Behind the 60 Minutes upheaval, a big merger seeking approval

SHARI REDSTONE wanted to know what 60 Minutes was going to say next about President Donald J. Trump.

SHARI REDSTONE wanted to know what 60 Minutes was going to say next about President Donald J. Trump.

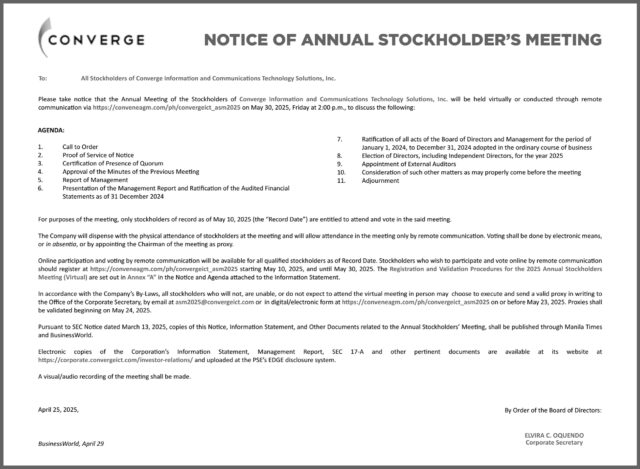

The CBS newsmagazine aired two segments involving Mr. Trump on April 13 that angered the president, one on his plans to take over Greenland and another an interview with Ukraine President Volodymyr Zelensky that discussed US policy in the region. Mr. Trump immediately lashed out on social media, saying 60 Minutes should “pay a big price” for its frequent reporting on him, which he called “fraudulent.”

Following Mr. Trump’s post, Ms. Redstone, who is the chair of CBS’s parent company Paramount Global, had a conversation with CBS Chief Executive Officer George Cheeks to discuss 60 Minutes’ upcoming slate of stories about the president. Ms. Redstone indicated which ones she thought were fair and those that could be problematic, according to CBS employees Bloomberg spoke with.

60 Minutes didn’t change its plans based on her feedback, the employees said. The network aired a segment Sunday about Mr. Trump’s cuts to the National Institutes of Health. Still, Executive Producer Bill Owens announced to his staff last week that he’s leaving, citing corporate interference at the most-watched TV news program in the US.

The 37-year CBS News veteran said in a memo to staff that it had become clear he “would not be allowed to run the show as I have always run it. To make independent decisions based on what was right for 60 Minutes, right for the audience.”

Also on Sunday night, correspondent Scott Pelley closed out the show with an explanation for Mr. Owens’ departure. “Paramount began to supervise our content in new ways,” Pelley told viewers. “None of our stories has been blocked, but Bill felt he had lost the independence that honest journalism requires. No one here is happy about it.”

Mr. Owens’ exit is the culmination of months of conflict between Ms. Redstone and CBS’s news division, during which the billionaire publicly criticized its decision-making and privately pushed for leadership changes, according to interviews with almost a dozen current and former Paramount employees, most of whom asked to not be identified discussing internal company business. Ms. Redstone, Mr. Owens, and Mr. Cheeks all declined to comment. Semafor reported earlier some details about Ms. Redstone’s request to hear about upcoming stories.

Ms. Redstone’s frustrations with the news division began with its coverage of Israel, a subject dear to her heart, and mounted as its reporting on the president jeopardized an $8 billion deal.

Mr. Trump sued CBS last year over the way it edited an interview 60 Minutes conducted with Kamala Harris, a complaint the network has said is without merit. Paramount is also waiting for the Federal Communications Commission to approve its merger with Skydance Media, a deal that includes a $2.4 billion payment for the Redstone family’s holding company. FCC Chairman Brendan Carr, who was appointed to that position by Mr. Trump, has been a staunch ally of the president.

Though the FCC review is officially unrelated to Mr. Trump’s complaint, many at the company believe approval is contingent upon a settlement, current and former executives said.

While the merger hangs in limbo, Ms. Redstone’s final months as a media mogul are engulfed in controversy, as the Boston-bred lawyer is caught between a defiant news division and a president who has sought to punish media companies he sees as disagreeing with him. Many journalists at CBS say they are worried that their corporate overlords are impinging upon their independence to get the deal approved.

“Bill’s departure is a real gut punch,” said Rome Hartman, a producer on 60 Minutes. “We all hope that the sacrifice that he’s making will convince the corporate bosses that the kind of oversight and meddling that they were trying to get Bill to accept is unacceptable.”

CBS News has long been a crown jewel for its owners, a legendary news division that’s been home to Walter Cronkite and Edward R. Murrow. While CBS trails NBC and ABC in the morning and evening audience ratings, 60 Minutes is the steward of that legacy. The show’s mix of awarding-winning journalism and celebrity interviews has delivered 8.4 million viewers a night during the 2024-2025 TV season, making it the third most-watched non-sports broadcast on TV. Bloomberg News competes with CBS in Washington and on business coverage.

Owning a news division can also be a headache. News operations can anger politicians and rack up legal bills. Ms. Redstone’s concerns first started to mount after a segment on CBS’s morning show last year.

On Sept. 30, CBS This Morning aired an interview with author Ta-Nehisi Coates about his new book, The Message, in which he expressed sympathy for Palestinians. Host Tony Dokoupil challenged Coates, saying the book sounded like it was written by an extremist. In response to many upset staffers, CBS News executives said the interview didn’t meet its editorial standards and reprimanded Dokoupil.

Ms. Redstone disagreed with the decision. “They made a mistake here,” she said during an Oct. 9 appearance at a media industry conference in New York. “I think we all agree that this was not handled correctly.”

Ms. Redstone, who is Jewish, has been heavily involved in causes related to Israel. She has devoted an increasing amount of her time to combating anti-Semitism since Hamas attacked Israel in October 2023, and has even told friends it’s one of the reasons she was ready to give up her family’s media empire, according to people close to her.

Her frustration with CBS News increased in January when 60 Minutes ran a piece about State Department officials who resigned over the US government’s support for Israel in the Gaza war. Ms. Redstone expressed her displeasure to Mr. Cheeks, and began suggesting the company make changes at 60 Minutes.

The day after that piece aired, CBS announced that Susan Zirinsky, the former head of the news division, would return to oversee standards. In a memo to staff, Mr. Cheeks said her mission was to ensure “balanced, accurate, fair and timely reporting, including highly complex, sensitive issues like the war in the Middle East,” Variety reported.

The appointment irked Mr. Owens, according to people who work for the company. 60 Minutes has long operated with a degree of independence that is rare in journalism. Though technically part of CBS News, the show sees itself as a separate entity. The producers often ignore requests and dictates from their corporate overlords, creating tension between the show and the rest of the division. Ms. Zirinsky added a level of scrutiny that hadn’t existed before.

She and Mr. Owens also had a history, having both worked at CBS News for decades. Ms. Zirinsky had been a top contender for the job of leading 60 Minutes, ultimately losing out to Mr. Owens. Ms. Zirinsky didn’t respond to a request for comment.

Ms. Zirinsky’s appointment, which Ms. Redstone supported, was in the works before the State Department piece ran, the people said. It allowed Ms. Redstone to deflect any questions about her intervention in newsgathering. Ms. Redstone officially kept her distance from the news division, channeling any frustration through Mr. Cheeks, who is expected to have a role at the new company. Mr. Cheeks and Mr. Owens, once friendly, all but stopped speaking to one another.

60 Minutes kept reporting on Mr. Trump, examining changes at the Justice Department and the dismantling of the US Agency for International Development. Most of them were narrated by Pelley, a longtime Owens collaborator and ally.

Despite Mr. Trump’s lawsuit against CBS, Ms. Redstone and executives at Skydance still assumed their deal would close by the end of March or early April, the people said. There were no antitrust concerns and the new entity would be controlled by Larry Ellison, a major Trump supporter, and his son David.

Throughout the end of 2024 and start of 2025, executives at Skydance met with all the top leaders at Paramount to introduce themselves and hear their perspective. Skydance executives have sketched out the leadership team of the new company, but made no official announcements or decisions while the deal is pending.

Former NBC leader Jeff Shell, who is expected to be the president of the combined company, met once with Mr. Owens, who came away heartened that Skydance was supportive of 60 Minutes.

Yet as weeks ticked by, the Paramount-Skydance deal seemed no closer to approval. It became clear to leaders at both companies that the FCC wouldn’t bless the deal until CBS had settled its suit with Mr. Trump. The FCC called upon CBS to release the full transcript of its interview with Harris, which Mr. Trump argued had been edited deceptively to help her win the election.

Mr. Owens initially refused, not wanting to kowtow to the president. Other media companies, such as Walt Disney Co. and Meta Platforms Inc., had paid Mr. Trump millions of dollars to settle lawsuits, and yet Mr. Trump still criticized both companies.

“It was edited not to make her look good or make her look bad,” said Hartman, the 60 Minutes producer. “It was edited for brevity and clarity because we couldn’t run the raw interview. We didn’t have time.”

Executives at both Paramount and Skydance believed CBS should release the transcript of the Harris interview to prove they had nothing to hide. While many felt that 60 Minutes didn’t commit any mistakes grave enough to merit a lawsuit, some inside the company thought the piece shouldn’t have been edited the way it had been, according to several current employees.

Mr. Owens released the transcript in February, but that did little to calm Mr. Trump or the FCC. As Mr. Owens began to weigh the situation, his future at CBS looked uncertain. Ellison was going to make changes in the news division, assuming the deal goes through. And if the Trump fight tanked the deal, Ms. Redstone would blame 60 Minutes, some of the people said.

Mr. Owens gathered his staff in a conference room last week to inform them of his departure. CBS News chief Wendy McMahon spoke, as did correspondents Lesley Stahl and Pelley, with the latter brought to tears. Anderson Cooper, a 60 Minutes contributor, appeared on Zoom from Rome, where he was reporting for CNN. Multiple attendees described the meeting as emotional.

Mr. Owens didn’t officially resign in protest. He and Paramount mutually agreed to part ways – a settlement that will pay him out for the rest of his contract. He hasn’t spoken to the press, though the audio of his meeting was leaked – as was his parting memo. Mr. Owens is still roving the hallways, although sitting out on screenings of upcoming segments.

Executives at Paramount and CBS are aiming to settle the suit with Mr. Trump as soon as possible. Both sides have agreed to mediation. News staffers and media watchdogs are keeping a close eye out for the terms, which may include contributing money to a Trump library and apologizing for the Harris edits, some of the people said.

The Center for American Rights, a nonprofit, public-interest law firm, has filed a complaint with the FCC alleging news distortion at CBS. The group recommends that the commission condition the Skydance merger approval on the addition of an independent ombudsman to field consumer complaints of bias.

All of those concessions are possible if Ms. Redstone wants to get the merger approved, the people said. — Bloomberg