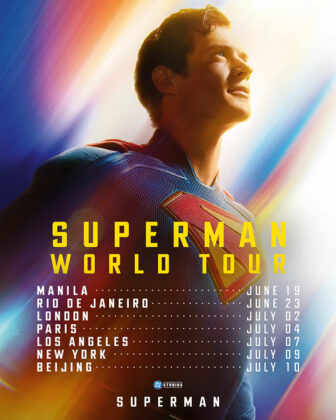

Superman filmmakers, stars to visit Philippines in June

THE first stop of the blockbuster film Superman world tour is Manila this month. Filmmakers James Gunn and Peter Safran and stars David Corenswet (who plays Clark Kent/Superman) and Rachel Brosnahan (who plays Lois Lane) will be traveling all over the world. Scheduled for June 19, the Manila stop includes a fan event to be held at the SM Mall of Asia Music Hall. The movie itself opens in cinemas and IMAX on July 9, distributed by Warner Bros. Pictures.

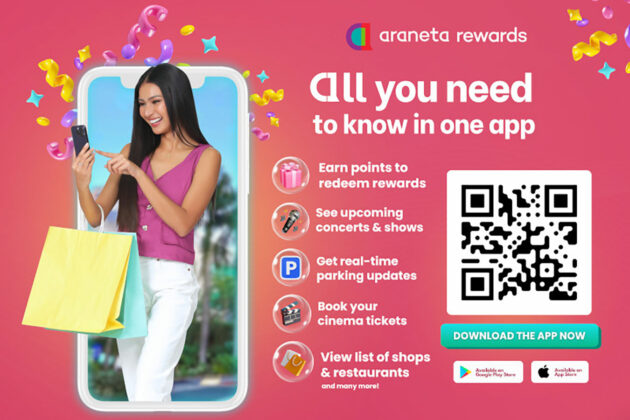

Araneta City launches Araneta Rewards

ARANETA REWARDS, a new loyalty program, is now available through the updated Araneta City mobile app. It will notify members of mall sales and events. Members can also book Gateway Cineplex 18 tickets in advance and check real-time parking availability across over 10,000 slots. The app will also send updates on upcoming shows at the Smart Araneta Coliseum and New Frontier Theater. The Araneta City mobile app is now available on the Apple App Store and Google Play Store, and points can now be earned with Araneta Rewards.

Miley Cyrus releases new album

MILEY CYRUS’ 9th studio album, Something Beautiful, is out now via Columbia Records and available on all streaming platforms. The 13-track album blends emotional clarity with expansive, cinematic production. It features the new song “Easy Lover.” A full-length visual companion to the album will premiere on June 6 at the Tribeca Festival, directed by Ms. Cyrus, Brendan Walter, Jacob Bixenman, and filmmaker Panos Cosmatos. It will have a one-night theatrical release in the US and Canada on June 12, with international screenings beginning June 27.

Jessica Soho marks 40 years with digital archive

TO MARK her 40th year in journalism in 2025, GMA Public Affairs has launched “Jessica Soho @40: Telling the Story of Filipinos.” This digital archive is available on GMA Public Affairs’ YouTube channel. It takes viewers through the journalist’s four-decade legacy of public service and storytelling excellence in her news show. It features curated exclusives, landmark reports, and deeply human stories that shaped national conversations and gave voice to the unheard. New content will be uploaded weekly.

Offshore Music drops Eraserheads tribute album

INDIE LABEL Offshore Music has honored the iconic OPM band The Eraserheads with a tribute record focusing on their album Cutterpillow. Featuring emerging acts, the tribute album marks the 30th anniversary of the landmark alternative rock album and offers a fresh take on the classic tracks. These include Diego’s Scenes and Ligaya Escueta’s emo-charged take on “Back2Me,” Elton Clark’s synth-pop spin on “Torpedo,” Carousel Casualties’ fun rendition of “Walang Nagbago,” Pinkmen’s harmony-rich version of “Ang Huling El Bimbo,” Pixie Labrador’s Lilith Fair-flavored style “Fill Her,” ALYSON’s slick city pop render of “Huwag Mo Nang Itanong,” ena mori’s theatrical reworking of the title track, and Amateurish and Stef Aranas’ dynamic redo of “Superproxy.” Offshore Music is set to premiere a companion online docuseries on June 6, with new episodes dropping every Friday through August.

HOKA to push Global Running Day campaign

ON JUNE 4, HOKA is inviting everyone to celebrate movement in all its forms through the Global Running Day campaign “One Day. All Ways.” The products it is promoting include the Clifton 10 or Bondi 9 for daily miles, the Cielo X1 2.0 or Rocket X2 on race day, trail-friendly kicks Mafate X or Speedgoat, or comfortable hiking buddies Hopara or Anacapa. To run with HOKA, visit any of its stores in One Ayala Mall, GH Mall, SM Aura, and Ayala Malls Manila Bay, as well as Planet Sports Asia TriNoma, Planet Sports Galleria Cebu, Planet Sports Clark City Front Mall, Runnr BGC, Planet Sports Ayala Center Cebu, and online at HOKA.com.

Sponge Cola releases new singles

FILIPINO rock band Sponge Cola has dropped their newest single, “Liwanag,” accompanied by an official music video. The upbeat, feel-good anthem captures Sponge Cola’s signature pop-rock energy, with bright guitars, driving drums, and Yael Yuzon’s unmistakable vocals. It is inspired by the spirit of Filipino summer road trips and spontaneous barkada adventures. Its music video mirrors that vibrant mood, following the band on a summer escapade with friends. It is out now on all digital music streaming platforms.

Thai horror movie Don’t Sleep in Ayala Malls Cinemas

AYALA Malls Cinemas is exclusively bringing to Philippine theaters another Asian horror film this month. The Thai horror-thriller Don’t Sleep, starring Atiwat Saengtien and Pantipa Arunwattanachai, opens on June 4. It is rated R-16. Set against the backdrop of modern-day Thailand, it blends ancient Thai folklore with contemporary themes of guilt, grief, and redemption. The film follows a group of friends who inadvertently awaken dark spirits while playing with a mystical version of a ouija board which plunges them into a harrowing battle for survival.

Thai rapper Milli showcases new single

RISING Thai rapper MILLI has just released a peek at her upcoming album with the single “MENACE,” a suave crossover track with introspective lyrics. The music video is directed by Rose-Ruangsroi Aksornsawang, an award-winning film director, who brought cinematic visuals to an intense storyline that reflects the themes of the upcoming album HEAVYWEIGHT. “MENACE” is out now on all digital music streaming platforms.

Italian Film Festival 2025 returns this June

THE Philippines’ iteration of the Italian Film Festival is back. Happening on June 6 and 7 at Cinema 2, SM Aura, Bonifacio Global City, Taguig, this two-day celebration of contemporary Italian cinema is presented by the Embassy of Italy in Manila and the Philippine-Italian Association. Check out the lineup at SM Aura and Italian Film Festival 2025’s social media pages.

New films on HBO Max this June

THE HBO Original film Mountainhead will premiere this month. Created by seven-time Emmy winner Jesse Armstrong, it stars Steve Carell, Cory Michael Smith, Ramy Youssef, and Jason Schwartzman as four rich tech leaders who gather for a poker weekend in a mountain mansion. Mountainhead premieres on June 1. Meanwhile, Award-winning movies such as The Brutalist (June 21) and Nosferatu (June 28) will also arrive on the platform this month.

Morissette returns to the concert stage with Ember

FILIPINO singer Morissette is set to headline a solo concert, Ember, on Oct. 28, 8 p.m., at the Smart Araneta Coliseum. It will celebrate 15 years of music, milestones, and global impact, charting her early days as a powerhouse teen vocalist on The Voice of the Philippines, to performing alongside icons like Michael Bolton and Alan Menken, to her award-winning performance in the musical film Song of the Fireflies which premieres in cinemas on June 25. Ticket details for Ember will be released soon.

Prime Video releases June slate of TV shows, movies

PRIME VIDEO is turning up the heat this June with a lineup of new titles, including the sci-fi adventure Borderlands (June 9), the action-comedy Deep Cover (June 12), and the haunting mystery series We Were Liars (June 18), based on the best-selling novel. Fans of supernatural romance can look forward to Head Over Heels (June 23), while crime drama enthusiasts can expect Countdown (June 25), led by Jensen Ackles.

Puregold to hold OPM Con in July

THE music event OPM Con 2025, hosted by supermarket chain Puregold, is coming up on July 5. It will bring together some of the biggest names in Filipino music: SB19, BINI, Flow G, Skusta Clee, KAIA, G22, and SunKissed Lola, among others. Over 50 Puregold branches will be giving free tickets to the event, with a minimum single receipt purchase of groceries that corresponds to their ticket type: P1,500 worth of purchases for general admission, P2,500 worth for Upper Box, P3,500 worth for Lower Box Regular, P4,500 worth for Lower Box Premium, P5,000 worth for Regular Patron, P6,000 worth for Premium Patron, and P7,500 worth for VIP Standing with Sound Check. For more information, visit Puregold and Ticketnet.

AXEAN Festival goes to Bali this September

FROM Sept. 13 to 14, the AXEAN Festival will light up the Jimbaran Hub in Bali, Indonesia, as musicians from all over Southeast Asia prepare to perform onstage. The intra-regional music event will showcase over 40 emerging and established acts. For the first time, the AXEAN Festival will be shining a spotlight on Southeast Asia’s burgeoning rave, dance, and electronic culture with the launch of its SEA Club Showcase, a live music platform dedicated to regional electronic subcultures — Indonesian funkot or dangdut, Vietnamese vinahouse, Singaporean/Malaysian manyao, and Filipino budots.

The Fray’s 20th anniversary tour comes to Manila

AMERICAN pop-rock band The Fray is set to bring its How to Save a Life: 20th Anniversary Tour to the Philippines on Dec. 12 at the Smart Araneta Coliseum. Celebrating two decades since the release of their legendary debut album, this special tour will feature original member Joe King, the band’s guitarist, vocalist, and main songwriter, taking on lead vocals. He’ll be joined by longtime guitarist Dave Welsh and drummer Ben Wysocki.