Opening weekend of NBA playoffs scores best ratings in 25 years

THE 2025 NBA playoffs drew the best ratings for an opening weekend in 25 years, the league announced on Tuesday.

The eight-game slate on Saturday and Sunday averaged 4.4 million viewers, a 17% increase from a year ago.

The six games on the ABC/ESPN platforms averaged 4.9 million viewers, making it the most-watched playoffs opening weekend in network history.

The two contests carried Sunday night by TNT, truTV and MAX — Cleveland over Miami, and Golden State downing Houston — averaged 4.13 million viewers. That’s the best ratings on that network platform in eight years and up 23% from 2024.

Most popular was the defending champion Boston Celtics’ 103-86 home win over the Orlando Magic that tipped off at 3:30 p.m. ET on Easter Sunday. The 6.69 million average made it the second-most watched first-round Game 1 ever on ABC. Ratings peaked at 8 million viewers.

ESPN, which showed the host New York Knicks’ 123-112 victory over the Detroit Pistons on Saturday and averaged 4.12 million viewers. — Reuters

Trade war fears hang over Shanghai auto show

SHANGHAI — China’s annual major auto shows have become a showcase for the rise of ever-cheaper, better-performing electric vehicles (EVs) and more confident local brands in the world’s biggest market for cars.

But the Shanghai auto show opened on Wednesday amid deep industry-wide uncertainty over how the US-China trade war could dampen demand and scramble supply chains as 100 more models launch into an already crowded market with more losers than winners.

In a further complication, Chinese regulators signaled more and tougher scrutiny for smart-driving features that many automakers had seen as the next big thing in setting apart their cars from competitors just a week ago.

US President Donald J. Trump’s move to impose a 145% tariff on Chinese imports and Beijing’s counter-tariffs and trade restrictions have pushed global growth forecasts lower and forced automakers and their suppliers to con-front new risks.

As the Shanghai show began on Wednesday, a coalition of US auto industry groups sent a combined letter to Mr. Trump urging him to roll back 25% tariffs on all imported auto parts, warning the duties would cut vehicle sales and raise prices.

The first blitz of presentations by automakers in Shanghai focused on safety and plans for a rapidly expanding portfolio of EVs from brands like Volkswagen and Nio without discussion of the economic uncertainty.

Car demand in China has held up so far this year despite the trade war. Industry-wide auto sales through March were up 12.5%, led by gains for BYD and Geely, China’s two top automakers.

But there are also signs of trouble. China is now the world’s largest car exporter by volume. While the US market is essentially closed due to tariffs, analysts expect the Trump administration’s trade policies to put pressure on Chinese automakers. That could come through weaker demand in China if its economy wobbles or pressure from Washington that could force other US trade partners to align their tariffs.

CHINA CRACKS DOWN

ON ‘SMART DRIVING’

Chinese automakers, which had been preparing to heavily market their driver-assistance features to set their cars apart from competitors at the show, were forced at last minute to switch to a “safety first” message.

Regulators last week cracked down on the use of marketing terms like “smart driving” and “autonomous driving” after a fatal accident involving Xiaomi’s best-selling SU7 EV in March that triggered concerns over how drivers were using systems not designed to be fully self-driving.

Chinese automakers, led by BYD, had previously been pushing advanced and autonomous driving systems, including on cheaper models, in a challenge to Tesla.

Xpeng, a brand built on the appeal of its in-house technology, including an artificial intelligence-powered virtual assistant, said it would launch a “training camp” for drivers on how to use its systems safely.

“We will emphasise the capability boundaries of the driving assistance functions to ensure safety,” Xpeng Chief Executive Officer (CEO) He Xiaopeng told reporters on Wednesday.

Geely said it would complete a global security testing center, which it described as the world’s largest standalone safety laboratory, in the second half of this year.

Volkswagen stressed its rigorous German craftsmanship and strict testing standards.

Lei Jun, the celebrity CEO of Xiaomi who stole the limelight with a crowd of cameras following his every move at last year’s Beijing show, was absent from Shanghai as the show opened.

CHINA SPEED

China’s hyper-competitive local market remains a minefield for foreign brands. Sales for Honda and Nissan, for example, were down 34% and 28% respectively in the first quarter from a year earlier.

Volkswagen, once China’s top-selling passenger car brand, saw sales drop 6% in the first quarter. Under an electronic banner with the motto “CHINA SPEED,” the German automaker on Wednesday unveiled the first of five new models, including for its premium Audi brand.

More than 70 Chinese and international auto brands will show off more than 100 new or refreshed models this week.

Less than 10% of the more than 160 auto brands competing in China have a market share higher than 2%, according to data from Jato Dynamics. Most still lose money. Among the winners: BYD, Chery and Geely are profitable, along with EV-focused Leapmotor and Li Auto.

Tesla, the only foreign automaker with a top-selling EV in China, said on Tuesday that it would have to reassess its growth forecast in three months because of the difficulty in predicting “the impacts of shifting global trade policy on the automotive and energy supply chains.”

The trade war has already hit Tesla. Its China sales were down 22% through March from a year earlier. The company has suspended orders for the Model S and Model X because of China’s counter-tariffs and paused some imports of China-sourced components.

Tesla CEO Elon Musk said on Tuesday while announcing a 71% plunge in first-quarter net profit that the EV maker’s already-delayed production plans for its Optimus humanoid robot had been slowed by China’s restrictions on the export of the rare earth magnets needed for the motor powering the robot’s arms.

Mr. Musk had earlier predicted the robot would be working in Tesla factories this year. — Reuters

MPTC Tour of Luzon ’25: ‘Great Revival’ kicks off 190.7-km Stage One in Paoay

PAOAY, Ilocos Norte — Four battle-tested Philippine continental teams seeking to impose their will, four dangerous foreign squads eyeing to give a strong challenge and a slew of wide-eyed Filipino young blood out to prove their worth will battle it out against themselves and nature’s elements when the Tour of Luzon gets another lease of life on Thursday in this charming little town here.

Fittingly called the MPTC Tour of Luzon 2025: “Great Revival,” the 1,074-kilometer (km), eight-stage summer cycling spectacle will be unwrapped via its longest stage — a grueling 190.7-km Stage One that will start and end near the majestic, centuries-old San Agustin or Paoay Church.

A total of 119 cyclists from 17 teams will vie not just for the total pot worth P6.1 million including P1 million to the team champion and P500,000 for the overall individual winner but also the distinction as its first champion on the fabled race’s much-awaited return.

And this early, four of them are being tipped to lead the country’s campaign — veteran internationalists Standard Insurance Philippines, Go for Gold, Victoria Sports and a retooled 7-Eleven Road Bike Philippines.

Of the four, expect the Navymen of Standard Insurance to draw most of the attention having a veteran-laden lineup that included skipper Ronald Oranza, Jan Paul Morales, Ronald Lomotos, and George Oconer — all former winners of the defunct Ronda Pilipinas.

“We’re going for the win, of course, but we know it will not be easy because there are strong young riders that are also competing and we can’t also discount the foreign teams,” said Reinhard Gorantes, one of Standard’s team leaders.

Go for Gold, which will be spearheaded by the talented Jericho Jay Lucero, and Victoria Sports, headed by Marcelo Felipe and Daniel Cariño, should also challenge for the crown.

“Our strength is our young harders, who are all out to prove themselves,” said Go for Gold director Ednalyn Hualda.

“Our team is prepared. We have raced in Europe in preparation for this,” said Victoria Sports director Joshua Cariño, a 2018 Tour champion.

7-Eleven is another squad that should make its mark as it parades a youth-laden squad led by skipper Rench Michael Bondoc.

“We have a young but experienced team because we have raced internationally. This is their chance to show their worth,” said 7-Eleven director Mark Galedo, a Tour and Ronda titlist and a Southeast Asian Games gold winner.

The foreign squads — Hong Kong’s CCN Factory Racing, Malaysia Pro Cycling Team, Bryton Racing Team of Taiwan and Gapyeong Cycling Team of South Korea — should also give the local teams a run for the money.

Also expected to throw its hat into the ring are Tom ‘N Toms, composed of the national Under-23 squad, a Cris Joven and Dominic Perez-led Exodus Army, and Excellent Noodles.

Other teams seeing action are DReyna Orion Cement, Dandex T-Prime Cycling Team, MPT Drivehub Cycling Team, Crest Forwarder (1Team Visayas), One Cycling Mindanao and Pangasinan.

Pangasinan, the country’s cycling hotbed and producer of many Tour champs in the past, was still waiting for its team captain, Efren Reyes, Jr., to get his approval from the Army where he is an enlisted personnel for him to be able to race.

If not, the team may just end up replacing the veteran Mr. Reyes with Ronyl Erquiza and assign deputy Jefferson Capua as its new skipper.

“Whatever happens, we’ll try to make our province proud,” said a shy Mr. Capua.

The race is presented by Cignal, backed by Pilipinas Live, Meralco, Maynilad, Metro Pacific Health, Megaworld, Landco, PLDT and Smart, and organized in partnership with Cardinal Santos Medical Center, Go21, Dongfeng, Victory Liner, DOOH, PSSLAI, Unilab, Huawei, Toyota and supported by Microtel by Wyndham, Gatorade, Drivehub, Homestretch, POC, Philippine Sports Commission, Games and Amusements Board, BCDA and MVP Sports Foundation. — Joey Villar

UST slams the door on UP in UAAP women’s volleyball

Games on Saturday

(Smart Araneta Coliseum)

9 a.m. – Ateneo vs UE (men)

11 a.m. – FEU vs DLSU (men)

1 p.m. – Ateneo vs UE (women)

3 p.m. – FEU vs DLSU (women)

UNIVERSITY of Santo Tomas (UST) booted out the University of the Philippines (UP), 25-20, 25-21, 25-18, to clinch a Final Four ticket and boost its twice-to-beat bid in the resumption of the UAAP Season 87 women’s volleyball on Wednesday at the Mall of Asia Arena.

Peaking at the right time, the UST Golden Tigresses punched their fourth straight win to jack up their slate at 9-4, slamming the door on the UP Fighting Maroons (6-7) with their seventh loss in the process, with still a game to go in the two-round elims.

Santo Tomas’ win also gave twice-to-beat rivals De La Salle University (8-4) and Far Eastern University (8-5) early rides into the Final Four, avoiding any possible complications due to UP’s costly defeat to complete the playoff picture.

But more than that, the Golden Tigresses put themselves in prime position to seal the other twice-to-beat incentive entering their final test this weekend against the reigning champion National University Lady Bulldogs, who clinched the No. 1 seed and the first bonus with an 11-2 slate.

Making it happen was Angge Poyos, who fired 19 points on 18 hits as Santo Tomas sent UP packing in only 90 minutes of play despite the latter marching into a duel with an all-time high morale after slaying La Salle before the UAAP break in observance of the Holy Week.

Regina Jurado chipped in 13 while Mary Banagua stepped up big time with 12 points on eight blocks in Santo Tomas’ fifth straight Final Four appearance, including a finals run last season that just fell short against the mighty NU.

“Our system is always here despite the changes in roster every year. Players come and go but the system stays. Now, we just have to keep pushing and we will not stop until we reach the ultimate goal. We just have to better every game,” said coach Kungfu Reyes as Santo Tomas moved closer to redemption with yet another semis entry.

Up against a young but formidable UP side that scored big wins against NU and La Salle this season, Santo Tomas leaned to its veteran pedigree in the last two sets to complete the wipeout.

The Golden Tigresses pounced on the Fighting Maroons in the first set but had to dig deep in the next two, running away from 20-all deadlock in the second with a 5-1 finishing kick and unleashing a 16-9 start in the third for the win.

Niña Ytang was the lone bright spot for UP this time around with 16 points on 13 hits and three blocks after a scattered onslaught in the team’s 26-24, 18-25, 19-25, 25-22, 16-14 stunner of La Salle to stay in con-tention.

Kianne Olango, Joan Monares and Kassy Doering had seven points each in UP’s gallant fifth-place finish under first-year mentor Benson Bocboc and will go for a graceful exit against Adamson on Saturday.

Meanwhile in the men’s division, Final Four-bound Santo Tomas (9-4) and La Salle (9-4) took care of business with wins against University of the Philippines, 25-17, 25-20, 25-11, and Adamson, 25-20, 27-25, 24-26, 25-17, respec-tively, to stay tied at No. 3 heading into their final matches.

FEU (12-1) and NU (11-2) already clinched the Top 2 seeds plus the twice-to-beat incentives, awaiting their semis counterparts pending the positioning of Santo Tomas and La Salle. — John Bryan Ulanday

Olympian Tabal, national, student-athletes join EVA Air Marathon

AROUND 24,000 runners including Filipina Olympian Mary Joy Tabal test their mettle on the road at the heart of Taiwan in the biggest edition of EVA Air Marathon on October 26.

It’s the return of Ms. Tabal, the country’s most decorated marathoner, to competitive running since breaking a long hiatus in the Tokyo Marathon in 2023. Her last campaign at home was in the 2019 Southeast Asian Games.

“I’m excited to be finally back on the road. It’s about finding the joy in running again after spending time with my family as a full-time mom and wife,” said Ms. Tabal in the official press conference on Tuesday night at the Crim-son Filinvest City Manila.

“The goal is to just get back on running and we’ll see. It’s just good to be back in the sport that made me an Olympian.”

A Rio Olympian, SEA Games gold medalist and six-time Milo Marathon queen, the 35-year-old Ms. Tabal will lead the local delegation as the official Team Philippines ambassadress.

Around 300 Filipinos will fly to Taipei to join Ms. Tabal for the EVA Air Marathon, including other national and student-athletes to be endorsed by the Department of Education (DepEd) and the Philippine Sports Commission courtesy of organizer TravelCare, which will shoulder the all-expense paid trip.

“It’s our fulfillment to boost the sportsmanship of our athletes. It’s our honor to send our Filipino delegation to Taiwan through the EVA Air Marathon,” said TravelCare Proprietor Sunshine Lim.

The participation of the Philippines along with other countries from all over the globe is what makes EVA Air Marathon a one-of-a-kind experience since its inauguration in 2018, according to EVA Airways General Manager Rick Hsieh.

“We connect the world through our airline and now, marathon,” said Mr. Hsieh, expecting a massive and successful turnout of the staple Taipei marathon that took only a year off during the COVID-19 pandemic.

“Our operation is getting bigger and wider so it’s an honor for us to have our Filipina Olympian here in Mary Joy (Tabal) to join the marathon. We’re proud to have the biggest Philippine delegation this time. And we will not stop here,” he said.

EVA Airways, with a slogan of “Fly From Taipei, See the World,” is the No. 1 airline in Taiwan, boasting a 5-star airline certification by SkyTrax and has three flight destinations to the Philippines and back.

Named the No. 8 airline in the world last year, EVA Airways flies from Taipei to Manila thrice a day and to Clark and Cebu as well once a day. Now, count marathon as an additional bridge between two friendly neighbors at the heart of the Pacific.

The EVA Air Marathon, which has The Philippine Star, The Freeman and Uratex as co-presenters, will have the 42K full marathon, 21K half marathon, 10K and 3K races featuring a smooth course that includes iconic landmarks such as the Chiang Kai-Shek Memorial Hall and the Taipei 101 Observatory Building.

The world-class marathon with TravelCare is also backed by Hotel, Resort and Restaurant Association of Cebu, Inc., (HRRACI), DepEd Region VII, Sto. Niño Mactan College, Inc., Inner Wheel Club of Cebu Lapu-Lapu and Inner Wheel Club of Cebu Lapu-Lapu Shining Stars. — John Bryan Ulanday

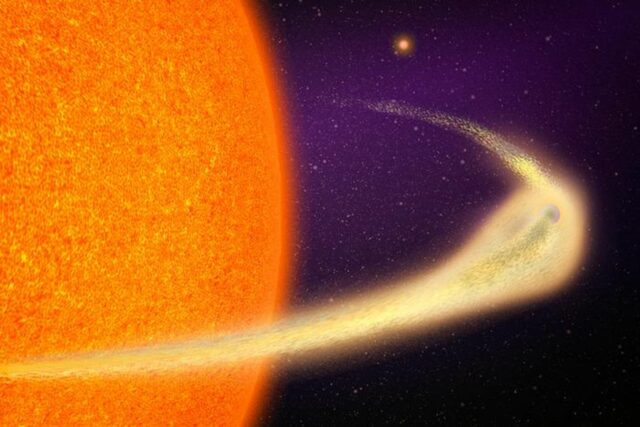

Planet with comet-like tail observed disintegrating near its star

WASHINGTON — Astronomers have spotted a small rocky planet that orbits perilously close to its host star disintegrating as its surface is vaporized by stellar heat, trailed by a comet-like tail of mineral dust up to about 5.6 million miles (9 million km) long.

About 5,800 planets beyond our solar system, called exoplanets, have been discovered since the 1990s. Of those, only four have been observed disintegrating in orbit, as this one is. This planet is the closest to our solar system of the four, giving scientists a unique opportunity to learn about what happens to these doomed worlds.

The researchers observed the planet, named BD+05 4868 Ab, as it gradually crumbles into dust, shedding material roughly equal to the mass of Mount Everest with each orbit of its star. The tail of dust trailing the planet wraps halfway around the star.

The planet is estimated as between the size of our solar system’s smallest and innermost planet Mercury and Earth’s moon. It is located about 140 light years away from Earth in the constellation Pegasus. A light-year is the distance light travels in a year, 5.9 trillion miles (9.5 trillion km).

Its host star, a type called an orange dwarf, is smaller, cooler and dimmer than the sun, with about 70% of the sun’s mass and diameter and about 20% of its luminosity. The planet orbits this star every 30.5 hours at a distance about 20 times closer than Mercury is to the sun.

The planet’s surface temperature is estimated at close to 3,000 degrees Fahrenheit (about 1,600 degrees Celsius) thanks to its close proximity to its star. As a result, the planet’s surface has probably been turned to magma — molten rock.

“We expect the planet to disintegrate into dust within the next million years or so,” said Marc Hon, a post-doctoral researcher at the Massachusetts Institute of Technology’s Kavli Institute for Astrophysics and Space Research and lead author of the study published on Tuesday in the Astrophysical Journal Letters.

“This is catastrophically quick in cosmic timescales. The disintegration is a runaway process. As more material from the planet turns into dust, the disintegration process gets faster,” Mr. Hon said.

Once in space, the vaporized material cools down to form mineral dust that streams away from the planet.

“We know the dust grains in the tail can have sizes between large soot particles and fine grains of sand,” Mr. Hon said. “We don’t know the mineral composition of the tail yet.”

The researchers detected BD+05 4868 Ab using the “transit method,” observing a dip in the host star’s brightness when the planet passes in front of it, from the perspective of a viewer on Earth. It was found using NASA’s Trans-iting Exoplanet Survey Satellite, or TESS, space telescope.

How the planet came to have its current close-in orbit is unclear.

“The planet’s orbit is not seen to be visibly decaying from the data. It is possible that the planet initially formed farther away, and had its original orbit altered under the influence of an external body, such that the planet was sent much closer to the star,” Hon said.

This could have resulted from the gravitational influence of another planet or some other celestial object.

The researchers plan further observations in the coming months using NASA’s James Webb Space Telescope to study the composition of the material in the tail, which could give clues about the makeup of rocky exoplanets. The search for life in other solar systems focuses on rocky exoplanets orbiting stars in the “habitable zone,” a distance where liquid water, a key ingredient for life, can exist on a planetary surface.

“The tail is expected to contain minerals evaporated from the surface or interior of the disintegrating planet. So, this could be the crust, mantle or even the planet’s core. Learning about the interiors of planets is extremely chal-lenging. Doing this even for planets within our solar system is difficult. But BD+05 4868 Ab will allow us to directly measure the mineral composition of a terrestrial planet outside our solar system,” Mr. Hon said.

“This is definitely an exceptional opportunity for exoplanet geology and to understand the diversity and potential habitability of rocky worlds beyond our solar system,” Mr. Hon said.— Reuters

Getting ahead of a Customs audit

The tariff wars continue to bring uncertainty to global trade, and businesses are bracing for impact. Philippine businesses are also bracing for other issues, like the increasing audit efforts of the Bureau of Customs. In 2024, the BoC’s Post Clearance Audit Group (PCAG) generated P2.710 billion through audits and voluntary-disclosure applications.

With the Bureau’s collection target ever increasing, PCAG is expected to raise P3.5 billion this year. Thus, more Audit Notification Letters (ANLs) can be expected, to cover more companies from various industries.

POST CLEARANCE AUDIT

Importers can be audited for shipments within three years from the date of payment of duties and taxes, or from the completion of customs clearance for duty and tax-free imports.

Considering the revenue target, PCAs tend to focus on areas that affect the duty and tax outcomes. Audit challenges may arise from valuation, and/or classification issues, as well as doubts on the origin of goods. In my experi-ence, the PCAG tends to jump in when:

• there are royalty or license payments, and/or post-import price adjustments related to transfer pricing, or the remittance of subsequent proceeds, etc.;

• actual freight and/or insurance expenses are higher than declared;

• goods are assigned other classification (harmonized system or HS) codes with higher duty rates; and/or

• doubts arise on the supportability of duty preferences availed under the benefit of a Free Trade Agreement.

For companies enjoying incentives, the PCA leans towards the examination of record-keeping practices, and on verifying whether the duty-and-tax free privileges availed are still intact under the changing incentive policies.

The above list is not exhaustive but such issues tend to set the PCA on the path to an examination.

Many companies are not aware that they are exposed to such risks because they believe they have made truthful declarations to the best of their ability. Note that import declarations are made based on self-assessment, and so are susceptible to the scrutiny of the BoC at the port of entry and/or during PCAs.

Although imports play a crucial part in many businesses, most customs-related operations and requirements are undertaken by third-party service providers on the company’s behalf. Many companies tend to be heavily reliant on third parties with minimal oversight. One cannot be blamed though as the intricacies of customs require specialization and dedicated attention.

Third party service providers are subcontracted to clear shipments from customs custody. However, they typically focus on getting shipments cleared and delivered at the soonest possible time. This sometimes creates uninten-tional compliance gaps or errors, and the company will primarily be liable to the BoC. Given this, it is important to partner with a reputable and trustworthy third party.

Companies may be caught unprepared for a PCA without an effective customs compliance process. Moreso, the PCA rules only provide for a short span of time for companies to act on or respond. This can be troublesome for compa-nies with large volumes of imports. When this happens, they face additional duties and taxes plus hefty penalties.

There are also penalties for poor record-keeping practices, which could involve surcharges, a waiver of rights to contest audit findings, cancellation of import privileges, and others. Companies may also be assessed fines for cler-ical errors for improperly filing out customs forms.

PRIOR DISCLOSURE PROGRAM (PDP)

A company can mitigate the risk of audit and related fines if it acts quickly, either at an early stage of an audit, or even before the PCAG knocks on its door. As a mitigating mechanism, the BoC has the Prior Disclosure Program (PDP).

By BoC definition, the PDP is based on international customs best practices, authorizing the Commissioner of Customs to accept voluntary disclosure from importers regarding errors and omissions in goods declaration resulting in deficiency in duties and taxes on past imports. The PDP can also be utilized for disclosures on royalties and other proceeds of any subsequent resale, disposal or use of the imported goods that accrue directly or indirectly to the seller.

The PDP reduces potential fines that would otherwise apply should PCAG identify underpaid duties and taxes during a PCA.

In a PCA, negligence carries a penalty of 125% with a 20% yearly interest, while fraud yields a penalty of 600% with 20% yearly interest. In a PDP, companies selected for PCA face a reduced fine of only 10% penalty on top of the 20% interest. A successful PDP application can lead to the closure of PCA investigation.

Outside of a PCA, PDP applicants can settle deficiencies without any fine other than the 20% yearly interest for declaration errors. Additionally, PDP applicants can settle deficiencies without any penalty or interest for post-import adjustments of import prices, including royalties, license fees, price adjustments, and proceeds if the application is made within 30 days from the date of accrual or adjustment. However, if the application is made after 30 days, the 20% interest penalty will still be imposed.

The filing of PDP for companies outside of the PCA can be seen as an act of transparency and a proactive measure to improve compliance. Because of this, filers can be considered low-risk and assigned the least priority during the audit selection process.

To put forward a well-supported and effective PDP application, it is imperative to have the knowledge of the customs issues to be disclosed and of the duty and tax exposures. This is where an effective compliance program comes in.

BE PCA-READY

Below are some practices that can be useful to start or manage a customs compliance program.

• Understanding the company’s operations, volume of import transactions, rates of duties used, preferential treatments applied (if any), licenses required, historical challenges, customs-related processes, among others.

• Conducting a periodic review of internal operations and customs documents to identify process gaps and improvement opportunities. This could help quantify potential risk exposure for devising corrective measures and modi-fications of policy to better align with compliance requirements.

• Establishing a compliance manual containing updated policies and processes relating to customs transactions. This should include risk identification and escalation process in cases of BoC challenges.

• Providing employees access to relevant training on customs rules and regulations, and related compliance requirements.

• Agreeing on compliance expectations with the third-party service provider and performing a periodic evaluation to assess their compliance level and efficiencies.

By embracing proactive measures and thorough preparations, businesses can navigate the complexities of customs audits with confidence and stay ahead of potential pitfalls. With adequate preparation and proactive involve-ment, companies can be one step ahead and PCA ready.

The views or opinions expressed in this article are solely those of the author and do not necessarily represent those of Isla Lipana & Co. The content is for general information purposes only, and should not be used as a sub-stitute for specific advice.

Luningning Pizarra is a senior manager at the Tax Services department of Isla Lipana & Co., the Philippine member firm of the PwC network.

Subsidized rice set for pilot in Visayas at P20 per kilo

THE Department of Agriculture (DA) said on Wednesday that it will be conducting a pilot program offering subsidized rice at P20 per kilo in the Visayas, which the Palace is pushing to sustain until the government steps down in 2028.

“We are launching it here because mas marami ang nangangailangan (many people are needy),” Agriculture Secretary Francisco P. Tiu Laurel, Jr. said at a briefing, noting eventual plans to offer P20 rice nationwide.

The subsidy for the program has been set at P3.5 billion to P4.5 billion, he said.

President Ferdinand R. Marcos, Jr. had promised to bring rice prices down to P20 per kilo when he was campaigning for the presidency.

The DA announcement follows a closed-door meeting of 12 Visayas governors with Mr. Marcos on Wednesday.

“Initially the program was supposed to only last until December and can be stretched until February. But our President has given a directive to the DA (to make the program) sustainable and continue until 2028,” Mr. Laurel said.

He said the reduced prices are also meant to help move inventory piling up in government grain warehouses.

“We have stocks, especially in Iloilo. So this can be a way for us to release our stocks,” he said.

“Punong-puno pa rin ang warehouses ng DA ng bigas at palay (DA warehouses are overflowing with milled and unmilled rice),” he added.

Currently, he said the rice inventory is at 358,000 metric tons, swelled by the harvest.

“A lot of steps are needed to make this happen,” Mr. Laurel said, adding that he has been asked to plan for P20 rice since he took office.

“We were not able to do it last year because the world price of rice was at a 15-year high. Now that the prices are lower, the subsidy will also be lower,” he added. — Justine Irish D. Tabile

Tax exemption rules simplified for education, training investments

The Bureau of Internal Revenue (BIR) said it simplified the tax exemption application process for education and upskilling projects.

BIR Revenue Regulations No. 13-2025 aim to “simplify and consolidate outdated procedures that have hampered access to tax incentives granted under existing laws for education and training.”

The revenue regulations were signed in March and took effect on April 17.

“The new regulations enhance the ease of doing business, while supporting investments in primary to tertiary education, technical education, and skills development,” the Department of Finance said.

The intent is to “spur private sector investment in human capital development,” it added.

The new rules are targeted at private companies participating in programs outlined in Republic Act (RA) No. 8525 or the Adopt-a-School Act of 1998, as well as RA No. 12063 or the Enterprise-Based Education and Training (EBET) Framework Act to ensure “efficient and effective implementation of tax incentives.”

For example, private entities that enter into an agreement with a public school to provide assistance will be entitled to tax incentives and exemptions, such as deductions from the gross income of the amount contributed that was directly and ex-clusively used for the program.

Technical-vocational institutions that implement a registered EBET program can also avail of certain perks.

“By prioritizing education, we are accelerating not only national development, but more importantly, we are creating more opportunities to uplift lives through strategic human capital investments,” Finance Secretary Ralph G. Recto said. — Luisa Maria Jacinta C. Jocson

Trump says he has no plans to fire Fed’s Powell

WASHINGTON — President Donald J. Trump on Tuesday backed off from threats to fire US Federal Reserve Chair Jerome H. Powell after days of intensifying criticisms of the central bank chief for not cutting interest rates.

“I have no intention of firing him,” Mr. Trump told reporters in the Oval Office on Tuesday. “I would like to see him be a little more active in terms of his idea to lower interest rates,” he added.

The de-escalation drew an immediate thumbs up from Wall Street, as equity index futures jumped by nearly 2% on the resumption of trading on Tuesday evening. Stocks, bonds and the US dollar had all slumped on Monday af-ter Mr. Trump over the Easter holiday weekend repeatedly attacked Mr. Powell for not cutting interest rates further since the president resumed office in January.

“Whether this reflects Monday’s brutal foretaste of what would happen in markets if he did try to fire Powell, or was the plan all along, it is a clear positive,” wrote Evercore ISI Vice Chairman Krishna Guha. “It materially reduces the likelihood of worst case outcomes including stagflation and the morphing of the tariff crisis into a sovereign debt crisis, though these risks remain.”

Also during his question-and-answer volley with reporters on Tuesday, Mr. Trump expressed optimism that a trade deal with China could “substantially” cut tariffs, which also provided a boost for investors. He said a deal would result in “substantially” lower tariffs on Chinese goods, suggesting that a final deal will not “be anywhere near” current tariff rates. But “it won’t be zero,” he added.

The combination of the rocky rollout of Mr. Trump’s tariffs and, more recently, his repeated barbs at Mr. Powell and the Fed had rattled investors and intensified selling of US assets including stocks, US Treasuries and the dollar.

Mr. Trump’s broadsides were often accompanied by threatening remarks, such as last week’s social media posting that Mr. Powell’s termination as Fed chair “cannot come fast enough” and more personal jabs, such as calling Mr. Powell “a major loser.” The threats spooked financial markets that view the Fed’s independence as critical to underpinning its credibility as the world’s most influential central bank and a cornerstone of global financial stability.

But while Mr. Trump seems to have set aside those threats for now, his criticisms of Fed rate policy remain just as pointed.

“We think that it’s a perfect time to lower the rate, and we’d like to see our chairman be early or on time, as opposed to late,” Mr. Trump said.

OLD FEUD

Mr. Trump’s sour grapes with Powell date back to the Republican’s first term in the White House. Mr. Trump elevated Mr. Powell from a Fed Board of Governors member to the central bank’s head but was soon irritated by on-going rate increases under Mr. Powell’s watch. Mr. Trump openly mused about firing Mr. Powell, but was ultimately dissuaded by his advisers.

Whether Mr. Trump has the authority is unclear. Mr. Powell, for his part, insists that the Federal Reserve Act of 1913 that created the central bank will not allow it. Mr. Trump, meanwhile, has said that if he wanted Mr. Powell out, he would be gone “real fast.”

The law stipulates that the seven Fed governors, appointed by the president and confirmed by the Senate to staggered 14-year terms, can only be removed for “cause” — long thought to mean misconduct, not policy disagreement.

That said, the law omits reference to limits on removal from its description of the four-year term of the Fed chair, who is one of the seven governors.

Mr. Trump’s harsh rhetoric came alongside court cases now proceeding over his firing of officials from other independent federal boards and agencies. Those are being watched closely in Fed circles as potential proxies for whether Mr. Trump has the authority to fire Fed officials long presumed to be able to pursue monetary policy free from political influence.

The Fed lowered interest rates by a percentage point late last year to the current range of 4.25% to 4.5%, but has held them unchanged in the two policy meetings convened since Mr. Trump returned to the White House. The Fed’s next rate-setting meeting is in two weeks.

Fed policy makers are concerned that the aggressive tariffs rolled out by Mr. Trump since early February could rekindle inflation that they had already found harder than expected to return to their 2% target. At the same time, policy makers worry their job could be complicated further if tariffs slow growth and drive up unemployment while also pressuring up inflation.

The result is a wait-and-see posture regarding further rate cuts, though most policy makers still see some rate reductions as likely later this year.

Interest rate futures traders pared bets on Fed policy easing after Mr. Trump’s remarks, and now are pricing three quarter-point interest-rate cuts by year’s end, versus the four seen as earlier as more likely.

So far, “hard data” measures of the US economy such as employment and retail sales reports have shown resilience, but surveys of households and businesses have shown rapidly deteriorating confidence. The consensus now among economists is that risks are skewed broadly to the downside from here as the effects of tariffs begin to stack up.

The International Monetary Fund on Tuesday slashed its outlook for both US and global growth this year, with Mr. Trump’s tariffs policy the central reason behind the downgrade. — Reuters

EU, Philippines launch green economy grants

THE European Union (EU) and the Philippines have launched two community grant programs to finance circular economy solutions focusing on informal sector and gender beneficiaries.

The grants are funded by the EU Green Economy Partnership with the Philippines, which is backed by a P3.67-billion (60 million euro) grant from the EU, the United Nations Development Programme (UNDP) said in a statement on Wednesday.

The partnership began in 2023 and will run until 2028.

“More than just financial support, the grants recognize the significant role of the people and partnerships and reflect a shared commitment to collaboration, capacity-building, and long-term sustainability. By leveraging the ex-pertise and networks of civil society, and academic institutions, LGUs (local government units) can lead circular economy implementation, and improve both environment and local economic resilience,” Department of the Interior and Local Government (DILG) Assistant Secretary for International Relations Lilian M. de Leon said.

The EU and the Philippines will launch community grants and circular economy education and behavioral change grants that will support initiatives in 10 partner LGUs aimed at reducing waste, promoting inclusion, and raising environmental education.

Environment department Policy, Planning and International Affairs Undersecretary Jonas R. Leones said the grants will focus on institutionalizing the role of the informal waste sector.

“The grants are part of the EU’s broader partnership with the Philippine government to build greener, more resilient communities. Spearheaded by the Department of Environment and Natural Resources (DENR), the Green LGUs project is co-implemented with the Department of the Interior and Local Government (DILG) and the United Nations Development Programme,” the UNDP said.

The UNDP is accepting grant proposals until May 5.

“Full participation of and collaboration with LGUs and CSOs ensures the sustainability of social enterprises and cooperatives, key to advancing the Philippines transition to a circular economy,” UNDP Philippines Resident Representative Selva Ramachandran said.

The EU-Philippine Green Partnership is co-funded by Germany’s development agency GIZ, and implemented by UNDP Philippines, Expertise France with Global Green Growth Institute, and the International Finance Corp. — Aaron Michael C. Sy