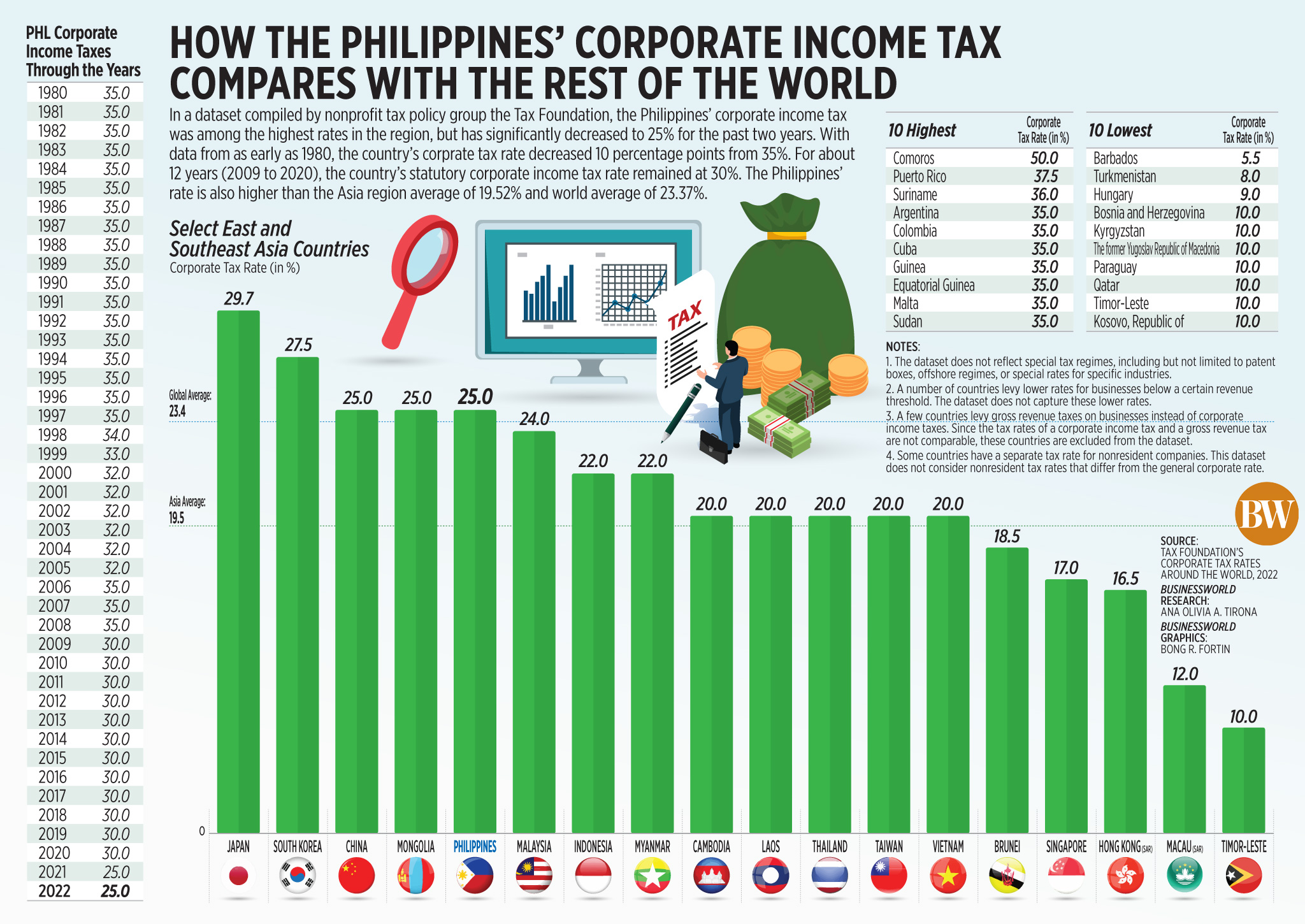

How the Philippines’ corporate income tax compares with the rest of the world

In a dataset compiled by nonprofit tax policy group the Tax Foundation, the Philippines’ corporate income tax was among the highest rates in the region, but has significantly decreased to 25% for the past two years. With data from as early as 1980, the country’s corprate tax rate decreased 10 percentage points from 35%. For about 12 years (2009 to 2020), the country’s statutory corporate income tax rate remained at 30%. The Philippines’ rate is also higher than the Asia region average of 19.52% and world average of 23.37%.