An interesting spin on Philippine colonial history

FOR writer and podcaster Lio Mangubat, fascinating yet less well-known tidbits of history had always been the driving force behind his many endeavors, be it a magazine article or an episode of his podcast The Colonial Dept.

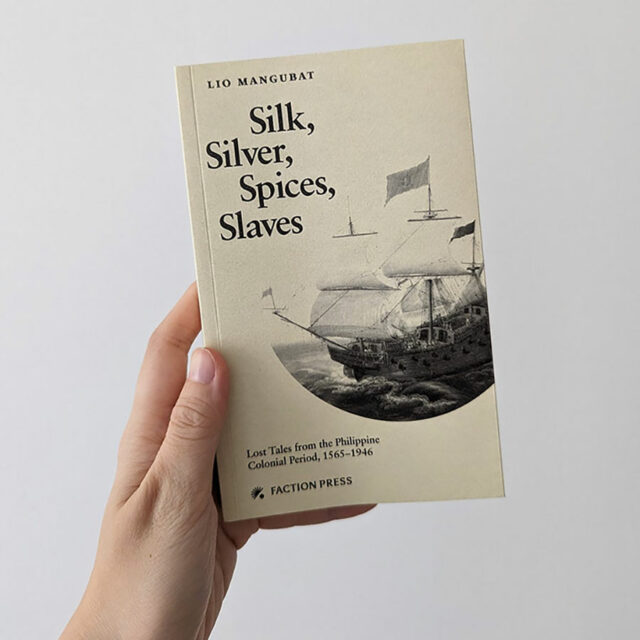

He was therefore pleasantly surprised when Singapore-based Faction Press’ publisher Chye Shu Wen reached out to him and suggested compiling all the research and writing he had done for various articles and podcast episodes into a nonfiction book. Thus Silk, Silver, Spices, Slaves: Lost Tales from the Philippine Colonial Period, 1565-1946 was born.

The book features 13 essays on episodes of history that were not taught in school, from Mexican fighter pilots flying dangerous missions over the Philippines during World War II, to the importation of talented Filipino orchestras and bands in Shanghai, to American occupiers falling victim to a mysterious illness called “Philippinitis.”

Silk, Silver, Spices, Slaves was first launched in July, is included in the top reads at the Kinokuniya bookstore in Singapore. It is now available in the Philippines at the independent bookstore Everything’s Fine in Makati City.

“I love that I’m in Kinokuniya, but this is a book about the Philippines, written by a Filipino, and I’m proud of that. We need more of these kinds of books in our reading diet,” Mr. Mangubat said at an Aug. 31 talk at Everything’s Fine.

“My main consideration is that I really wanted to make history accessible, entertaining, something fun to read,” he said. “You get immersed in another world, and it’s a world that actually happened. It transports you.”

FASCINATING FACTS

Silk, Silver, Spices, Slaves tackles a wide range of topics, some peculiar and others a marvel to ponder.

One chapter talks about how baseball was once the most popular sport in the Philippines, which Mr. Mangubat first discussed on his podcast and later adapted into the book.

“To think that we have a very huge and strong basketball culture here now when, less than a hundred years ago, it was another sport capturing the imagination of Filipinos!” he said.

The chapter follows an all-Filipino baseball team (unfortunately named the Brownies for, well, obvious reasons) and their tour of America, where they played exhibition games. It culminates with a match where they face off with the all-black team.

Mr. Mangubat said at the talk that one of his favorite chapters is on his interview with Filipino-American author Albert Samaha, whose book Concepcion traced the story of his ancestors. On Mr. Samaha’s mother’s side, he is descended from Maguindanao sultans, while on his father’s side, he is descended from the family of Andres Bonifacio.

“There’s a line in it where his great-grandparents met in a schoolhouse in Mindanao, and the way he wrote it was that there was an American flag fluttering above the daughter of sultans and the son of revolutionaries, and they fell in love. And I thought, wow, that is such a great encapsulation of the colonial era, of the Philippines,” said Mr. Mangubat.

He invited the author to guest on his podcast, but the book goes even further by describing Mr. Samaha in detail, bringing him to life for the reader.

SOUTHEAST ASIAN VOICES

Faction Press’ Ms. Chye explained that, while they are new in publishing, the need for more Southeast Asian voices in literature around the world is a pressing one that must be addressed.

“The fact that the book is doing well in Kinokuniya shows that people want to read more about our region, our history,” she told BusinessWorld. “We want to uplift the voices of Asian authors from different parts of the globe.”

Mr. Mangubat added that he hopes historical nonfiction as a genre isn’t relegated to something academic. “There are lots of history books but, for casual readers, they can be intimidating. A book like this is not geared towards the academe or someone writing a thesis, but towards the average Filipino who can walk into a store and fall in love with history,” he said.

History professor Micah R. Perez from the University of the Philippines, whom Mr. Mangubat consulted for the project, said that Silk, Silver, Spices, Slaves approaches history like it’s an interesting story to tell friends.

An inspiration for Mr. Mangubat was David Grant, who wrote the historical novels Lost City of Z, based on British explorers finding ancient cities in the Amazon, and Killers of the Flower Moon, based on the Osage tribe murders and the founding of the FBI, both of which have been made into films.

“These books showed me you can make history very entertaining. Grant zeroed in on a specific topic and expanded it into a novel, connecting dots along the way. If I had the time, I would want to write a book like that, but I can only manage a chapter per topic,” he said.

While various university and independent presses have published similar types of books over the years, Mr. Mangubat told BusinessWorld that having a plethora of these on the market will build a strong readership of Filipinos interested in history.

“I wish that more of it will continue to get published, and that more of it will be available to many more people.” — Brontë H. Lacsamana