Yields on government debt drop after data

By Lourdes O. Pilar, Researcher

YIELDS on government securities (GS) went down last week following the release of the latest Philippine inflation and gross domestic product (GDP) data and strong demand for the retail Treasury bond (RTB) offering.

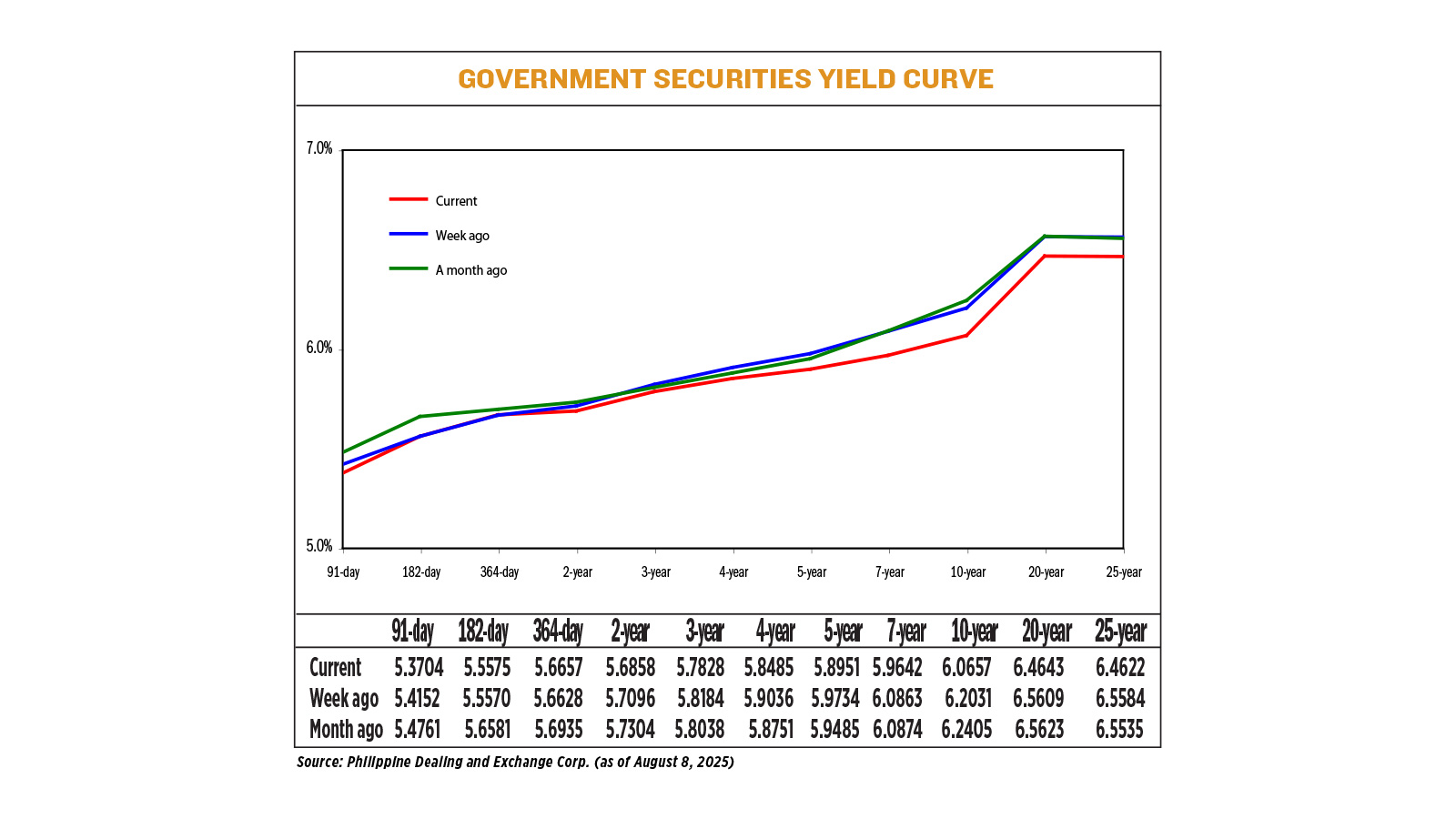

GS yields, which move opposite to prices, declined by an average of 6.24 basis points (bps) week on week at the secondary market, according to data from the PHP Bloomberg Valuation System Reference Rates as of Aug. 8 published on the Philippine Dealing System’s website.

At the short end, rates were mixed. The 91-day Treasury bills (T-bill) fell by 4.48 bps week on week to fetch 5.3704%. Meanwhile, yields on the 182- and 364-day T-bills inched up by 0.05 bp and 0.29 bp to 5.5575% and 5.6657%, respectively.

At the belly, rates of the two-, three-, four-, five- and seven-year Treasury bonds (T-bonds) declined by 2.38 bps (5.6858%), 3.56 bps (5.7828%), 5.51 bps (5.8485%), 7.83 bps (5.8951%), and 12.21 bps (5.9642%), respectively.

Rates at the long end likewise dropped across the board, with the 10-, 20-, and 25-year debt yielding 6.0657%, 6.4643%, and 6.4622%, down by 13.74 bp, 9.66 bps, and 9.62 bps week on week, respectively.

GS volume traded climbed to P90.84 billion on Friday from the P26.1 billion recorded the week prior.

“Local bonds saw a sharp rally and bull flattened [last] week, with yields gapping lower by over 20 bps as market liquidity was put into play. A bevy of bond-friendly news also added fuel to the bond rally [last] week, such as lower US rates as well as the softer-than-expected July inflation print for the Philippines at 0.9% versus 1.2% market expectations. The 10-year government bonds dipped below 6% trading as low as 5.97% for the first time since last year, while the 20-year broke the 6.5% resistance level,” Dino Angelo C. Aquino, vice-president and head of fixed income at Security Bank Corp., said in an e-mail on Friday.

“The market reacted positively to the CPI (consumer price index) surprise as it would give the Bangko Sentral ng Pilipinas (BSP) ample room to reduce policy rates this month. The gross domestic product print was slightly above expectations and market participants did not react much given that BSP Governor Eli M. Remolona, Jr. hinted at the figure a few weeks back,” Mr. Aquino said.

Philippine headline inflation eased to 0.9% in July from 1.4% in June and the 4.4% print in the same month a year ago, the government reported last week.

This was the lowest CPI in nearly six years or since the 0.6% posted in October 2019. It also marked the fifth straight month that inflation settled below the central bank’s 2-4% target range.

The July print was within the BSP’s 0.5%-1.3% forecast for the month, but below the 1.2% median estimate yielded in a BusinessWorld poll of 17 analysts.

Year to date, the CPI averaged 1.7%, slightly higher than the BSP’s 1.6% full-year forecast.

Meanwhile, Philippine GDP expanded by 5.5% in the April-to-June period, slightly faster than the 5.4% growth in the first quarter but slower than the 6.5% expansion in the second quarter last year.

This matched the 5.5% median forecast in a BusinessWorld poll of 17 economists and the lower end of the government’s 5.5%-6.5% growth target for this year.

For the first half, GDP growth averaged 5.4%, slightly below the government’s goal.

Following the release of the July inflation data, Mr. Remolona told Bloomberg on Tuesday that the latest CPI reading makes a rate cut “more likely” at the Monetary Board’s Aug. 28 meeting.

He added that this would likely be followed by another reduction in the fourth quarter.

After this month’s review, the Monetary Board’s remaining meetings for this year are scheduled for Oct. 9 and Dec. 11.

Mr. Remolona also said that the BSP has room to continue lowering benchmark borrowing costs until next year “as long as the numbers look good, inflation remains low and the economy can still afford” more easing, although he flagged lingering global uncertainties.

The Monetary Board has slashed benchmark borrowing costs by a total of 50 bps this year via two consecutive 25-bp cuts in April and June, with the policy rate now at 5.25%. This brought cumulative reductions since August 2024 to 125 bps.

Mr. Aquino added that GS market took its cue from the lower-than-expected nonfarm payroll data out of the United States, which dragged down US Treasuries.

US employment growth was weaker than expected in July while the nonfarm payrolls count for the prior two months was revised down by a massive 258,000 jobs, suggesting a sharp deterioration in labor market conditions that puts a September interest rate cut by the Federal Reserve back on the table, Reuters reported.

“US bond yields took a dive, with the US 10-year dropping 15 bps to 4.21% after the data print. Perhaps the more pressing concern was the revisions which saw a downward revision of 258,000 which roughly estimates that the US only added 30,000 plus jobs in the past three months which puts the US Federal Reserve in a bind as now it appears they are late in their easing cycle,” he said.

“Bond yields declined week on week, supported by a favorable move in US Treasuries, a well-received RTB auction, and a better-than-expected local CPI print,” a bond trader added in a Viber message.

The government raised an initial P210 billion from via its offer of five-year RTBs at the rate-setting auction held on Tuesday, with tenders reaching P354.175 billion.

The notes are priced at 6% per annum, payable quarterly.

The public offer period will run until Aug. 15, while settlement is on Aug. 20. On Friday, the government closed the bond exchange component of the RTB offering. It also began limiting the sale of new retail bonds to individual investors.

For this week, the bond trader said the market will likely focus on US data releases — particularly the July US CPI report due out on Aug. 12 (Tuesday) — amid the lack of domestic catalysts.

“For now, conditions appear supportive for a possible BSP rate cut on Aug. 28, while expectations for a US Fed rate cut in September are also gaining momentum. We expect local bond yields to drop further in anticipation of the said policy move,” the trader said.

“The market may see some consolidation at current levels as most players are now all eyes on the final amount of RTB31 that would be issued after the BTr closed the offering to institutions by Aug. 8. RTBs are still offered by the Treasury to individual investors,” Mr. Aquino said.