Sectoral parochialism is a limited outlook focused only on the favorite sector of certain groups of people. Only their sector is very important, the others are less important. Hence, more public resources should be poured into their sector and less funding be given to the others as much as possible.

Fiscal realism is having a broader outlook on the overall economic and social sectors of a country with a realistic view that fiscal resources are limited while public wants are unlimited. Thus, based on Constitutional provisions or dominant values of the people in a particular period, fiscal resources are reallocated accordingly.

I made up these definitions myself as I realized there are no existing definitions when I checked the search engines like Google, Bing and Yahoo.

So sectoral parochialism is present in all sectors and sub-sectors of the economy. Those in the education sector, police, and local governments sector, defense and military sector, social welfare sector, health sector, agriculture sector, and so on will argue that their sectors must get more of the budget every single year.

Department and agency’s annual budget preparation get inputs from local government units through the various regional development councils. Civil society organizations (CSO) and non-government organizations (NGO) input are also considered. For instance, there is a big NGO network called the Alternative Budget Initiative (ABI) with sectoral clusters. The Department of Health (DoH) holds an “Annual Consultative Meeting with CSOs on Budget Proposal” and this is participated by Health cluster NGOs and held usually in early February of each year.

Since it is nearly impossible that people will not insert their biases and sectoral or political interests when given the chance to propose budget spending, then it is safe to assume that there is “LGUs pork” by elected mayors and governors, and “NGOs pork” by self-appointed people’s representative CSOs. These leaders may not accept the term but that is part of the annual process of budget preparations before the proposed budget is submitted to Congress by late July to mid-August.

In a sense, Congress (the House and Senate) come in late with budget insertions or “Congressional pork,” but they do make the ultimate decision over which of the projects and programs funding submitted by agencies will be retained, increased, or cut.

PHILHEALTH IDLE FUNDS

A number of columnists continue to criticize the Department of Finance (DoF) for its decision to tap the P90 billion in so-called idle or excess funds of the Philippine Health Insurance Corp. (PhilHealth) to fund some unprogrammed appropriations like foreign-assisted projects, government infrastructure, and social programs, payment of personnel benefits, etc.

The usual arguments against this move by the DoF and the economic team (including the Department of Budget and Management and the National Economic and Development Authority) are the following:

1. If those projects are indeed vital and crucial for economic growth, Congress should have prioritized them and included them among the programmed appropriations with regular funding and not put them among the unprogrammed appropriations with unprogrammed funding.

2. The integrity of our social health insurance should be protected so its funding should not be diminished and used for other sectors. (This is the standard sectoral parochialism argument.)

3. Instead of including more of Congress’ pork projects in programmed appropriations that bump off funding for some important programs, the DoF should call out the legislators instead for diverting PhilHealth funds for unprogrammed appropriations.

4. PhilHealth’s excess funds will qualify only as “idle” funds once we have already achieved universal healthcare (UHC) in the country, implying 100% health insurance coverage and, by extension, having out-of-pocket expenditures (OOPE) for healthcare reduced to the minimum if not eliminated.

As discussed in this column last week, “PhilHealth’s idle funds and health spending in Asia” (Aug. 27), the four points and related arguments have become predictable, repetitive, and unconvincing. And here are the reasons why.

On point one, even excluding the unprogrammed appropriations, excluding Congressional pork, the programmed budget deficit as submitted to Congress is already big — it was P1.50 trillion in 2023 and P1.36 trillion in 2024 — because of sectoral parochialism plus LGU pork and NGO pork.

On point two, members’ contributions (from P106 billion to P158 billion from 2021 to 2023) will not be used elsewhere, they will go to members’ benefit claims (from P85 billion to P153 billion in 2021 to 2023). It is the money from gamblers and bettors (portions of the remittances from the Philippine Amusement and Gaming Corp. or PAGCOR and the Philippine Charity Sweepstakes Office or PCSO), plus money from drinkers and smokers of legal products (portions of the alcohol and tobacco tax revenues), which average around P80 billion/year over the same period, that are being tapped for the unprogrammed appropriations.

On point three, LGU pork, NGO pork, and Congressional pork have become realities in our annual budget. It is difficult to quantify how much the pork for each of these three groups is because they are embedded in each agency and department. And it is not good to single out one while giving the other pork a pass.

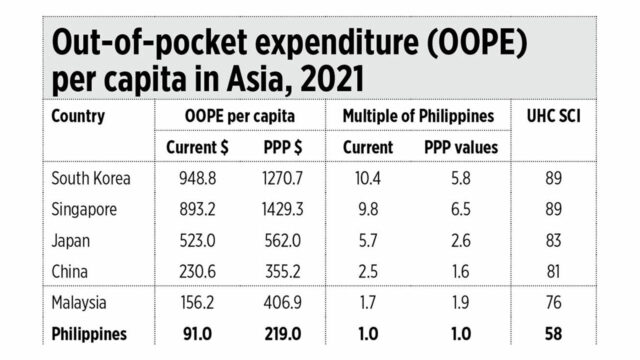

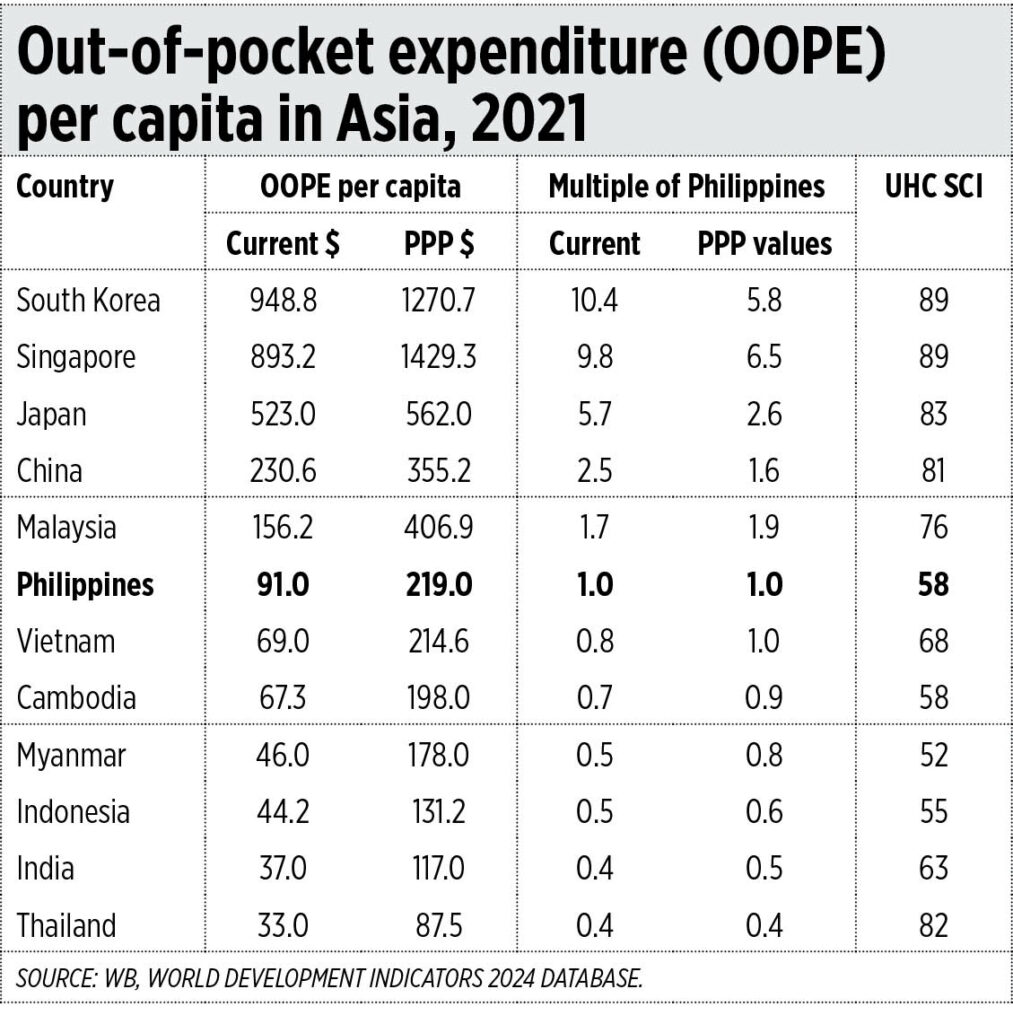

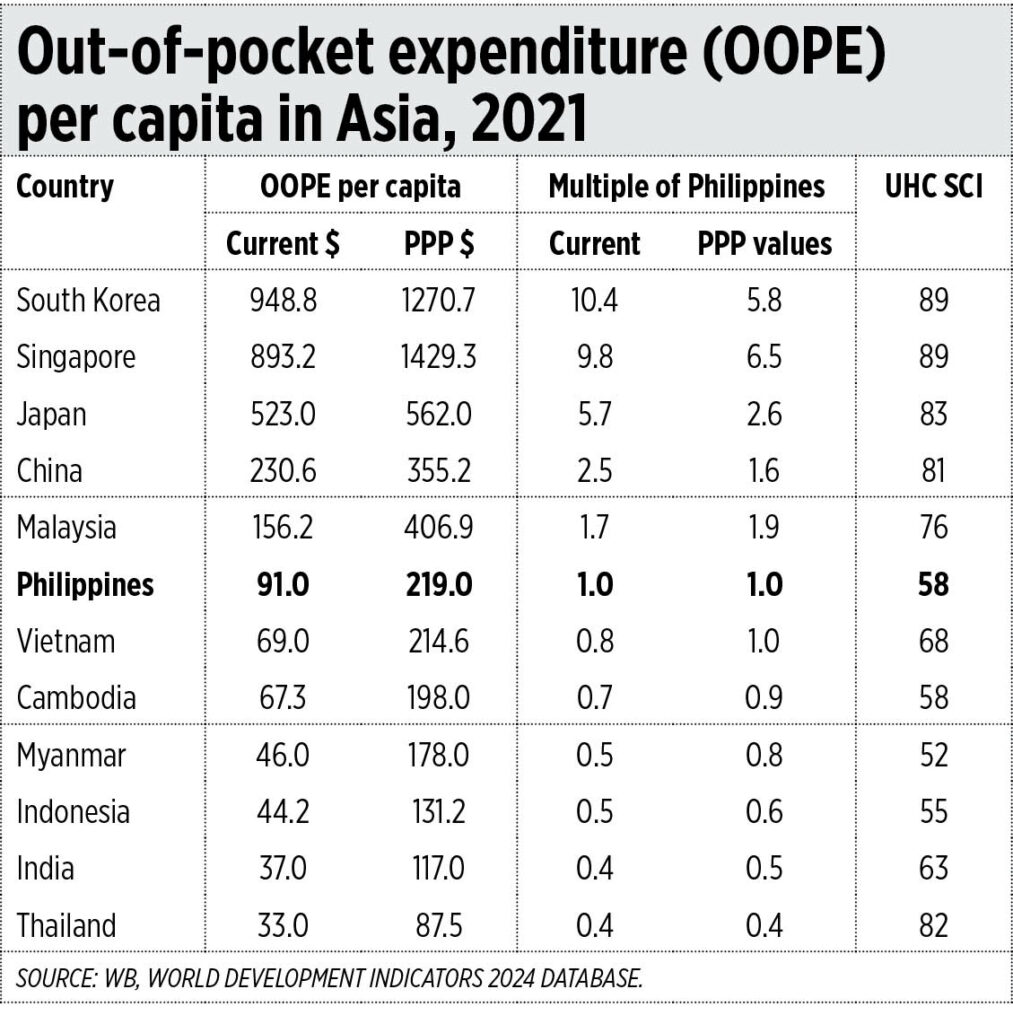

On point four, 100% UHC coverage is a pipedream, an illusion that even very rich countries like Singapore and Japan cannot attain until today. For instance, in 2021, OOPE per capita in Singapore was $893 in current or nominal values and $1,429 in purchasing power parity (PPP) values, which are already 10 times and 6.5 times larger than Philippines. Yet Singapore has a UHC service coverage index (SCI) of only 89, same as South Korea, never 100% (see the table).

Even in theory, UHC will never happen. Even if the UHC budget is P1 trillion or P2 trillion/year out of the P6-trillion total budget, it will not be enough. Why?

Because whenever a service is free, demand will always be larger than supply, 100%. Just a mild fever and some people will demand hospital confinement — anyway, the UHC fund has a trillion pesos. A patient that has recovered after two- or three-days confinement will demand to stay for several days more, anyway it is at zero cost to them. And hospitals, physicians and other professionals will accommodate this kind of patient and raise their fees — the UHC fund is in the trillions of pesos anyway.

What forced UHC and health socialism will achieve is not 100% coverage but 100% fiscal collapse. The government debt stock to fund very costly UHC will keep rising to the stratosphere and debt servicing for principal plus interest will be at the lower layer troposphere.

With the persistent opposition to the reallocation of PhilHealth’s “idle funds” for other sectors even for a single year, the health sector has shown itself as being addicted to the gambling fund, the alcohol and tobacco tax fund, while at the same time lambasting alcohol and tobacco products. This is double talk and lacking intellectual honesty.

I think the public health advocates and lobbyists should thank the DoF because it is helping them to wean themselves away from addiction of gambling tax, alcohol and tobacco tax money.

Finally, we should go back to assuming more personal responsibility in running our own lives. Healthcare, education, food are first and foremost a personal and parental responsibility, secondarily a government responsibility. And fiscal realism should prevail over sectoral parochialism.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.

minimalgovernment@gmail.com