Current demographic trends do not justify reduction of PhilHealth premiums

The recent announcement of the Philippine Health Insurance Corp.’s (PhilHealth) P463.7-billion cumulative reserve fund in 2023, with an annual unutilized fund of P89 billion in 2024, has led to calls for premium reductions. On Aug. 27, as a response, the Senate passed SB 2620, which lowers the PhilHealth premium to 3.25% starting in 2025 and increases it to 4% in 2028. This is lower than the original 5% rate stipulated in the Universal Health Care (UHC) law.

While possible reasons include a lower utilization rate after the pandemic, and the slow increase of benefit payments relative to the rise in premium collections, we need to consider that demographic factors also play a significant role.

The Philippines is undergoing a demographic transition characterized by an increasing working-age population, declining fertility rates, and improving life expectancy, all affecting healthcare utilization and financial reserves. This article explores the demographic factors in detail and their impact on the growing PhilHealth reserves.

The declining fertility rate (1.9 births per woman in the last National Demographic and Health Survey) and growing working-age population (aged 15 to 64) create a potential for a “demographic dividend.” This means our health system will have a larger pool of contributors and relatively fewer dependents.

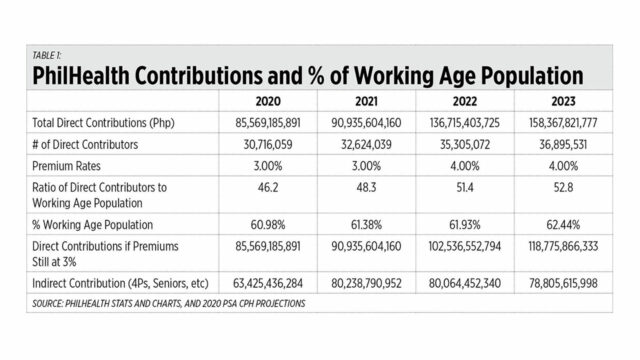

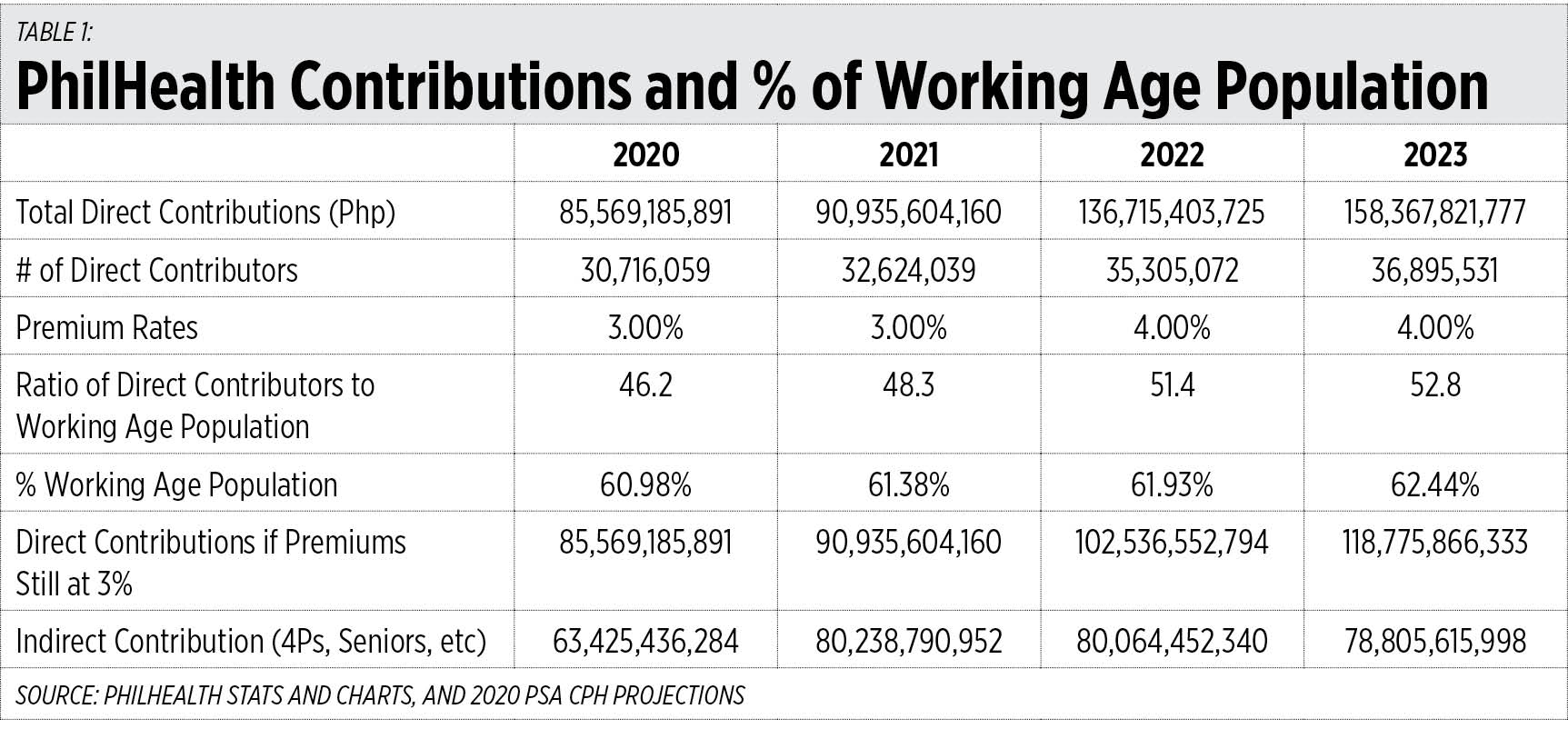

This demographic shift presents both a challenge and a golden opportunity for our healthcare system, particularly PhilHealth. More workers mean more premium contributions, as shown in Table 1, where contributions surged from P85 billion in 2020 to P158 billion in 2023. This will still be true even without premium rate increases. Fewer dependents translate to lower per capita health expenditures vis-a-vis insurance contributions, as health spending is typically highest among the very young and older people.

However, the demographic dividend is not automatic, and forever. Projections in Figure 1 indicate that by 2028, when retaining a 4% premium rate, the surplus will dwindle as our population ages and healthcare costs inevitably rise.

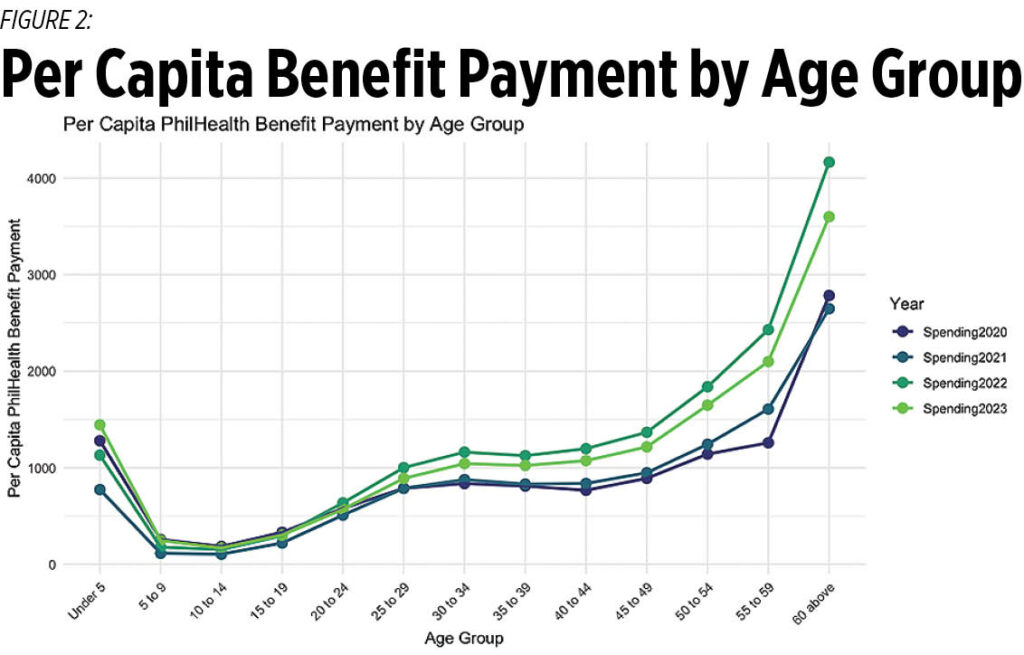

This is further evidenced by the increasing per capita benefit payment, particularly among older age groups, as seen in Figure 2.

SEIZING THE MOMENT: INVESTING IN THE FUTURE

Reducing premiums now might not be beneficial in the long term for several reasons:

• High out-of-pocket expenses: Data from the Philippine National Health Accounts show that Filipino households still shoulder 44.4% of their healthcare costs out-of-pocket. The Longitudinal Study of Ageing and Health in the Philippines found that 67% of older people’s healthcare costs are out-of-pocket, shouldered mostly by their family, despite health insurance coverage. Reducing premiums without addressing this issue can worsen financial burdens on individuals and families facing health crises.

• Opportunity for long-term investment: The current surplus presents a rare opportunity to invest in expanding PhilHealth’s coverage and improving the quality of care. This investment will yield long-term benefits for both the health and economic well-being of the population.

• Preparation for population aging: Lowering premiums could leave the system unprepared for the inevitable increase in healthcare needs as the population ages.

To maximize the benefits of the increased premium collections, we must do the following:

a. Invest the surplus in expanding PhilHealth packages:

• Improve cost coverage to prevent catastrophic health expenditures for individuals and families.

• Invest in high-return-on-investment (ROI) health services (e.g., nutrition, maternal health) that yield strong economic returns throughout the life course.

b. Prepare for the eventual population aging:

• Review premium schemes, especially focusing on making them more progressive to ensure equity and sustainability.

• Explore other sources of financing for health, such as sin taxes or dedicated health funds.

• Increase the efficiency of PhilHealth funds by reducing fraud, covering cost-effective interventions, and focusing on primary and preventive care.

To end, rather than reducing premiums, PhilHealth can expedite the expansion of its benefits package while remaining prudent in its utilization. While it may take time to have the health system to fully implement UHC, some low-hanging fruits can be considered:

• Expedite the roll-out of the expanded primary care benefit package (Konsulta).

• Cover for the provision of discharge medicines that can be integrated into the inpatient benefit packages. While the goal is to cover outpatient medicines eventually, this is easier to implement in the short term as it will not require any additional capital investment from providers as many already licensed hospitals should have their hospital pharmacies address this.

• Re-cost existing high-burden packages. In the current financing scheme, the support cost of PhilHealth for different services varies depending on the case rates. While PhilHealth is in the process of implementing new provider payment mechanisms, in the short term, it can look into making sure its current case rates cover the full cost of care.

References:

Boerma, T., Eozenou, P., Evans, D. B., Evans, T., & Kieny, M. P. (2020). Universal health coverage: Now is the time to invest in health systems. BMC Public Health, 20(1). https://tinyurl.com/2dzr8td8

BusinessWorld. (2024, May 15). “PhilHealth coverage vs. savings hit.” BusinessWorld Online. https://tinyurl.com/249vrf3r

Philippine Statistics Authority. (2024). Philippine population projected to be around 138.67 million in 2055 under scenario 2. https://tinyurl.com/2244npdy

United Nations Population Fund. (2015). Demographic Sweet Spot and Dividend in the Philippines. https://philippines.unfpa.org/sites/default/files/pub-pdf/Demographic%20Sweet%20Spot%20and%20Dividend%20in%20the%20%20Philippines_FINAL_DRAFT_Ver4_OCT2015-withcover_0.pdf

United Nations Population Fund. (2021). A Life Cycle Approach for Transforming Economies. https://asiapacific.unfpa.org/sites/default/files/pub-pdf/210927_unfpa_a_life_cycle_approach_layout.pdf

Dr. Charl Andrew Bautista is a medical doctor working in public health, population, and development. This paper was written as part of his previous course requirements at the University of the Philippines Population Institute.

Dr. Elma Laguna is the current director of the University of the Philippines Population Institute. She is also an associate professor of Demography.

Dr. Michael Ralph Abrigo is a senior research fellow at the Philippine Institute for Development Studies (PIDS).