Addressing high inflation in the Philippines — the role of policy mix

THE Philippine economy has witnessed a robust performance over the past few years. However, such a performance was accompanied by high inflation, which became the main issue of concern. Despite some moderation from its peak of 8.7% in January 2023, headline inflation was 6% for the full year of 2023 while core inflation recorded a notable increase from 3.9% in 2022 to 6.6% in 2023.

What is driving inflation in the Philippines and how can the authorities utilize the “all-of-government” approach to combat inflation?

KEY DRIVERS OF INFLATION IN THE PHILIPPINES

In general, inflationary pressures arise from a combination of demand-side (such as strong economic activities) and supply-side factors (such as increases in wages and commodity prices). A 2023 study conducted by the ASEAN+3 Macroeconomic Research Office on the drivers of Philippine consumer price index (CPI) inflation found that Philippine inflation was mainly driven by supply factors in 2022. However, thanks to the positive output gap, demand factors have become the main driver in 2023 (see the Table).

The rise in headline inflation in 2022 was largely driven by external supply factors such as surges in international commodity prices due to global supply chain disruptions and depreciation of the local currency. However, the persistence of high inflation in 2023 was mainly due to domestic demand factors, including a positive output gap thanks to robust growth performance and second-round effects induced by minimum wage hikes and expectations of persistently high inflation. At the same time, local supply shocks, such as typhoons, animal diseases, and other natural disasters, also contributed to the high inflation (see Figure 1).

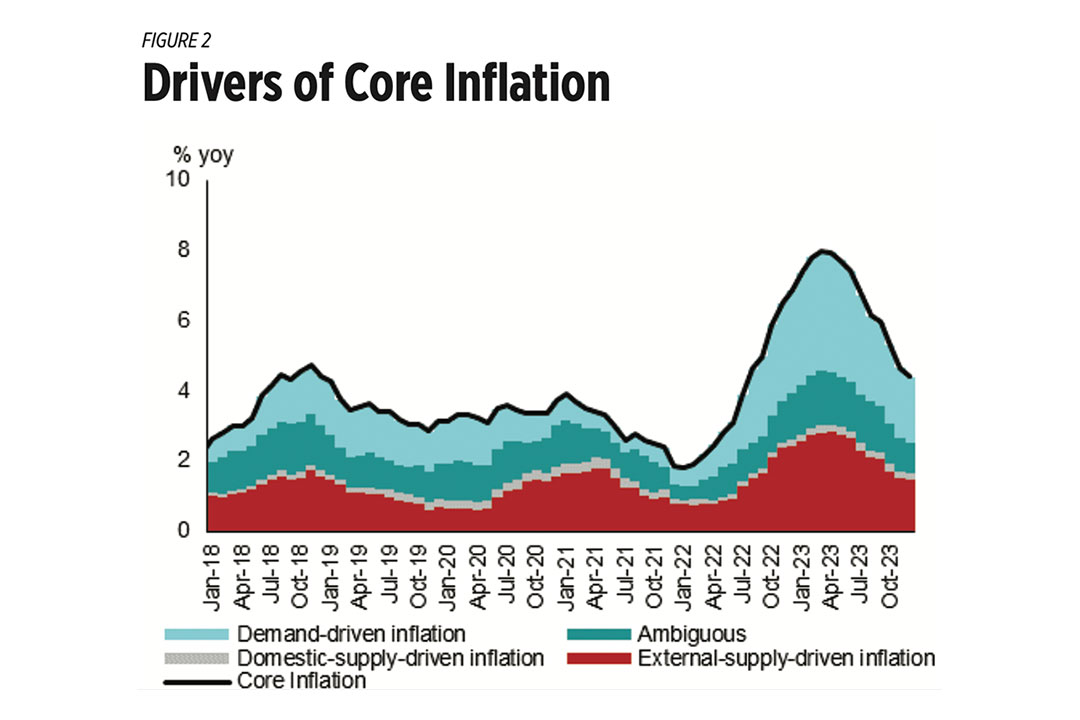

Meanwhile, both demand- and supply-side factors continued to influence prices in the Philippines over the past two years, leading to high and persistent core inflation which excludes selected volatile food and energy components.

‘ALL-OF-GOVERNMENT’ POLICY MIX

Having an in-depth understanding of the country’s inflation dynamics and the underlying drivers is vital to the setting of policies for the Philippine economy. In particular, the empirical results support the Philippine authorities’ “all-of-government” approach, which comprises both monetary and non-monetary measures, as it was timely and appropriate to curb persistently high inflation, which was driven by buoyant demand and supply shocks, in 2022-2023. Aided by a moderation in international commodity prices, monthly headline inflation has declined from its peak of 8.7% (year on year) in January 2023 to 2.8% in January 2024.

Our findings showed that demand-side factors dominated in driving inflation in mid 2022 through 2023, which implies that the use of demand management policy — tightening stance of monetary and fiscal policy — was warranted. Between May 2022 and end-2023, the Bangko Sentral ng Pilipinas (BSP) tightened monetary policy aggressively by raising the policy rate 10 times, from a historic low of 2% to 6.5%, which was deemed timely and appropriate.

As growth is projected to remain strong in 2024, the BSP should maintain a hawkish bias and stand ready to tighten the policy rate further if inflation becomes more persistent than expected. The ongoing fiscal consolidation also complements the tightening monetary policy stance in curbing high inflation.

Meanwhile, the contribution from supply-side factors to the high inflation rates was far from negligible. Most notably, prices of key food items, such as rice, onions, sugar, eggs, and pork, have surged to unprecedented levels due to a shortage of domestic supply. The surge certainly would call for the use of appropriate supply-side (or non-monetary) measures to help ease supply constraints.

In the short term, import restrictions should be relaxed by lowering import tariffs, speeding up the administrative processes required for importation, and allowing for more imports of food through the market. These relaxations should remain in place subject to developments in domestic supply and prices.

In the medium to long term, the country should promote a stronger agricultural sector and a more resilient domestic food supply chain to reduce fluctuations in food prices and enhance food security. Specifically, it would be beneficial to introduce institutional reforms, such as land consolidation, enhancement of farmers’ access to financing, introduction of modern farming and innovation through the use of technology, and improvement in the supply chain.

Amid the battle against high inflation, the government can help ease the pain of those most affected through targeted subsidies to the vulnerable groups. Compared to broad-based subsidies, the existing subsidies targeted for the lower-income groups are more appropriate as they can help mitigate the adverse impact of inflation on the vulnerable groups without undermining fiscal sustainability.

Thanks to the use of a policy mix, the Philippine authorities have taken a balanced approach in their attempts to tackle high inflation in recent years. However, the battle is not over yet as there are likely to be more shocks ahead. Supply side factors will continue to play a part as important determinants of Philippines’ inflation dynamics going forward. The authorities should remain vigilant and continue to address challenges which may arise from heightened uncertainty in the global economy, geopolitical conflicts and climate change.

Dr. Andrew Tsang joined AMRO in September 2021. He is AMRO’s country economist for the Philippines and backup economist for Brunei Darussalam.