Innovative pivot: Startup simplifies financial operations for small businesses

By Patricia B. Mirasol, Multimedia Producer

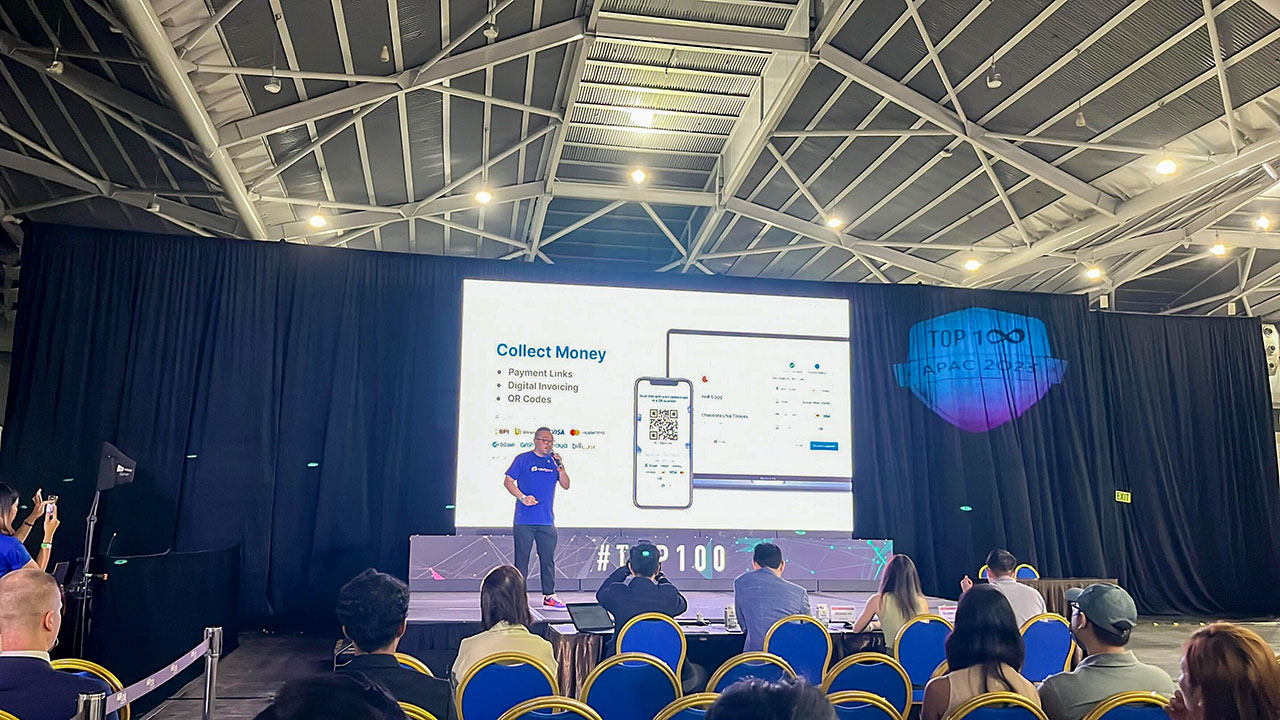

BORN as a financial wellness application in 2020, NextPay quickly morphed into a digital banking suite tailored for small businesses. Its mission? To simplify, streamline, and de-stress financial operations.

The goal was to offer solutions that resonate with the pain points of small businesses, Don Pansacola, co-founder and chief executive officer of NextPay, said in an interview with BusinessWorld.

Businesses used the company’s platform to pay their workforce, and in the process, NextPay would set aside money for the latter on their behalf.

“We’ve built an app where — when people get paid their salaries — we can help them automatically set aside money towards their savings goal, whether it’s towards their emergency fund or even towards aspirational goals like their trip to Japan,” Mr. Pansacola said.

But the pandemic period saw NextPay pivot its services, emphasizing helping businesses with their disbursement needs.

The public health crisis made it “almost impossible” for businesses, especially micro, small, and medium enterprises (MSMEs), to pay their workers, Mr. Pansacola noted.

Many small businesses found banking processes, like opening accounts, daunting.

“Another challenge would be the average daily balance you need to come up with to open such an account,” he added.

“These are not really problems that big companies have to deal with,” he noted. “It’s the MSME market — from the small business all the way down to the entrepreneur — they’re the ones who have no access to these financial services.”

NextPay, Mr. Pansacola said, expanded its services to replace the need to open a corporate bank account.

To date, it serves over 12,000 companies and has processed payments worth of P5 billion.

MSMEs are not just economic units in the Philippines; they are the lifeblood of the Philippine economy, comprising 99.5% of total enterprises.

According to the Philippine Statistics Authority, MSMEs contribute 35.7% of the total value-added in 2020, 60% of all exports, representing 25% of total export revenues, and support 62.7% of total employment.

Many of these businesses grapple with optimizing their digital platforms, making online visibility a challenge. Transforming online engagements into tangible sales is also a daunting task, according to a 2022 report by the United Nations Industrial Development Organization.

Accessing suitable financing options can also be a steep climb for many MSMEs.

Philippine banks failed to hit the mandated quota for small business loans in the first half of 2023, data from the Bangko Sentral ng Pilipinas showed. MSME loans extended by banks amounted to P189.08 billion in the first quarter, comprising 1.93% of their total loan portfolio, or below the 8% quota.

“A lot of small business owners are stuck,” Mr. Pansacola said. “They’re not really able to grow their business because once they reach a certain scale, they’re just stretched too thin.”

Growing a business while managing the operational side of things — not to mention acquiring customers — is challenging, he noted.

“We’re not even talking about having to manage your vendors and ensuring your employees are doing the job they need to do.”

QUICKER PROCESS

Among the company’s clients are Prosperna, an online store builder; Bizu, a patisserie and bistro; and KinderCare, a feeding accessories brand for babies.

Before using the NextPay platform, KinderCare facilitated its payrolls by collecting the timesheets of its more than 100 employees, computing everything, collating the data in an Excel document, and then using two banks to dispense the payments.

“This company literally sends a person to a Palawan Express [a pawnshop offering money remittances and corporate payouts] — with the driver serving as a bodyguard — because she’s holding a lot of cash to send their pay,” Mr. Pansacola said.

The whole process, which used to take three days, has been whittled down to under three hours with NextPay’s platform, which also enables businesses to disburse salaries through a member of staff’s e-wallet or bank account of choice.

While smartphone penetration among Filipinos is 80.34%, only 56% in the country are banked.

Automated platforms also offer automatic reconciliation of payments, so business owners know who paid what, instead of having to ask each customer to send a screenshot of their individual payments.

“That is a big improvement over the current status quo,” said Mr. Pansacola.

NextPay is targeting non-registered MSMEs next.

“I’m sure you know someone, like a tita [aunt] or cousin, who sells something on the side,” said Mr. Pansacola. “They’re not included in the one million MSMEs statistic from the Department of Trade and Industry. If we were to include those people, the number could rise to as high as 40 million. That’s a significant number of people.”

Lending also presents another opportunity.

“If you consider the type of data we have access to, especially as their financial transactions come through our platform, we are positioned to excel in lending,” Mr. Pansacola said.

“We can process loans much faster than the traditional method where businesses would send documents like a business plan,” he noted.

“Our approach has always been there’s always an opportunity that’s not addressed,” he added.