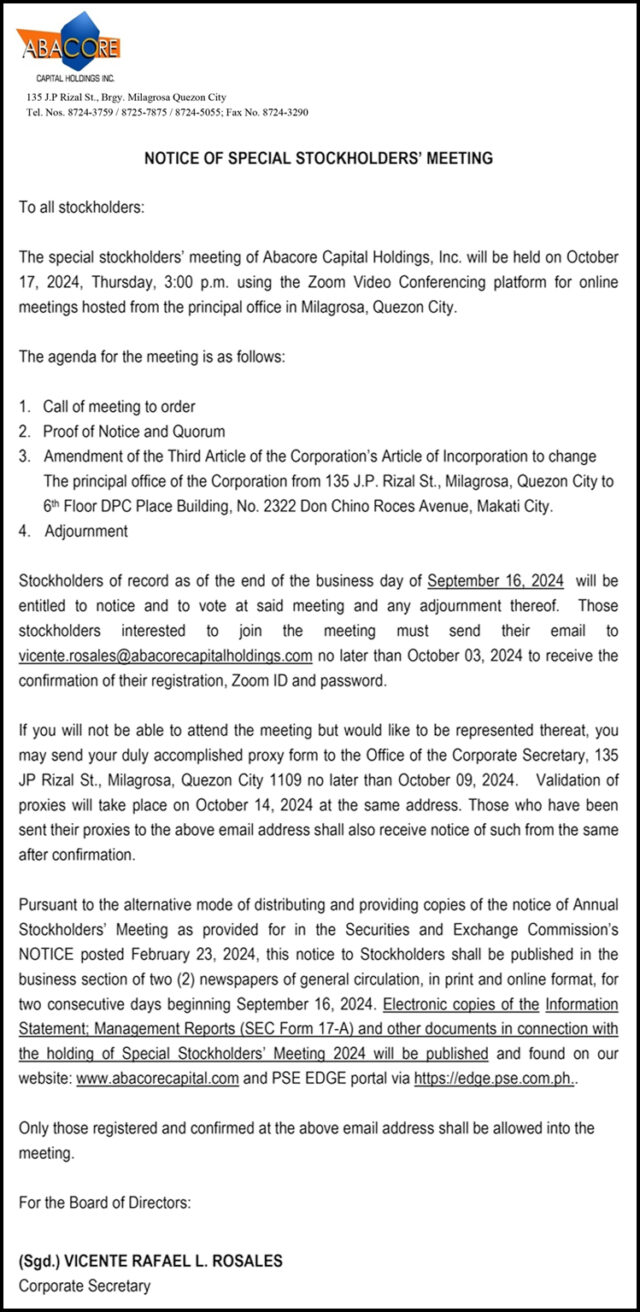

Thai sci-fi epic in Philippine cinemas

DIRECTOR CHOOKIAT “Matthew” Sakveerakul’s ambitious project, Taklee Genesis x Worlds Collide, will have its premiere in the Philippines on Sept. 18. The sci-fi epic charts an interstellar journey that reflects on time. It is also an opportunity to broaden the scope of Thai films. “I’m all for it but I wouldn’t call it the acme of my career. I’d rather it be a door which opens opportunities for my more ambitious projects in the future and for those who love sci-fi and challenging film projects to further develop themselves,” said Mr. Sakveerakul in a statement. Taklee Genesis x Worlds Collide is distributed in the Philippines by Warner Bros. Pictures.

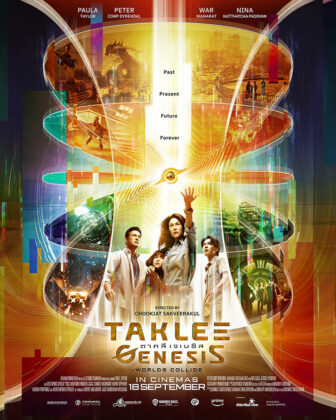

2nd round sale of Olivia Rodrigo concert tickets

FANS of American singer-songwriter Olivia Rodrigo have flocked online in the first stage of ticket selling for her upcoming concert in the Philippines as part of her GUTS World Tour. Scheduled for Oct. 5 at the Philippine Arena in Bulacan, ticket prices for the concert were uniformly set at P1,500, inclusive of taxes and fees. Proceeds from the ticket sales will go to Fund 4 Good, a non-profit organization dedicated to “an equitable and just future for all women, girls, and people seeking reproductive health freedom.” Another round of ticket sales will open on Sept. 29 over the counter at SM Tickets outlets.

Martin Nievera holds 42nd anniversary concert

TO MARK his 42nd year in the music industry, Martin Nievera will once again stage a show, The King 4ever. With it, the singer who earned the moniker “Concert King” aims to bring his audience back in time through music. The concert is scheduled for Sept. 27, 8 p.m., at the Smart Araneta Coliseum, Quezon City. Tickets, which range in price from P840 to P11,200, are available via TicketNet.

ACEL announces album launch and farewell concert

FILIPINO pop-rock singer-songwriter ACEL has announced that she will be starting a new life in the Netherlands early next year. The former Moonstar88 lead vocalist made the announcement on her social media accounts and extended an invitation to her final performance in a major concert, co-produced by GNN Entertainment Productions. Being And Becoming serves as a farewell concert, album launch, and gift to friends, loved ones, fans, and colleagues. The show will also highlight the advocacies of her NGO, Right Start, which works with children in disadvantaged communities. The concert will take place at the Teatrino Promenade in Greenhills, San Juan, on Oct. 11, 7 p.m. onwards. Tickets are now available via bit.ly/acelconcert.

Kai Del Rio releases comeback single

KAI DEL RIO, formerly known as Kai Honasan, has dropped her new single “Ang Nag-iisa” via Underdog Music. The bluesy pop-rock anthem serves as the Filipino singer-songwriter’s comeback single. It looks at a woman coming to terms with her own anger, pain, and disappointments in life. The track is produced by musician Karel Honasan, with Ira Cruz on guitar, Nikko Rivera on keyboard, and Rickson Ruiz on drums, with the help of Tower of Doom sound engineer Macoy Manuel. Ms. Del Rio will also drop the piano ballad, “Storm Like Me,” in the coming week as part of her non-consecutive double single release. The stripped-down track will provide a stark contrast to “Ang Nag-iisa,” which is out now on all digital music platforms worldwide.

Korean action crime film set for PHL premiere

THE action crime thriller I, The Executioner, directed by Ryoo Seung-wan, will be coming to Philippine cinemas on Sept. 25. The film was among this year’s Festival de Cannes and Toronto International Film Festival official selections. The sequel to 2015 box office hit Veteran, this new film stars Hwang Jung-min and Jung Hae-in as detectives of a Major Crimes Investigation Division discovering a murder’s links to past cases and opening up a potential serial killer investigation. It is distributed in Philippines through Warner Bros. Pictures.

Tate McRae releases new song and video

MULTI-PLATINUM pop singer Tate McRae has released her new song, “It’s ok I’m ok,” alongside the official music video via RCA Records. Written and produced with hitmakers Ryan Tedder, ILYA, and Savan Kotecha, the pop-infused offering is accompanied by a dance visual directed by Hannah Lux Davis and choreographed by Sean Bankhead. The high-energy music video follows an unbothered Ms. McRae strutting through city streets. “It’s ok I’m ok” is the first taste of new music following her 2023 album. It is now available on all digital music streaming platforms worldwide.

Disney and Pixar’s Inside Out 2 to stream on Disney+

THE highest-grossing animated movie of all time, Disney and Pixar’s Inside Out 2, will be making its streaming debut on Disney+ on Sept. 25. The film returns to the mind of newly minted teenager Riley just as headquarters is undergoing a sudden demolition to make room for new emotions. Joy (voiced by Amy Poehler), Sadness (Phyllis Smith), Anger (Lewis Black), Fear (Tony Hale), and Disgust (Liza Lapira), who’ve long been running a successful operation by all accounts, are forced to welcome Anxiety (Maya Hawke) to the headquarters of the mind. Inside Out 2 is directed by Kelsey Mann and produced by Mark Nielsen.

Joker: Folie à Deux to hit theaters in October

THE SEQUEL to 2019’s Academy Award-winning film Joker will be coming to Philippine cinemas on Oct. 2. Joker: Folie à Deux finds Arthur Fleck (played by Joaquin Phoenix) institutionalized at Arkham Asylum awaiting trial for his crimes as Joker. While struggling with his dual identity, he stumbles upon true love and finds the music that’s always been inside him. Written, directed, and produced by Todd Phillips, the film also stars Lady Gaga as Harley Quinn. The film will come to Philippine theaters via Warner Bros. Pictures.

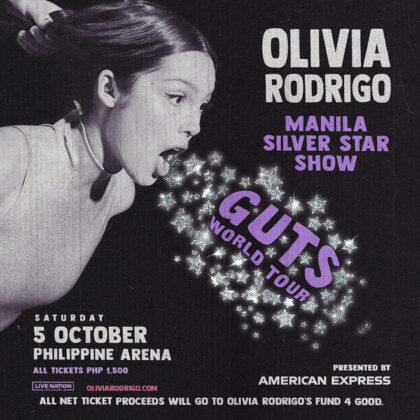

Kim Won-shik makes runway debut, teases single

ON SEPT. 1, South Korean actor and singer Kim Won-shik made his runway debut at BENCH Fashion Week Holiday 2024, donning an all-white ensemble that included a sleek tank top, a sheer cover-up, and knee-length shorts. Following a rising career as a fashion icon in the Philippines, he is also back with his second single, “Hello My Love,” a ballad that aims to capture the essence of unwavering love and commitment. Set to be released in October, the song blends English and Korean lyrics.

Max Original film Salem’s Lot to debut in October

NEW LINE Cinema’s film adaptation of Stephen King’s 1975 bestselling novel Salem’s Lot will debut on Oct. 3 on HBO GO. The film reunites the producing teams behind the record-breaking horror franchises The Conjuring universe and the It films. Gary Dauberman writes, directs, and executive produces the film, with producers James Wan and Michael Clear for Atomic Monster, Roy Lee for Vertigo, and Mark Wolper.

Bestseller The Wild Robot gets animated film

TO CELEBRATE a story that transcends pages, Peter Brown’s #1 New York Times bestseller has been adapted for the big screen by DreamWorks Animation. The Wild Robot follows the story of Roz (voiced by Lupita Nyong’o), a robot stranded on an uninhabited island, and how it navigates the harsh environment and forges new relationships with wildlife. Writer-director Chris Sanders, known for his work on How to Train Your Dragon and The Croods, is at the helm of the film. It also features the voices of Pedro Pascal, Catherine O’Hara, Bill Nighy, Kit Connor, and Stephanie Hsu. The Wild Robot opens in Philippine cinemas on Oct. 9.