Data centers expected to be next high-growth property segment

THE data center market is expected to be the next high-growth segment of the property market amid growing demand from prospective operators, according to Santos Knight Frank, a real estate services firm.

The company said it expects the energy drawn by Philippine data centers to “more than double in the medium term,” with an energy requirement of 125 megawatts (MW) projected to be added to the current 94 MW used by incumbent data-center operators.

“This puts us ahead of Vietnam and catching up with Thailand, definitely among the emerging countries for this sector in Southeast Asia,” Santos Knight Frank’s Data Centers Lead Monica Gonzalez said in an online briefing on Wednesday.

Data centers, which are energy intensive, house servers and other equipment that cater to businesses’ online operations.

Santos Knight Frank said data centers are considered an emerging sector globally. The global data center market was estimated at $59.3 billion last year and is expected to grow to $143.4 billion by 2027.

The Asia-Pacific (APAC) is expected to post 90% growth in total data capacity by 2023, with data center spending in the region projected to grow to over $30 billion by 2023.

“The APAC region is actually the fastest growing market for data centers in the world. Not the largest yet, compared to North America, but the fastest-growing currently,” Ms. Gonzalez said.

“In fact, 30% of global revenue of the data center sector will come from the APAC region as early as next year,” she added.

Interest in the Philippines centers on the government’s push to develop infrastructure and digitize many processes, as well as the talent pool of engineering and information technology (IT) professionals, Santos Knight Frank said.

The Philippines’ plan to shift to renewable energy, as well as the underdeveloped market, are also attractive to investors, it said.

“Singapore is the leading hub for data centers in the region but they have a moratorium in place for new data center development because of how the data centers use quite a lot of land and power, so this has pushed the interest to other countries in Southeast Asia that can absorb that demand such as Malaysia, Thailand, and now the Philippines,” Ms. Gonzalez said.

Most of the data centers in the Philippines are located in Metro Manila and are dominated by telecommunications companies.

The typical data center in the Philippines draws power of 5-7 MW or even less, but Ms. Gonzalez said the firm is seeing demand for centers that require 10-70 MW.

Ms. Gonzalez said data centers need at least one to two hectares of land to accommodate a facility that draws 10 MW.

“There’s no perfect location for a data center. The country is exposed to a lot of natural weather patterns and movements but there are areas in the Philippines such as in the southern greater Manila area, Cavite, and part of Laguna, which are relatively hazard-free… these are areas that the data center operators are looking at mostly,” Ms. Gonzalez said.

Santos Knight Frank Head of Investment and Capital Markets Kash Aristotle Salvador said there are at least five or six groups interested in expanding in the Philippines.

“If everything goes well, we could do at least 20 hectares for 2022. This is all preliminary; this depends on how fast they can move in terms of their acquisitions but the demand is there,” Mr. Salvador said.

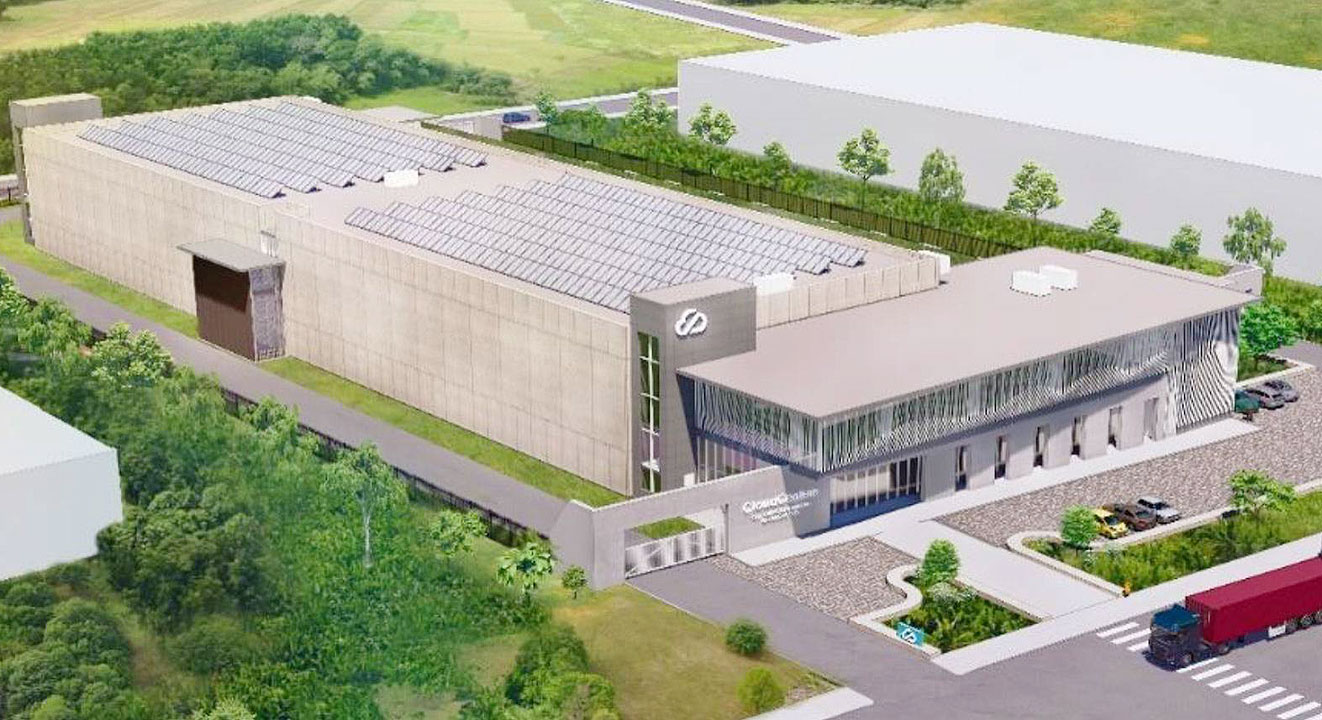

YCO MANILA DIGITAL 1

Separately, YCO Cloud Centers said it is building its first data center serving the capital region, which will be called YCO Manila Digital 1, to be located in Malvar, Batangas.

The company said the project will be a “gateway for the expansion of digital businesses within the Philippines.”

“Our data center will address interest from enterprises seeking to scale their mission-critical workload in the region. Special consideration has been placed on delivering greater connectivity, compute capacity, and coverage in the areas along with sustainable sources of electrical power,” YCO Chief Executive Officer Nik de Ynchausti said in a statement on Wednesday.

YCO Manila Digital 1, with a Tier III/Tier III+ classification, will draw 12 MW, powered by renewable energy. — Keren Concepcion G. Valmonte