Replying to SSS: Demonopolize social security

IN a Letter to the Editor yesterday, “SSS clarifies: Not a subsidy for operations,” Mr. Fernando F. Nicolas of the Social Security System (SSS) said that “the P51 billion given to SSS in 2020 was not a subsidy for the agency’s operation (but) wage subsidies to over three million workers nationwide under the Small Business Wage Subsidy (SBWS) program.”

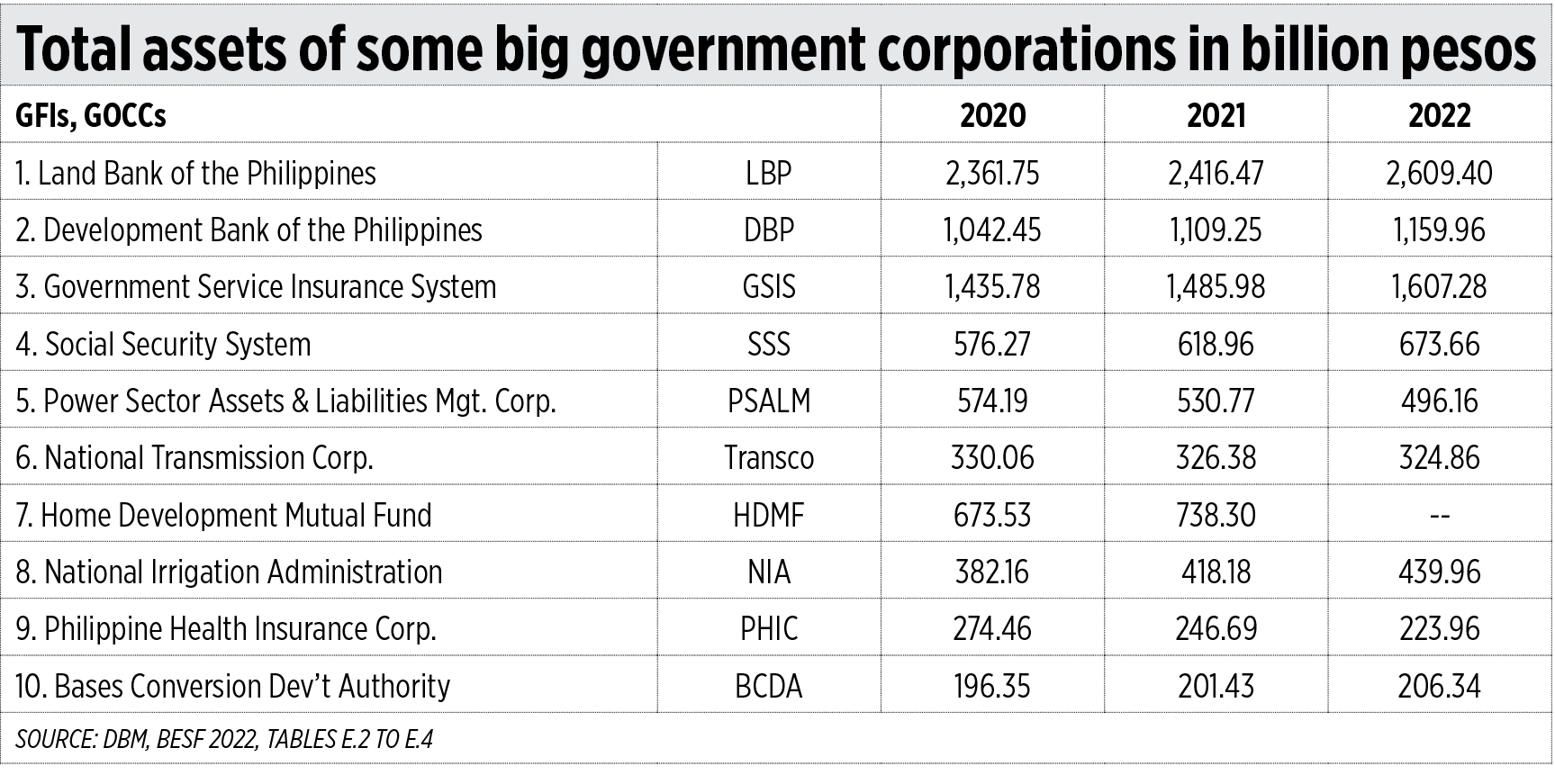

I checked again Tables B.9 and B.11 of the Department of Budget and Management’s Budget of Expenditures and Sources of Financing (BESF) 2022 and the term used is “Budgetary support to government corporations.”

So the SSS is correct, it is “support” to member-workers and not a “subsidy” for its regular operations. My apologies to SSS for mixing them along with PhilHealth, the National Food Authority, the National Irrigation Administration, the National Electrification Administration, Bases Conversion and Development Authority, and other government corporations that just rely on taxpayers’ subsidy yearly to make them “viable.”

Now that we discuss SSS, a state-owned pension monopoly for private sector personnel, we can extend the discussion to another state-owned pension monopoly, that for government sector personnel, the Government Service Insurance System (GSIS). And why they need to be demonopolized and the pension system be made competitive. Three quick reasons.

One, people mobility needs pension mobility. The SSS was created in 1957, and the GSIS was created in 1937, periods when it was generally assumed that people would work, retire, and die in the Philippines. No longer the case now, many Filipinos work a few years here, then work abroad, and go back and forth, even migrate and retire abroad. Same for foreigners who opt to work and retire here. Their pension contributions should be credited wherever they work and retire later. Private pension and insurance firms with a global network would be in a better position to offer this kind of service.

Two, government-owned and -controlled corporations (GOCCs) and government financial institutions (GFIs) like the SSS are political institutions subject to political pressure by any administration in power. Expansion of benefits, even if revenues are not there, extension of funding even to non-contributing members and sectors, are yearly political pressures they must endure and are likely to give in to.

Three, the government needs more privatization money to service and retire huge public debt without any major tax hike. SSS, GSIS, other GFIs and GOCCs are good candidates for privatization in the long-term. SSS and GSIS combined have P2.28 trillion in assets as of 2022.

Government regulations are expanding, not shrinking. When government regulates players and owns some players at the same time, there is a conflict of interest, and favoritism towards government-owned players is inevitable. That is why demonopolization and privatization of those government enterprises should be the appropriate fiscal policy over the medium to long-term.

Read: SSS clarifies: Not a subsidy for operations, Public finance and UPSE’s PDE batch 33