By Jomarc Angelo M. Corpuz, Special Features and Content Writer

FOR NEARLY 40 years, BusinessWorld has kept in step with the growing Filipino community by providing competent and responsible reporting of news as well as industry insights and reports that guide readers with the information they need to make informed decisions for their enterprises.

Two of the business paper’s most anticipated releases, its Quarterly Banking Report (QBR) and BusinessWorld Top 1000 Corporations in the Philippines, are published by its comprehensive Research department. The QBR and the Top 1,000 magazine have long served as solid guides for navigating the Philippine business landscape by offering in-depth analysis and data-driven insights.

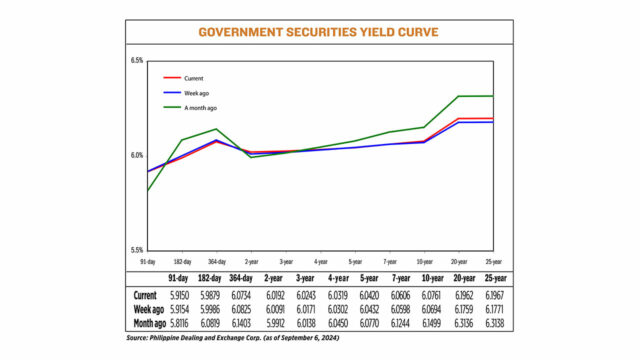

The paper’s QBR tracks the quarterly performance of the Philippines’ largest lenders based on their published statements and ranks banks based on the size of their balance sheets. The banking report helps bankers in the country pinpoint strengths and weaknesses in the industry by identifying significant events in the quarter and gathering expert opinions on the issue.

“We discuss topics and themes that have impacted the quarter, such as the relevant reports that have significantly influenced the banking sector. Then, we ask reliable and credible sources or those with expertise on our topic about their insights and outlook,” BusinessWorld Deputy Research Head Abigail Marie P. Yraola said.

Furthermore, the strength of BusinessWorld’s QBR lies in its rigorous data collection and analysis processes. To ensure the accuracy of the figures encoded in the report, researchers are assigned to fact-check the data multiple times, Ms. Yraola explained. The department then tallies the quarterly performance of banks by providing indicators such as asset size, capital adequacy, liquidity, total loan size, and earnings.

In recent quarters, several key trends have emerged from the paper’s banking report. The previous QBR highlighted digitalization as one of the drivers for the industry’s growth. The Bangko Sentral ng Pilipinas’ (BSP) programs that aim to promote financial inclusion and improve financial literacy have also boosted the sector’s expansion.

“Developments that are also unlikely to be missed are the use of digital channels, such as ‘buy now, pay later’ services and lending apps, that have seen significant growth, even the use of digital banks and other financial technology services,” Ms. Yraola added.

Meanwhile, the annual Top 1,000 Corporations in the Philippines is recognized as the most credible ranking of the country’s biggest corporations based on their performance over the past year. The annual magazine ranks Filipino stock corporations based on their gross revenues from the most recent fiscal year.

Data for the rankings are obtained from the audited financial statements (AFS) submitted by private companies to the Securities and Exchange Commission (SEC) and the AFS of government-owned and -controlled corporations from the Commission on Audit (CoA).

Through these statements, the rankings are derived from business performances from May and December of the previous year, and January and April of the current year with AFC reported in foreign currencies converted to Philippine peso using conversion rates set by the BSP.

“To ensure credibility and accuracy, we have the computation and methodology for the Top 1000 verified by leading auditing firms in the country,” Ms. Yraola assured.

One noticeable feature in the Top 1000 magazine is the difference between the parent company and consolidated rankings. Parent-only financial statements where companies record equitized earnings of their subsidiaries and associates are included in the main table for the Top 1000; while the conglomerate rankings treat both the parent company and its subsidiaries as a single entity.

Another notable feature of the annual publication is the competitors’ table, which shows how companies fared in their respective sectors factoring in their gross earnings. Data from this table shows that the manufacturing sector led all industries in the most recent Top 1000, with total revenues reaching P5.76 trillion, indicating a 20.7% increase compared to the previous year.

Recent editions of the Top 1000 magazine indicate that corporations on the list have helped the country thrive and reflect positive improvements in the Philippine economy that marked the fastest economic growth since 1976, with a 7.6% increase in gross domestic product (GDP) in 2022.

“[In 2022], the combined revenues of the top 1,000 corporations increased by 21.2% to reach P16.68 trillion, marking the highest growth in two years. Meanwhile, the companies [in the list] recorded an aggregate net income of P1.80 trillion in 2022, an increase of 3.1%. Fourteen sectors also logged double-digit growth in the latest edition, while only two sectors posted a decline,” Ms. Yraola said.

Last year’s magazine saw Petron Corp. dethrone Manila Electric Company (Meralco) as the country’s top-grossing company with the former posting P438.87 billion in gross revenue in 2022 and the latter with only P382.42 billion.

Rounding out the top 10 were Shell Pilipinas Corp. with gross revenue of P292.88 billion; BDO Unibank, Inc. (P209.29 billion); Mercury Drug Corp. (P177.59 billion); PMFTC, Inc. (P176.99 billion); Toyota Motor Philippines Corp. (P173.27 billion); Globe Telecom, Inc. (P158.87 billion); TI (Philippines), Inc. (P154.93 billion); and Philippine Airlines (P145.8 billion).

In the same edition of the publication, Top Frontier Investment Holdings, Inc. barely beat out San Miguel Corp. (SMC) as the leading conglomerate in the annual top 200 list with both companies posting P1.58 trillion in gross revenue in 2022.

Petron and its subsidiaries claimed the third spot with P865.58 billion in gross revenues, followed by SM Investments Corp. (P557.68 billion); Meralco (P445.34 billion); San Miguel Food and Beverage, Inc. (P360.18 billion); Aboitiz Equity Ventures, Inc. (P335.65 billion); Ayala Corp. (P332.62 billion); JG Summit Holdings, Inc. (P313.98 billion); and GT Capital Holdings, Inc. (P245.31 billion).

With the 2024 edition of the Top 1000 issue still in the works, avid readers of the publication can expect to find the same trusted and reliable data, along with an extensive process of how the tables were made.

“Readers should look forward to which sectors experienced growth, as well as any that declined; what developments and economic indicators either fuelled, if not dragged businesses. Additionally, readers should also anticipate which companies made it into the Top 1000 league and how well they performed,” Ms. Yraola said.

Moreover, this year’s Top 1000 will have the benefit of having an interactive and digital format for accessing corporate information and analytics through Top 1000 Premium (https://top1000.bworldonline.com).

The Top 1000 Premium maximizes information from BusinessWorld’s vast repository of data amassed from its most recent Top 1000 editions, from the basic company information to the more intricate income statements and balance sheets. Top 1000 Premium carries up to 10 years of Top 1000 data and gives exclusive access to the magazine’s tables, detailed reports, articles, and infographics, among others. This interactive format provides users who will sign up to the platform with the data they need in a user-friendly manner which allows them to navigate the data and process it themselves.

The platform makes it easier to view how a corporation, a conglomerate, or sector has performed, for instance, in the previous year, alongside how it performed in previous years. It also allows a corporation’s performance to be viewed in comparison with its competitors in its particular industry. The Top 1000 Premium can also narrow down the data viewed from, for example, all the values in an income statement to solely the Revenue, Net Sales, or Net Income.

“I think this digital format will amplify readers’ appreciation of the Top 1000 publication and other reports. An interactive plus digital format is the preferred ‘language’ for audiences these days. They need to access data quickly, and digital adoption has become the new norm,” Ms. Yraola said.

In a modern world where numbers and figures indicate the direction of any corporation, the importance of reliable, data-driven insights cannot be overstated. BusinessWorld’s Quarterly Banking Reports and Top 1000 Corporations in the Philippines have stood the test of time, continue to evolve, and remain indispensable resources for those looking to stay ahead in the competitive Philippine market.