Last week I attended two energy fora: the Power 101: Energy Security in times of La Niña and El Niño seminar for media on April 21-22, sponsored by Aboitiz Power (AP) and the Department of Energy (DoE), and the Giga Summit 2025: The Fusion of Power and Intelligence, on April 24-25, sponsored by the Meralco Power Academy (MPA).

In his closing remarks on Day 2, AP Vice-President for Corporate Affairs Suiee Suarez optimistically said that AP’s “strategy is to diversify its portfolio with renewables and selected baseload builds including energy storage systems, thereby helping overcome the shifts and shocks brought about by changes in the weather, season, and climate. We’ve always aspired to operate and manage our power plants with as much data driven foresight and operational excellence to provide sufficient and reliable power.”

At the Giga Summit Opening messages on Day 1, Energy Department Secretary Raphael PM Lotilla highlighted Meralco’s “primordial role” as it serves Metro Manila and nearby provinces, an area that contributes 48% of the country’s GDP.

Meralco Chairman and Chief Executive Officer Manuel V. Pangilinan, followed by Meralco Executive Vice-President and Chief Operating Officer Ronnie L. Aperocho, launched the company’s “Nuclear Energy Strategic Transition” (NEST) program as the company’s flagship initiative to incorporate nuclear power into the Philippine energy mix as a long-term, low-carbon energy solution.

Various pathways for nuclear power deployment in the Philippines have already been initiated, including partnerships with the International Atomic Energy Agency (IAEA), the Nuclear Energy Agency (NEA), and nuclear operators from France and South Korea for development of greenfield full-scale and large nuclear reactors. The potential deployment of small modular reactors (SMRs) also started via collaboration with the US, and additional studies are being made on how to refurbish and rehabilitate the Bataan Nuclear Power Plant (BNPP).

Most presentations on Day 1 were by nuclear energy developers from different countries. Representatives from Electricite de France (EDF) discussed their Flamanville European Pressurized Reactor (EPR) 3, the “most powerful reactor in the world” with a capacity of 1,650 megawatts (MW), while the Organization of Canadian Nuclear Industries (OCNI) discussed their nuclear history dating back to 1944. The speaker also showed a photo of Ontario Power Generation (OPG) Darlington CANDU (Canada Deuterium-Uranium) Nuclear Station. As part of the Philippines Nuclear Trade Mission to Canada in March 2024, my companions and I entered and toured the facility, which is huge. We also entered OPG’s mock-up reactor.

From the US State Department came a discussion on the US building a large reactor in Poland by Westinghouse, setting up SMRs in Romania by NuScale, one in Canada by GE-Hitachi, and one in Michigan by Holtec.

Meanwhile, the Japan Electric Power Information Center (JEPIC) advised that in Luzon, large conventional pressurized water reactor (PWR) or boiling water reactor (BWR) of 1,000 MW may be adopted, but said that rehabilitating the BNPP may be difficult.

Finally, Korea Hydro and Nuclear Power (KHNP) showed their high-capacity factor nuclear plants, with 81.8% in 2023 and aiming for 10% capacity factor increase in 2025.

On Day 2, Meralco Power Gen (MGEN) President and CEO Emmanuel V. Rubio gave the opening speech and he mentioned, among others, energy decentralization via Distributed Energy Resources (DER), and changes on how and where energy is produced and consumed. Solar rooftops, batteries, and embedded generation no longer fringe technologies but core components of the grid, he said.

During that afternoon’s the roundtable discussion on “The Future of the Philippine Power Industry,” I like Mr. Rubio’s point that “Energy transition is a balancing act between ambitions and reality. Ambitions of additional RE (renewable energy), climate targets, innovative technologies. Reality of fuel prices, fragility of infrastructures. Transformation must happen across the entire energy value chain. At MGEN, we are ready to lead this charge, but it will take all of us — utilities, developers, policymakers, and innovators — to shape a brighter energy future for every Filipino.”

It was a very educational, successful, and packed conference. I learned a lot. Congratulations, MPA.

GDP AND NUCLEAR POWER

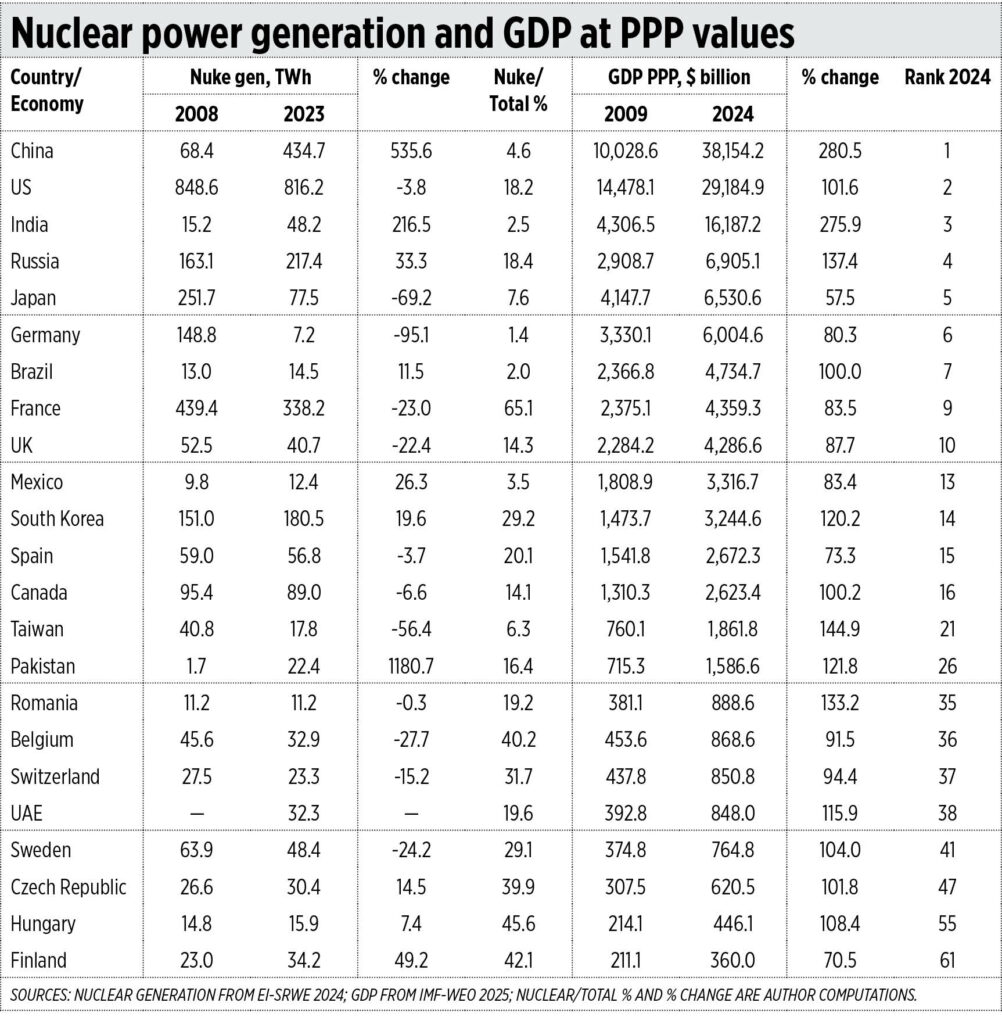

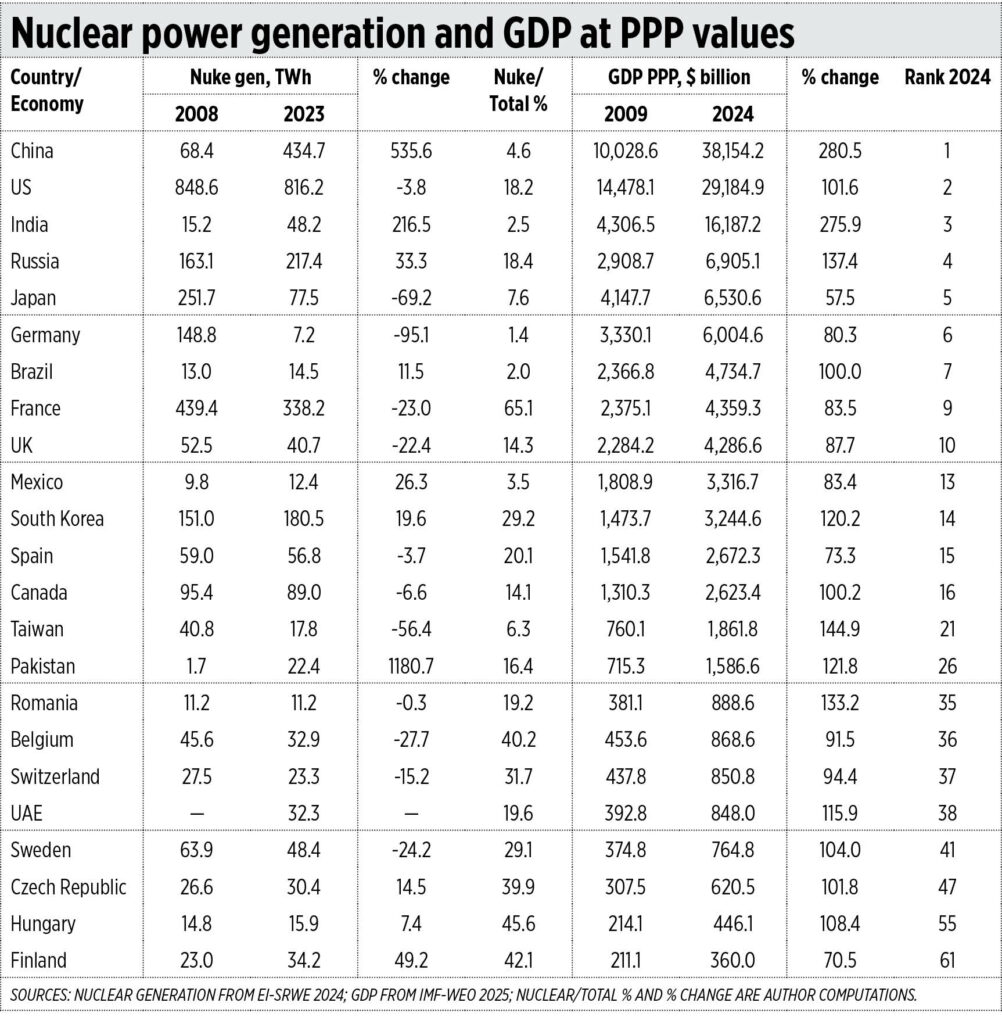

Also last week, on April 22, the IMF released the World Economic Outlook (WEO) 2025 that includes final GDP data for 2024. I downloaded the database in Excel files. Then I compare this with nuclear data from Energy Institute’s Statistical Review of World Energy (EI-SRWE) 2024 that covers data up to 2023 only. SRWE 2025 will be released in late June so I will make a one-year lag in comparison.

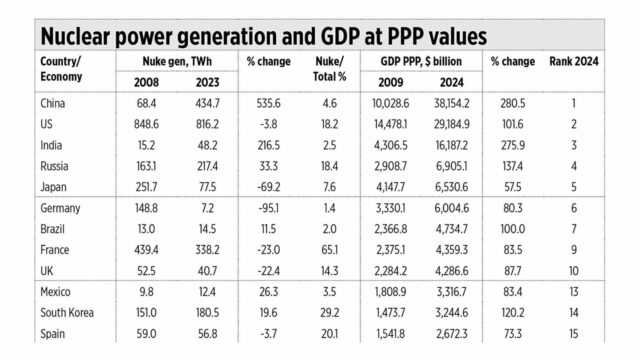

Of the top 16 largest economies in the world in GDP size at Purchasing Power Parity (PPP) values, all have nuclear power except three: Indonesia at No. 8 with a GDP of $4.66 trillion, which largely uses coal which makes up 62% of total generation in 2023; Italy at No. 11 with a GDP of $3.61 trillion and which largely uses gas, which is 44% of the total energy mix; and Turkey at No. 12, with a GDP of $3.46 trillion and which largely uses coal and gas (36% of the total energy mix and 21%, respectively).

The one-year lag comparison shows that the countries with rising nuclear generation, with an increase of at least 20% in 15 years (2008 to 2023) — these are China, India, Russia, South Korea, Pakistan, the United Arab Emirates, the Czech Republic, and Hungary — have seen a considerable increase in their GDP size over the period, one of at least 100%.

And countries with declining nuclear generation — the US, Canada, Japan, Germany, the UK, France, Belgium, Spain, Switzerland, and Sweden — have seen low GDP expansion of at most 80%, except for the US and Sweden (see the table).

The economic data from many countries that deployed nuclear energy show that to further develop and industrialize the Philippines, we should soon turn to nuclear energy to complement and back up our overworked coal and gas plants.

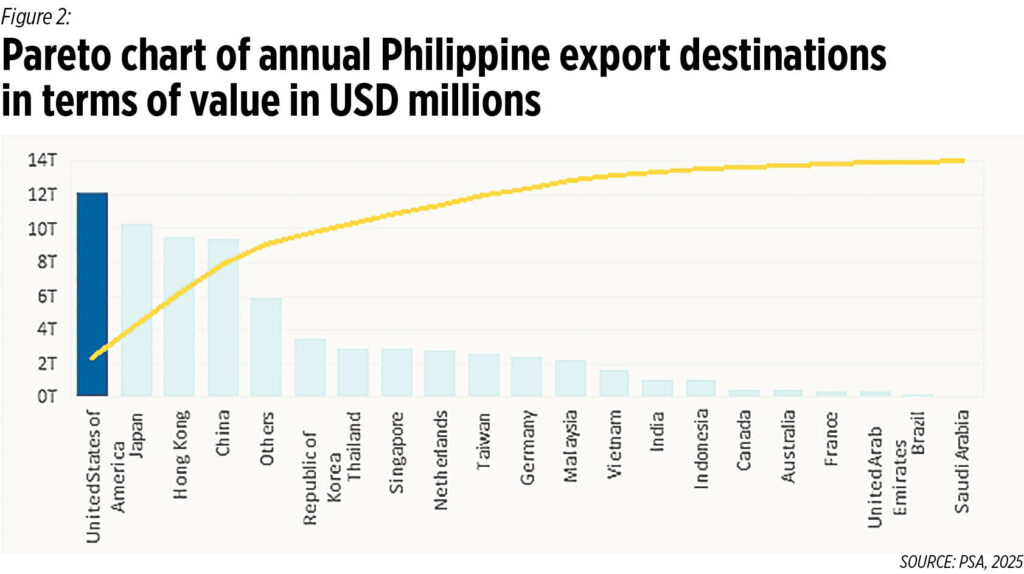

The Philippines was the 31st largest economy in the world in GDP-PPP, with $1.37 trillion, in 2024. We are projected to overtake Malaysia this year for the 30th spot, and are projected to overtake Argentina and the Netherlands in 2026 for the 28th spot.

In average GDP growth over the last three years (2022-2024), of the top 53 economies with a GDP size of at least $500 billion in 2024, the Philippines had third fastest growth of 6.3%, behind India’s 7.3% and Vietnam’s 6.8%.

We exhibit fast economic growth and have a high consumer base with a big population — many investors abroad should be considering coming to the Philippines now. We should welcome them with a good business environment and a stable, reliable, competitively priced electricity supply. Then they will generate more jobs for our people.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.

minimalgovernment@gmail.com