which may likely be associated with dirty money.”

Anti-Money Laundering Council Executive Director Matthew David in January noted that the “most challenging action item” for them was the prosecution of terrorism funding cases. “We need to file more terrorism financing cases,” he said at a Palace briefing.

Chester B. Cabalza, who teaches at the National Defense College of the Philippines, said via Messenger chat that proceeds from POGOs are at high risk of being used for financing criminal activities. “They are harbingers for criminal activities.”

The Philippines hosts over 300 illegal POGO hubs, according to the PAOCC, which in recent weeks raided several sites in Central Luzon.

PAOCC and the Criminal Investigation and Detection Group were able to rescue over 100 foreign nationals, including 126 Chinese and 23 Vietnamese, in a June 4 raid of Lucky South 99 Outsourcing, Inc., a POGO complex in Porac, Pampanga described by authorities as the biggest business facility in the province with 46 buildings such as villas and a golf course.

PAOCC’s Mr. Casio, speaking to BusinessWorld in a phone call, said Lucky South “had a provisional license up until September 2023,” which was canceled “around the same time.”

“Then they submitted a letter request to the Philippine Amusement and Gaming Corp. (PAGCOR), but on May 22, 2024, it was denied with finality by PAGCOR.”

DAMAGE TO REPUTATION

Mr. Villanueva said POGOs threaten the Philippine government’s goal of making the country an investment hub in the region.

“There may be sovereign or private entities who are particularly sensitive to money laundering and gaming, so this group may shun the Philippines as an investment destination if their concerns are not addressed,” he said.

The government should continue to press the gaming sector for “acceptable ways of preventing money laundering,” he added. “Banks on the other hand have to be more vigilant in onboarding clients from the gaming sector and in monitoring flows from this sector.”

Mr. Guinugundo said: “If all that we could show to the world is our increasing dependence on these gambling operations for public revenues, I don’t think that reputation could inspire confidence in the long-term viability of investments in this country.”

PAGCOR said on Wednesday the proposal to ban POGOs might force them to go underground and would be harder to regulate.

“If this happens, it would become harder for us to monitor them, and the number of illegal operators would grow and pose a bigger headache to our law enforcement authorities,” PAGCOR Chairman and Chief Executive Officer Alejandro H. Tengco was quoted as saying in a statement.

“Once they are underground, we lose control over them.”

A ban on POGOs, also called Internet Gaming Licensees (IGLs), does not assure that its operations will stop and face legal consequences, Mr. Tengco said.

“On top of these, the government will lose potential revenues of more than P20 billion annually, without any guarantee that illegal activities will stop,” he added.

If outlawed, POGOs could also be free to engage in illegal activities like scamming, hacking and other cybercrimes, posing threats to the country’s security, the PAGCOR chairman said.

“However, for us, the real problem are the criminal syndicates masquerading as POGOs.”

Albay Rep. Jose Ma. Clemente S. Salceda, who heads the House Ways and Means Committee, said banning POGOs could push them to proceed with illegal operations.

“It will kill any inducement to good behavior in that sector. It will also completely wipe out the incentive for legally compliant licensees to tip off illegal operations of noncompliant competitors,” he said in a Viber chat message. — with Beatriz Marie D. Cruz

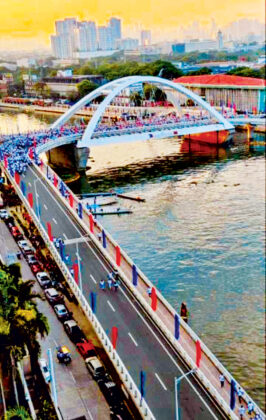

Simultaneously in the morning of June 9, the “FFCCCII Lakad Magkaibigan” civic walks were also conducted in Bacolod City, Cebu, Tacloban, and Palawan.

Simultaneously in the morning of June 9, the “FFCCCII Lakad Magkaibigan” civic walks were also conducted in Bacolod City, Cebu, Tacloban, and Palawan.

The magazine got its name and inspiration from the fabled and world-famous Manila Galleon trade of 250 years which saw Manila emerge as a vital entrepot between the thriving China intercontinental trade with Latin and Central America, Europe.

The magazine got its name and inspiration from the fabled and world-famous Manila Galleon trade of 250 years which saw Manila emerge as a vital entrepot between the thriving China intercontinental trade with Latin and Central America, Europe.