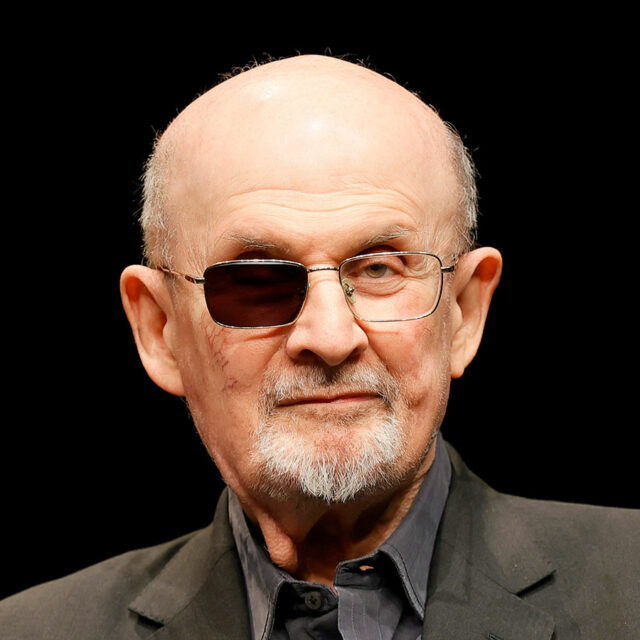

Man who stabbed novelist Salman Rushdie guilty of attempted murder

MAYVILLE, New York — Hadi Matar, the man who stabbed and partially blinded the novelist Salman Rushdie onstage at a New York arts institute, was found guilty on Friday of attempted murder.

Mr. Matar, 27, can be seen in videos of the 2022 attack rushing the Chautauqua Institution’s stage as Mr. Rushdie was being introduced to the audience for a talk about keeping writers safe from harm, some of which were shown to the jury during the seven days of testimony.

Mr. Rushdie, 77, was stabbed with a knife multiple times in the head, neck, torso, and left hand, blinding his right eye and damaging his liver and intestines, requiring emergency surgery and months of recovery.

The writer was among the first to testify at the Chautauqua County Court in Mayville, calmly describing to jurors how he believed he was going to die and showing them his blinded eye by removing his adapted spectacles with a blacked-out right lens.

Mr. Matar was found guilty of attempted murder in the second degree and assault in the second degree for stabbing Henry Reese, the co-founder of Pittsburgh’s City of Asylum, a non-profit group that helps exiled writers, who was conducting the talk with Mr. Rushdie that morning.

He will be sentenced on April 23, and faces up to 25 years in prison.

Speaking after the verdict, Chautauqua County District Attorney Jason Schmidt praised the scores of audience members who rushed to Mr. Rushdie’s aid when he was attacked.

“The Chautauqua Institution community, which I believe saved Mr. Rushdie’s life when they intervened, I would say to you that this entire community deserved swift justice here, and I’m glad that we were able to achieve that for them.”

Nathaniel Barone, a public defender representing Mr. Matar, said his client was disappointed by the verdict.

“The video, I think, was extremely damaging to Mr. Matar,” Mr. Barone said outside the courtroom, referring to the video of the attack that was shown repeatedly to jurors, sometimes in slow motion. “It’s that old expression, a picture is worth a thousand words.”

Mr. Rushdie, an atheist born into a Muslim Kashmiri family in India, has faced death threats since the 1988 publication of his novel The Satanic Verses, which Ayatollah Ruhollah Khomeini, then Iran’s supreme leader, denounced as blasphemous.

After the knife assault, Mr. Matar told the New York Post that he had traveled from his home in New Jersey after seeing the Rushdie event advertised because he disliked the novelist, saying Mr. Rushdie had attacked Islam.

Mr. Matar, a dual citizen of his native US and Lebanon, said in the interview that he was surprised Mr. Rushdie had survived, the Post reported.

Mr. Matar did not testify at his trial. His defense lawyers told jurors that the prosecutors had not proved beyond reasonable doubt the necessary criminal intent to kill needed for a conviction of attempted murder, and argued that he should have been charged with assault.

Mr. Matar also faces federal charges brought by prosecutors in the US attorney’s office in western New York, accusing him of attempting to murder Mr. Rushdie as an act of terrorism and of providing material support to the armed group Hezbollah in Lebanon, which the US has designated as a terrorist organization.

Mr. Matar is due to face those charges at a separate trial in Buffalo. — Reuters