THE Bureau of Internal Revenue (BIR) said it extended the deadline for businesses to obtain the new Notice to Issue Receipt/Invoice (NIRI), a sign which they are required to post on their premises.

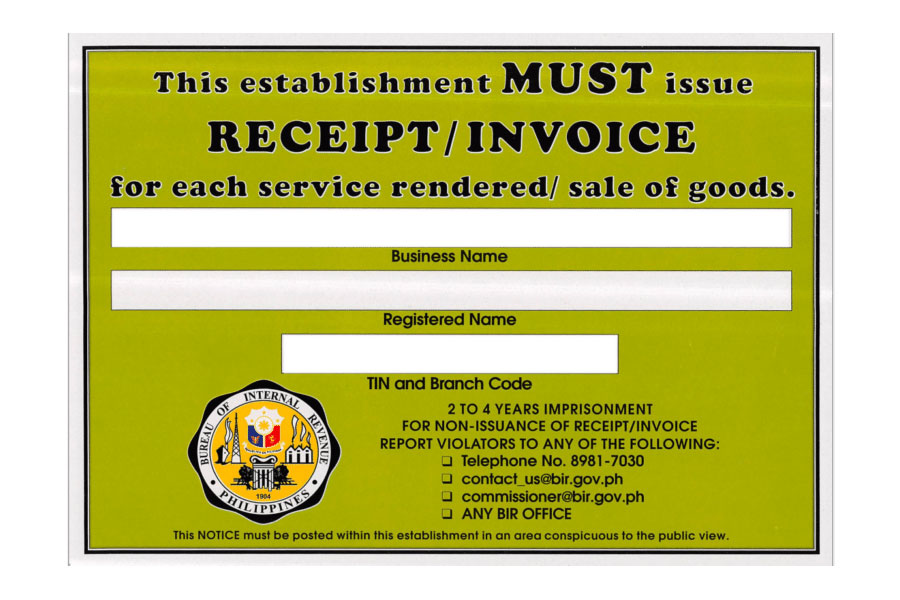

Businesses now have until Sept. 30 to obtain and display the NIRI, which will replace the previous Ask for Receipt Notice (ARN).

“Several inquiries are being received from business taxpayers asking (for an) extension on replacing the ARN with NIRI,” the BIR said in a memorandum circular.

Businesses were initially required to use the NIRI by July 1. Authorization to post the ARN expired on June 30.

“Business taxpayers who failed to renew on or before Sept. 30, 2023, shall be imposed a penalty of a fine not more than P1,000 pursuant to Section 275 of the Tax Code, as amended. The taxpaying public may report business establishments that do not have the NIRI,” it added.

The NIRI must be displayed “prominently” in sellers’ respective establishments, websites, or social media accounts.

“To secure the NIRI, the taxpayer shall fill out the Registration Update Sheet to indicate/update the designated official e-mail address which will be used by the Bureau as an additional manner in serving BIR orders, notices, letters, communications, and other processes to the taxpayers,” it added. — Luisa Maria Jacinta C. Jocson